When someone forces you into a deal with an illegitimate threat or coercion, that’s duress. It invalidates a contract because it wasn't signed with free will. Instead, one party was subjected to wrongful pressure so intense that it crushed their ability to make a genuine choice.

The legal issue here isn't that consent was totally absent, but that it was twisted and obtained improperly.

Why Free Will Is the Heart of Every Contract

At its very core, contract law runs on the principle of mutual agreement—a true "meeting of the minds" where both sides willingly accept the terms. Think of it like the foundation of a house. If that foundation is cracked, the whole structure is compromised. In contracts, that foundation is voluntary consent.

Duress is the sledgehammer that shatters this foundation. It introduces a wrongful threat that corners one party, leaving them with no reasonable way out except to sign on the dotted line. The law is clear: consent given under these conditions isn't real consent.

It’s the difference between a persuasive salesperson and a blackmailer. The first is negotiation; the second is coercion.

Distinguishing Tough Bargaining from Coercion

Not all pressure is illegal, of course. Business negotiations can be intense, filled with aggressive tactics and hardball offers. The law has a term for this: "commercial pressure," and it's perfectly acceptable. Duress only kicks in when that pressure crosses the line into something illegitimate or wrongful.

So, how do the courts draw that line? They look at a few key things:

- The nature of the threat: Was it a threat to do something illegal, like commit a crime? Or was it a threat to do something technically legal but for an improper reason, like threatening to breach another contract just to gain leverage?

- The victim’s state of mind: Did the pressure actually overpower their will? The court wants to know if the threat was a primary reason they agreed to the deal.

- The available alternatives: Did the person being pressured have any other reasonable choice? If there was no practical way to escape the situation other than signing, the claim for duress gets much stronger.

The legal doctrine of duress isn't here to save people from bad deals or buyer's remorse. Its real purpose is to shield them from being backed into a corner by illegitimate threats that effectively destroy their free will.

For example, a landlord telling you, "Sign the lease by Friday or I'll rent it to someone else," is just standard business pressure. But a supplier telling you, "Sign this new contract at double the price, or we'll stop the critical shipment you need to avoid bankruptcy tomorrow"—that could easily slide into economic duress.

Understanding this critical difference between legitimate commercial hardball and wrongful coercion is the key to grasping duress in contract law. It's what gives you the grounds to challenge a contract's validity in court.

The Evolution of Contractual Duress

The idea of duress in contract law wasn't dreamed up overnight. It has a long history that stretches back to old English common law, where the concept was far more rigid and unforgiving than what we see today. In the beginning, courts would only step in for the most extreme and obvious types of coercion.

Anything less than a direct, severe threat was often dismissed. The law held a very narrow view of what could truly overpower someone's free will, meaning only a handful of coercive acts were enough to get a contract thrown out.

The Original High Bar for Duress

Back in the day, proving duress was a steep climb. The threat had to be incredibly serious, almost always involving physical harm. The legal system was built to protect a person's body, not necessarily their bank account.

The only threats that really counted were:

- Loss of life or limb: Direct threats of death or severe injury.

- Physical violence: The risk of being assaulted.

- Unlawful imprisonment: Threats of being illegally locked up or detained.

What about threats to your property? Things like destroying your goods or wrongfully holding onto your assets were usually seen as insufficient. The prevailing legal attitude was that a person should be tough enough to withstand that kind of pressure—a much harsher standard than we have now.

This historical view is key to understanding the shift. The law first focused on coercion that was truly shocking, like physical violence. It took a long time for the courts to accept that financial or psychological pressure could be just as crippling. Essentially, you needed a "gun to the head" scenario for the law to intervene.

This limited perspective started to crack as the world of business became more complex. The doctrine of duress in contract law originated in English common law, where it was initially confined to these severe threats. Early precedents from the 19th and early 20th centuries established that lesser threats—such as battery, destruction of goods, or wrongful detention of property—were insufficient to render a contract voidable. You can discover more insights about this legal history and its development over time.

Shifting Focus to the Wrongfulness of the Pressure

The 20th century brought a huge change in thinking. Courts started to realize that in a modern economy, a threat didn't need to be physical to be devastating. The legal analysis began to shift from a rigid test of the victim's bravery—asking if they were "strong enough" to resist—to a more sophisticated look at the wrongfulness of the pressure being used.

This was a massive conceptual leap. The question was no longer just, "Was the victim's will broken?" but instead, "Was the pressure applied illegitimate and unfair?" This change opened the door for courts to recognize the more subtle, yet powerful, forms of coercion that were popping up in business.

By the 1980s, this evolution had solidified new types of duress, most importantly economic duress. Courts finally accepted that threatening to breach a critical contract or taking advantage of someone's dire financial straits could leave them with no reasonable choice but to agree. This adaptation kept contract law relevant, protecting people from modern forms of coercion that are just as potent as the physical threats of the past.

Proving a Duress Claim in Court

So, you believe you were forced to sign a contract. Successfully arguing duress in contract law takes more than just describing a high-pressure situation. To get a contract thrown out, you need to show the court concrete evidence that meets some very specific legal tests.

It all comes down to proving two things. First, you have to establish that you were hit with an illegitimate threat. Second, you must show that this threat was the only reason you signed, leaving you with no other reasonable choice.

Establishing an Illegitimate Threat

The first hurdle is proving the threat was wrongful or illegitimate. This isn't about feeling uncomfortable during a tough negotiation; it's about facing pressure that crosses a clear legal and ethical line.

So what makes a threat illegitimate? Courts typically look for a few things:

- Threatening a Crime or Tort: This one is the most obvious. If someone threatens physical harm, to damage your property, or to unlawfully detain you unless you sign, that's an open-and-shut illegitimate threat.

- Threatening Criminal Prosecution: Using the threat of reporting a crime to gain an advantage in a contract can be duress. This is especially true if the motive is personal gain, not just a sense of civic duty.

- Using Civil Process in Bad Faith: Threatening to sue someone is usually part of business. But threatening a lawsuit you know has no legal basis just to scare someone into signing? That’s wrongful pressure.

- A Breach of Good Faith and Fair Dealing: This is a big one in economic duress cases. Imagine a supplier threatens to breach your existing contract to force you into a new, less favorable one, knowing you're completely dependent on them. That's a classic example.

The real question is whether the threat itself was improper. A supplier threatening to sell their last batch of goods to another buyer is just business. But that same supplier threatening to withhold a critical shipment you’ve already paid for unless you agree to an unrelated, unfair deal? That’s likely an illegitimate threat.

Proving the Threat Caused the Agreement

Once you’ve shown the threat was illegitimate, you have to connect the dots. You need to prove this threat was the direct cause of you signing the contract. The legal term for this is causation.

The court needs to be convinced you wouldn’t have signed otherwise. To figure this out, they use what's called the "no reasonable alternative" test. This means you have to demonstrate that, in your situation, you had no other practical or viable option but to give in.

A court will look at the situation from a practical standpoint. If a reasonable person in your position would have felt cornered with no way out, the causation element is likely met. This is a crucial step in understanding what it means to sign under duress in the eyes of the law.

Think about a small business whose only local supplier for a critical component suddenly triples the price and threatens to cut them off right before their biggest seasonal rush. If finding another supplier would take months and bankrupt the business, they might have no reasonable alternative but to agree to the new terms.

To help you see how these pieces fit together, here’s a quick summary of what a court looks for when evaluating a duress claim.

Elements Required to Prove Duress

| Element | What It Means | Example |

|---|---|---|

| Illegitimate Threat | The pressure applied must be wrongful. This can be a threat of physical harm, a bad faith lawsuit, or economic pressure that violates fair dealing. | A supplier threatens to withhold a critical, paid-for delivery unless the buyer agrees to a separate, unfavorable contract. |

| Causation | The victim must prove that the illegitimate threat was the reason they entered into the contract. | The buyer signs the unfavorable contract because the withheld delivery would cause their factory to shut down, leading to massive financial loss. |

| No Reasonable Alternative | The victim must show they had no other viable or practical choice but to agree to the coercer's demands. | The buyer couldn't find another supplier in time to prevent the factory shutdown, leaving them with no other option. |

Meeting these legal standards is what separates a simple case of tough negotiation from a valid claim of duress.

When you're trying to prove your case in court, every word matters. Precise documentation of the proceedings is absolutely essential. This is where using legal court transcription services can be a game-changer, creating an accurate, verbatim record of all testimony and evidence. This documented proof helps build a stronger case by capturing the exact details of the coercive circumstances as they were discussed.

The Different Types of Duress

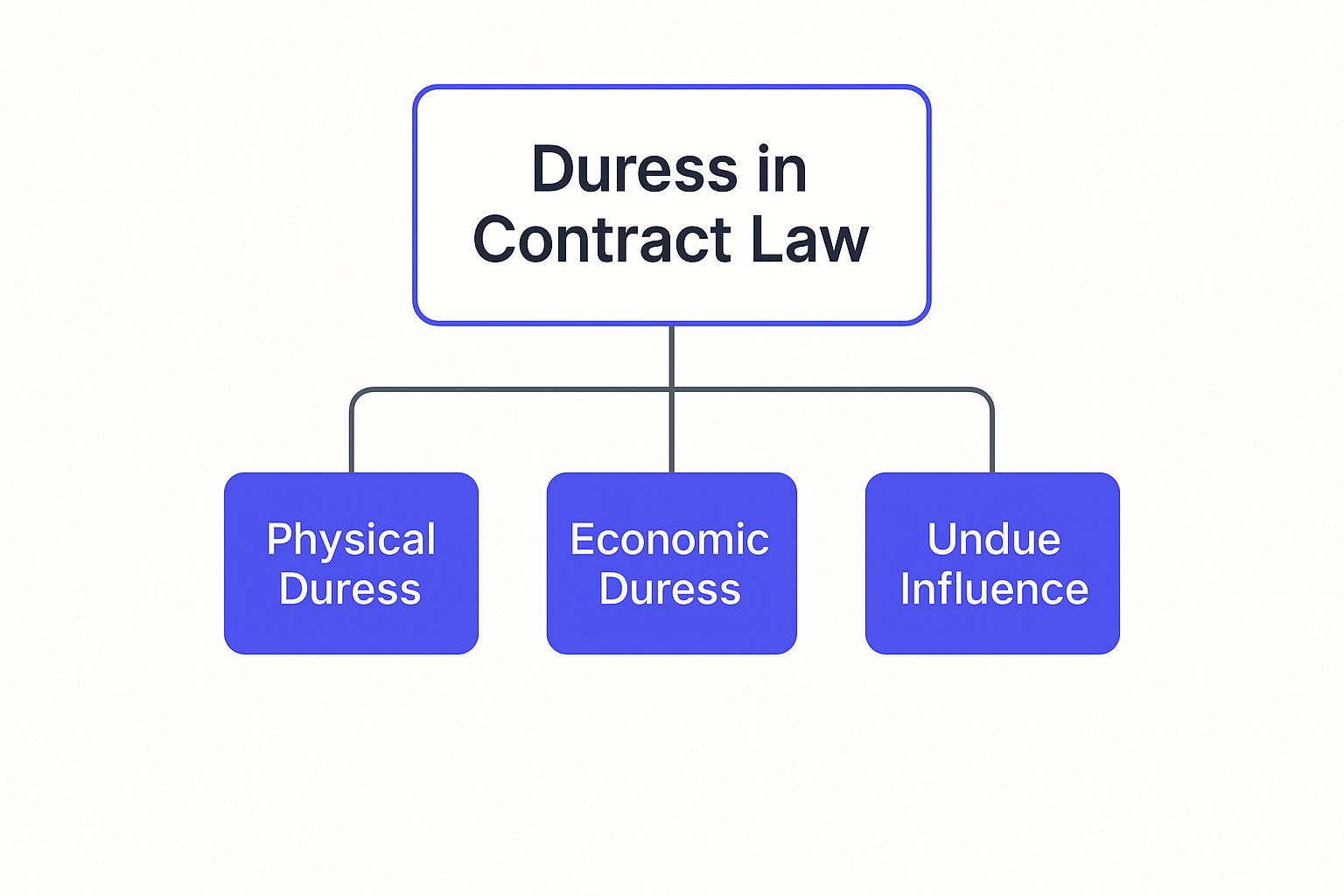

While the core idea of duress is about illegitimate pressure, this coercion doesn't always look the same. In the eyes of the law, duress isn't a single concept but a category of wrongful conduct that shows up in several distinct forms. Each type has its own flavor, ranging from overt physical threats to more subtle, yet equally powerful, economic manipulation.

Understanding these different categories is crucial for spotting when a contract might be vulnerable to a challenge. The pressure can be blatant or hidden, but the result is always the same: it shatters the voluntary consent that forms the bedrock of any valid agreement.

This hierarchy diagram shows the primary categories of duress recognized in contract law.

As the diagram shows, the law addresses a whole spectrum of coercive behavior, from direct physical force to the more nuanced pressures common in modern business.

Physical Duress

This is the most straightforward and historically recognized form of duress. Physical duress happens when a person enters into a contract because of a threat of violence or physical harm. This includes threats of death, bodily injury, or unlawful imprisonment aimed at the person signing or even a close family member.

Think of it as the classic "gun to the head" scenario. The threat is direct, immediate, and leaves zero doubt that the consent wasn't freely given.

For example, if a business owner is forced to sign a deed transferring property to a competitor who threatened to harm their child, that contract is voidable. The law is crystal clear on this point; contracts born from violence are fundamentally unenforceable.

Duress of Goods

A less common but still important category is duress of goods. This is when one party unlawfully holds—or threatens to hold—another party's property hostage to force them into a contract. The wrongful pressure here isn't against a person, but against their assets.

Imagine a mechanic refuses to return your repaired car, which you desperately need for your delivery business, unless you agree to sign a separate, unrelated service contract for the next five years. You're stuck. You need your property to run your business, so you reluctantly sign.

In this situation, your consent to the service contract was obtained by the wrongful act of withholding your property. This form of coercion, while not physical, still leaves you with no reasonable alternative, making the resulting agreement voidable.

The core principle is that one person can't hold another's possessions hostage to extract a contractual promise. The law recognizes that the urgent need to retrieve essential property can be a powerful coercive tool.

Economic Duress

By far the most common and complex form of duress in modern business is economic duress. This is when one party uses illegitimate economic pressure to force another into an agreement. Unlike physical duress, there are no threats of violence. Instead, the threats are purely financial.

Economic duress often crops up in situations with a major power imbalance, where one party is financially vulnerable and the other exploits that weakness. This is more than just hard bargaining; it involves a threat so severe that it leaves the victim with no practical choice but to agree.

Key elements that often point to economic duress include:

- A threat to breach an existing contract: One party threatens to walk away from a vital agreement unless the other party agrees to new, less favorable terms.

- Exploiting financial vulnerability: The coercing party knows the other is on the brink of financial collapse and uses that knowledge to impose unfair demands.

- Lack of a reasonable alternative: The victim can't find another supplier, customer, or solution in time to avoid catastrophic financial harm.

Economic duress is a significant modern extension of the old duress doctrine, and it's especially relevant in corporate and commercial contracts. The famous U.S. case of Austin v. Loral is a perfect illustration. Austin, a subcontractor for military components, demanded a price increase and threatened to breach its contract otherwise. Loral, facing its own strict government deadlines, was forced to agree. The court later found this was economic duress because Loral had no reasonable alternative. You can read the full analysis of this landmark case and its impact on contract law.

This type of coercion is particularly damaging because it undermines the trust and good faith essential for healthy business relationships, turning negotiation into outright exploitation.

Landmark Cases in Contractual Duress

Legal principles can feel a bit abstract until you see them play out in a real courtroom. The idea of duress in contract law is no different. Its modern shape was carved out by judges digging into real-world disputes, and by looking at these key cases, we can see exactly how the courts separate aggressive business tactics from genuine, wrongful coercion.

These landmark decisions give us a practical roadmap. They show how theoretical legal tests get applied to messy, complex conflicts between people and companies. They really bring the law to life, showing us the specific facts that can lead a court to throw out an agreement.

Old Precedents and Psychological Intimidation

Early cases often dealt with more direct, personal forms of pressure. A powerful example that shows just how harsh contractual duress can be comes from an 1877 Canadian case, Armstrong v. Gage. In this situation, an elderly man with very little legal knowledge was backed into a corner and forced to sign a mortgage for $600.

The defendants were described as shrewd and calculating, and they essentially used psychological warfare. They falsely accused the man of forgery, held him in a room for at least four hours, and refused to let him talk to anyone for advice. To really crank up the pressure, they threatened to have him arrested on the spot if he tried to leave without signing. The court saw this for what it was—wrongful coercion—and voided the contract. You can explore the full legal analysis and its implications to see how the court reasoned through this blatant intimidation.

Modern Disputes and Economic Pressure

While threats of false imprisonment aren't as common in business deals today, the core principles from cases like Armstrong are alive and well. They've just been adapted for modern commercial disputes. The battleground has simply shifted from physical confinement to financial chokeholds, where the weapon of choice is economic pressure.

Courts today often have to untangle sophisticated scenarios that blur the line between tough negotiation and illegal coercion. But the central question is still the same: was the consent genuine, or was it the result of an illegitimate threat that left the person with no reasonable alternative?

To get to the answer, judges look at a few key factors that define our modern understanding of duress:

- The Nature of the Threat: Was it a threat to do something unlawful, like breaching another contract just to gain leverage?

- The Victim's Options: Did the person being pressured have any practical way out of the situation without taking a significant hit?

- Protest and Timeliness: Did the victim protest when the coercion was happening and act quickly to challenge the contract once the pressure was off?

A key takeaway from modern case law is that the wrongfulness of the pressure is what truly matters. Even threatening to do something technically legal can be considered duress if it's used for an improper purpose, like extorting an unfair advantage in a contract.

These judicial decisions have painted a much clearer picture of what counts as unacceptable pressure in business. By understanding the reasoning behind these cases, you can get much better at spotting situations where an agreement might not hold up in court. Gaining clarity on these precedents is crucial when you're facing a potential conflict; learn more by checking out our detailed guide on duress in contracts and its modern applications.

Landmark cases act as our guideposts, showing how the concept of duress has evolved from overt physical threats to more subtle economic manipulation. They confirm that the law’s core purpose hasn't changed: to protect voluntary agreement and ensure that contracts are a product of free will, not fear.

Legal Remedies and Defenses in Duress Lawsuits

When a court finds a contract was signed under duress, the agreement doesn't just vanish. Instead, it becomes voidable, which puts all the power in the hands of the person who was coerced. They get to decide: cancel the contract or stick with it.

The main legal remedy here is rescission. Think of it like hitting a giant rewind button on the whole deal. The court essentially erases the contract, treating it as if it never even existed in the first place.

The goal is to put everyone back where they were before the contract was signed. This means any money, property, or goods that were exchanged have to be returned—a process known as restitution.

Pathways to Contract Rescission

For someone who was a victim of duress, rescission is the most direct way out. The aim is to completely and fairly unwind the entire transaction.

- Canceling the Agreement: The victim has to formally state that they want to void the contract.

- Returning Benefits: Both sides must give back whatever they got out of the deal. If a buyer was forced to put down a deposit, for example, the seller has to return it.

The core idea behind rescission is simple: the person who used duress shouldn't get to profit from their bad behavior. The law steps in to make sure coercion doesn't pay off.

This is where having a solid contract risk management strategy becomes so important. To learn how to proactively protect your agreements and avoid these messes, check out our guide on the https://legaldocumentsimplifier.com/blog/contract-risk-management-process.

Common Defenses Against a Duress Claim

Just because someone claims they were under duress doesn't mean it's an open-and-shut case. The accused party has some powerful arguments they can use to defend the contract's validity.

The biggest defense is affirmation, which is sometimes called ratification. This happens when the victim, once they are free from the threat or pressure, does something that shows they accept the contract anyway. This could look like:

- Unreasonable Delay: Waiting way too long to challenge the contract after the duress has ended.

- Accepting Benefits: Knowingly continuing to accept payments or services under the agreement without raising any issues.

- Express Confirmation: Saying or writing that they agree to the terms after the fact.

If a court decides the victim affirmed the contract, they lose their right to back out of it. It’s why understanding the basic principles of enforceability in documents like general Terms and Conditions is so crucial—it clarifies both the escape routes and the roadblocks in a duress lawsuit.

Common Questions About Duress in Contract Law

When you dig into duress in contract law, a few common questions always seem to pop up. It's one thing to know the definition, but it's another to understand where the legal lines are drawn in real-world situations.

Getting clear on these points can make a huge difference in knowing your rights and whether an agreement is truly valid. Let’s tackle some of the most frequent questions.

Duress vs. Undue Influence: What’s the Difference?

This is easily one of the most confusing areas. Both duress and undue influence can get a contract thrown out, but they come from different places.

- Duress is all about coercion. Think of it as a direct, illegitimate threat. It’s overt pressure, like someone threatening to harm you or your business if you don’t sign. The threat is front and center.

- Undue influence is about manipulation. This one is much more subtle. It happens when someone abuses a position of trust—like a caregiver, family member, or advisor—to unfairly persuade another person. They aren't making an explicit threat; they're exploiting the relationship to overpower someone's free will.

Here’s a simple way to think about it: A supplier threatening to withhold critical materials unless you agree to unfair terms is duress. A trusted financial advisor pressuring an elderly client to invest in a scheme that benefits the advisor is undue influence. One is a threat, the other is a betrayal of trust.

Is Threatening to Sue Someone Considered Duress?

Usually, no. Threatening to file a lawsuit is not duress. Our legal system is the accepted forum for resolving disputes, so threatening to use it is generally seen as a legitimate move.

But there’s a big exception.

If the threat is made in bad faith, it absolutely can be duress. "Bad faith" means the person making the threat knows they have no real legal claim. They’re just using the threat of a costly and stressful lawsuit to bully you into an agreement. The key here isn't the threat itself, but whether there's a legitimate claim behind it.

How Long Do I Have to Make a Duress Claim?

There isn't one single answer, as the specific time limits (statutes of limitations) change from one jurisdiction to another. However, the most important rule is to act fast.

You must challenge the contract promptly after the threat or pressure has been removed.

If you wait too long, you risk a court deciding you’ve "ratified" the contract. Ratification happens when you act as if the agreement is valid—for example, by continuing to accept its benefits long after the duress has ended. This essentially validates the contract, and you lose your right to void it. For a broader perspective on various legal topics related to contracts, you might explore a legal blog for additional legal insights.

Struggling to make sense of dense legal contracts? Legal Document Simplifier uses AI to instantly translate complex agreements into clear, simple summaries. Upload your document and get actionable insights on key terms, deadlines, and potential risks in seconds, empowering you to make smarter decisions without the high cost of legal fees.