That sinking feeling of 'renter's remorse' is a real thing. But once you've signed on the dotted line, what can you actually do about it?

The short answer is yes, you can sometimes cancel a lease after signing. It’s rarely straightforward or free, though. A lease is a legally binding contract, but certain circumstances and local laws can give you a way out.

The Reality of Canceling a Lease After Signing

Once your signature is on that lease, you're legally on the hook for its terms. You can't just walk away because you changed your mind—not without potential consequences, anyway. But don't lose hope just yet. Your ability to cancel often boils down to a few key factors that can tip the scales in your favor.

Figuring out where you stand is the first step. The main things that come into play are:

- The lease document itself: It might have an early termination or "buy-out" clause built right in.

- Your reason for canceling: Some situations, like being called for active military duty, are legally protected.

- Your local and state laws: Tenant rights vary wildly from one place to another.

- Your landlord's willingness to negotiate: Sometimes, a simple, mutual agreement is all it takes to dissolve the contract without a major fight.

Common Scenarios and Likely Outcomes

Before we get into the nitty-gritty legal details, it helps to see how common situations usually play out. Knowing where your circumstances fit can give you a realistic idea of what to expect. Whether you found a better place, lost your job, or are dealing with a personal crisis, the way you handle it makes all the difference.

Breaking a lease legally almost always involves navigating complex rules and potential penalties. In the United States, you’re generally bound to the contract unless you can negotiate a mutual termination with your landlord or find a specific clause that lets you out.

Data shows that roughly 15-20% of residential leases in the U.S. run into early termination issues, usually sparked by major life changes. You can dive deeper into these trends and the data behind lease administration by checking out resources on lease administration statistics.

Key Takeaway: While a signed lease is a serious legal commitment, it's not an unbreakable iron cage. Your power lies in understanding the specific clauses, laws, and negotiation tactics available to you.

To give you a clearer picture, I've put together a table summarizing common reasons for breaking a lease and what you can generally expect. This should help you quickly assess your situation.

Common Lease Cancellation Scenarios and Potential Outcomes

| Reason for Cancellation | Is It a Legally Justified Reason? | Potential Outcome or Penalty |

|---|---|---|

| Job Relocation | Rarely | Responsible for rent until a new tenant is found; potential buy-out fee. |

| Uninhabitable Conditions | Yes, in most states | Lease can be voided without penalty if the landlord fails to make repairs. |

| Military Deployment (SCRA) | Yes, federally protected | Lease can be terminated with 30-day notice without penalty. |

| Domestic Violence | Yes, in many states | Protected right to terminate with proper documentation. |

| Financial Hardship | No | Responsible for rent; may negotiate a payment plan or settlement. |

| Found a Better Apartment | No | Responsible for all lease terms, including full rent payment. |

This table provides a quick reference, but remember that the specifics can change based on your location and the fine print in your lease. Always check your local tenant laws to understand your full rights and obligations.

Exploring Your Legal Rights To Break A Lease

That sinking feeling after signing a lease you now need to break is all too common. But a lease isn't always the iron-clad document it seems to be. Certain situations give you a powerful, legally protected right to walk away, often without a massive penalty.

Before you do anything else, the first and most critical step is to figure out if your circumstances fall into one of these specific categories. These aren't sneaky loopholes; they're established rights designed to protect tenants from unsafe living conditions or to accommodate major, unavoidable life events.

One of the most powerful protections you have is the implied warranty of habitability. This legal concept exists in nearly every state and means your landlord has a non-negotiable duty to provide a safe, livable home. It’s a core part of your rental agreement, even if it’s not spelled out in the fine print.

When a Property Becomes Uninhabitable

What actually makes a property legally uninhabitable? It’s a high bar, far beyond a minor inconvenience or a cosmetic issue. We're talking about serious problems that genuinely threaten your health or safety.

Common examples include:

- Serious Health Hazards: This could be a persistent mold problem that won't go away, a severe pest infestation (like rats, roaches, or bedbugs), or exposure to toxins like lead or asbestos that the landlord fails to fix.

- Lack of Essential Utilities: Think no running hot water, a lack of heat in the winter, or a complete failure of the electrical system. These are basic necessities, not luxuries.

- Structural Dangers: A roof that leaks every time it rains, broken windows that leave you vulnerable, or unsafe floors and stairs all fall into this category.

If you're facing one of these issues, your first move is to notify your landlord—in writing—and give them a reasonable amount of time to make the necessary repairs. If they ignore your request or fail to act, you may have solid grounds to terminate the lease. For a full breakdown of the process, you can learn more about https://legaldocumentsimplifier.com/blog/how-to-terminate-lease to ensure you follow the correct legal steps.

Special Protections for Specific Groups

Beyond habitability issues, both federal and state laws carve out specific rights for certain people, recognizing that life can throw some serious curveballs.

A major one is the Servicemembers Civil Relief Act (SCRA). This federal law is a lifeline for active-duty military members. If you receive orders for a permanent change of station (PCS) or are deployed for 90 days or more, the SCRA allows you to terminate your lease legally. You’ll need to provide your landlord with written notice and a copy of your official orders. Your lease will then end 30 days after your next rent payment is due.

Important Note: The SCRA covers all uniformed services: the Army, Navy, Air Force, Marine Corps, and Coast Guard. It also protects activated National Guard members and commissioned officers of the Public Health Service and NOAA.

Many states have also passed laws to protect victims of domestic violence, sexual assault, or stalking. These laws generally permit a tenant to break their lease without penalty, provided they can supply proper documentation, like a police report or a protective order.

Navigating these situations requires a clear understanding of the law in your specific area. Mastering effective legal research methods is key to finding the correct information and confidently asserting your rights. Since the rules on notice and proof vary from state to state, it pays to do your homework. Understanding these legal protections is your strongest asset when you need to cancel a lease after signing.

Finding Exit Clauses in Your Lease Agreement

When you need to get out of a lease you just signed, that agreement goes from being a formality to your most important roadmap. It's the very first place you should be looking for an exit strategy, as it might have specific clauses built in for this exact situation. It’s time to put on your detective hat and comb through every single line.

Don't just skim it. You're hunting for specific language that acts as a built-in escape hatch. These clauses go by a few different names, but they all serve a similar purpose.

Spotting Your Escape Route

When you’re meticulously digging through your lease for an out, a structured approach is a lifesaver. Using a good Top Contract Review Checklist can make sure you don’t miss any of the fine print.

Here’s what to keep an eye out for:

- Early Termination Clause: This is your most direct route. It will spell out exactly how you can end the lease early, the notice you need to give (often 30 or 60 days), and the specific penalty fee involved.

- Buy-Out Clause: Think of this as a specific type of early termination. It lets you "buy" your freedom by paying a set lump sum, which is often equal to one or two months' rent.

- Break Clause: This is more common in fixed-term leases. A break clause gives either you or the landlord the option to end the agreement at a designated point—say, six months into a one-year lease—as long as you provide proper notice.

Pro Tip: Pay very close attention to the wording. A clause might say, "Tenant may terminate this lease with 60 days' written notice and payment of a fee equal to two months' rent." That right there is your blueprint for a clean break.

If your lease doesn't have any of these clauses, it doesn't mean you're totally stuck. It just means your path forward will probably involve more negotiation instead of following a pre-written rule. No exit clause usually means you're on the hook for the rent for the entire lease term unless you and your landlord can agree on something different.

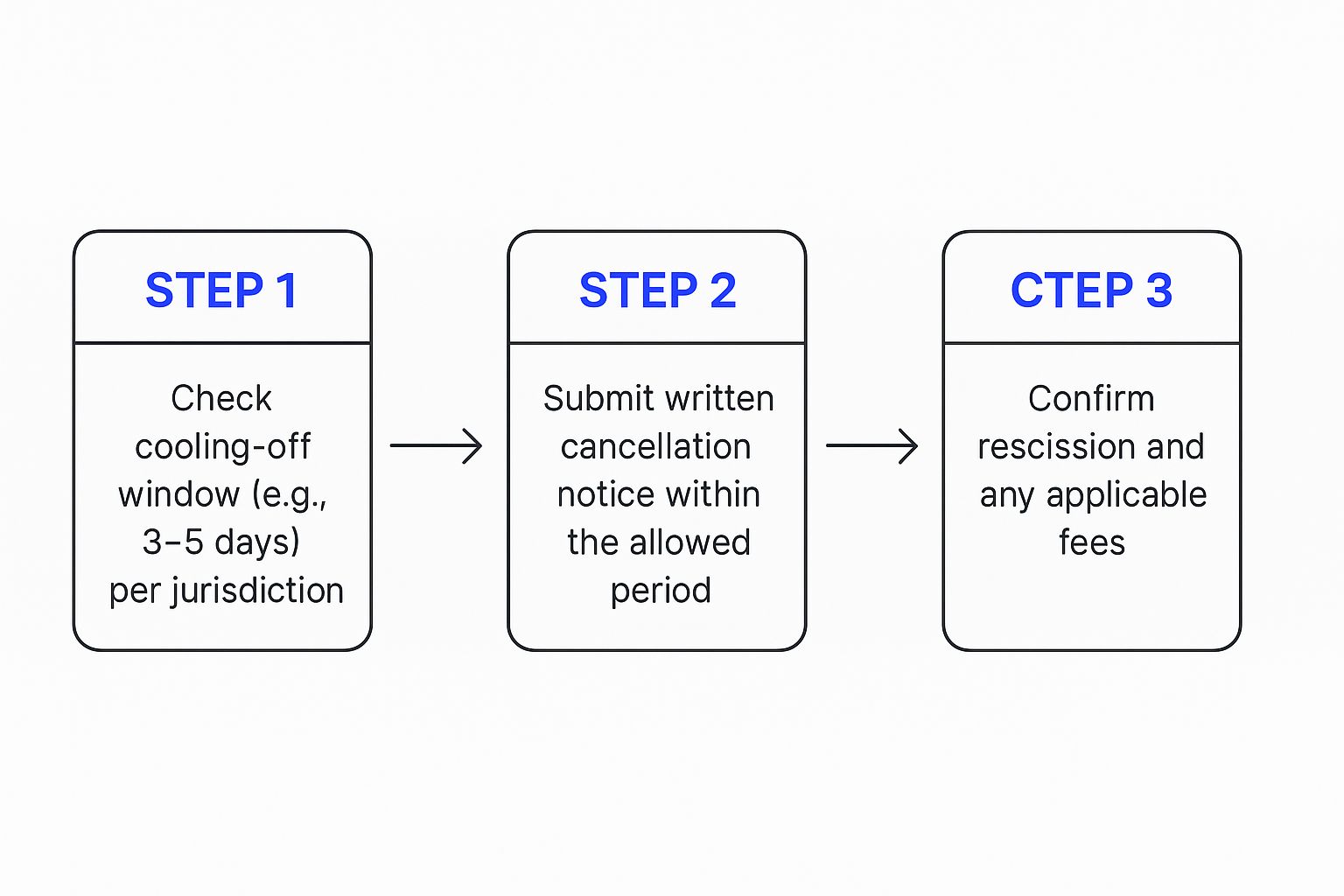

The infographic below shows the first steps to take if you think you have a short window to rescind the contract, which is an option in some jurisdictions.

The biggest takeaway here is to act fast and get everything in writing. Any "cooling-off" period will be extremely short and requires you to take immediate, formal action.

A Practical Guide to Negotiating With Your Landlord

When the law and your lease agreement don't give you a clear way out, your best bet is often a direct conversation. It might seem intimidating, but approaching your landlord to mutually end your lease can be surprisingly effective. The key is how you frame it. This isn't about making demands; it's about working together to find a solution.

Start the conversation with a professional, polite letter or email. You don’t need to pour your heart out, but you should briefly and honestly explain your situation. Whether it's a sudden job relocation or a family emergency, sticking to the facts without getting overly emotional shows you’re a responsible tenant trying to handle a tough situation correctly.

This proactive approach immediately sets a cooperative tone and opens the door for a real discussion.

Making an Offer They Can't Refuse

At the end of the day, landlords are running a business. Their biggest headaches are lost rent and the time it takes to find a new, reliable tenant. If you can solve these problems for them, your odds of getting a "yes" go way up.

One of the most powerful things you can do is offer to find a qualified replacement tenant yourself.

This shows you're serious about minimizing their financial hit. With their permission, you can handle the initial work of advertising the unit and pre-screening applicants. Handing them one or two fantastic candidates who already meet their criteria makes it incredibly easy for them to agree.

You could also propose a "buy-out" option, even if it's not mentioned in your lease. Offering a lump sum—maybe one or two months' rent—in exchange for being released from the contract can be a strong financial incentive. For a deeper look at these strategies, check out our guide on https://legaldocumentsimplifier.com/blog/how-to-negotiate-lease.

Key Insight: A landlord's biggest fear is an empty property bleeding money. When you offer a solution that either prevents or shortens a vacancy, you turn your problem into a shared benefit. That makes your request a lot more appealing.

Understanding the Landlord's Perspective

It’s easy to forget, but landlords want to avoid court just as much as you do. The thought of eviction proceedings or dragging things into small claims court is a nightmare for everyone involved. By suggesting a mutual termination, you're offering a clean, fast, and cheap way out.

Economic conditions can also play a huge role in a landlord’s flexibility. History shows that during economic downturns, when it's harder to find new tenants, landlords are often more willing to negotiate. For instance, during the 2008 financial crisis, commercial lease cancellations in major cities jumped by about 25% as businesses scrambled to cut costs, making landlords more open to buyouts.

For more tips on how to approach these conversations, this guide on negotiating rent with your landlord has some great pointers.

No matter what you agree on, get it in writing. A simple, signed document that outlines the termination date, any fees paid, and the plan for your security deposit is non-negotiable. It protects both of you and prevents any "he said, she said" arguments down the road.

Understanding the Financial Consequences

When you're trying to figure out how to get out of a lease you just signed, money is almost always the biggest roadblock. Let's be real: breaking a legally binding contract usually comes with a hefty price tag. Before you make any moves, you need a crystal-clear picture of what you might owe.

The first hit you'll likely take is losing your security deposit. Landlords use this to cover their losses from unpaid rent or damages, and an early termination almost always qualifies. But that's usually just the beginning of the financial pain.

Common Financial Penalties

Dig into your lease agreement and look for an early termination fee or a buy-out clause. This is a specific dollar amount—often equal to one or two months' rent—that you agree to pay to walk away clean. It’s a painful check to write, but it gives you a predictable, clean break from your financial obligations.

If your lease doesn't have a buy-out option, things get more complicated. You could be on the hook for the rent for the entire remaining lease term, or at least until the landlord finds a new tenant to take your place. This is where a critical legal concept comes into play.

Mitigation of Damages: In most states, landlords have a legal duty to "mitigate damages." This means they can't just sit on their hands and send you a bill every month. They have to make a real, active effort to re-rent the unit.

But don't think that gets you off the hook entirely. You’re still responsible for paying rent for every month the unit is empty, plus any reasonable costs the landlord racks up trying to find a replacement, like advertising fees.

Hidden Costs and Long-Term Impact

The financial fallout can go way beyond just paying your landlord. If you simply walk away and refuse to pay what you owe, your landlord can take you to court. A judgment against you can lead to garnished wages and will absolutely wreck your credit score, making it a nightmare to get loans, credit cards, or even another apartment for years.

The scale of financial decisions tied to leases is massive, even at the corporate level. For example, in 2025, Global Net Lease, a major real estate investment trust, closed multi-phase sales of 100 assets, generating $1.1 billion in gross proceeds. These moves were driven by strategic lease adjustments and portfolio restructuring, which just goes to show how much financial weight these agreements carry. You can read more about these strategic lease decisions in their Q1 2025 report.

And don't forget about your rental history. A black mark for breaking a lease can follow you around. Landlords talk, and property managers use screening services. Getting flagged as a risk can make it incredibly difficult to find a new place to live. When you’re weighing your options, you have to think about these long-term financial and reputational risks just as carefully as the immediate fees.

Common Questions About Canceling a Lease

Even when you know your rights and have a plan, the idea of breaking a lease can bring up some very specific, nagging questions. Let's tackle a few of the most common ones that come up when tenants find themselves in this tough spot.

What Happens If I Just Move Out and Stop Paying?

This is a tempting, but terrible, idea. Just packing up your things and ghosting the property is legally known as lease abandonment, and it does absolutely nothing to end your financial obligation.

In fact, it makes things much worse. Your landlord can—and almost certainly will—sue you for the entire remaining rent owed under the lease. When they win the lawsuit, that judgment gets handed over to collections. This will tank your credit score for years, making it nearly impossible to rent from a reputable landlord, secure a loan, or even get a credit card. You can also kiss your security deposit goodbye.

Can My Landlord Charge for Advertising a New Tenant?

Yes, in most states, they absolutely can. When you break a lease, the landlord has to spend time and money to find a replacement, and those expenses are considered direct damages caused by your breach of contract.

These re-renting costs often include:

- Advertising Fees: The price of listing the unit on rental sites.

- Tenant Screening Costs: Fees for running background and credit checks on applicants.

- Broker's Commission: If a real estate agent is hired to fill the vacancy.

Pro Tip: Don't just take their word for it. Always request an itemized list of these charges along with copies of the receipts. This keeps everyone honest and ensures the expenses are both legitimate and reasonable.

Is a Digitally Signed Lease as Binding as a Paper One?

You bet it is. Thanks to laws like the federal E-SIGN Act here in the U.S., an electronically signed lease carries the exact same legal weight as one signed with a pen.

The second you apply that digital signature, you've created a binding, enforceable contract. Every rule, penalty, and legal option we’ve discussed applies just the same, whether you signed on a screen or on paper. Don't fall into the trap of thinking an e-signature is somehow less serious.

For a deeper dive into the legal steps involved, you can find more information by reading our detailed guide on how to break a lease.

Is "Renter's Remorse" a Legal Reason to Cancel?

I wish I had better news, but unfortunately, no. While that sinking feeling of post-signing regret is very real, "renter's remorse" isn't a legally recognized reason to void a lease.

Unlike some consumer products that have a mandatory "cooling-off period," residential leases are binding the moment both you and the landlord have signed. Your only way out is to find a specific escape clause in the lease itself, prove the property is legally uninhabitable, or successfully negotiate a mutual termination with your landlord. Simply changing your mind, unfortunately, won't cut it.

Navigating legal documents like leases can be confusing and stressful. Legal Document Simplifier uses powerful AI to instantly translate dense contracts into clear, easy-to-understand summaries. Identify key terms, risks, and obligations in seconds to make informed decisions with confidence. Learn more at https://legaldocumentsimplifier.com.