Navigating the Complexities of Contract Compliance in 2025

This contract compliance checklist provides seven essential steps to effectively manage your contracts and minimize risk. From initial review to audit reporting, learn how to build a comprehensive process for maintaining compliance and maximizing contract value. This list helps small business owners, freelancers, legal teams, and individuals ensure adherence to contract terms and avoid costly disputes. Following these steps supports efficient obligation tracking, financial verification, performance monitoring, and risk mitigation. A strong contract compliance checklist is crucial for success in 2025 and beyond.

1. Contract Review and Documentation

A crucial first step in any contract compliance checklist is contract review and documentation. This involves a comprehensive analysis of all contract terms, conditions, and obligations to ensure they align with pre-agreed terms, internal policies, and regulatory requirements. This process establishes a solid foundation for compliance by creating a "single source of truth" for all contract-related information. This not only minimizes the risk of overlooking critical clauses but also streamlines future audits and reporting.

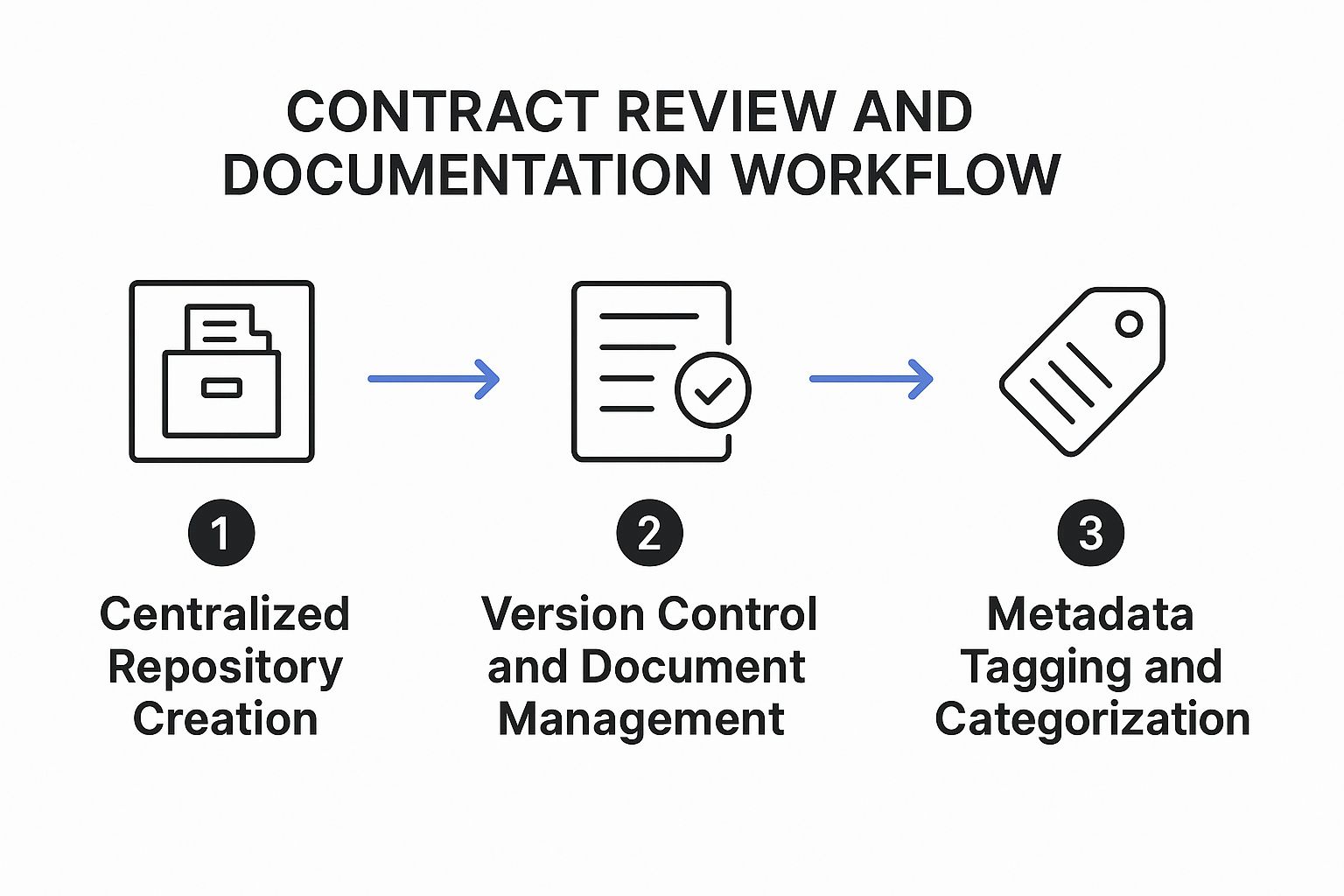

The infographic above visualizes the contract review and documentation process, starting with contract request and creation, moving through negotiation and approval, and culminating in execution and ongoing management. This visualization emphasizes the cyclical nature of contract management and the importance of each step in maintaining compliance.

Effective contract review and documentation goes beyond simply storing contracts; it requires a systematic approach to organizing and managing them. This often involves implementing a centralized contract repository system with features like version control, categorization (by type, value, and risk), comprehensive metadata tagging, and digital signature verification. Managing compliance effectively is crucial for any business, especially those operating with subscription models. A well-defined process ensures adherence to legal and contractual obligations, minimizing risks and fostering trust with customers. For businesses using subscriptions, understanding the nuances of these models is especially important for contract compliance. Learn more about optimizing these relationships in the Ultimate Guide to Ecommerce Subscription Model: Expert Strategies for Predictable Growth from Sharpei. Check out this helpful resource: ecommerce subscription model

The benefits of such a system are numerous. It provides a single source of truth for all contract information, reduces the risk of missing contracts or key terms, facilitates efficient auditing and reporting, and establishes baseline documentation for ongoing compliance tracking. For example, General Electric implemented a contract repository that saved $50 million annually by eliminating duplicate contracts, showcasing the potential for significant cost savings through effective contract management. Similarly, Microsoft's contract management system reduced review time by 70% through standardized documentation processes.

However, there are also potential drawbacks to consider. The initial setup of a comprehensive contract management system can be time-consuming and resource-intensive. It may require specialized contract management software and necessitates ongoing maintenance and updates to ensure its effectiveness.

Tips for Successful Contract Review and Documentation:

- Implement consistent naming conventions and filing systems: This simplifies searching and retrieval of contracts within the repository.

- Use OCR technology for scanning legacy paper contracts: This digitizes existing contracts, making them searchable and accessible within the digital system.

- Regularly audit the repository for completeness and accuracy: This ensures the integrity of the data and identifies any gaps or inconsistencies.

- Implement role-based access controls for sensitive contract information: This protects confidential information and ensures compliance with data privacy regulations.

This meticulous approach to contract review and documentation deserves its place at the top of any contract compliance checklist. By ensuring that contracts are thoroughly reviewed, properly documented, and easily accessible, businesses can minimize risks, maximize efficiency, and build a strong foundation for long-term success. Learn more about Contract Review and Documentation

2. Obligation Tracking and Management

Obligation tracking and management is a crucial component of any effective contract compliance checklist. This systematic process involves monitoring and managing all contractual obligations, deadlines, milestones, and deliverables to ensure timely fulfillment. It encompasses tracking both your organization's obligations to counterparties and their obligations to you. This proactive approach is essential for minimizing risk and maximizing the value of your contracts. Effective obligation management transforms a static contract into a dynamic tool that drives performance and mitigates potential disputes.

Key features of a robust obligation tracking and management system include automated obligation extraction from contracts, calendar integration for key dates and deadlines, notification and alert systems, role assignment for accountability, and progress tracking against milestones. These features streamline the management of complex agreements and empower organizations to stay ahead of their contractual commitments.

This approach is invaluable for any individual or organization dealing with contracts. From small business owners navigating lease agreements to large enterprises managing complex supplier relationships, obligation tracking ensures that all parties meet their commitments. For freelancers and consultants, it provides a structured way to manage client expectations and deliverables. In-house legal teams benefit from improved visibility and control over contractual obligations, while startup founders can leverage it to manage rapid growth and evolving agreements. Even individuals managing personal legal agreements, such as NDAs, can benefit from the organized approach offered by obligation tracking.

Pros:

- Prevents costly missed deadlines and obligations

- Provides early warning for potential compliance issues

- Improves resource allocation for meeting obligations

- Creates an audit trail of obligation fulfillment

Cons:

- Complex contracts may have interdependent obligations that are difficult to track

- Requires regular updates as circumstances change

- May require significant manual input for nuanced obligations

Examples of Successful Implementation:

- Walmart implemented an obligation tracking system that reduced compliance-related penalties by 35%.

- Boeing's obligation management system helped identify $120 million in recoverable value from supplier commitments.

Actionable Tips:

- Create RACI matrices (Responsible, Accountable, Consulted, Informed) for each major contract to clarify responsibility.

- Implement a tiered notification system (30/60/90 days before deadlines).

- Schedule regular obligation review meetings with key stakeholders.

- Develop contingency plans for high-risk obligations.

Learn more about Obligation Tracking and Management, particularly how AI is transforming this critical area of contract compliance. Solutions like ServiceNow Contract Management and SAP Ariba Contract Management, popularized by organizations like The National Contract Management Association (NCMA), offer robust features to support comprehensive obligation tracking and management. By prioritizing this aspect of contract compliance, you can significantly reduce risk, improve performance, and unlock the full value of your agreements.

3. Financial Compliance Verification

Financial Compliance Verification is a critical component of any robust contract compliance checklist. It's the process of ensuring all financial terms outlined in a contract – including payment schedules, pricing arrangements, discounts, rebates, and other monetary aspects – are correctly implemented and consistently monitored throughout the contract lifecycle. This meticulous approach helps organizations avoid revenue leakage, maintain accurate financial records, and optimize costs. For businesses of all sizes, maintaining tight financial control through contract compliance translates to a healthier bottom line.

This process typically involves several key features:

- Invoice validation against contract terms: This ensures that invoices received align precisely with the agreed-upon pricing, quantities, and other relevant contract stipulations.

- Price and discount verification: Regularly checking that the correct prices and agreed-upon discounts are applied to each transaction prevents overpayments and ensures contract profitability.

- Payment schedule tracking: Monitoring payment deadlines for both incoming and outgoing payments helps avoid late payment penalties and maintains positive vendor relationships.

- Financial variance analysis: Comparing actual financial performance against the projected figures outlined in the contract allows for early identification of discrepancies and potential issues.

- Budget alignment verification: Confirming that contract spending aligns with allocated budgets provides better financial control and prevents overspending.

The benefits of incorporating Financial Compliance Verification into your contract compliance checklist are substantial:

- Prevents revenue leakage and overpayments: By meticulously checking invoices and payments against contract terms, you can identify and rectify discrepancies, preventing financial losses.

- Ensures consistent application of financial terms: A structured verification process guarantees that all parties adhere to the agreed-upon financial stipulations, minimizing disputes and promoting transparency.

- Provides data for cost optimization: Tracking financial data related to contracts provides valuable insights into spending patterns, enabling businesses to identify areas for cost reduction and negotiation leverage in future contracts.

- Supports accurate financial forecasting: Reliable contract financial data allows for more accurate budgeting and forecasting, improving financial planning and decision-making.

However, implementing a comprehensive Financial Compliance Verification process also presents some challenges:

- Requires integration with accounting/ERP systems: Seamless data flow between contract management and financial systems is essential for efficient verification. This often requires integration efforts and potential software investments.

- Complex pricing structures can be difficult to monitor: Contracts with intricate pricing tiers, volume discounts, or performance-based incentives can be complex to track and verify.

- Currency fluctuations may complicate international contracts: For businesses operating globally, currency exchange rate fluctuations can impact financial compliance and require careful monitoring and adjustments.

Several successful examples demonstrate the value of Financial Compliance Verification:

- Pfizer: By implementing a robust financial compliance system, Pfizer reportedly recovered $15 million in incorrect supplier billings within the first year.

- AT&T: Through their contract financial verification process, AT&T identified $30 million in billing discrepancies across their telecom service agreements.

To effectively implement Financial Compliance Verification within your organization, consider these actionable tips:

- Implement automated three-way matching (PO, receipt, invoice): This automated process significantly reduces manual effort and improves accuracy in invoice verification.

- Create standardized financial term templates for common contract types: Using pre-approved templates ensures consistency in financial terms across different contracts.

- Perform quarterly financial compliance audits on high-value contracts: Regular audits help identify and address potential financial discrepancies proactively.

- Develop clear escalation paths for financial discrepancies: Establishing a defined process for reporting and resolving financial issues ensures timely resolution and minimizes potential losses.

Financial Compliance Verification deserves its place in any contract compliance checklist because it directly impacts an organization's financial health. By proactively monitoring and verifying financial terms, businesses can mitigate risks, optimize costs, and ensure contract profitability. This meticulous approach is especially valuable for small business owners, freelancers, legal teams, and startups – anyone dealing with contracts and seeking to maintain control over their financial resources. While implementing a robust system may require some initial investment, the potential returns in terms of cost savings and improved financial management make it a worthwhile endeavor. Though providers like Oracle Financial Services, PwC Contract Compliance Services, and Deloitte Contract Risk & Compliance practice offer enterprise-level solutions, smaller businesses can adapt these principles and implement cost-effective processes tailored to their needs.

4. Performance and SLA Monitoring

Performance and SLA monitoring is a crucial element of any comprehensive contract compliance checklist. This process involves systematically tracking and evaluating performance metrics, service level agreements (SLAs), key performance indicators (KPIs), and other measurable aspects of contract performance to ensure all parties fulfill their contractual obligations. This proactive approach shifts contract management from reactive problem-solving to proactive performance optimization. By implementing robust monitoring, businesses can identify potential issues early on, mitigating risks and maximizing the value of their contracts. This is why it deserves a prominent place in any contract compliance checklist.

This method works by establishing a clear framework for measuring and evaluating contract performance. This framework typically includes pre-defined KPIs and SLAs, along with the mechanisms for collecting and analyzing performance data. Real-time KPI dashboards, automated reporting, and root cause analysis tools facilitate this process. These tools provide objective evidence of contract performance, enabling early intervention for performance issues and supporting data-driven contract negotiations and renewals. Features like real-time KPI dashboards provide at-a-glance insights into contract performance, while automated reporting streamlines the communication of performance metrics to stakeholders. Root cause analysis tools help identify the underlying reasons for performance issues, enabling corrective actions.

Examples of Successful Implementation:

- Salesforce: Implemented an SLA monitoring system that improved vendor performance by 28% across IT service contracts.

- FedEx: FedEx's performance monitoring framework reduced service delivery failures by 40% with key logistics partners.

Actionable Tips for Readers:

- Establish clear, measurable KPIs during contract negotiation: Don't just agree on deliverables; define how success will be measured.

- Schedule regular performance review meetings with suppliers/vendors: Open communication is key to addressing performance gaps proactively.

- Implement a scorecard system for objective evaluation: Scorecards provide a standardized way to track and compare performance across different contracts and vendors.

- Document all performance discussions and agreed action plans: This creates a record of performance history and agreed-upon improvements.

When and Why to Use This Approach:

Performance and SLA monitoring is particularly valuable when dealing with complex contracts, long-term agreements, or contracts involving critical services. It's especially relevant for:

- Service Level Agreements: Ensuring vendors meet agreed-upon service levels.

- Key Performance Indicators: Tracking progress towards specific performance targets.

- Contract Renewals: Providing data-driven insights for negotiation.

- Dispute Resolution: Offering objective evidence of performance issues.

Pros:

- Provides objective evidence of contract performance

- Enables early intervention for performance issues

- Supports data-driven contract negotiations and renewals

- Creates accountability for all parties

Cons:

- Measuring qualitative performance can be subjective

- Data collection may be labor-intensive

- Requires agreement on measurement methodologies

Popularized By:

- Information Technology Infrastructure Library (ITIL) framework

- ServiceNow Performance Analytics

- ISO 9001 Quality Management Standards

By incorporating performance and SLA monitoring into your contract compliance checklist, you can transform your contract management process, minimizing risks, optimizing performance, and maximizing the value of your contracts. This approach empowers businesses, from startups to large enterprises, to proactively manage contract performance, ultimately contributing to better business outcomes.

5. Risk Assessment and Mitigation

A crucial component of any effective contract compliance checklist is risk assessment and mitigation. This ongoing process involves identifying, analyzing, and addressing potential contract-related risks. These risks can include compliance violations, regulatory changes, market fluctuations, and operational factors that could negatively impact contract performance or introduce liability. Ignoring this step can expose your business to significant financial and legal penalties, making it a critical part of your contract compliance checklist.

Risk assessment and mitigation works by systematically evaluating potential problems that could arise during the contract lifecycle. This involves:

- Identifying potential risks: This includes brainstorming all possible scenarios, from minor breaches to major disruptions.

- Analyzing the likelihood and impact of each risk: Risks are typically categorized and scored based on their potential impact and the probability of occurrence. This helps prioritize which risks need the most attention.

- Developing mitigation strategies: For each identified risk, specific actions are planned to either prevent the risk from occurring or minimize its impact if it does occur. This might involve adding specific clauses to the contract, implementing monitoring procedures, or establishing contingency plans.

Features of robust risk assessment and mitigation systems often include:

- Risk scoring and categorization: Allows for prioritization of mitigation efforts.

- Regulatory compliance monitoring: Ensures ongoing adherence to relevant laws and regulations.

- Force majeure and exception tracking: Provides a structured approach to handling unforeseen circumstances.

- Contingency planning templates: Facilitates rapid response to disruptive events.

- Risk mitigation strategy development: Creates proactive plans to address identified risks.

Implementing a comprehensive risk assessment and mitigation process offers several advantages:

- Reduces exposure to financial and legal penalties: By proactively addressing potential issues, you can minimize the likelihood of costly disputes and fines.

- Provides early warning of potential compliance issues: Ongoing monitoring allows you to identify and address compliance problems before they escalate.

- Improves business continuity planning: By anticipating potential disruptions, you can develop plans to maintain operations in the face of adversity.

- Prioritizes resources toward highest risk areas: Focusing on the most significant risks ensures efficient allocation of resources.

However, like any process, risk assessment and mitigation has its drawbacks:

- Risk assessment can be subjective: Different individuals may perceive and evaluate risks differently, leading to inconsistencies in assessment.

- Regulatory requirements evolve continuously: Staying abreast of changes and updating your risk assessments accordingly can be challenging.

- May create excessive caution in contract management: Overemphasis on risk avoidance can sometimes hinder business opportunities.

Real-world examples demonstrate the power of effective risk assessment and mitigation: Netflix developed a contract risk framework that reportedly prevented an estimated $75 million in potential regulatory fines. Similarly, BP's enhanced risk assessment protocols following the Deepwater Horizon incident transformed industry standards for contractor safety compliance. These examples highlight why this deserves a place in your contract compliance checklist.

Learn more about Risk Assessment and Mitigation

Here are some actionable tips for implementing risk assessment and mitigation in your contract management process:

- Conduct quarterly risk reassessments of high-value contracts: Regularly review your highest-value contracts to ensure your mitigation strategies remain relevant.

- Maintain current regulatory compliance matrices by industry and region: Staying informed about regulatory changes is essential for effective compliance.

- Implement scenario planning for high-impact, low-probability events: While rare, these events can have devastating consequences, so planning for them is crucial.

- Establish clear ownership for risk mitigation actions: Assigning responsibility ensures that mitigation strategies are implemented effectively.

Popularized by organizations like COSO (Committee of Sponsoring Organizations of the Treadway Commission), the ISO 31000 Risk Management framework, and Thomson Reuters Regulatory Intelligence, risk assessment and mitigation has become a standard practice for businesses of all sizes. Whether you're a small business owner, a freelance professional, or part of a large corporate legal team, incorporating risk assessment and mitigation into your contract compliance checklist is essential for protecting your interests and ensuring long-term success.

6. Change Management and Amendment Tracking

A critical component of any contract compliance checklist is Change Management and Amendment Tracking. This process provides a structured approach for handling modifications to existing contracts, ensuring all changes are properly documented, communicated, and implemented across the organization. Without a robust system for managing amendments, organizations risk contractual disputes, compliance violations, and revenue leakage. This is why it deserves a prominent place in your contract compliance checklist.

This process typically involves several key features working in concert:

- Version Control for Contract Documents: Maintaining a clear history of all contract versions, allowing easy access to previous iterations and tracking the evolution of the agreement.

- Amendment Approval Workflows: Establishing a defined process for approving amendments, ensuring all necessary stakeholders sign off on changes before they are implemented.

- Change Impact Assessment Tools: Analyzing the impact of proposed changes on the overall contract and related business processes.

- Communication Protocols for Changes: Ensuring all relevant parties are informed of any modifications to the agreement, minimizing confusion and potential disputes.

- Contract Redlining and Comparison Capabilities: Facilitating the easy identification and review of changes between different contract versions.

By implementing a comprehensive Change Management and Amendment Tracking system, organizations realize several key benefits:

Pros:

- Maintains Contractual Integrity Through Changes: Ensures that modifications are made in a controlled and compliant manner, preserving the validity of the agreement.

- Creates a Clear Audit Trail of Modifications: Provides a documented history of all changes, simplifying audits and facilitating dispute resolution.

- Ensures All Stakeholders are Aware of Changes: Improves communication and transparency, reducing the risk of misunderstandings and errors.

- Prevents Unauthorized or Undocumented Modifications: Safeguards against unauthorized changes, protecting the organization's legal and financial interests.

Cons:

- Complex Change Processes May Delay Urgent Modifications: Implementing rigorous change procedures can sometimes slow down the process of making time-sensitive changes.

- Multiple Amendments Can Create Confusing Contract Documentation: If not managed effectively, numerous amendments can make it difficult to understand the current terms of the agreement.

- Requires Discipline in Following Change Procedures: The effectiveness of this system relies on consistent adherence to established processes.

Examples of Successful Implementation:

- Apple's contract amendment system reduced change implementation time from 15 days to 3 days while improving compliance.

- Accenture's change management framework for service contracts reduced disputed changes by 65%.

Actionable Tips for Implementation:

- Create Amendment Templates for Common Change Scenarios: Streamline the amendment process by using pre-approved templates for frequently occurring modifications.

- Implement Digital Signature Workflows for Amendment Approvals: Accelerate the approval process and enhance security by using digital signatures.

- Maintain a Consolidated Version of the Contract That Incorporates All Amendments: Ensure easy access to the most up-to-date version of the agreement.

- Establish Thresholds for Escalated Approval of Significant Changes: Require higher-level approvals for changes that have a substantial impact on the contract.

When and Why to Use This Approach:

Change Management and Amendment Tracking is essential for any organization that deals with contracts, regardless of size or industry. It is particularly important for businesses that:

- Manage a large volume of contracts

- Frequently modify existing agreements

- Operate in highly regulated industries

- Want to mitigate the risk of contractual disputes

Popularized By:

- DocuSign CLM (Contract Lifecycle Management)

- Project Management Institute (PMI) change management practices

- Prosci ADKAR Model for organizational change

By incorporating a robust Change Management and Amendment Tracking system into your contract compliance checklist, you can ensure the integrity of your agreements, improve communication, and minimize the risk of costly disputes. This proactive approach will safeguard your organization's legal and financial interests while streamlining contract management processes.

7. Audit and Compliance Reporting

A crucial component of any robust contract compliance checklist is audit and compliance reporting. This systematic process involves the collection, analysis, and presentation of contract compliance data to various stakeholders, including internal teams, regulatory bodies, and external auditors. It forms the backbone of demonstrating adherence to contractual obligations and legal requirements, earning its place on this checklist due to its powerful impact on risk mitigation and operational efficiency. Effective audit and compliance reporting provides a clear picture of your organization's contract compliance posture, enabling proactive identification and remediation of potential issues before they escalate.

How it Works:

Audit and compliance reporting hinges on establishing regular review cycles. These reviews can be scheduled (e.g., quarterly, annually) or triggered by specific events (e.g., contract renewals, regulatory changes). During these reviews, relevant contract data is gathered and analyzed against predefined compliance metrics. The findings are then compiled into comprehensive reports, presented via user-friendly dashboards or formal documents. Maintaining meticulously organized, audit-ready documentation throughout the contract lifecycle is paramount to this process.

Features that Facilitate Effective Reporting:

- Automated compliance reporting dashboards: These provide real-time visibility into key compliance metrics, allowing for quick identification of potential issues.

- Audit trail documentation: A detailed record of all contract-related activities, modifications, and approvals ensures transparency and accountability.

- Configurable reporting templates: Tailor reports to the specific needs of different stakeholders, ensuring relevance and clarity.

- Compliance certification processes: Formalized procedures for verifying compliance with specific standards or regulations.

- Evidence collection and management: Centralized repositories for storing and managing all relevant documentation, simplifying audit preparation.

Pros:

- Demonstrates due diligence: A robust reporting system showcases your commitment to compliance, building trust with stakeholders and regulators.

- Reduces time and stress during formal audits: Readily available, organized documentation streamlines the audit process, significantly reducing preparation time and associated costs.

- Identifies systemic compliance issues: Regular reporting helps uncover patterns of non-compliance, allowing for proactive intervention and process improvement.

- Supports continuous improvement of compliance processes: Data-driven insights from compliance reports inform best practices and drive ongoing optimization of contract management workflows.

Cons:

- Can be resource-intensive: Maintaining comprehensive documentation and generating detailed reports can require significant time and resources.

- Different stakeholders may require different reporting formats: Tailoring reports to various audiences can create an administrative burden.

- May create administrative burden without proper automation: Manual reporting processes can be cumbersome and inefficient.

Examples of Successful Implementation:

- Johnson & Johnson implemented a compliance reporting system that reduced audit preparation time by a remarkable 80%, demonstrating the efficiency gains achievable through streamlined reporting.

- IBM's contract audit program recovered $40 million annually through the identification of non-compliance issues, highlighting the significant financial benefits of proactive compliance monitoring.

Actionable Tips for Implementing Effective Audit and Compliance Reporting:

- Establish a regular cadence of internal compliance reviews: Consistent monitoring is key to identifying and addressing compliance issues promptly. Consider quarterly or semi-annual reviews.

- Create a centralized evidence repository with clear naming conventions: This ensures easy access to relevant documentation during audits and facilitates efficient reporting.

- Develop stakeholder-specific reporting templates: Tailor reports to the information needs of different audiences, such as executives, legal teams, and regulatory bodies.

- Conduct mock audits to test compliance documentation: Regularly test your reporting processes and documentation to identify gaps and ensure audit-readiness.

Popularized By:

The importance of robust compliance reporting has been underscored by regulations like the Sarbanes-Oxley Act, as well as the services offered by leading consulting firms like KPMG Contract Compliance Services and Ernst & Young Contract Risk Services. These influences have contributed to the widespread adoption of formal compliance reporting practices across various industries.

By incorporating these strategies and focusing on the features and benefits of a strong audit and compliance reporting system, organizations can significantly improve their contract compliance posture, mitigate risks, and ultimately protect their bottom line. This critical element of the contract compliance checklist should not be overlooked.

7-Point Contract Compliance Checklist Comparison

| Checklist Item | 🔄 Implementation Complexity | 🛠️ Resource Requirements | 📊 Expected Outcomes | 💡 Ideal Use Cases | ⭐ Key Advantages |

|---|---|---|---|---|---|

| Contract Review and Documentation | Medium - Setup time-consuming, requires specialized software | Moderate - Needs software & ongoing maintenance | High - Centralized data, audit efficiency | Organizations needing contract centralization | Single source of truth, reduces missing contracts |

| Obligation Tracking and Management | High - Complex obligations, needs regular updates | High - Automation, calendar tools, manual input | High - Prevents missed deadlines, early warnings | Contracts with multiple deadlines/milestones | Prevents penalties, improves resource allocation |

| Financial Compliance Verification | Medium-High - Requires ERP/accounting integration | High - Accounting system integration, audits | High - Prevents revenue leakage, cost optimization | Financial-critical contracts, payment-heavy | Prevents overpayments, supports forecasting |

| Performance and SLA Monitoring | Medium - Labor-intensive data collection, agreement needed | Moderate - Dashboards, reporting tools | High - Early issue detection, data-driven decisions | Service contracts with clear KPIs | Objective performance evidence, accountability |

| Risk Assessment and Mitigation | Medium - Subjective risk analysis, ongoing updates | Moderate - Risk frameworks, regulatory tracking | Medium-High - Reduced penalties, business continuity | High-risk contracts, regulatory sensitive | Early warning, prioritizes high-risk areas |

| Change Management and Amendment Tracking | Medium - Complex workflows, discipline required | Moderate - Workflow tools, version control | Medium - Maintains integrity, clear audit trail | Dynamic contracts with frequent amendments | Prevents unauthorized changes, improves compliance |

| Audit and Compliance Reporting | Medium-High - Data collection, diverse reporting needs | High - Automation, documentation management | High - Reduces audit time, identifies compliance gaps | Regulated industries, audit-heavy environments | Demonstrates due diligence, supports continuous improvement |

Achieving Contract Compliance Excellence: A Continuous Journey

Mastering contract compliance isn't a destination, but a continuous journey of improvement. This contract compliance checklist, encompassing crucial steps from initial contract review and documentation to ongoing audit and compliance reporting, provides a roadmap for minimizing risk and maximizing the value of your agreements. By diligently tracking obligations, verifying financial compliance, monitoring performance, assessing risks, managing changes, and generating comprehensive reports, you build a robust framework for success. These proactive measures empower you to identify potential issues early, avoid costly disputes, and foster stronger business relationships. Whether you're a small business owner, a freelance consultant, or part of a large legal team, understanding and implementing these elements of a comprehensive contract compliance checklist is paramount for protecting your interests and achieving your business objectives.

The consistent application of these principles, coupled with a proactive approach to risk management, can transform your contract management process from a reactive burden to a strategic driver of growth. This not only safeguards your business from legal and financial pitfalls but also unlocks the full potential of your contracts, allowing you to leverage them for maximum benefit.

Ready to streamline your contract compliance process and experience the peace of mind that comes with proactive management? Legal Document Simplifier can help automate your contract compliance checklist, providing the tools and insights you need to navigate the complexities of contract management with ease. Visit Legal Document Simplifier today to learn more and discover how we can empower you to achieve contract compliance excellence.