Mastering Your Contracts in 2025: A Practical Guide

This listicle presents seven contract management best practices to minimize risk and maximize value. Learn how to streamline processes and improve outcomes with techniques like standardized templates, centralized repositories, automated lifecycle management, robust risk assessment, proactive obligation tracking, cross-functional governance, and data-driven analytics. Implementing these contract management best practices empowers you to take control of your legal agreements, whether you're a freelancer, a small business owner, or part of a corporate legal team. Discover how to improve efficiency and achieve better business results.

1. Standardized Contract Templates and Clause Libraries

Creating and maintaining standardized contract templates and clause libraries is a cornerstone of effective contract management and arguably the most impactful best practice. This approach involves developing a core set of pre-approved contract templates for frequently used agreements, such as Non-Disclosure Agreements (NDAs), Master Service Agreements (MSAs), and Statements of Work (SOWs), alongside a comprehensive library of standardized clauses categorized by subject matter, risk level, and function. These pre-vetted clauses can then be easily inserted into contracts as needed, streamlining the drafting process and ensuring consistency. By leveraging approved language and pre-built structures, organizations can significantly reduce the time and resources spent on drafting, reviewing, and negotiating contracts, while simultaneously minimizing legal risks.

This best practice is particularly beneficial for organizations seeking to streamline their contract lifecycle management. Key features of a robust system include pre-approved templates for routine contracts, a categorized clause library, regular reviews and updates to reflect evolving legal and business landscapes, and version control systems to track template modifications. These features enable efficient contract creation, consistent application of legal standards, and facilitate collaboration across different teams.

This standardized approach deserves its place on the best practices list due to the numerous advantages it offers. These include a significant reduction in contract creation time (often by 60-80%), ensured consistency and compliance across the organization, minimized legal risk by using pre-approved language, facilitated and faster reviews and approvals, and ultimately makes contract management more accessible to non-legal staff. This empowers other business units to handle simpler agreements, freeing up legal resources for more complex matters.

However, implementing standardized contract templates and clause libraries does come with some initial challenges. Building comprehensive libraries requires a significant upfront investment of time and resources. Highly specialized or unique agreements may not be easily accommodated within standardized templates. Ongoing maintenance is essential to keep templates current with regulatory changes and internal policy updates. Additionally, there can sometimes be resistance from teams accustomed to custom drafting, requiring effective change management strategies.

Successful implementations of this best practice highlight its potential. Salesforce, for example, implemented a clause library that dramatically reduced contract creation time from days to mere hours. Microsoft's legal department created a contract template system that enabled self-service for basic agreements, saving thousands of attorney hours annually. Pharmaceutical giant AstraZeneca uses standardized clinical trial agreement templates across its global operations to ensure consistency and compliance with complex regulations.

Actionable Tips for Implementation:

- Prioritize High-Volume Contracts: Start by creating templates for the contract types your organization uses most frequently.

- Use Plain Language: Draft templates and clauses in clear, concise language to improve readability and understanding.

- Include Guidance Notes: Add notes within templates to explain key provisions and guide users on when customization might be necessary.

- Regular Review Cycle: Implement a regular review schedule (e.g., quarterly or bi-annually) to ensure templates remain up-to-date with legal and business requirements.

- Risk-Tiered Templates: Create different versions of the same template type to accommodate varying levels of risk.

By following these tips and considering both the pros and cons, organizations can effectively implement standardized contract templates and clause libraries to significantly improve their contract management processes. This best practice, popularized by organizations like the International Association for Contract and Commercial Management (IACCM), Corporate Legal Operations Consortium (CLOC), and WorldCC, is a proven method for enhancing efficiency, reducing risk, and optimizing the entire contract lifecycle.

2. Centralized Contract Repository

A centralized contract repository is a crucial element of effective contract management best practices. It's a secure, organized digital storage system that acts as a single source of truth for all contracts and related documents. This approach eliminates the chaos of scattered storage across departments, providing comprehensive visibility into contractual obligations and opportunities. Modern contract repositories typically include robust search capabilities, permission-based access controls, and metadata tagging to enable quick retrieval and analysis of contracts. This streamlined access empowers businesses to leverage contract data for informed decision-making and strategic planning.

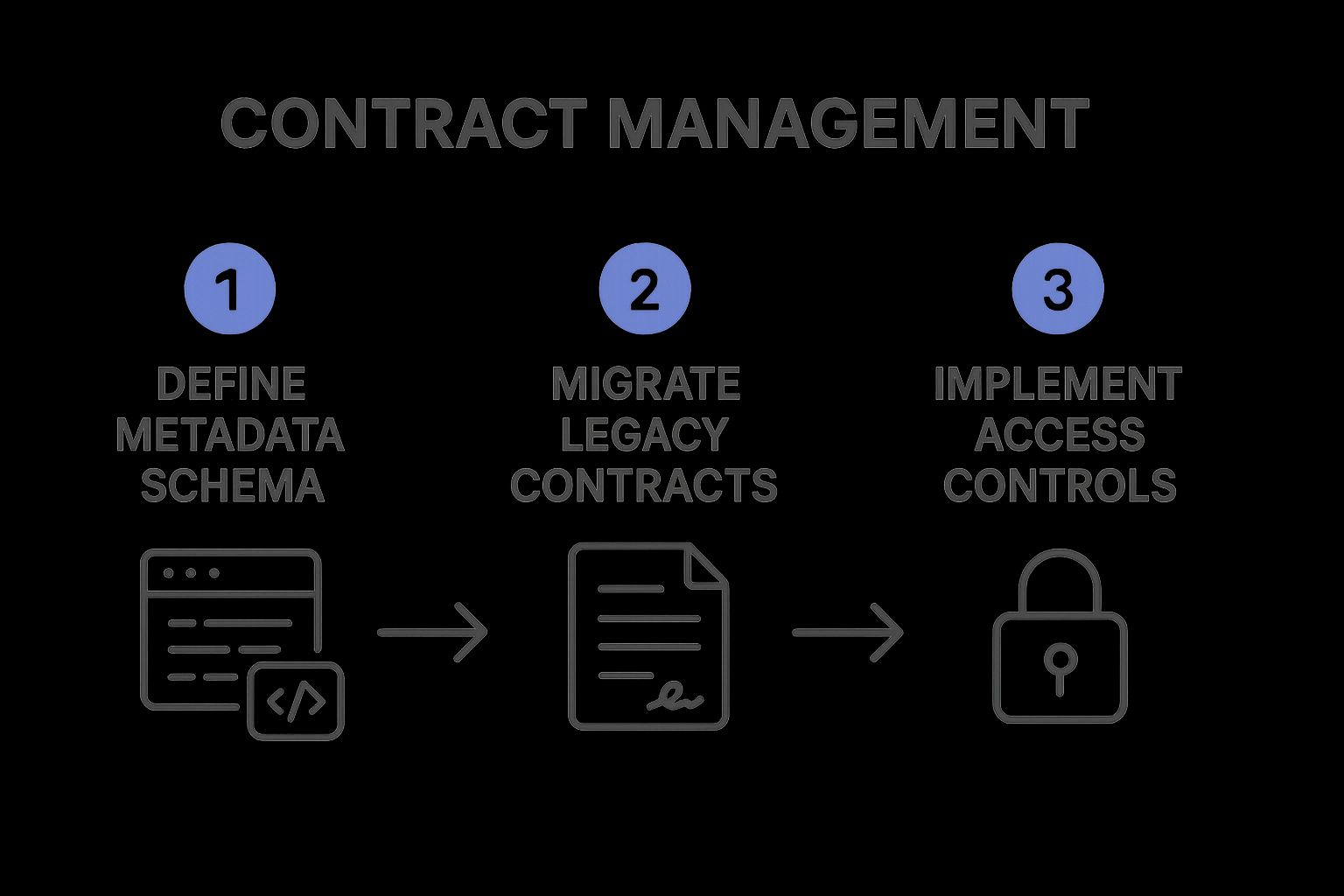

The infographic illustrates the process of centralizing contract management, starting with disparate contracts scattered across various locations. These are then consolidated into a unified repository, enabling efficient search and retrieval. The process culminates in improved compliance, reduced risk, and ultimately, better business outcomes. The visual emphasizes the streamlined efficiency and control a centralized system provides.

Features of a robust contract repository include a searchable document database with OCR capabilities, metadata tagging and custom fields for enhanced filtering, role-based access controls and permissions, version history and audit trails, integration capabilities with other business systems, and cloud-based access for remote teams. These features combine to create a powerful tool for managing the entire contract lifecycle.

When and Why to Use a Centralized Repository:

This approach is particularly beneficial when:

- Contracts are scattered across multiple departments and systems. A centralized repository consolidates everything into one accessible location.

- Manual contract retrieval is time-consuming and inefficient. Robust search and filtering capabilities drastically reduce search time.

- There's a lack of visibility into contractual obligations and deadlines. A centralized system provides a clear overview of all active contracts.

- Compliance and risk management are a concern. Access controls, audit trails, and version history ensure compliance and minimize risk.

Examples of Successful Implementation:

- General Electric: Implemented a centralized repository that uncovered over $150 million in missed revenue opportunities.

- Dell Technologies: Uses a centralized system that reduced contract retrieval time from days to seconds.

- Vodafone: Their global contract repository helped them identify and eliminate redundant vendor agreements, saving millions annually.

Pros:

- Eliminates lost or misplaced contracts

- Provides instant access to contracts across the organization

- Enables comprehensive reporting and analysis of contract data

- Improves security and confidentiality of sensitive agreements

- Facilitates better handoffs during employee transitions

Cons:

- Significant implementation costs for enterprise-grade systems

- Requires time-intensive migration of legacy contracts

- Potential user adoption challenges

- Ongoing maintenance and governance needs

Actionable Tips:

- Create a comprehensive metadata schema before beginning implementation.

- Use AI-powered extraction tools to populate metadata for legacy contracts.

- Implement a clear naming convention for all documents.

- Assign repository 'champions' in each department to encourage adoption.

- Regularly audit the repository for compliance and completeness.

Popularized By: DocuSign, Icertis, SAP Ariba, Agiloft, Gartner's Contract Life Cycle Management Magic Quadrant

A centralized contract repository deserves its place in the list of contract management best practices because it addresses fundamental challenges related to organization, access, and analysis. By providing a single source of truth, it empowers businesses to leverage contract data effectively, mitigate risks, and drive better business outcomes. This is critical for everyone from small business owners to large enterprises, ensuring contract management is a source of strength rather than a potential liability.

3. Automated Contract Lifecycle Management Systems

One of the most impactful contract management best practices is leveraging Automated Contract Lifecycle Management (CLM) systems. These platforms provide end-to-end management of contracts, streamlining every stage from initial creation and authoring, through negotiation and approval, to execution and post-execution activities like amendments, renewals, and obligation tracking. This comprehensive approach eliminates the inefficiencies of manual contract management, enabling organizations to significantly reduce manual effort, improve compliance, and gain valuable performance insights. Modern CLM systems integrate with other essential business systems such as CRM, ERP, and procurement platforms, creating a centralized and interconnected contract ecosystem. This integration allows for seamless data flow and enhanced visibility across the organization.

CLM systems offer a powerful suite of features designed to optimize and automate the entire contract lifecycle. These features typically include automated workflows and approval routing, electronic signature integration for faster execution, real-time collaboration tools to facilitate negotiations, obligation tracking and management to ensure compliance, automated alerts for key dates and milestones, reporting and analytics dashboards to provide data-driven insights, and even AI-powered contract review and analysis for enhanced accuracy and efficiency. Just as implementing an automated solution like an employee leave management system can streamline the entire process, from request to approval, and minimize errors, a CLM does the same for contracts.

The advantages of implementing a CLM are substantial. Studies show that CLM systems can reduce contract cycle times by 50-85% on average, freeing up valuable time and resources. They minimize human error through automated processes, leading to improved accuracy and reduced risk. Furthermore, CLM systems improve compliance through consistent procedures and automated tracking, helping organizations adhere to regulatory requirements and internal policies. The enhanced visibility into contract status offered by real-time dashboards empowers businesses to make informed decisions and proactively manage their contractual obligations. Finally, CLM systems capture valuable data that can be used for business intelligence, providing actionable insights into contract performance and identifying areas for improvement.

However, it's essential to be aware of the potential drawbacks. Implementing a CLM system can involve high upfront implementation and ongoing licensing costs. The implementation process itself can be complex, requiring significant change management within the organization. There’s also the potential for over-reliance on automation, and some systems may require customization to align with specific business processes.

Several organizations have seen remarkable success with CLM implementation. Walmart, for instance, implemented an enterprise CLM system that reduced contract cycle time by 70%. Johnson & Johnson uses a global CLM platform that provides real-time reporting across 400+ legal entities. Bank of America’s CLM system helped them achieve 99.9% compliance with regulatory requirements for financial contracts.

To ensure a successful CLM implementation, consider these tips:

- Thorough Assessment: Begin with a thorough assessment of your current contract management processes to identify areas for improvement and define your specific needs.

- Phased Implementation: Implement the CLM system in phases rather than attempting a complete transformation at once. This allows for easier adaptation and minimizes disruption.

- Resource Allocation: Allocate sufficient resources for user training and change management to ensure smooth adoption and maximize user proficiency.

- Clear KPIs: Establish clear Key Performance Indicators (KPIs) to measure the success of your CLM implementation.

- Integration Planning: Plan for integration with existing business systems from the beginning to ensure seamless data flow and avoid compatibility issues.

CLM systems are becoming increasingly crucial for effective contract management best practices. Whether you're a small business owner, a freelance professional, or part of a large enterprise, a CLM can significantly improve your contract processes, reduce risk, and enhance overall business performance. Leading providers in the CLM space include Icertis, Conga, DocuSign CLM, Coupa, and World Commerce & Contracting (WorldCC). By understanding the features, benefits, and potential challenges, and by following the implementation tips outlined above, you can successfully leverage a CLM system to optimize your contract management and drive significant business value.

4. Robust Contract Risk Assessment Framework

A robust contract risk assessment framework is a critical component of effective contract management best practices. It provides a structured approach to identifying, evaluating, and mitigating potential risks within contracts before they are signed. This proactive approach helps organizations avoid unfavorable terms, ensures appropriate review levels for high-risk agreements, and streamlines the approval of lower-risk contracts, ultimately saving time and resources. This framework establishes a consistent and defensible process for contract review, minimizing subjectivity and fostering better decision-making.

A robust contract risk assessment framework typically incorporates several key features: a tiered risk categorization system (e.g., low, medium, high), defined approval thresholds based on the assigned risk level, checklists for common risk factors (e.g., limitations of liability, indemnification clauses, payment terms), considerations for industry-specific and jurisdiction-specific risks, regular reviews and updates of the risk criteria, and pre-approved fallback positions for negotiation.

Examples of Successful Implementation:

- Accenture: Implemented a risk-tiered approval matrix that reportedly reduced legal review time by 40% while simultaneously improving risk identification. This demonstrates the efficiency gains possible with a structured approach.

- Cisco: Incorporated automated risk scoring into their contract risk framework, automatically routing contracts to the appropriate reviewers based on the assessed risk level. This showcases how technology can streamline the process.

- Shell: Developed a global risk assessment framework that standardized contract review across more than 70 countries while still respecting local legal requirements. This highlights the adaptability of a well-designed framework.

Actionable Tips for Implementation:

- Collaborative Development: Develop risk criteria collaboratively with legal, business, and compliance teams to ensure all perspectives are considered.

- Clear Documentation: Create clear documentation that explains how risk factors are assessed and categorized. This promotes transparency and consistency.

- Learn from the Past: Use historical contract disputes and breaches to inform your risk categorization and refine your assessment criteria.

- Escalation Pathways: Establish clear escalation pathways for unique or unforeseen risk scenarios that fall outside the standard categories.

- Regular Audits: Implement regular audits to validate the effectiveness of your risk assessments and identify areas for improvement.

Pros and Cons:

Pros:

- Focuses legal resources on high-risk contracts.

- Creates consistent, defensible decision-making.

- Accelerates low-risk contract approvals.

- Reduces subjectivity in contract review.

- Builds organizational risk intelligence over time.

Cons:

- May initially slow down contract processes during implementation.

- Requires specialized expertise to develop effective risk criteria.

- Can become rigid if not regularly updated.

- Potential for over-categorization of risk.

Why This Approach is Essential:

A robust contract risk assessment framework is crucial for any organization or individual dealing with contracts, regardless of size or industry. For small business owners and freelancers, it provides a cost-effective way to analyze legal agreements and protect their interests. For in-house legal teams, it offers a scalable approach to document management and risk mitigation. For startups, it facilitates rapid legal insights and informed decision-making. By implementing this best practice, you can proactively manage risk, minimize potential disputes, and ensure favorable contract outcomes. This framework deserves its place in this list because it's a foundational element of sound contract management, impacting efficiency, compliance, and ultimately, the bottom line. While frameworks like KPMG's Contract Risk Assessment Framework and ISO 31000 provide valuable guidance, the key is to tailor the framework to your specific organizational needs and risk appetite. Resources like the Association of Corporate Counsel (ACC) and Harvard Business Review articles on contract risk management offer further valuable insights.

5. Proactive Milestone and Obligation Management

Proactive milestone and obligation management is a crucial contract management best practice that elevates contracts from static documents to dynamic tools for value creation and risk mitigation. It involves systematically tracking, monitoring, and acting upon contractual commitments, deadlines, and performance requirements. This proactive approach ensures all parties fulfill their obligations, critical milestones are met, and decisions regarding renewals or terminations are made strategically, not reactively. This best practice is essential for anyone involved in contract management, from small business owners to large enterprise legal teams.

How it Works:

Proactive milestone and obligation management hinges on establishing a structured process. This involves identifying all key obligations and milestones within a contract, assigning ownership for each obligation to specific individuals or teams, setting up automated alerts for upcoming deadlines, and establishing regular compliance verification processes. Performance is tracked against pre-defined Service Level Agreements (SLAs) and Key Performance Indicators (KPIs). Escalation procedures are put in place to address at-risk obligations proactively. Finally, the process integrates strategic advance planning for renewals and terminations to avoid unwanted auto-renewals or missed opportunities.

Features of Effective Obligation Management:

- Automated Alerting: Automated reminders for upcoming deadlines and milestones ensure timely action.

- Ownership Assignment: Clear assignment of responsibility for each obligation ensures accountability.

- Compliance Verification: Regular audits and checks ensure adherence to contractual terms.

- Performance Tracking: Monitoring performance against SLAs and KPIs provides valuable insights.

- Escalation Procedures: Defined escalation paths for at-risk obligations facilitate timely intervention.

- Strategic Planning: Advance planning for renewals and terminations enables informed decision-making.

Why Use Proactive Milestone and Obligation Management?

This approach is crucial for maximizing contract value and minimizing risk. It’s particularly relevant when dealing with complex contracts with multiple stakeholders, long-term agreements, or contracts with significant financial implications. Implementing this best practice allows businesses, freelancers, and individuals to stay ahead of their contractual obligations and avoid costly surprises.

Pros:

- Prevents Costly Mistakes: Avoids financial penalties associated with missed deadlines and unwanted auto-renewals.

- Maximizes Value: Ensures you receive the full value promised in your contracts.

- Enhances Compliance: Reduces the risk of compliance violations and associated penalties.

- Strengthens Relationships: Improves vendor and partner relationships through clear expectations and consistent performance.

- Improves Negotiation Leverage: Provides data-backed leverage in renewal negotiations.

Cons:

- Requires Discipline: Successful implementation requires disciplined processes and consistent follow-through.

- Administrative Burden: Can create an administrative burden if not supported by appropriate technology.

- Needs Clear Accountability: Requires clear ownership and accountability structures.

- Global Challenges: Can be challenging to implement consistently across global operations.

Examples of Successful Implementation:

- IBM: Saved over $5 million annually by preventing unwanted auto-renewals through a robust obligation management system.

- Siemens: Tracks over 10,000 contractual obligations through a centralized system with individual accountability.

- Netflix: Utilizes a proactive rights management system to ensure content licensing compliance across multiple jurisdictions.

Actionable Tips:

- Early Identification: Begin identifying key obligations during contract drafting, not after execution.

- RACI Matrix: Create a RACI matrix (Responsible, Accountable, Consulted, Informed) for each major obligation.

- Three Horizons Alerting: Implement a 'three horizons' alert system: long-term, mid-term, and imminent deadlines.

- Regular Reviews: Conduct quarterly obligation review meetings with key stakeholders.

- Develop Playbooks: Develop standardized playbooks for common milestone scenarios (renewals, terminations, price adjustments).

Popularized By:

This best practice is supported by research and frameworks from leading organizations like Gartner (contract value management), Deloitte (Contract Management Optimization framework), and PwC (Contract Compliance & Optimization services).

By incorporating proactive milestone and obligation management into your contract management strategy, you can transform your contracts from potential liabilities into valuable assets that drive business success. This proactive approach empowers you to take control of your contractual relationships, minimize risk, and maximize the return on your contracts.

6. Cross-Functional Contract Governance: A Key Contract Management Best Practice

Cross-functional contract governance is a critical component of effective contract management best practices. It establishes a formal structure for overseeing the entire contract lifecycle across all relevant departments within an organization. This holistic approach ensures consistency, reduces risk, and maximizes the value of your contracts, contributing significantly to overall business success. By implementing a robust governance framework, you create a system where contracts are managed strategically, not just tactically. This is crucial for any organization, from small businesses to large enterprises, seeking to optimize their contract management processes.

How it Works:

Cross-functional contract governance typically involves establishing a steering committee composed of representatives from key departments involved in the contract lifecycle. This includes, at a minimum, legal, procurement, sales, finance, and IT. This committee is responsible for defining and enforcing contract management policies and procedures, setting performance standards, and resolving cross-functional conflicts. A well-defined decision rights matrix clarifies approval authorities, streamlining the approval process and minimizing bottlenecks. Regular performance reviews, tracked against pre-defined Key Performance Indicators (KPIs), ensure continuous improvement and accountability.

Features of Effective Cross-Functional Governance:

- Contract Management Steering Committee: A dedicated committee with cross-departmental representation ensures all perspectives are considered.

- Documented Policies and Procedures: Clear guidelines provide a framework for consistent contract management across the organization.

- Decision Rights Matrix: Defines who has authority to approve different types of contracts and contract modifications.

- Regular Performance Reviews and KPI Tracking: Provides visibility into contract performance and identifies areas for improvement.

- Continuous Improvement Mechanisms: Regularly evaluating and adjusting processes to optimize contract management effectiveness.

- Escalation Pathways: Clear procedures for handling non-standard situations and resolving disputes.

Pros:

- Organizational Alignment: Creates a shared understanding of contract strategy and objectives across departments.

- Consistent Application of Policies: Reduces risk and ensures compliance across the organization.

- Conflict Resolution: Provides a neutral forum for resolving disagreements between departments.

- Strategic Portfolio View: Enables a holistic view of the contract portfolio, identifying opportunities and risks.

- Reduced Siloed Decision-Making: Fosters collaboration and informed decision-making.

Cons:

- Potential Bureaucracy: If not implemented carefully, it can introduce unnecessary complexity.

- Requires Leadership Commitment: Success depends on buy-in and active participation from leaders across all functions.

- Potential for Slowed Decision-Making: Proper delegation structures are crucial to avoid bottlenecks.

- Ongoing Maintenance: Requires continuous attention and refinement to maintain effectiveness.

Examples of Successful Implementation:

- Procter & Gamble: Established a Contract Center of Excellence that standardized practices across its numerous global business units, demonstrating the scalability of this approach.

- Amazon Web Services: Implemented a tiered governance model that balances central control with the flexibility required by individual business units, addressing the need for both standardization and adaptability.

- Unilever: Utilizes a contract governance committee that meets regularly to review performance metrics and adapt policies to evolving business needs, showcasing the importance of ongoing monitoring and adjustment.

Actionable Tips for Implementation:

- Diverse Representation: Include representatives from all key departments involved in the contract lifecycle.

- Clear Documentation: Create a charter document that clearly outlines the governance structure, roles, and responsibilities.

- Regular Meetings: Establish a consistent cadence for both operational (monthly) and strategic (quarterly) meetings.

- Performance Dashboard: Develop reporting mechanisms to track key governance metrics and identify areas for improvement.

- Exception Process: Define a clear process for handling exceptions to established policies while maintaining control.

Why Cross-Functional Contract Governance Deserves Its Place on the List:

In today's complex business environment, effective contract management is no longer a departmental function but a strategic imperative. Cross-functional contract governance provides the framework necessary to align contract management with overall business objectives, mitigate risk, and maximize contract value. It's a vital best practice for any organization seeking to achieve contract management excellence. This approach benefits everyone from small business owners managing a few key contracts to large enterprises with extensive contract portfolios. It ensures consistency, reduces risk, and ultimately contributes to a healthier bottom line.

7. Data-Driven Contract Analytics and Performance Measurement

In today's fast-paced business environment, effective contract management is crucial for success. Among the best practices for optimizing contract management, data-driven contract analytics and performance measurement stands out as a game-changer. This practice elevates contracts from static legal documents to dynamic, strategic assets, providing valuable insights that drive better business decisions and improve bottom-line results. This makes it an essential component of any robust contract management strategy and deserves its place among the top contract management best practices.

Data-driven contract analytics involves systematically collecting, analyzing, and leveraging contract data to gain a deeper understanding of contract performance and identify opportunities for improvement. It's about transforming raw contract data into actionable intelligence. This is achieved by extracting key information from contracts, such as pricing trends, negotiation patterns, contract cycle times, risk profiles, and value realization. Instead of relying on manual review, which can be time-consuming and prone to errors, data-driven analytics provides an objective, comprehensive view of your contract landscape.

How it Works:

The process typically involves leveraging technology solutions, ranging from basic spreadsheet analysis to sophisticated AI-powered platforms, to extract and analyze contract data. This data is then used to generate reports, dashboards, and visualizations that highlight key performance indicators (KPIs) and trends. Advanced analytics can even predict future outcomes, such as potential risks or opportunities.

Features of Data-Driven Contract Analytics:

- KPI Dashboards: Provide real-time visibility into contract performance metrics like cycle time, compliance rates, and financial impact.

- Trend Analysis: Identify patterns and trends across contract portfolios to understand negotiation effectiveness, pricing variations, and risk exposure.

- AI-Powered Contract Data Extraction: Automates the extraction of key data points from contracts, reducing manual effort and improving accuracy.

- Predictive Analytics: Forecasts potential risks and opportunities based on historical data and market trends.

- Benchmark Reporting: Compares contract performance against industry standards to identify areas for improvement.

- Integration with other systems: Connects contract data with financial and operational systems to provide a holistic view of business performance.

Pros:

- Identifies optimization opportunities: Unveils hidden cost savings, revenue opportunities, and process inefficiencies not visible through manual review.

- Objective data for negotiations: Provides data-backed leverage for vendor negotiations and internal process improvements.

- Early identification of problems: Enables proactive identification of problematic contracts or terms before they escalate.

- Data-backed decision-making: Supports informed decisions regarding contract strategies and resource allocation.

- Quantifies improvements: Measures the financial impact of contract management improvements, demonstrating ROI.

Cons:

- Data quality dependence: Requires accurate and consistent data for reliable insights.

- Technology investment: Advanced analytics may require investment in specialized software.

- Specialized skills: Interpreting and acting on analytics requires skilled personnel.

- Information overload: Without proper focus, the sheer volume of data can be overwhelming.

Examples of Successful Implementation:

- Mastercard identified $23.5 million in savings opportunities through their contract analytics program.

- Boeing uses AI-powered analytics to review contract performance across its vast supplier network and identify negotiation leverage points.

- Adobe reduced contract approval times by 65% using a contract analytics platform that provided real-time visibility into bottlenecks.

Actionable Tips for Implementation:

- Define clear metrics: Start by identifying the key performance indicators that align with your business objectives.

- Start simple, then scale: Begin with basic analytics before implementing more advanced techniques.

- Clean and standardize data: Ensure data quality by cleaning and standardizing existing contract data.

- Create role-specific dashboards: Tailor dashboards to the specific needs of different stakeholders.

- Regular reviews and action planning: Establish a regular cadence for reviewing analytics and developing action plans.

When and Why to Use This Approach:

Data-driven contract analytics is particularly valuable for organizations looking to:

- Reduce costs: Identify opportunities for cost savings and improve negotiation outcomes.

- Mitigate risk: Proactively identify and manage contractual risks.

- Improve compliance: Ensure adherence to contractual obligations and regulatory requirements.

- Optimize contract performance: Streamline contract processes and improve overall efficiency.

- Gain a competitive advantage: Leverage contract data to make better business decisions.

By embracing data-driven contract analytics, organizations of all sizes, from small businesses to large enterprises, can transform their contract management processes and unlock significant value. This approach aligns perfectly with the needs of anyone handling contracts, whether they are managing complex legal agreements or simple personal contracts, empowering them to make informed decisions and achieve better outcomes. While some solutions popularized by companies like Kira Systems and Seal Software (now DocuSign Insight) might be more suited to larger organizations, the core principles and benefits of data-driven contract management are applicable and valuable across the board. Resources like Spend Matters contract analytics research and Harvard Business Review articles on contract intelligence can provide further guidance.

7 Best Practices Comparison Matrix

| Best Practice | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Standardized Contract Templates & Clause Libraries | Moderate - requires initial investment and ongoing updates | Medium - legal expertise and content creation | Faster contract creation (60-80% time reduction), consistency, legal risk reduction | High-volume, routine contracts with some variability | Time-saving, compliance, accessibility for non-legal staff |

| Centralized Contract Repository | High - system selection, legacy migration, governance | High - IT infrastructure, data migration, user training | Instant contract access, reduced losses, better security, improved reporting | Organizations with dispersed contract storage and compliance needs | Single source of truth, enhanced security, auditability |

| Automated Contract Lifecycle Management Systems | High - complex integration, change management needed | High - licensing, training, customization | 50-85% reduction in contract cycles, improved compliance, real-time visibility | Large organizations with high contract volume and complexity | Cycle time reduction, error minimization, scalability |

| Robust Contract Risk Assessment Framework | Moderate - requires specialized risk criteria and cultural adoption | Medium - expertise in risk, training | Focused legal reviews, consistent decisions, faster low-risk approvals | Organizations requiring stringent risk control and compliance | Risk focus, defensible decisions, approval acceleration |

| Proactive Milestone & Obligation Management | Moderate - process discipline and accountability needed | Medium - systems for alerts and tracking | Missed deadline prevention, compliance, vendor relationship improvement | Contracts with critical deadlines, renewals, and performance metrics | Risk mitigation, value realization, improved compliance |

| Cross-Functional Contract Governance | Moderate to High - committee building and policy design | Medium - leadership time and coordination | Organizational alignment, consistent policies, conflict resolution | Multi-departmental organizations needing strategic oversight | Alignment, policy consistency, strategic portfolio view |

| Data-Driven Contract Analytics & Performance Measurement | High - data quality, analytics tools, and skills required | High - technology investment, analytics expertise | Identified savings, informed strategies, risk/opportunity prediction | Organizations seeking strategic insights through contract data | Insights generation, predictive capability, decision support |

Elevate Your Contract Management Game

Mastering contract management best practices is no longer a luxury, but a necessity in today's fast-paced business environment. From standardized contract templates and centralized repositories to automated lifecycle management and robust risk assessment, the strategies outlined in this article provide a roadmap for optimizing your contract processes. By prioritizing proactive milestone management, cross-functional governance, and data-driven analytics, you transform your contracts from static documents into dynamic tools that drive business growth. Implementing these contract management best practices empowers you to minimize legal risks, maximize value realization, and gain a competitive edge. Whether you're a small business owner, a freelance consultant, or part of a large enterprise, these principles are crucial for success. The benefits extend far beyond simple compliance, contributing to improved operational efficiency, stronger vendor relationships, and ultimately, a healthier bottom line.

By embracing these contract management best practices, you're not just streamlining administrative tasks; you're building a foundation for strategic decision-making and sustainable success in 2025 and beyond. Ready to simplify your contract management and unlock its full potential? Explore how Legal Document Simplifier can automate and enhance many of these best practices, helping you achieve contract excellence. Visit Legal Document Simplifier today to learn more and request a demo.