Imagine someone twisting your arm to sign a document. That’s the simplest way to think about contract law duress—it's any unlawful threat or pressure that forces someone into an agreement they wouldn't have otherwise made. When duress is in play, the contract becomes voidable because one person's signature wasn't a genuine act of consent.

Unpacking the Meaning of Contract Duress

At its core, a solid contract is a "meeting of the minds." It’s a voluntary deal where both sides freely agree to the terms. Duress completely shatters that foundation. It introduces coercion that strips away a person’s free will, making their signature an act of surrender, not agreement.

Now, not all pressure is illegal. Tough negotiations are just part of doing business. Duress, however, is what happens when that pressure crosses a line into something wrongful and overpowering. The real test is whether the pressure was so intense that the person felt they had no other reasonable choice but to sign. To see what it truly means to be forced into a decision, you can learn more about this specific legal state in our detailed guide.

The Different Faces of Coercion

Duress isn't a single concept; it shows up in a few different forms. Recognizing these types is key to spotting when a contract might be invalid. The pressure can be as obvious as a physical threat or as subtle as a crippling economic ultimatum.

A contract is voidable on the ground of duress when it is established that the party making the claim was forced to agree to it by means of a wrongful threat precluding the exercise of free will.

This legal principle is important because it shows the threat itself doesn't have to be a crime. It just needs to be wrongful in the context of forcing someone's hand.

To help you get a handle on these different forms, we've broken them down in the table below. It lays out the main categories of duress, explaining the core idea behind each one and giving you a simple, real-world example to make it stick.

A Quick Guide to Types of Duress

| Type of Duress | Core Concept | Simple Example |

|---|---|---|

| Physical Duress | Coercion through threats of violence or physical harm. | "Sign this contract, or I'll ensure you get hurt on your way home." |

| Duress of Goods | Unlawfully detaining or threatening to harm property. | "You won't get your custom manufacturing equipment back unless you agree to pay more." |

| Economic Duress | Using wrongful financial pressure to force an agreement. | "Accept these lower payment terms, or we will cancel all future orders, bankrupting your company." |

By understanding these distinctions, you'll be far better equipped to recognize the red flags of coercion, whether you're dealing with a personal agreement or a high-stakes business contract.

The Evolution From Physical Threats to Economic Pressure

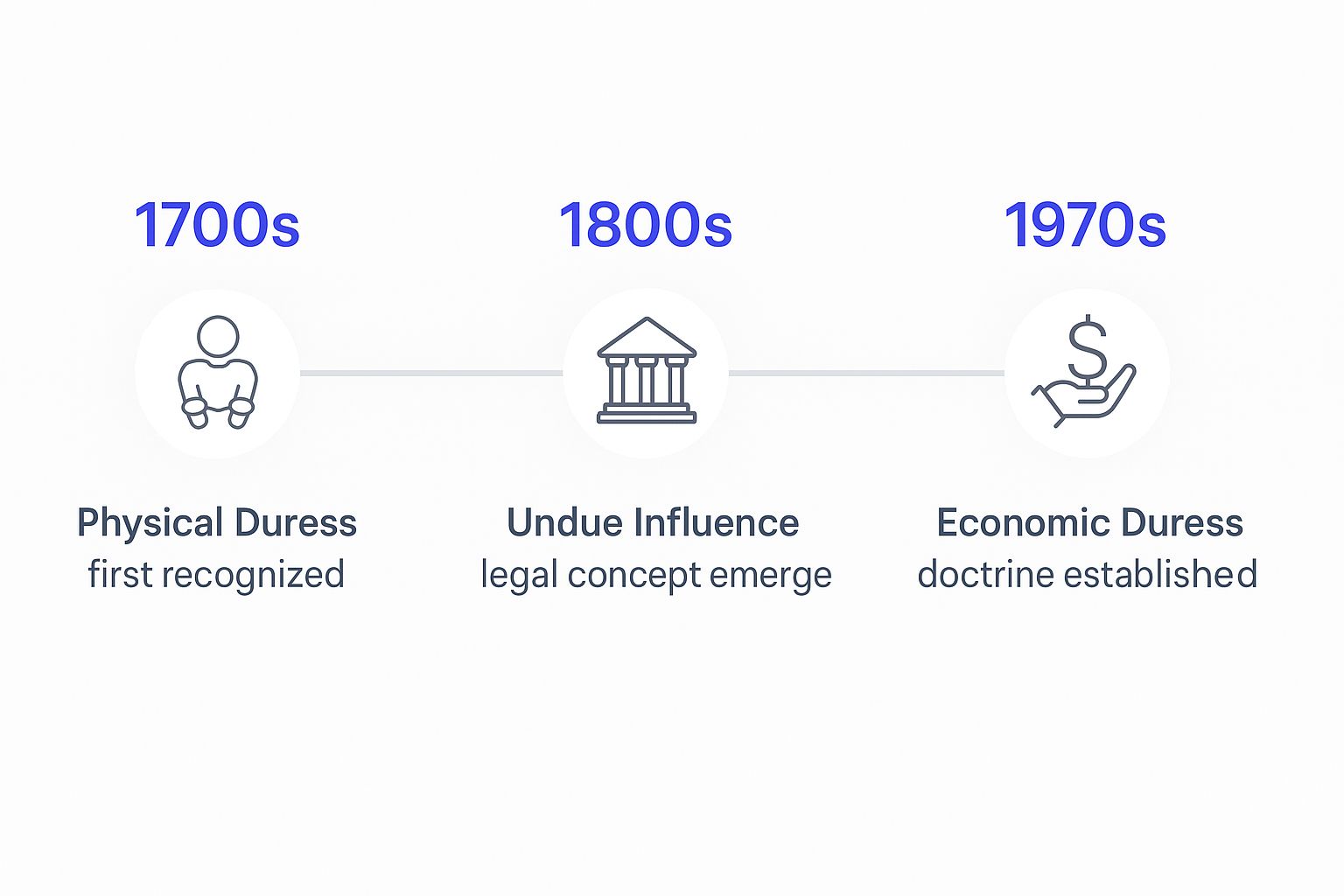

The concept of contract law duress didn't just appear fully formed. Its history is a fascinating look at how the law adapts to an ever-changing commercial world. In the beginning, the law only stepped in to stop the most obvious and brutal forms of coercion. The legal shield was narrow, protecting against little more than direct physical harm.

Early on, duress in common law meant one thing: a credible threat of violence. Think of a merchant being told, "Sign this contract, or you'll regret it." The law clearly saw this as a violation of free will. Any consent given under the shadow of physical injury or wrongful imprisonment was no real consent at all, and the resulting contract was worthless.

But as commerce grew more sophisticated, so did the ways people could force someone's hand. It became clear you could strong-arm a person into a deal without ever laying a finger on them. This realization led to the first major expansion of the duress doctrine: duress of goods.

Broadening the Scope Beyond Physical Harm

Duress of goods happens when one party unlawfully holds or threatens to damage another's property to force them into an agreement. Picture a shipping company refusing to release essential cargo unless the owner suddenly agrees to a massively inflated fee. The owner, facing catastrophic business losses, feels they have no choice but to comply.

Courts started to recognize that this kind of pressure, while not physically violent, was just as coercive. It put the victim in an impossible position, completely undermining their ability to negotiate freely. This was a critical step forward, as it acknowledged that financial and property-based threats could be just as potent as a physical one.

The core principle of duress evolved from protecting the body to protecting a person’s economic interests and free will in commercial dealings.

This shift paved the way for the most significant development in modern contract law: recognizing economic pressure as a valid reason to void a contract. This infographic shows a simplified timeline of how the law progressed.

The visualization clearly shows the slow but steady journey from only acknowledging physical threats in the 1700s to finally establishing the more nuanced doctrine of economic duress in the 1970s.

The Rise of Economic Duress

The idea of economic duress really took hold as business relationships became more interconnected. A threat to breach a single contract could now trigger a catastrophic domino effect, giving a bad actor immense leverage. The law had to catch up to this new reality.

You can see this evolution play out in landmark legal cases. In Armstrong v. Gage (1877), an early Canadian case, an elderly man was confined and threatened with wrongful prosecution until he signed over a mortgage. Much later, the doctrine was refined in cases like Atlas Express Ltd v Kafco (1989), where a small company was forced to accept crippling new payment terms because the alternative—a contract breach by their much larger partner—would have destroyed their business. There was no practical alternative. You can find more insights on these historical cases and their impact in McGill's Law Journal.

This progression was essential. Today, a threat to do any of the following could be considered economic duress, as long as the pressure is improper and leaves the victim with no reasonable choice:

- Refuse to pay a legitimate debt, knowing the creditor is on the brink of bankruptcy.

- Terminate a vital supply contract right before a major product launch.

- Blacklist a smaller company within an industry, effectively killing its business prospects.

This modern understanding ensures the law protects not just against a punch, but against the kind of financial coercion that can be just as damaging.

The Key Elements of Economic Duress

In the high-stakes world of business, not all pressure is created equal. Aggressive negotiation is a daily reality, but when does it cross the line into coercion? This is where the concept of economic duress becomes critical. Unlike physical threats, economic duress is about wrongful financial pressure so intense it effectively erases a person’s free will.

To successfully claim contract law duress on economic grounds, you have to prove two core things. First, you must show the pressure was illegitimate. Second, you need to demonstrate that this pressure was so significant it left you with no reasonable alternative but to agree to the terms.

Identifying Illegitimate Pressure

The first hurdle is proving that the pressure exerted was wrongful or illegitimate. This is the trickiest part, because it’s not always about illegal actions. Sometimes, a perfectly legal act can become illegitimate if it's used to back someone into a corner in bad faith.

Think of it this way: a supplier raising prices is usually just business. But what if a supplier threatens to halt all deliveries of a critical, sole-sourced component one day before your major product launch unless you agree to double the price? That pressure starts to look illegitimate. The context and the intent behind the threat matter immensely.

A classic example of illegitimate pressure is when one party threatens to breach an existing contract. They might refuse to perform their duties unless the other party agrees to new, more favorable terms. This forces the victim to choose between two bad options: accept the unfair demand or suffer the damaging consequences of the breach.

The heart of economic duress lies not just in the demand itself, but in the coercive nature of the threat used to compel agreement. The pressure must be so great that it voids consent, turning a negotiation into a non-negotiable demand.

Economic duress can also come from more subtle, wrongful threats. For instance, in the landmark case B & S Contracts & Design Ltd v Victor Green Publications Ltd [1984], builders threatened to stop work just a week before an exhibition unless they got paid more. The claimant had to pay to avoid devastating financial losses, which the court later recognized as duress. This principle extends to threats of withholding essential services or components, essentially leaving a business with no practical choice. You can learn more about these fascinating case studies and the development of lawful act duress in English courts.

The Absence of a Reasonable Alternative

Proving illegitimate pressure is only half the battle. The second critical element is showing that the pressure left you with no reasonable or practical alternative but to give in. If other viable options were available, a claim of duress will likely fail.

So, what counts as a "reasonable alternative"? The courts look at the practical reality of the situation. Simply having the option to sue for breach of contract later might not be considered reasonable if doing so would lead to your immediate financial ruin.

A court might evaluate several factors to see if you were truly stuck:

- Protest: Did you protest the demand at the time? A formal, written objection can be powerful evidence that the agreement wasn't voluntary.

- Independent Advice: Did you have a chance to get legal or financial advice? Being rushed into a decision with no time for consultation strengthens a duress claim.

- Affirmation: After the pressure was gone, did you take steps to void the contract, or did you act as if it were valid? Waiting too long can be seen as affirming the contract, which means you lose the right to cancel it.

A classic example is when a party is presented with a last-minute prenuptial agreement. If one partner gets the document just days before the wedding with a "sign it or the wedding is off" ultimatum, they may be left with no reasonable alternative. Their ability to negotiate freely has been compromised by the timing and emotional pressure.

Ultimately, the court's goal is to figure out if the victim’s will was truly overborne by the pressure. By examining both the illegitimacy of the threat and the practical options available, the legal system can distinguish between the rough-and-tumble of legitimate commerce and the kind of coercive behavior that undermines the very foundation of contract law.

How Contract Duress Plays Out in the Real World

Legal theory is one thing, but seeing how contract duress actually impacts real people and businesses is where the concept truly clicks. The line between tough negotiation and illegal coercion often blurs until you look at specific scenarios where one party exploits a serious power imbalance.

These stories bring the textbook elements to life, showing exactly how illegitimate pressure and the absence of a reasonable alternative can corner someone into a deal they never wanted. Let's walk through a few compelling situations, from the corporate boardroom to personal agreements, to see what duress looks like on the ground.

The Supplier Pinned Against a Wall

Imagine a small, specialized parts manufacturer, "Innovate Components," which has built its business around a long-standing relationship with an automotive giant, "Apex Motors." Innovate isn't just a supplier; Apex accounts for a staggering 70% of its annual revenue. Their three-year supply agreement is about to expire.

Just one week before the deadline, Apex’s procurement officer sends over the new terms. They’re a gut punch. The price per unit is slashed by 30%, and payment terms are stretched from 30 days to an almost unmanageable 120 days. The owner of Innovate immediately calls to protest, explaining that these terms are financially ruinous and would force massive layoffs.

The Apex officer’s response is ice-cold: "Sign it by Friday, or we're moving our business to your competitor. You and I both know what that means for your company."

This is a textbook case of economic duress. Apex isn't just negotiating hard; it's using its massive leverage to apply illegitimate pressure. The threat is not simply to end the relationship—it's to deliberately bankrupt a smaller partner, leaving Innovate with no reasonable alternative but to sign a disastrous deal.

The Employee and the Last-Minute Non-Compete

Sarah is ecstatic. She’s just accepted a dream job at a top tech firm. After quitting her previous job and moving her entire family across the country, she shows up for her first day. But before she can even get her login credentials, the HR manager slides a thick document across the table: a highly restrictive non-compete agreement. It would bar her from working in her specialized field for two years if she ever left the company.

Sarah is taken aback and says she needs time to have a lawyer review it. The HR manager offers a tight-lipped smile. "It’s just a formality, of course, but company policy requires it to be signed before you can be officially onboarded. We need it done today."

The pressure here is immense and multi-layered.

- The Threat: It’s implied that her new job—the one she has already sacrificed so much for—hangs in the balance.

- The Timing: By ambushing her on the first day, the company removes any real chance to negotiate or seek proper legal counsel without jeopardizing her employment.

- Lack of Alternative: What choice does she have? Backing out now would leave her unemployed, in a new city, and in a terrible financial and personal bind.

While non-competes can be perfectly legal, the way they are presented is critical. The combination of last-minute timing and intense pressure to sign immediately can make an employee's consent completely involuntary.

This tactic preys on the employee's vulnerability at a pivotal moment, making a claim of duress highly plausible.

The Contractor Forced to Waive Their Rights

A freelance web developer wraps up a major project for a client and sends over their final invoice for $25,000. The client loves the work but goes silent when it's time to pay. After weeks of polite follow-ups, the developer, whose cash flow is getting dangerously tight, finally gets a response.

But it’s not a payment confirmation. It’s a "Final Payment Settlement Form." To get the $25,000 he's owed, the developer must sign a new clause waiving all future claims against the client. This includes any intellectual property disputes or claims for additional work. The client's email is blunt: "Sign this release, and the funds will be wired tomorrow. Otherwise, our legal team will have to review the invoice, which could take several months."

This is a clear-cut case of coercion. The client is wrongfully withholding a legitimate payment to force the developer into surrendering his legal rights. For the developer, who needs that money to pay his own bills, there’s no practical alternative. Agreeing under these conditions means that waiver was almost certainly secured through duress.

The Legal Consequences of a Contract Made Under Duress

When a court finds that a contract was signed under duress, the agreement doesn't just disappear. The law offers specific remedies designed to protect the victim and, essentially, turn back the clock. The key is that the power to decide what happens next shifts entirely to the wronged party.

Most often, the contract is deemed voidable. This doesn't mean it's automatically cancelled. Instead, it puts the person who was coerced in the driver's seat. They get to make the call: they can either void the contract entirely or, if the deal somehow still works in their favor, they can choose to go ahead with it.

This choice is a powerful one. It gives the victim a way out of a bad deal they were forced into, without losing out if, for some strange reason, they decide the agreement is still worth keeping.

The Primary Remedy: Rescission and Restitution

If the victim decides to cancel, the main legal tool they'll use is rescission. Think of rescission as hitting a giant "undo" button. The whole point is to put both parties back in the exact financial position they were in before the contract was ever created.

But just tearing up the paper isn't enough. Rescission goes hand-in-hand with another principle called restitution. This simply means that anything of value that changed hands because of the contract has to be returned.

The core purpose of rescission is not to punish the wrongdoer, but to restore the status quo ante—the state of affairs that existed previously. It aims to unwind the transaction completely.

So, if you were forced to pay a $10,000 deposit, restitution demands you get that money back. If a piece of property was signed over, it has to be returned. This ensures the person who used duress can't keep any of the gains they got from their wrongful pressure. It's a straightforward concept rooted in fairness.

Potential Roadblocks to Undoing the Contract

While rescission is a strong remedy, it’s not a sure thing. You have to act. Courts pay close attention to what the victim does after the pressure is gone. A few missteps can lock you into a contract you never wanted.

A court might refuse to grant rescission if the victim:

- Waits Too Long to Act: The law expects you to challenge the contract within a reasonable time after the duress has ended. Dragging your feet can be interpreted as accepting the situation.

- Affirms the Contract: If you start acting like the contract is valid—for instance, by making payments or accepting benefits—you might legally "affirm" or ratify the deal. This sends a clear signal that you’ve consented, even if that consent was originally forced.

These hurdles are exactly why it's so critical to know your rights and move quickly if you believe a contract was signed under duress. For a closer look at what constitutes duress, you can explore the different types of duress in contracts and how they play out in the real world. Knowing about these potential pitfalls is the best way to protect your right to void an unfair agreement.

How to Avoid and Address Duress in Your Agreements

Navigating negotiations is a balancing act between being firm and being fair. While it's important to understand the legal ins and outs of contract law duress, the real power lies in proactively protecting your agreements from coercion in the first place.

With the right strategies, you can stop high-pressure tactics before they start and know exactly what to do if you ever feel cornered. The goal is simple: ensure every agreement is based on genuine consent, not forced compliance. This approach doesn't just protect you legally; it builds stronger, more dependable business relationships.

Proactive Strategies for Fair Negotiations

Prevention is always the best medicine. By adopting smart habits during negotiations, you create a transparent environment where duress struggles to take root. It all comes down to creating a clear record and never letting yourself get backed into a corner.

A fundamental part of this is implementing essential contract negotiation strategies to keep discussions fair and balanced from the start.

Here are some key steps to take:

- Document Everything: Keep a detailed written record of all communications. Emails, meeting notes, even text messages can become invaluable evidence if a dispute ever arises.

- Never Sign Immediately: Always give yourself time to review a contract. If the other party refuses to allow a reasonable review period, consider it a major red flag for potential duress.

- Seek Independent Advice: Before you sign anything significant, have a legal professional look it over. This is a critical step to understand your rights and obligations without pressure from the other side.

- Maintain Alternatives: Try to avoid becoming completely dependent on a single client, supplier, or partner. Having other options automatically reduces the leverage another party can hold over you.

What to Do If You Suspect Duress

If you feel you're being coerced into signing an agreement, your immediate actions are critical. How you respond can make or break your ability to challenge the contract's validity later on. The most important thing is not to suffer in silence.

If you believe you are under duress, formally protesting in writing before you sign can be powerful evidence. An email stating, "I am signing this agreement under protest and due to the economic pressure you have applied," creates a contemporaneous record of your state of mind.

Here are the first steps to take if you feel pressured:

- Voice Your Objection: Clearly and formally state that you object to the pressure being applied. If possible, do this in writing.

- Gather Your Evidence: Preserve all communications that show the coercive behavior. This includes any threats to your business, property, or financial well-being.

- Act Quickly to Rescind: Once the pressure is off, don't wait. Contact legal counsel immediately to take formal steps to void the contract. Waiting too long might be interpreted as you accepting the deal.

Managing these tense situations is a core part of strong contract risk management. You can learn more by reading our complete guide on how to build a solid contract risk management strategy. By acting decisively, you protect your own interests and help reinforce ethical business practices for everyone.

Of course. Here is the rewritten section, crafted to sound completely human-written and match the provided style examples.

Common Questions About Contract Duress

When you're trying to wrap your head around contract law, "duress" is a term that often causes confusion. People have a general idea of what it means, but the legal specifics can be tricky. Let's clear up a few of the most common questions that come up.

Is Duress the Same as Undue Influence?

While they both can get a contract thrown out, duress and undue influence are two very different beasts.

Think of duress as a "gun to the head" situation, either literally or financially. It’s all about coercion through a wrongful threat. The pressure is obvious and comes from an outside force demanding you sign, or else.

Undue influence, however, is much more subtle. It’s about the abuse of a trusted relationship. This isn't about threats; it's about one person using their special sway over another—like a caregiver pressuring an elderly patient—to get them to agree to something that isn't in their best interest. Duress is about force; undue influence is about manipulation.

Is Hardball Negotiation a Form of Economic Duress?

Not at all. The law fully expects businesses to negotiate hard. Pushing for the best deal you can get, even aggressively, is just part of the game. That’s just smart commerce.

Economic duress only kicks in when that pressure crosses the line into something illegitimate. We're talking about a wrongful act, like threatening to breach a separate contract just to corner someone. The final piece of the puzzle is that this wrongful pressure must leave the victim with absolutely no reasonable alternative but to cave. Just driving a tough bargain doesn’t even come close to the legal standard for contract law duress.

The key distinction lies in the nature of the pressure. Legitimate commercial pressure aims to secure a better deal; illegitimate pressure aims to exploit a vulnerability, leaving the victim with no real choice.

How Do You Actually Prove a Contract Was Signed Under Duress?

Proving a contract was signed under duress isn't easy, but it comes down to showing two things: there was illegitimate pressure, and you had no other reasonable way out.

Your argument lives and dies by the evidence you can gather. This can include:

- Written Communications: Emails, texts, or letters that spell out the threat.

- Witness Testimony: Statements from anyone who saw the coercion happen.

- Proof of Protest: Any record showing you objected to the terms when you signed.

- Lack of Counsel: Evidence that you were blocked from getting independent legal advice.

You also have to act fast. If you wait too long to challenge the contract after the threat is gone, a court might see that as you accepting the deal, which could sink your claim.

Navigating complex legal documents doesn't have to be a struggle. Legal Document Simplifier uses powerful AI to transform dense contracts into easy-to-understand summaries. Instantly spot key terms, obligations, and potential risks, all without the high cost of a legal consultation. Take control of your agreements by visiting Legal Document Simplifier to see how it works.