Mastering Contract Compliance Fundamentals That Actually Work

Effective contract compliance management is more than just keeping track of documents. It's a crucial strategy for ensuring agreements are followed, obligations are met, and risks are minimized, all while maintaining business flexibility. This involves a shift from simply ticking boxes to actively creating value. It means moving away from outdated manual methods and adopting a more proactive and integrated strategy.

Why Compliance Matters: Beyond the Basics

Traditional contract tracking often falls short. It tends to focus on administrative tasks rather than the strategic implications of contracts. For instance, simply knowing a contract's renewal date doesn't guarantee you're ready for negotiation or aware of potential risks. Manual tracking is also susceptible to errors, potentially leading to missed deadlines and obligations. This can negatively impact your finances, reputation, and relationships with key stakeholders. This underscores the need for strategic contract compliance management.

Truly effective contract compliance management offers significant advantages. It helps organizations minimize financial and legal risks, bolster partner relationships, and improve overall operational efficiency. A well-defined compliance framework, for example, can prevent expensive disputes and ensure everyone fulfills their agreed-upon obligations. Contract compliance management is essential for businesses because it directly affects their profitability.

One striking statistic highlights the importance of effective contract management: a study shows that businesses lose an average of 9.2% of their annual revenue due to contract mismanagement. For larger companies, this loss can reach up to 15% of their revenue. Conversely, efficient contract management can save organizations up to 2% of their annual costs. Implementing robust contract management systems not only minimizes financial losses but also ensures adherence to regulatory requirements, avoiding potential legal and reputational damage. The rapid growth of the contract lifecycle management market further emphasizes this increasing focus. You can find more detailed statistics here.

Key Components of Effective Contract Compliance Management

To achieve strategic compliance, businesses should concentrate on several key elements:

Clear Governance Structure: Establish a well-defined hierarchy of authority and responsibility for contract management. This includes appointing dedicated compliance officers and establishing clear reporting lines.

Standardized Processes: Implement consistent procedures for contract creation, review, approval, and execution. This reduces ambiguity and ensures compliance with internal policies and external regulations.

Proactive Monitoring: Continuously track contract performance and compliance. Automated alerts and reports can help identify potential problems before they escalate into major issues.

Stakeholder Accountability: Clearly define roles and responsibilities for everyone involved in the contract lifecycle. This fosters a culture of shared responsibility and accountability.

The following table provides a more detailed explanation of these components:

Key Components of Contract Compliance Management This table outlines the essential elements that comprise a robust contract compliance management system

| Component | Purpose | Business Impact |

|---|---|---|

| Governance Structure | Defines authority and responsibility for contract management. | Ensures clear accountability and minimizes the risk of unauthorized actions. |

| Standardized Processes | Creates consistent workflows for all contracts. | Reduces errors, streamlines operations, and ensures compliance with internal policies and external regulations. |

| Proactive Monitoring | Continuously tracks contract performance and compliance. | Identifies potential issues early, enabling proactive mitigation and preventing costly disputes or breaches. |

| Stakeholder Accountability | Assigns clear roles and responsibilities for all involved parties. | Fosters a culture of shared ownership, promotes collaboration, and ensures that all obligations are met effectively. |

By prioritizing these fundamentals, organizations can move beyond basic contract tracking and develop robust contract compliance management systems that generate real business value. These systems, coupled with effective technology and continuous evaluation, build a foundation for long-term success and sustainable growth. This allows the business to concentrate on its core objectives, confident that its contracts are being managed efficiently.

The Real Business Case for Contract Compliance Management

Contract compliance management is more than just ticking a box; it's a crucial strategy for improving your company's financial performance. Effective compliance offers real business benefits, going beyond simply avoiding risks to actively adding value. This involves understanding how robust contract compliance protects revenue, reduces costs, and builds stronger partnerships.

Quantifying the ROI of Compliance

Top organizations understand that contract compliance management provides a measurable return on investment (ROI). Minimizing contract breaches, for example, means avoiding expensive legal battles and hefty penalties. Ensuring everyone sticks to the agreed terms also allows for early payment discounts and prevents late fees, directly boosting profits. A well-drafted contract forms the bedrock of compliance. Learn how carefully crafted contracts can safeguard your business with this Employment Contracts resource. This forward-thinking strategy strengthens financial stability.

Industry-Specific Compliance Challenges

Compliance rules change significantly depending on the industry. Highly regulated sectors like healthcare and financial services face especially strict requirements. For instance, healthcare providers have to comply with HIPAA regulations, while financial institutions grapple with KYC and AML requirements. This means effective contract compliance management must adapt to the specific regulations within each industry. Missing these requirements can result in substantial fines and damage a company's reputation.

Evaluating Your Compliance Performance

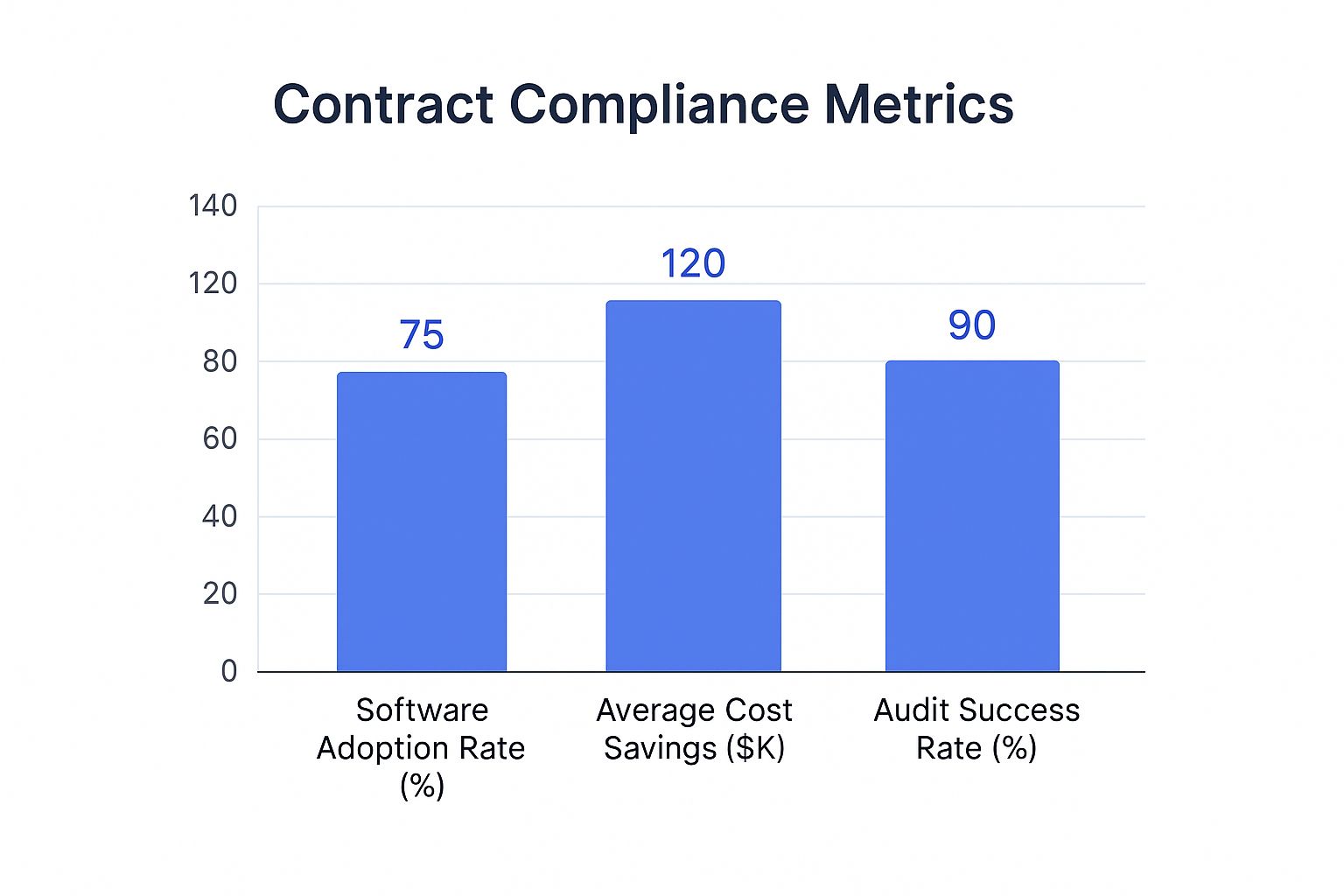

It's essential to develop a system for assessing your organization's compliance performance. This involves establishing key performance indicators (KPIs) that measure how effective your compliance efforts are.

These KPIs could track:

- The percentage of contracts checked for compliance

- The number of breaches discovered

- The time it takes to fix compliance issues

Monitoring these metrics lets businesses pinpoint areas for improvement and showcase the value of their compliance work. Regular internal audits can also reveal hidden weaknesses and improve your overall compliance stance.

Balancing Investment and Risk

Creating a strong contract compliance management system needs investment in resources and technology. However, it's important to weigh this investment against the potential costs of non-compliance. Compliance failures might not always show up directly on financial statements, but their effects can be significant. These effects can include lost revenue, reputational harm, and damaged business relationships. This emphasizes the importance of treating compliance as a strategic investment, not just an expense. By understanding the possible negative outcomes of non-compliance, businesses can make informed choices about resources and technology. This proactive approach to compliance sets the stage for long-term stability and success.

Breaking Through Contract Complexity and Negotiation Bottlenecks

Contract complexity poses a significant challenge for many businesses. However, it doesn't have to bring everything to a standstill. Successful organizations find ways to manage complex agreements without sacrificing speed or security. This involves understanding what makes contracts complex and developing strategies to improve the negotiation process.

Understanding the Complexity Drivers

Several factors contribute to contract complexity. These include regulatory requirements, which can differ significantly across industries and jurisdictions. Cross-border transactions add another layer, introducing varying legal systems and cultural norms. In addition, industry-specific obligations, such as data privacy rules in healthcare or financial reporting standards in finance, create unique challenges. Addressing these factors directly is the first step toward effective contract compliance management.

Frameworks for Managing Complexity

Leading companies use established frameworks to categorize contracts based on their complexity. This allows them to allocate resources effectively and establish appropriate compliance checks. One common framework involves evaluating the number of parties, the contract's value, and the potential risks. Another approach focuses on the level of customization needed and the extent of regulatory oversight. By categorizing contracts in this way, businesses can tailor their approach to compliance.

Streamlining Negotiations and Approvals

A thoughtful approach is vital for keeping complex negotiations on track. For example, standardizing certain clauses can simplify the review process and reduce ambiguity. Developing contingency plans for high-value agreements allows businesses to anticipate potential issues. Streamlining the approval workflow helps maintain momentum without compromising compliance. This is particularly important for organizations with multiple stakeholders involved in contract review.

The complexity and length of negotiations can vary significantly. High-complexity international contracts can take an average of 29.6 weeks, while simpler domestic contracts might be finalized in about 4.4 weeks. You can find more detailed statistics on contract management at Fynk.

Visualizing Contract Negotiation Timelines

The following data chart visualizes average negotiation timelines by contract type and sector.

Contract Complexity and Negotiation Timeline Comparison

| Contract Type | Private Sector (Weeks) | Public Sector (Weeks) | International (Weeks) |

|---|---|---|---|

| Low Complexity | 4 | 8 | 6.5 |

| High Complexity | 30 | 30 | 29.6 |

This chart illustrates how complexity and location impact contract negotiations. One key takeaway is that high-complexity contracts, regardless of location, take significantly longer to negotiate. It also reveals that low-complexity contracts take longer in the public sector compared to the private sector, likely due to increased regulatory requirements and internal approvals.

By implementing the strategies discussed, businesses can effectively manage the intricacies of modern contracts. This not only improves compliance but also promotes efficiency and better decision-making throughout the contract lifecycle. Using tools like Legal Document Simplifier can significantly improve these processes.

Building Compliance Processes That Actually Get Followed

Even with the best technology, contract compliance management can fail if your team doesn't use the established processes. This section provides a practical guide to creating contract compliance processes that your team will want to use, not find ways to avoid. It all starts with understanding how to design workflows that are both efficient and user-friendly.

Designing User-Friendly Workflows

Effective contract compliance management requires finding the right balance. Strong oversight is essential, but too much red tape can hinder efficiency and lead to workarounds. Instead of strict, top-down enforcement, concentrate on building processes that fit smoothly into existing workflows.

This means thinking about the daily tasks of everyone involved with the contract lifecycle. Look for ways to add compliance checks without creating extra steps. For instance, automated reminders for important dates and obligations can be much more effective than manual tracking.

Embedding Compliance Checkpoints

Compliance shouldn't be something you tack on at the end. Build checkpoints into every part of the contract lifecycle. From initial creation and approvals through ongoing monitoring and renewals, think about where compliance checks can add the most value without disrupting the workflow.

Automated alerts for approaching deadlines can encourage prompt action. Real-time dashboards can give everyone immediate insight into contract performance. This makes compliance a natural part of each stage, not a separate, overwhelming chore.

Overcoming Implementation Challenges

Introducing new compliance processes often meets with resistance. Team members may hesitate to adopt new technologies or change their routines. System integration problems can also create technical obstacles, especially when linking new tools with older systems. There’s also a common perception of a trade-off between compliance and speed.

Tackling these challenges directly is vital for successful implementation. This may involve providing comprehensive training on new systems, offering continuous support during the transition, and showing how streamlined processes can actually improve efficiency.

Practical Approaches to Common Challenges

Stakeholder Resistance: Bring key stakeholders into the process early on. Get their feedback on workflow design and address any concerns they have proactively. This builds support and increases the chances of successful adoption.

System Integration Issues: Make smooth integration with existing systems a priority. Choose tools that easily connect with your current infrastructure to avoid data silos and technical difficulties. Tools like Legal Document Simplifier can be helpful in this regard.

Compliance-Speed Tradeoff: Highlight how automated tools and streamlined processes can speed up contract management. By reducing manual work and increasing visibility, compliance becomes a driver of efficiency, not an obstacle. This changes how people see compliance, shifting it from a cost center to a strategic asset.

By addressing these challenges proactively and focusing on user-friendly design, organizations can create compliance processes that teams will readily adopt. This results in better compliance, lower risk, and more effective contract management overall. A collaborative strategy, combined with the right technology, creates a path towards sustainable compliance. This proactive approach isn't just about following the rules; it's about laying the foundation for stronger business relationships and lasting success.

Leveraging Technology To Transform Contract Compliance

Technology is changing how we manage contract compliance, going beyond simply storing documents. Leading companies are now using AI-powered platforms to greatly improve their compliance efforts. This involves understanding which features truly add value and how to assess the return on investment for these new technologies.

AI-Powered Platforms: Separating Hype From Reality

Many software solutions claim to have AI capabilities, but not all deliver. When evaluating contract compliance management software, concentrate on tangible results. Look for practical features like automated key term detection, deadline tracking, and risk alerts. These tools provide more than just convenience. They can substantially lower the risk of missed deadlines and expensive errors.

For instance, automated deadline tracking ensures important dates aren't missed, minimizing the risk of breaches and penalties. AI-powered key term detection helps quickly locate vital clauses and obligations, enabling faster, more informed decisions.

Evaluating ROI on Compliance Technology

Investing in technology requires carefully examining the potential return on investment (ROI). When considering compliance technology, analyze these key factors:

- Cost savings: Does the platform reduce administrative expenses, legal fees, or penalties due to non-compliance?

- Efficiency gains: Does the platform simplify workflows, automate tasks, and free up your team for strategic work?

- Risk reduction: Does it enhance compliance monitoring, allowing you to identify potential issues early and minimize legal exposure?

Quantifying these advantages demonstrates the value of the technology and builds a strong case for its adoption.

Practical Approaches To Implementation

Implementing new technology effectively goes beyond just buying software. Building efficient compliance procedures is vital for success. A compliance audit checklist template can be a valuable resource. Also, consider these important steps:

- Integration strategies: Smooth integration with your current systems is key to preventing data silos and maximizing efficiency.

- Data migration: A carefully planned data migration strategy will ensure a seamless transition and minimize interruptions.

- User adoption: Encouraging user adoption involves providing training, support, and clear communication about the technology's benefits.

Overcoming Implementation Challenges

Introducing new technology can be difficult. Common hurdles include stakeholder resistance, system integration problems, and the perceived compliance-speed tradeoff. Open communication, comprehensive training, and consistent support are essential for addressing these difficulties and ensuring a smooth transition.

By proactively tackling these challenges, businesses can maximize the return on their technology investment and reshape their contract compliance management. This proactive approach strengthens compliance and fosters a culture of informed decision-making and ongoing improvement. Technology ultimately empowers organizations to move beyond simply reacting to requirements, enabling proactive risk management across the entire contract lifecycle.

Measuring What Matters in Contract Compliance Performance

Measuring contract compliance involves more than just checking signatures. It requires a deeper look into the effectiveness of your contract compliance management processes and their impact on your business. This means using key performance indicators (KPIs) to assess how well compliance is working and find areas for improvement.

Key Performance Indicators (KPIs) for Contract Compliance

The right KPIs offer valuable insights into your compliance efforts. Here are some important metrics to consider:

Obligation Fulfillment Rate: This tracks how often contractual obligations are met on time. A consistently performing supplier, for example, would have a high obligation fulfillment rate. This KPI is crucial for understanding overall compliance health.

Financial Impact Measures: This looks at the financial consequences of compliance, such as cost savings from avoiding penalties or revenue gains from meeting payment terms. This directly links compliance to business results.

Time to Compliance Resolution: This measures how quickly compliance problems are identified and fixed. A shorter resolution time shows a more efficient and responsive compliance system. Quickly addressing a breach, for instance, minimizes potential damage.

Number of Compliance Audits Conducted: Regular contract audits help uncover potential risks and ensure adherence to regulations. Tracking the number of audits reflects a proactive approach to risk management.

Efficient Data Collection

Collecting data for these KPIs shouldn't be a burden. Use technology to automate the process whenever possible. Contract management software, like ContractWorks, can automatically track obligation fulfillment and create compliance reports. This saves time and improves accuracy. Consider integrating your compliance tools with other systems to streamline data flow and reduce manual entry.

Establishing Baselines and Driving Improvement

After collecting data, establish a compliance baseline to monitor progress. This baseline acts as a benchmark to measure the impact of improvement initiatives. For example, after implementing a new process, compare the obligation fulfillment rate before and after the change to see the impact. This data-driven approach demonstrates the value of compliance efforts.

Effective Reporting and Accountability

Compliance performance reports should be clear, concise, and accessible to stakeholders. Visualizations like dashboards and charts help simplify complex data and identify trends. Transparency fosters accountability by highlighting areas needing improvement. Sharing reports regularly keeps compliance top of mind and encourages continuous improvement across the organization.

Adapting to Change

Business and regulatory environments are constantly evolving. Your contract compliance management strategy needs to adapt. Regularly review your KPIs and processes to ensure they align with business goals and regulatory requirements. This proactive approach allows for adjustments and maintains a strong compliance posture. This flexibility is key to managing risk and staying ahead of potential issues.

Don't let complex legal documents slow you down. Simplify your contracts and improve your compliance management with Legal Document Simplifier. Their AI-powered platform offers clear, concise summaries, automated key term detection, and deadline tracking for faster, more informed decisions.