To default on a contract is to break a promise. It's that simple. When you fail to fulfill a legally binding duty laid out in an agreement, you've defaulted. This isn't just a minor slip-up; it's a broken commitment that can set off a chain reaction of serious legal and financial consequences.

A default can be anything from missing a payment to not delivering a promised service on time.

What It Really Means to Default on a Contract

Think of a contract as a shared blueprint for building something together. Each party has its own set of jobs and deadlines, and everyone agrees to follow the plan to make sure the final structure is sound. A default happens when someone goes off-script—maybe they use the wrong materials, blow past a deadline, or just walk off the job entirely.

That failure to perform is the heart of what it means to default. One side hasn't held up their end of the bargain, which puts the entire agreement and the other party’s investment on the line. Getting a handle on what a default looks like in practice often starts with understanding the specific type of agreement, like those detailed in guides to real estate management contracts.

The Core of a Contractual Promise

At its core, a default is the violation of a promise the law will actually enforce. When you sign a contract, you're not just making a casual commitment. You're creating a legal obligation, and the law has a system in place to make things right if that obligation isn't met.

The term is often used interchangeably with another key legal concept. To dig deeper into the legal specifics, check out our guide on what a breach of contract means. https://legaldocumentsimplifier.com/blog/what-does-breach-of-contract-mean

Not All Defaults Are Created Equal

It's really important to understand that defaults come in all shapes and sizes. The fallout from being one day late on a minor report is worlds away from failing to deliver a multi-million dollar piece of machinery. This difference is critical because it dictates what legal options are available.

A minor default might only give the other party the right to be compensated for any direct financial harm. But a major, or "material," default could blow up the entire contract, freeing the wronged party from their own obligations.

Knowing this distinction is the first step in navigating the often-tricky world of contract law. A small stumble won't always bring the whole project crashing down, but a fundamental failure certainly can, leading straight to a serious legal fight.

The Different Categories of Contract Defaults

When a deal goes south, it's rarely a simple, black-and-white issue. A default on a contract can be anything from a minor hiccup to a total breakdown that brings the whole agreement crashing down. Understanding these different shades of failure is crucial, because the type of default dictates your legal rights and what you can actually do about it.

After all, not all slip-ups are created equal. The law treats a small delay much differently than a complete failure to deliver on a core promise. That's why defaults are sorted into different types based on how serious they are and the impact they have.

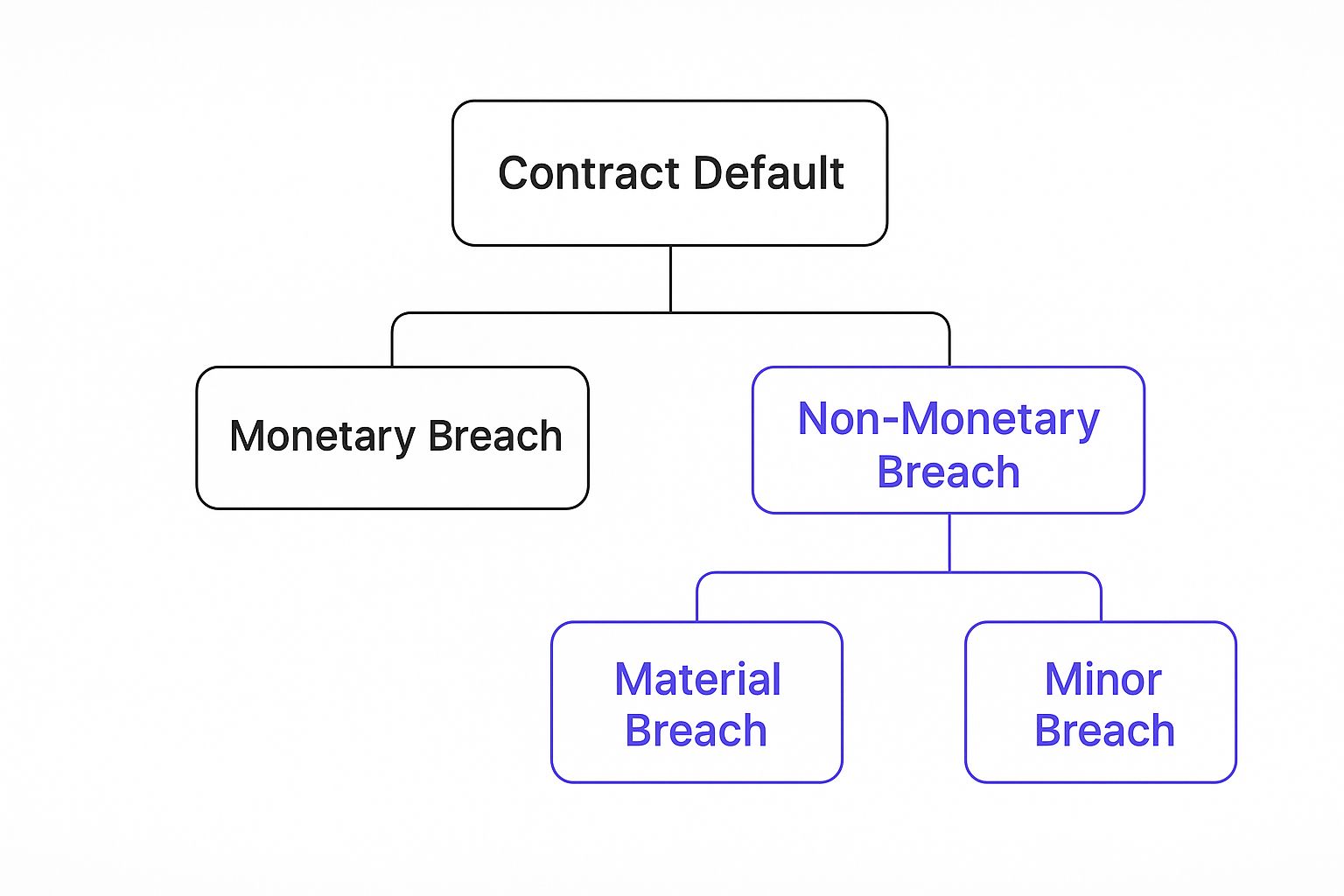

This chart gives you a quick visual breakdown of how contract defaults are typically organized, separating them into a few key buckets.

As you can see, defaults often fall into either financial (monetary) or performance-based (non-monetary) camps, with performance issues getting broken down even further by severity.

Material vs. Minor Breach: What Is the Difference?

The most critical distinction you need to know is the one between a material breach and a minor breach.

A material breach is the big one. It’s a serious failure that goes straight to the heart of the contract. Think of it as a violation so significant that it completely undermines the whole point of the agreement for the person on the receiving end.

Imagine you hire a developer to build an e-commerce app. They deliver something, but it’s so full of bugs that customers can't actually buy anything. That's a classic material breach. The core promise—a working app—was broken, which likely gives you the right to terminate the contract and sue for damages.

A minor breach (sometimes called a partial breach) is less severe. It happens when a less critical part of the contract isn't met, but the main goal of the agreement is still largely achieved. Let's use that same app developer. If they delivered a fully functional app but were just one day late, that would probably be considered a minor breach. It’s not great, but you still got what you paid for. You could potentially seek damages for that one-day delay, but you couldn't just cancel the entire contract over it.

A simple way to think about it: a material breach breaks the contract, while a minor breach just bends it. After a minor breach, you still have to uphold your end of the deal, though you can sue for the specific harm caused.

To help clarify these distinctions, the table below provides a quick side-by-side comparison.

A Quick Guide to Contract Breach Types

This table breaks down the different types of contract defaults, showing what defines them and what they look like in the real world.

| Type of Default | Core Meaning | Real-World Example | Likely Outcome |

|---|---|---|---|

| Material Breach | A major failure that defeats the purpose of the contract. | A construction company uses substandard materials, making a new building unsafe. | The non-breaching party can terminate the contract and sue for significant damages. |

| Minor Breach | A less serious violation that doesn't undermine the core agreement. | A freelance writer delivers an article two hours after the agreed-upon deadline. | The non-breaching party must still perform but can sue for damages caused by the delay. |

| Anticipatory Repudiation | One party clearly states they will not fulfill their obligations before the due date. | A supplier emails you to say they won't be able to deliver the ordered goods next month. | The non-breaching party can sue immediately, cancel the contract, and find a new supplier. |

Understanding these categories helps you identify what kind of breach you're facing and decide on the most appropriate course of action.

Understanding Anticipatory Repudiation

There's another important category called anticipatory repudiation, which is unique because it happens before the performance deadline even hits. This is when one party makes it crystal clear—either with their words or their actions—that they have no intention of fulfilling their side of the bargain.

For example, a supplier calls you a month before a big delivery and says their factory has shut down and there's absolutely no way they can provide the goods you ordered. You don't have to just sit around and wait for the delivery date to come and go.

This announcement is treated as an immediate breach, giving you the power to:

- Sue for damages right away.

- Cancel the contract and line up another supplier.

- Hold up your end of the deal, like withholding payment.

This is a practical rule that allows the innocent party to start limiting their losses immediately instead of waiting for the inevitable to happen. Knowing these different types of defaults is the first step to forming a smart, effective response when a contract starts to go sideways.

The Legal Consequences of Breaching a Contract

So, a contract has been broken. What now? When one party defaults on an agreement, the law doesn't just throw up its hands and walk away. Instead, it offers a toolkit of legal remedies designed to put the wronged party back in the position they would have been in if the contract had been fulfilled.

The goal isn't really to punish the person who breached the contract. It's about fairness—restoring the non-breaching party and making them whole again. This process is more than just sending an angry email; it involves specific, court-ordered actions tailored to the type of contract, the nature of the breach, and the actual harm done.

Common Remedies for a Contract Default

When a court gets involved, it has a few different ways to fix the situation. The most common remedies are about compensating for losses, but sometimes, they force the breaching party to follow through on their original promise.

Here are three of the most frequent remedies you'll encounter:

- Compensatory Damages: This is the big one—the most common fix. The court orders the party at fault to pay money to cover the direct financial losses caused by the breach.

- Specific Performance: Sometimes, money just doesn't cut it. In unique cases, like a real estate deal for a specific property, a court might force the breaching party to do exactly what they promised.

- Restitution: This remedy is all about preventing one party from being unfairly enriched at the other's expense. It forces the breaching party to return any payments or benefits they received.

Think of it this way: Compensatory damages are like getting reimbursed for a canceled flight. Specific performance is the airline being forced to get you to your destination anyway. Restitution is simply getting your ticket money back.

Real-World Example The Caterer Who Bailed

Let's make this real. Imagine you hired a caterer for a huge corporate event and paid a $5,000 deposit. The day of the event arrives, and... crickets. They're a no-show. That’s a classic material breach.

You're left scrambling and have to find a last-minute replacement, which ends up costing $12,000. The original caterer was only going to cost $10,000 total.

In this scenario, a court would almost certainly award you compensatory damages. That would include getting your $5,000 deposit back, plus the extra $2,000 you had to shell out for the more expensive replacement caterer. Sometimes, contracts actually spell out these amounts ahead of time—you can learn more about what liquidated damages mean in our detailed guide.

Of course, when a default is more severe, like a major lease violation, the stakes get higher. In those situations, it's critical to understand the eviction process and the formal legal steps required to address the breach.

Your Next Steps After a Contract Default

Finding out you’re on either side of a default on a contract is a stressful moment. Whether you’re the one who couldn’t deliver or the one left waiting, it’s easy to feel overwhelmed. But how you react in these first few hours is crucial and will set the tone for everything that follows.

The temptation might be to immediately pick up the phone to make demands or excuses. Don't. A calm, strategic approach will get you much further than an emotional one. Your first move should be to grab the one thing that matters most right now: the contract itself.

Review the Contract and Document Everything

Before you do anything else, read the contract again. This time, zero in on the sections covering default, termination, and dispute resolution. These clauses were written for this exact scenario and will spell out the agreed-upon rules of engagement.

Pay special attention to any mention of a "cure period"—this is a specific window of time the breaching party has to fix the issue.

At the same time, start documenting everything with meticulous detail. This isn't just about covering your bases; it's about building a case if things escalate. Your file should include:

- All communications: Save every single email, text, and note from phone calls related to the agreement and the default.

- Proof of the breach: Collect hard evidence. This could be photos of shoddy work, delivery logs showing late shipments, or bank statements reflecting missed payments.

- Proof of your own performance: Keep records that show you’ve held up your end of the bargain, like receipts for payments you've made or confirmation of tasks you’ve completed.

This isn’t busywork. In formal settings like federal contracting, agencies must provide written notice before terminating for default, a process that hinges entirely on clear, organized documentation.

Communicate Formally and Clearly

With the contract's terms fresh in your mind and your evidence in order, it's time to communicate. The standard next step is to send a written notice of breach.

Keep the tone professional and to the point. The notice should clearly identify which part of the contract was breached, detail the failure, and reference the specific clauses that apply. It should also state what you expect to happen next, whether that’s demanding performance by a new deadline or signaling your intent to seek damages.

Sending a formal notice does two things. First, it officially puts the other party on notice and gives them a chance to make things right. Second, it creates a paper trail proving you took the proper steps to address the default on a contract before taking more serious action.

Consider Alternatives to Litigation

Jumping straight to a lawsuit is almost never the best first option. Litigation is a long, expensive, and often emotionally draining process that can burn bridges for good. Fortunately, there are smarter ways to find a resolution.

- Negotiation: Often, a direct and honest conversation between both parties is all it takes. You might be able to find a compromise by adjusting timelines, changing payment terms, or finding another middle ground.

- Mediation: In mediation, a neutral third party helps guide the conversation. The mediator doesn’t make a ruling but helps both sides find a solution they can agree on.

These alternative dispute resolution (ADR) methods can save you thousands in legal fees and might even salvage a valuable business relationship. If you go this route, knowing how to prepare for mediation can make all the difference in reaching a positive outcome.

How to Proactively Prevent Contract Defaults

The best way to handle a contract default is to stop it from ever happening. You can't control what the other party does, but a proactive strategy built on clarity and good old-fashioned diligence will dramatically lower your risk.

This isn't about hoping for the best. It's about building your agreements on a solid foundation of precision, foresight, and open communication from the very beginning.

Think of it this way: a poorly written contract filled with vague terms is like a map with no street names. It’s an open invitation for misunderstandings that can quickly spiral into a full-blown default.

Your first move is to ditch ambiguity for absolute clarity.

Draft Contracts with Precision

A contract is only as strong as its specifics. Vague language is the number one cause of disputes, so the goal is to leave zero room for misinterpretation. Define every key part of the deal in painstaking detail.

To get there, focus on a few key areas:

- Define Performance Standards: Don't just say a service will be "high quality." Get specific. Define website uptime as 99.9% or state that product defect rates must be less than 1%.

- Set Firm Timelines and Milestones: A single final due date isn’t enough. Break the project into phases with clear deadlines for each milestone. Even better, tie payments to the successful completion of each stage.

- Outline Clear Payment Terms: Specify the exact amounts, due dates, payment methods, and any penalties for late payments. This removes any questions about financial obligations.

The clearer the obligations, the harder it is for anyone to default by accident. When expectations are precisely defined, both sides have a clear benchmark for success.

Conduct Thorough Due Diligence

Never walk into an agreement blind. Before you sign anything, you have to vet your potential partner. Honestly, a party's track record is often the best predictor of their future behavior.

This means doing your homework. Investigate their professional reputation, check references from past clients, and get a sense of their financial stability. A quick search for past lawsuits or public disputes can reveal red flags you’d otherwise miss.

But it doesn't stop once the ink is dry. Maintaining open lines of communication is just as critical. Regular check-ins can help you spot potential issues long before they snowball into serious problems. Actively managing your agreements is a continuous process. For more on this, check out our guide on tracking contract obligations.

By combining a meticulously drafted contract with comprehensive due diligence, you build a powerful defense against the costly headaches of a default.

Of course. Here is the rewritten section, crafted to sound completely human-written and natural, following the provided style guide.

Got Questions About Contract Defaults?

When a contract goes sideways, it’s natural to have a million questions. What happens now? What are my rights? Let’s cut through the confusion and get you some straight answers to the most common questions that pop up when dealing with a default.

We'll tackle the tricky terminology, clarify what happens in different scenarios, and walk through the essential steps you need to take when a contract issue arises.

Are Default and Breach of Contract the Same Thing?

Yes, for all practical purposes, they are. Think of "default" as the general term for failing to do something you promised, whether it’s missing a car payment or not delivering goods on time.

"Breach of contract" is just the specific legal term for that failure when it happens inside a formal agreement. So, if you default on a contract, you’ve legally breached it. You’ll often hear the terms used interchangeably, and that’s perfectly fine.

Can I Still Get Paid If I Only Messed Up a Little?

In many situations, the answer is yes. This is where a legal concept called “substantial performance” comes into play. It’s a rule of fairness that says if you’ve completed the essential purpose of the contract, a minor slip-up shouldn’t prevent you from getting paid for the work you did.

This isn't a get-out-of-jail-free card, though. The other party can usually deduct any costs they incurred because of your minor failure. For example, if a contractor used a slightly different (but still functional) doorknob than specified, they’ll probably get paid the full contract price, minus the cost for the property owner to buy and install the correct doorknob.

The idea behind substantial performance is to prevent someone from using a tiny, insignificant error as an excuse to avoid paying for a job that was, by and large, done right.

It strikes a balance, making sure small mistakes don’t lead to disproportionately harsh financial outcomes for either side.

How Long Do I Have to Sue for a Breach of Contract?

Every state has a deadline for filing a lawsuit called the statute of limitations. This is a hard-and-fast rule. If you miss this window, your right to sue is gone forever, no matter how solid your case is.

These time limits can vary wildly. For instance, in one state you might have ten years to sue over a written contract, but only three for a verbal one. Another state might give you just four years for both.

Because of this variation, you can't afford to wait. The only way to know the exact deadline for your specific contract and situation is to talk to a legal professional as soon as possible.

What Should I Put in a Notice of Breach Letter?

A formal notice of breach is a serious document, and it needs to be crystal clear. A vague or sloppy notice can hurt your case down the road if things escalate.

Your notice needs to include a few key things to be effective:

- Identify the Contract: State the name and date of the agreement you’re referencing.

- Detail the Breach: Be specific. Point to the exact clause that was violated and clearly explain how the other party failed to meet their obligation.

- Offer a Cure Period: Give them a reasonable amount of time to fix the problem. This is often called a "cure period."

- State the Consequences: Make it clear what will happen if they don't fix the default by your deadline—whether that's terminating the contract or taking legal action.

Navigating contracts can be tough, but you don't have to do it alone. Legal Document Simplifier uses AI to instantly translate complex agreements into simple summaries, helping you spot risks and understand your obligations without the high legal fees. Upload your document today and see the difference clarity makes. Find out more at https://legaldocumentsimplifier.com.