Let's be honest, legal language can feel like it's designed to be confusing. But some concepts, like the indemnity clause, are too important to ignore. So, what is it really?

At its heart, an indemnity clause is a promise. It's one party in a contract saying to the other, "If something specific goes wrong because of me, I'll cover your financial losses." It’s a way to transfer risk from one person to another.

Think of it like this: you borrow your neighbor’s expensive new lawnmower. As you hand it back, you might say, "Hey, if I managed to break anything on that, I'll pay to get it fixed." You've just made a basic indemnity promise. You’re taking responsibility for any harm you might have caused.

In the business world, this simple promise is formalized into a clause that manages potential financial fallout. It's a powerful tool for shifting the burden of costs—like damages or lawsuits—from one party to another. That’s why you’ll find these clauses in almost every type of agreement, from freelance contracts to massive construction projects. It’s all about proactive risk management.

The Key Players Explained

To really get what’s happening in an indemnity clause, you need to know the two main roles: the indemnitor and the indemnitee. Getting this straight is critical, because one person is taking on risk, and the other is getting a safety net.

We've created a simple table to break down who's who.

The Key Roles in an Indemnity Agreement

| Role | Plain-Language Explanation | Simple Analogy |

|---|---|---|

| The Indemnitor | This is the party making the promise to pay for damages. They are taking on the financial risk. | In our lawnmower example, you are the indemnitor. You're the one promising to cover the costs if you break it. |

| The Indemnitee | This is the party being protected from loss. They are the ones who will be paid back if things go south. | Your neighbor, who owns the pricey lawnmower, is the indemnitee. They are being shielded from the cost of repairs. |

Knowing these roles makes the purpose of the clause crystal clear.

The whole point is to give one party a contractual safety net. The indemnitee wants a guarantee that they won't be stuck with a huge bill for problems caused by the indemnitor's actions (or lack thereof).

This relationship is the bedrock of how businesses protect themselves from unexpected costs. For instance, a software company (the indemnitor) might promise to pay for any legal fees if its client (the indemnitee) gets sued for patent infringement over the software.

The goal is always to make the protected party "whole" again by covering their specific, defined losses. The real negotiation, and where things can get tricky, is in defining the exact scope of that protection—a topic we'll dig into next.

How Indemnity Became a Contract Heavyweight

The indemnity clause you see in contracts today—often complex, non-negotiable, and a little intimidating—didn't just appear out of nowhere. It evolved from a simple promise into a legal powerhouse, driven by big changes in how businesses handle risk. This is especially true in high-stakes industries like construction, software, and insurance.

To really get why this clause carries so much weight, you have to understand its journey. Initially, it was just a straightforward agreement to cover someone's direct losses. But as business got more complicated, so did the fights. The modern indemnity clause started to cover not just the final bill for damages but also the expensive and draining duty to defend against a lawsuit from the very beginning.

The Turning Point in a California Courtroom

A few landmark court cases completely flipped the script, dramatically changing the power dynamic between the person giving the indemnity (the indemnitor) and the person receiving it (the indemnitee). These weren't just small tweaks to the law; they were seismic shifts that redefined who was on the hook for what.

A perfect example is the 2008 California Supreme Court case, Crawford v. Weathershield Manufacturing. This case was a game-changer. The court decided that an indemnitor's duty to defend kicks in immediately when a claim is made—long before anyone has been found liable. This ruling sent ripples through thousands of commercial contracts, setting a precedent that massively expanded the financial and legal burden on indemnitors. You can read the full analysis of its impact on indemnity law to see just how significant it was.

What this meant in practice was that a mere accusation could trigger enormous legal costs for the indemnitor, even if they were eventually proven innocent.

Key Takeaway: The duty to defend can be more costly than the final damages award itself. Landmark cases made this duty an immediate and substantial financial risk for the party giving the indemnity.

From Simple Promise to Strategic Weapon

After rulings like Crawford, businesses and their lawyers started looking at indemnity clauses in a whole new, much more strategic light. The clause transformed from a simple "I've got your back" promise into a sophisticated tool for shifting risk before a single shovel hits the ground or a line of code is written.

This evolution has had huge real-world consequences across different fields:

- Construction: General contractors started demanding broad indemnity from their subcontractors, effectively shielding themselves from nearly any liability that could pop up on a job site.

- Software & Tech: SaaS companies began using indemnity clauses to protect their customers from intellectual property lawsuits. This wasn't just a defensive move; it became a competitive selling point.

- Insurance: While the entire insurance industry is built on the concept of indemnity, these court interpretations have continuously reshaped what policies are legally required to cover.

The bottom line? What started as a simple concept is now one of the most complex and heavily negotiated parts of any serious business deal. This history makes it crystal clear why you have to scrutinize every single word of an indemnity clause. It’s not just good practice—it's essential for survival.

Decoding the Anatomy of an Indemnity Clause

To really get what an indemnity clause does, you have to look under the hood. Think of it like a complex machine—each part has a specific job in managing risk, and you need to understand the components to see how the whole thing works.

At its heart, every indemnity clause is defined by its scope. The scope spells out exactly what kinds of losses are covered. Is it just for third-party lawsuits, or does it also include direct damages between the two parties in the contract? A blurry, ill-defined scope is a huge red flag because it’s a recipe for arguments over what is and isn't a covered event.

The Power of the Duty to Defend

Another critical piece is the duty to defend. This is often the most powerful—and costly—part of the clause. It forces the indemnitor (the one making the promise) to start paying for the other party's legal defense the moment a claim is filed. That’s right, before anyone has even figured out who is at fault.

This obligation is a heavyweight. Legal fights are notoriously expensive, and the duty to defend puts the indemnitor on the hook for attorney fees and court costs from day one. It completely shifts the immediate financial weight of a lawsuit onto one party’s shoulders.

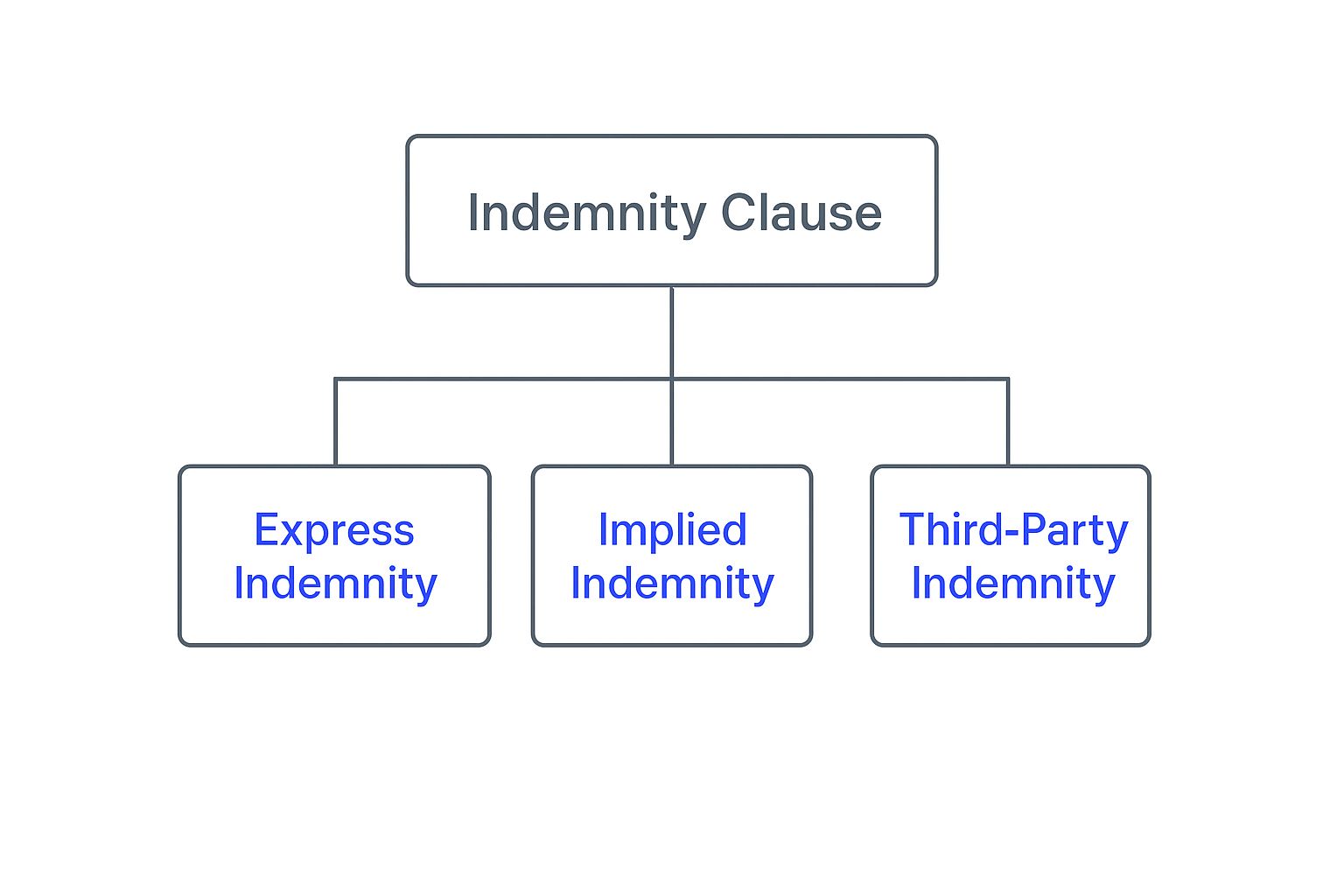

The infographic below shows the main types of indemnity clauses, which really just dictate how broad this protection is.

This hierarchy makes it clear that indemnity isn’t a one-size-fits-all deal. The form it takes directly controls how much risk is actually being transferred.

Smart Limitations That Control Risk

Because an indemnity promise can create massive financial exposure, contracts usually include limitations to keep the risk from spiraling out of control. Think of them as financial guardrails. They are not just boilerplate language; they are intensely negotiated terms that set the real-world financial stakes.

An indemnity clause without clear limitations is like writing a blank check. Caps and baskets are essential tools for defining the financial boundaries of the promise and preventing runaway liability.

These limitations come in different flavors, but they all serve the same purpose: to make the indemnitor's potential financial hit more predictable and manageable.

Common Limitations in Indemnity Clauses

| Limitation Type | Plain-Language Explanation | Analogy |

|---|---|---|

| Indemnity Cap | This sets a maximum, or ceiling, on the total amount the indemnitor has to pay out. It's a hard stop on their liability. | It's like a credit limit on a credit card. No matter what happens, your total exposure won't exceed that pre-set amount. |

| Indemnity Basket | This works like an insurance deductible. It sets a minimum loss amount that must be met before the indemnity obligation kicks in. | It's like the deductible on your car insurance. You don't file a claim for a tiny scratch; you only use it for bigger issues. |

| Time Limits | This restricts how long after the deal closes a party can make an indemnity claim. | It’s like a warranty period for a product. You can't ask for a replacement five years after the warranty has expired. |

| Exclusions | This part of the clause specifically lists certain types of damages that are not covered, such as lost profits or reputational harm. | It's like an insurance policy that covers water damage but specifically excludes damage from floods. |

By building these controls into the agreement, both sides can get a much clearer picture of their potential financial risks and rewards.

These baskets and caps are especially crucial in high-value deals. For instance, in private mergers and acquisitions, they are a standard feature, showing up in roughly two-thirds to three-quarters of deals analyzed between 2017 and 2023. These thresholds are key negotiated points that help filter out trivial claims and manage the seller's financial exposure. You can discover more insights about M&A deal terms and see how these mechanisms function in the wild.

By taking apart these core pieces—the scope, the duty to defend, and the financial limitations—you can move past a simple dictionary definition and start to see how an indemnity clause truly operates to shift risk from one party to another.

Broad, Intermediate, and Limited Indemnity Explained

When it comes to indemnity, you'll find that not all promises are created equal. They actually exist on a spectrum of risk, from extremely one-sided protection for one party to a much fairer, more balanced agreement. Getting a handle on the difference is critical, because the specific type of clause in your contract determines who’s on the hook for what could be massive damages.

Think of it like different tiers of car insurance. You could have a basic liability policy, or you could have a premium, all-inclusive plan that covers everything imaginable. When you see a basic definition of an indemnity clause, that’s just the starting point—the real meaning is found in which form it takes.

The three main types you’ll run into are broad form, intermediate form, and limited form. Each one shifts risk around differently, and knowing which one you’re signing can be the difference between a successful project and a financial disaster.

Broad Form: The All-Encompassing Promise

Broad form indemnity is the most aggressive and one-sided of the bunch. With this setup, the indemnitor (the one making the promise) agrees to cover all losses tied to the contract. This includes losses caused solely by the negligence of the indemnitee (the party being protected).

It’s the legal equivalent of saying, “I'll pay for any car accident, even if you were the one who blew through the red light.” This creates a huge, lopsided risk. In fact, it's considered so unfair that many states have passed laws making this type of clause unenforceable, especially in construction agreements.

Intermediate Form: The Shared Responsibility

The intermediate form is a small step back from the broad form, but it’s still a big deal. Here, the indemnitor agrees to cover losses, unless they come from the indemnitee's sole negligence. But here’s the catch: if both parties are even 1% at fault, the indemnitor often gets stuck paying 100% of the damages.

This version still heavily favors the protected party. It basically says, “I’ll cover everything, just as long as you weren’t the only one to blame.” While it gives the indemnitor a tiny bit of protection, it’s still a massive transfer of risk. Seeing these different contract clause examples really drives home how a few words can completely change who pays for what.

Key Insight: The difference between these forms isn't just a legal footnote—it's about financial survival. A broad or intermediate clause can make you liable for someone else's mistakes, turning a profitable project into a complete financial catastrophe.

Limited Form: The Fairest Approach

Finally, we have the limited form indemnity clause, which is the most balanced and common type you'll find in well-negotiated contracts. In this structure, the indemnitor is only responsible for losses up to the extent of their own fault.

This is by far the most equitable approach. If the indemnitor is found to be 40% at fault for something that went wrong, they are only on the hook for 40% of the damages. It directly ties responsibility to fault, which prevents one side from having to pay for the other's mistakes. This “you break it, you buy your share of it” model is the gold standard for fair risk sharing in modern contracts.

Indemnity Clauses in Real-World Scenarios

Knowing the textbook definition of an indemnity clause is one thing. But seeing it play out in the real world? That’s when it really clicks. These clauses aren't just legal fluff; they're on-the-ground tools that manage very real financial risks in businesses every single day.

Let's turn the legal theory into a couple of mini-stories you'll instantly recognize. By walking through these situations, you'll see exactly how this contractual promise shifts risk from one party to another when things inevitably go wrong.

The Construction Site Scenario

Picture a general contractor running a huge commercial building project. They hire an electrical subcontractor, and the contract has an indemnity clause. In it, the subcontractor promises to cover any losses the general contractor might face because of the electrician's work.

One afternoon, a subcontractor's employee accidentally leaves a toolbox in a main walkway. A visitor trips, falls, and gets hurt. Naturally, they sue the general contractor, who’s in charge of the whole site.

- How Indemnity Works: This is where the indemnity clause kicks in. The general contractor points to the clause, and just like that, the subcontractor is on the hook for the legal defense fees and any settlement paid to the injured visitor. The risk was cleanly transferred.

This type of risk management is absolutely essential for projects with lots of moving parts. A solid contract risk assessment is a must before signing anything, because these clauses decide who pays the bill when accidents happen.

The Freelance Content Scenario

Now, imagine a busy digital marketing agency. They hire a freelance writer to create blog posts for a big-name client. The freelance agreement includes an indemnity clause where the writer agrees to shield the agency from any claims that come from their work, like copyright violations or plagiarism.

The writer, rushing to meet a deadline, grabs a cool image online without checking the license. Turns out, it's copyrighted. The image owner finds it on the client's blog and sues the marketing agency for infringement.

The Takeaway: For any work involving creativity or intellectual property, indemnity clauses are your best friend. They act as a critical shield, protecting the agency or publisher from the financial fallout of a creator's mistake.

The agency immediately invokes the indemnity clause. The freelance writer is now contractually obligated to pay for the agency's legal bills and any damages awarded to the copyright holder.

This idea of functional risk transfer has come a long way. In the past, insurance policies often had "moral hazard clauses" that would void coverage if someone acted recklessly. But as data showed these risks were often overblown, insurers moved to a more practical model. This shift allowed indemnity to cover a wider range of damages, even indirect business losses. You can learn more about this historical shift in indemnity coverage and see how it shaped modern contracts.

How to Review and Negotiate an Indemnity Clause

When an indemnity clause pops up in a contract, it’s tempting to just sign and move on. But these aren’t take-it-or-leave-it terms. They are absolutely negotiable, and making a few smart tweaks can protect you from a financial nightmare down the line.

You don’t need a law degree to review one, but you do need to be sharp. Your mission is to hunt down any vague, over-the-top language that could leave you paying for someone else’s mess. This is your chance to push back and get specific before you’re locked in.

Key Negotiation Tactics

When you’re looking at a lopsided indemnity clause, you have more power than you think. The first thing to do is push for mutuality. If they’re asking you to cover their back, it’s only fair they do the same for you. This simple change creates a much more balanced agreement where both parties share the risk.

Next up, narrow the scope. Look closely at what actually triggers the indemnity. You want to limit your liability strictly to losses that come directly from your own negligence or a breach of the contract—not for problems you had nothing to do with.

Crucial Tip: Never, ever accept an indemnity clause without a financial cap. An unlimited indemnity is like giving someone a blank check tied to your bank account. Always insist on a clear, reasonable limit on your total liability.

Finally, a solid negotiation game plan can change everything. For some practical tips on handling these talks, take a look at our guide on how to negotiate contracts for more actionable advice.

Red Flags to Watch For in an Indemnity Clause

Knowing what to look for is half the battle. When you’re combing through a contract, keep an eye out for these common red flags that scream "high-risk indemnity clause":

- Vague Language: Watch out for phrases like "any and all claims" or "arising from any cause." These are huge red flags. The scope should be laser-focused and specific.

- No Fault Requirement: The clause should only kick in because of your specific actions or mistakes. Steer clear of any wording that makes you responsible for things regardless of who was at fault.

- Covering the Other Party’s Negligence: You should never agree to foot the bill for damages caused by the other party's own errors. This is a classic feature of "broad form" indemnity, which is so unfair that many states won't even enforce it.

- No Financial Cap: As we said before, a missing liability cap is a deal-breaker. It opens you up to unpredictable and potentially infinite risk.

Catching these issues early gives you the power to protect yourself and transform a dangerous clause into something fair and manageable.

Common Questions About Indemnity Clauses

Even after you get the hang of the basics, a few tricky questions about indemnity clauses always seem to pop up. Let's tackle some of the most common points of confusion head-on to sharpen your understanding before you sit down at the negotiating table.

Indemnity vs. Hold Harmless: What’s the Real Difference?

People throw around the terms indemnity and hold harmless like they're the same thing, but they carry different legal weight. Think of a "hold harmless" agreement as a promise not to blame someone else if you get hurt. An indemnity clause takes it a big step further.

It’s a promise to actively step in and cover the other party’s financial losses—like legal bills and damages—if someone else sues them because of something related to your work.

Here’s a simpler way to see it:

- Hold Harmless: "I agree not to sue you if I get hurt on this project."

- Indemnity: "If a third party gets hurt and sues you, I’ll handle the legal fight and pay the costs."

While both are about managing risk, indemnity involves a much more active and potentially expensive financial duty.

Can an Indemnity Clause Be Unlimited?

Technically, yes, but it's a terrifying risk that no smart business owner should ever accept. An unlimited indemnity clause means there's no cap on the amount of money you could be on the hook for. It’s like handing over a signed, blank check tied directly to your company's bank account.

This is exactly why negotiating a financial cap is so critical. A cap limits your total exposure to a specific, agreed-upon amount, turning an unknown liability into a predictable and manageable business risk. Without one, a single claim could literally bankrupt your company.

A poorly written or ambiguous indemnity clause is an invitation for a legal battle. When the language is unclear about what triggers the indemnity or what costs are covered, both sides are left to argue over the intended meaning—often in an expensive courtroom setting.

Ambiguity is the enemy of any solid business agreement. A vague clause might fail to protect the party who needs it or unfairly saddle the other with costs they never agreed to cover. The goal is always to draft language so precise that there’s no room for misinterpretation, ensuring the clause works exactly as everyone intended.

Feeling overwhelmed by dense legal contracts? Legal Document Simplifier can help. Our AI-powered tool instantly translates confusing clauses into plain English, highlighting risks, obligations, and key terms so you can sign with confidence. Stop guessing and start understanding your documents by visiting https://legaldocumentsimplifier.com today.