Unlocking the Secrets to a Successful Lease Negotiation

Negotiating a lease can feel overwhelming. This is true whether you're a small business owner securing an office, a freelancer setting up a studio, or an individual renting an apartment. Securing favorable terms and protecting your interests requires understanding key lease provisions and effective negotiation strategies. This guide provides eight actionable lease negotiation tips to help you navigate lease agreements and achieve optimal outcomes. These lease negotiation tips offer real-world examples and expert insights.

This listicle will empower you to:

- Understand market dynamics: Research comparable properties and leverage market rates in your negotiations.

- Negotiate key lease terms: Learn how to strategically negotiate lease length, renewal options, and rent escalation clauses.

- Secure financial advantages: Explore tenant improvement allowances, build-out concessions, and favorable payment terms.

- Address operational responsibilities: Clarify maintenance, repair, and operating expense responsibilities.

- Prepare for the unexpected: Negotiate flexibility clauses for business changes and favorable default provisions.

- Seek expert guidance: Understand the value of professional representation and thorough documentation.

Mastering these lease negotiation tips can significantly impact your long-term financial well-being and operational flexibility. Don't leave your lease agreement to chance – equip yourself with the knowledge and strategies to negotiate effectively.

1. Research Market Rates and Comparable Properties

Entering a lease negotiation without understanding the market is like navigating a maze blindfolded. Thorough research on comparable properties is crucial for securing a fair lease agreement. This foundational step provides the leverage needed to negotiate effectively by establishing a baseline for rental rates, terms, and conditions. Knowing the market value empowers you to confidently counter offers and avoid overpaying.

This research is particularly vital for lease negotiation tips, as it directly impacts your bottom line. Whether you're a small business owner, freelancer, or individual, understanding market dynamics is essential. It ensures you secure a space that aligns with your budget and avoids unnecessary expenses.

Examples of Effective Market Research

Real-world examples demonstrate the power of market research in lease negotiations:

- Tech Startup Savings: A San Francisco tech startup presented market data showing similar properties leasing for 20% below their landlord's initial asking price, resulting in a 15% rent reduction.

- Retail Chain Strategy: Major retail chains like Starbucks utilize sophisticated market analysis to negotiate favorable terms in prime, high-traffic locations.

- WeWork's Expansion: WeWork's rapid expansion strategy relied heavily on market research to identify undervalued properties for subleasing.

Actionable Tips for Market Analysis

To effectively research market rates, implement these practical tips:

- Utilize Multiple Sources: Explore various resources like LoopNet, CoStar, local brokers, and direct property inquiries.

- Document Your Findings: Maintain detailed records including photos, property specifications, and contact information.

- Factor in Hidden Costs: Consider additional expenses like parking, utilities, and common area maintenance fees.

- Analyze Closed Deals: Look beyond asking prices to understand the actual final prices of closed lease deals.

- Stay Updated: Keep your research current, especially within 30 days of serious negotiations. Market conditions can change rapidly.

By meticulously researching market rates and comparable properties, you gain a distinct advantage in lease negotiation tips. This preparation empowers you to confidently negotiate favorable terms and secure the best possible deal. It positions you for success, whether you're seeking office space, retail space, or a personal residence.

2. Negotiate Lease Length and Renewal Options Strategically

Lease term negotiation is more than just agreeing on a monthly rent figure. It involves strategically structuring the initial lease period and building in favorable renewal options. This approach balances stability with flexibility, protecting against market volatility while providing growth opportunities. A well-negotiated lease term can significantly impact your long-term financial health and operational agility.

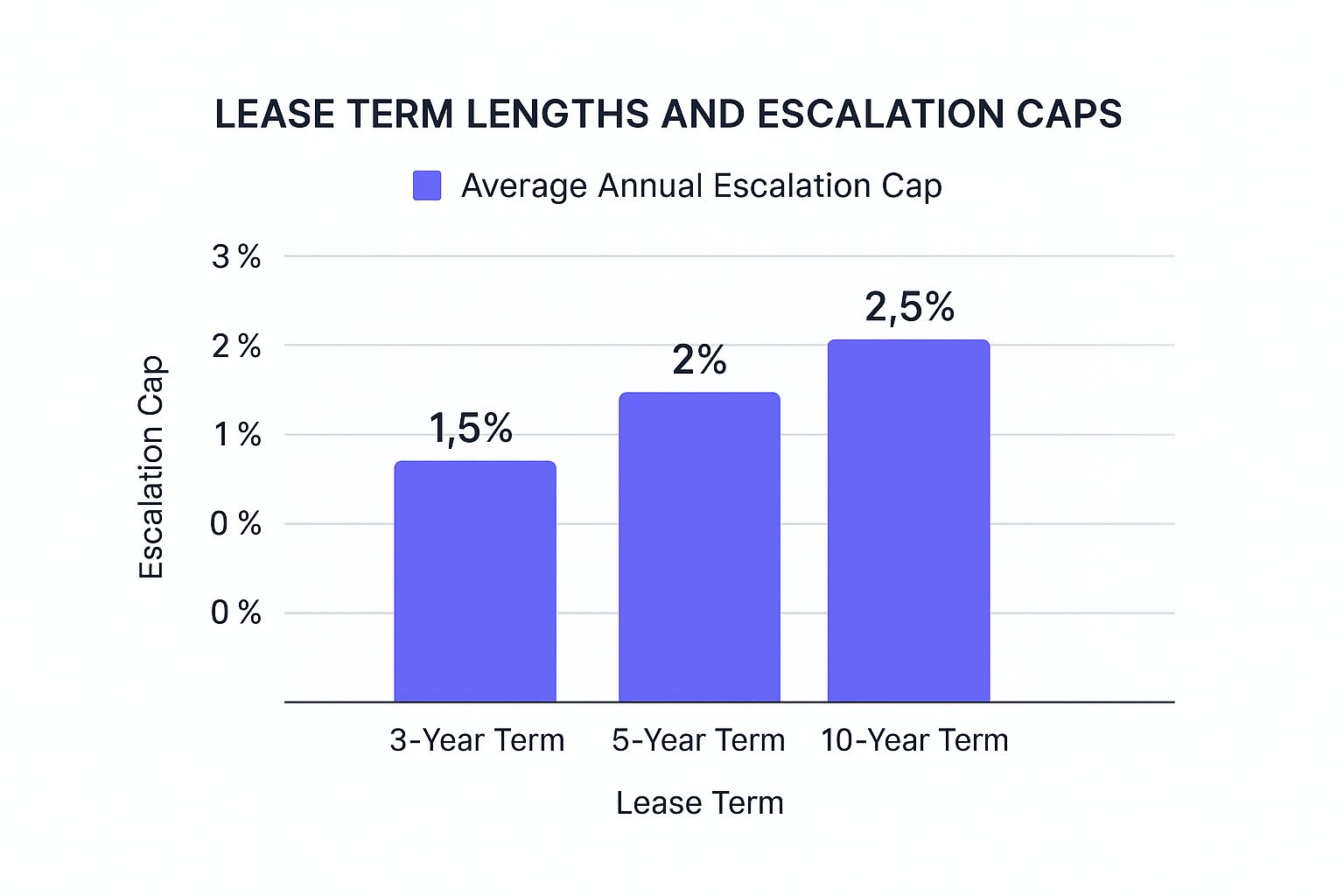

The bar chart above visualizes the relationship between lease term length and average annual escalation caps. As you can see, longer lease terms often correlate with slightly higher escalation caps, but also offer greater stability and predictability.

This research is particularly vital for lease negotiation tips, as it directly impacts your future costs and flexibility. Whether you're a small business owner securing an office or an individual renting an apartment, understanding how lease length impacts your options is crucial. Learn more about renewing a lease agreement to further solidify your understanding.

Examples of Strategic Lease Negotiations

Several real-world examples highlight the importance of strategic lease term negotiation:

- Amazon's Flexibility: Amazon often negotiates long-term leases (10 years) with renewal options (5 years) for their fulfillment centers, providing stability while maintaining expansion flexibility.

- Restaurant Chain Stability: Restaurant chains frequently negotiate 15-20 year initial terms with multiple 5-year renewal options to justify significant build-out investments.

- Biotech Growth: Biotech companies often include lab expansion options within their leases, tied to milestones like FDA approvals, allowing for controlled growth.

Actionable Tips for Lease Term Negotiation

To effectively negotiate lease length and renewals, consider these practical tips:

- Align with Business Plans: Match your lease length to your business planning horizons and capital investment recovery periods.

- Percentage-Based Increases: Negotiate percentage-based rent increases rather than fixed dollar amounts to mitigate the impact of inflation.

- Fair Market Value Renewals: Include fair market value renewal clauses with clearly defined arbitration mechanisms in case of disputes.

- Expansion Rights: If possible, build in expansion rights for adjacent spaces at predetermined rates to accommodate future growth.

- Termination Options: Include reasonable early termination options for specific scenarios like business failure or sale.

By strategically negotiating lease length and renewal options, you gain significant control over your long-term occupancy costs and flexibility. This proactive approach empowers you to align your lease terms with your business goals and adapt to changing market conditions.

3. Secure Tenant Improvement Allowances and Build-Out Concessions

Tenant improvement (TI) allowances are funds provided by landlords to help tenants customize their leased space. Negotiating substantial TI allowances and build-out concessions can significantly reduce upfront costs and improve cash flow, particularly for small businesses and startups. This allows businesses to allocate more capital to core operations and growth initiatives, rather than pouring it all into initial setup. Securing favorable TI allowances can be a game-changer in lease negotiation tips, effectively lowering your overall lease cost.

This aspect of lease negotiation is crucial because it directly impacts your initial investment. Whether you're setting up a new office, retail store, or restaurant, build-out costs can be substantial. By securing generous TI allowances, you can mitigate these expenses and free up valuable resources.

Examples of Successful TI Allowance Negotiation

Real-world examples highlight the potential benefits of negotiating TI allowances:

- Google's Custom Fit-Outs: Google negotiated over $200 per square foot in TI allowances for specialized office build-outs, incorporating server rooms and collaborative workspaces.

- Medical Practice Build-Outs: Medical practices regularly secure $75-$150 per square foot for essential equipment installations and HIPAA-compliant modifications.

- Law Firm Enhancements: Law firms often negotiate allowances covering high-end finishes, custom-built casework, and robust security systems, exceeding $100 per square foot.

Actionable Tips for Securing TI Allowances

To maximize your TI allowance, implement these practical strategies:

- Detailed Quotes: Obtain comprehensive quotes for your planned build-out before starting negotiations. This strengthens your position and justifies your requests.

- Negotiate Above Minimums: Aim for allowances 15-25% above the landlord's initial offer. This provides a buffer for unexpected costs.

- Comprehensive Coverage: Ensure allowances cover permits, design fees, project management, and contingencies.

- Escalation Clauses: Include provisions for allowance increases if construction costs escalate during the project.

- Contractor Selection: Negotiate the right to choose your own contractors (within reasonable parameters). This ensures quality and cost control.

By strategically negotiating tenant improvement allowances and build-out concessions, you can significantly reduce your upfront investment and enhance your long-term financial position. This essential lease negotiation tip empowers you to create a customized space that meets your specific needs without breaking the bank.

4. Negotiate Rent Escalation Clauses and Payment Terms

Negotiating rent escalation clauses and payment terms is a critical aspect of lease negotiation tips, directly impacting your long-term costs and cash flow. Rent escalation clauses dictate how and when your rent will increase over time, while payment terms define the schedule, deposits, and potential penalties. Mastering these elements can significantly affect your bottom line.

This negotiation is particularly important for lease negotiation tips because it provides predictability and control over future expenses. Whether you're leasing office space, retail space, or a personal residence, understanding these clauses is essential for financial planning and stability. Learn more about how to Negotiate Rent Escalation Clauses and Payment Terms at this link.

Examples of Effective Escalation and Payment Term Negotiation

Real-world examples highlight the impact of these negotiations:

- Whole Foods' Portfolio Strategy: Whole Foods has successfully negotiated rent escalations capped at 2% annually across their portfolio, protecting against unpredictable inflation while providing landlords with a degree of security.

- Tech Companies in Silicon Valley: During periods of high inflation, tech companies in Silicon Valley often negotiate CPI-based rent increases with 3% caps to manage costs effectively.

- Retail Percentage Rent: Retail tenants frequently negotiate percentage rent clauses, tying rent increases to sales performance rather than fixed escalations, aligning rent with revenue.

Actionable Tips for Negotiating Escalations and Payments

Implement these practical tips to secure favorable terms:

- Cap Annual Increases: Aim for annual rent increases capped at 2-3%, regardless of the chosen escalation method (fixed, CPI-based, or percentage).

- Negotiate Rent Commencement Delays: Offset construction and opening periods by negotiating delays in rent commencement.

- First-Year Grace Period: Consider structuring escalations to skip the first year, providing valuable breathing room for startup costs.

- Percentage Rent for Retail: For retail spaces, explore gross sales percentage options to align rent with your business performance.

- Align Payment Dates with Cash Flow: Negotiate payment dates that synchronize with your business's natural cash flow cycles.

By strategically negotiating rent escalation clauses and payment terms, you gain significant control over your long-term lease costs. This proactive approach ensures financial predictability and positions you for sustained success in your leased space.

5. Address Maintenance, Repairs, and Operating Expense Responsibilities

Clearly defining maintenance responsibilities and operating expense allocations prevents future disputes and unexpected costs. This involves negotiating who handles different types of repairs, establishing maintenance schedules, and clarifying how common area maintenance (CAM) costs are calculated and allocated. A well-defined agreement protects both the landlord and tenant, ensuring a smooth and predictable tenancy.

This aspect of lease negotiation is particularly vital for lease negotiation tips as it directly impacts your operational budget. Whether you're leasing office space, retail space, or industrial property, understanding these responsibilities is crucial. It helps you accurately forecast expenses and avoid unexpected financial burdens.

Examples of Successful Implementations

Real-world examples demonstrate the importance of addressing these responsibilities:

- Major Retailers: Retailers like Target often negotiate comprehensive maintenance agreements where landlords handle all building systems. This allows them to focus on their core business operations.

- Manufacturing Tenants: Manufacturing tenants might negotiate caps on CAM charges while retaining control over specialized equipment maintenance within their leased space. This allows for customized maintenance schedules aligned with production needs.

- Professional Service Firms: These firms typically negotiate detailed HVAC maintenance schedules to ensure consistent office comfort for clients and employees, crucial for maintaining a professional image.

Actionable Tips for Negotiating Responsibilities

Implement these practical tips for addressing maintenance and operating expenses:

- Define Responsibilities: Clearly define maintenance responsibilities in writing, providing specific examples of who is responsible for what.

- Negotiate Caps: Negotiate annual caps on operating expense increases (typically 3-5%) to protect against unpredictable cost escalations.

- Review Statements: Require detailed annual operating expense statements with audit rights to ensure transparency and accuracy.

- Establish Response Times: Establish response time requirements for different types of maintenance issues (e.g., emergency repairs vs. routine maintenance).

- Include Self-Help Provisions: Include provisions for tenant self-help with cost recovery for emergency situations to avoid business disruptions.

By meticulously addressing maintenance, repairs, and operating expense responsibilities, you gain a distinct advantage in lease negotiation tips. This preparation empowers you to confidently negotiate favorable terms, predict costs accurately, and avoid potential disputes. It positions you for a successful and financially sound tenancy, regardless of your business type.

6. Include Flexibility Clauses for Business Changes

Navigating the unpredictable landscape of business requires adaptability. Building flexibility into your lease agreement is crucial for mitigating risks and capitalizing on opportunities. Incorporating clauses that address potential changes in your business needs, such as expansion options, assignment rights, and modification clauses, can protect you from unforeseen circumstances and market fluctuations. This proactive approach ensures your lease remains a valuable asset rather than a liability.

Flexibility clauses offer operational agility while preserving the benefits of a long-term lease. Whether you're a rapidly growing startup, a freelancer adapting to market demands, or an established business navigating economic shifts, these provisions offer essential safeguards. They empower you to respond effectively to evolving circumstances without sacrificing the stability of your workspace.

Examples of Flexibility in Action

Real-world examples illustrate the strategic value of flexibility clauses:

- Starbucks' Expansion Strategy: Starbucks often incorporates expansion options in their leases, enabling them to add drive-throughs or expand patio seating as market demand dictates.

- Tech Company Agility: Tech companies like Salesforce frequently negotiate assignment rights, facilitating office sharing or subleasing with acquired companies or partners.

- Retail Chain Protection: Retail chains utilize co-tenancy clauses to mitigate risk. These clauses reduce rent if anchor tenants vacate the premises, preserving the retail ecosystem.

Actionable Tips for Negotiating Flexibility

To effectively incorporate flexibility, consider these lease negotiation tips:

- First Right of Refusal: Negotiate for the first right of refusal on adjacent spaces. This allows you to expand your footprint as your business grows.

- Assignment Rights: Include reasonable assignment rights for potential business sales, mergers, or corporate restructuring.

- Use Clause Flexibility: Negotiate flexibility within the "use" clause to accommodate evolving business models or product offerings.

- Force Majeure: Include comprehensive force majeure clauses covering unforeseen events like pandemics or natural disasters.

- Subletting Rights: Negotiate reasonable subletting rights, potentially with profit-sharing arrangements, to offset costs during periods of downsizing or transition.

By proactively incorporating flexibility clauses, you gain a significant advantage in lease negotiations. This foresight empowers you to adapt to changing market conditions and business needs, ensuring your lease remains a strategic asset throughout its term. These lease negotiation tips are invaluable for any business seeking long-term stability and growth.

7. Negotiate Favorable Default and Termination Provisions

Default and termination provisions outline the consequences of lease violations and establish procedures for ending the lease agreement. Skillful negotiation of these clauses safeguards both the landlord and tenant, providing reasonable remedies for various scenarios. This is a critical aspect of lease negotiation tips, ensuring your business isn't unfairly penalized and that you have options if circumstances change.

These provisions are particularly vital for lease negotiation tips as they can significantly impact your business's future. Whether you're a small business owner, freelancer, or individual, understanding these clauses is essential for protecting your interests. Learn more about understanding lease terms at Legal Document Simplifier.

Examples of Strategic Negotiation

Real-world examples demonstrate the importance of negotiating favorable default and termination provisions:

- Restaurant Flexibility: Restaurant operators often negotiate extended cure periods for health department violations, recognizing that rectifying such issues can take time.

- Seasonal Business Protection: Seasonal businesses might include provisions preventing termination during off-peak periods when cash flow is naturally lower.

- Startup Graduated Remedies: Startups often negotiate graduated default remedies, providing multiple opportunities to cure violations before lease termination.

Actionable Tips for Negotiation

To effectively negotiate default and termination provisions, implement these practical tips:

- Cure Periods: Negotiate 30-60 day cure periods for monetary defaults, aligning with your business's cash flow cycles.

- Force Majeure: Include force majeure provisions that prevent default during extraordinary circumstances beyond your control.

- Personal Guarantees: Limit personal guarantees to specific time periods or until your business meets certain financial milestones.

- Notice Requirements: Negotiate reasonable notice requirements (15-30 days minimum) for all default allegations.

- Mediation: Include mediation requirements before resorting to litigation for default disputes, saving time and legal expenses.

By carefully negotiating favorable default and termination provisions, you gain substantial protection and flexibility in your lease agreement. This preparation empowers you to mitigate risks and navigate unforeseen challenges effectively, ensuring the long-term success of your business.

8. Leverage Professional Representation and Documentation

Navigating lease negotiations can be complex, especially for those unfamiliar with the intricacies of commercial real estate. Engaging qualified professionals and meticulously documenting the process is crucial for protecting your interests and maximizing negotiation outcomes. Professional representation brings market expertise, sharp negotiation skills, and essential legal protection throughout the leasing process. This proactive approach minimizes risks and ensures you secure the most favorable terms.

This strategy is particularly valuable among lease negotiation tips as it directly impacts your long-term financial and operational well-being. Whether negotiating your first office space or renewing a multi-year lease, professional guidance can be invaluable. It levels the playing field, providing the leverage needed to confidently negotiate with experienced landlords and their representatives.

Examples of Effective Professional Representation

Real-world examples demonstrate the significant impact of professional representation in lease negotiations:

- CBRE's Netflix Deal: CBRE helped Netflix negotiate master lease agreements across multiple markets. Through coordinated negotiations, they saved an estimated 12% on total occupancy costs.

- JLL and Facebook: JLL's representation of Facebook in their major office expansions included comprehensive market analysis. This analysis identified off-market opportunities, leading to significant cost savings and strategic location advantages.

- Local Broker Success: Local commercial brokers often achieve 15-25% better lease terms for small businesses through established landlord relationships and intimate market knowledge.

Actionable Tips for Professional Representation

To effectively leverage professional representation and documentation, implement these practical tips:

- Interview Multiple Brokers and Attorneys: Engage professionals with specific experience in your industry and target market.

- Negotiate Broker Compensation: Structure compensation to align your broker's interests with achieving your optimal lease terms.

- Ensure Thorough Legal Review: Legal review should cover all business-specific issues, including zoning, permits, and operational requirements.

- Document Everything: Maintain written records of all lease negotiations and agreements, validated by professional legal review.

- Build Ongoing Relationships: Cultivate relationships with brokers and attorneys for future lease needs and renewals.

By leveraging professional representation and documentation, you gain a significant advantage in lease negotiation tips. This proactive approach protects your interests, minimizes risks, and positions you for long-term success. It ensures you secure the best possible lease terms, whether you're a small business, freelancer, or individual.

Lease Negotiation Tips Comparison Table

| Item Title | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Research Market Rates and Comparable Properties | Moderate - requires data collection and analysis | High - multiple data sources and tools needed | Informed negotiation baseline and leverage | Lease negotiations needing market validation | Data-driven leverage, prevents overpaying |

| Negotiate Lease Length and Renewal Options | Moderate to High - complex term structuring | Moderate - legal expertise for clauses | Stability with flexibility in occupancy costs | Long-term planning and market uncertainty | Cost predictability, growth flexibility |

| Secure Tenant Improvement Allowances and Build-Out Concessions | Moderate - negotiation plus construction coordination | Moderate - requires contractor quotes, management | Reduced upfront costs, customized spaces | Businesses needing significant space customization | Lower capital requirements, construction risk transfer |

| Negotiate Rent Escalation Clauses and Payment Terms | Moderate - involves financial modeling and legal review | Moderate - financial and legal advisory | Controlled rent increases, improved cash flow | Budget-sensitive tenants in variable markets | Predictable cost increases, aligned payment timing |

| Address Maintenance, Repairs, and Operating Expense Responsibilities | Moderate - detailed clause negotiation | Moderate - ongoing monitoring and auditing | Clear maintenance roles, cost control | Tenants seeking expense clarity and cost limits | Dispute prevention, maintenance standards |

| Include Flexibility Clauses for Business Changes | Moderate to High - complex approval processes | Moderate - legal and strategic planning | Business agility with lease benefits intact | Businesses expecting growth, contraction, or pivots | Operational agility, exit strategy protection |

| Negotiate Favorable Default and Termination Provisions | High - detailed legal clause crafting | High - legal expertise needed | Clear remedies, asset protection | Businesses needing risk mitigation and exit options | Reduced disputes, liability limitation |

| Leverage Professional Representation and Documentation | Moderate - engagement of experts | High - brokerage, attorney, and consultant fees | Improved terms and comprehensive legal protection | Complex leases and high-value transactions | Market expertise, negotiation skill, legal safety |

Secure Your Ideal Lease Terms with Confidence

Negotiating a lease can feel daunting, but armed with the right knowledge and strategies, you can confidently secure terms that benefit your specific needs. This article has explored crucial lease negotiation tips, from researching market rates to leveraging professional representation. Mastering these concepts empowers you to minimize risks, maximize value, and create a lease agreement that supports your long-term goals.

Key Takeaways for Successful Lease Negotiations

Let's recap the essential takeaways to remember as you embark on your lease negotiation journey:

- Preparation is Paramount: Thorough research on comparable properties and market rates provides a strong foundation for your negotiations. Understanding your own needs and priorities is equally vital.

- Proactive Negotiation: Don't be afraid to negotiate key lease terms, including lease length, rent escalations, and tenant improvement allowances. A proactive approach can significantly impact your overall costs and flexibility.

- Attention to Detail: Carefully review every clause in the lease agreement. Pay close attention to maintenance responsibilities, default provisions, and renewal options. Overlooking seemingly minor details can have substantial consequences.

- Seek Expert Advice: Leveraging professional representation, such as a real estate attorney or lease consultant, can provide invaluable insights and protect your interests.

Empowering Your Lease Negotiation Journey

These lease negotiation tips empower you to approach the process with confidence. By implementing these strategies, you'll be well-positioned to secure a lease agreement that aligns with your business or personal objectives. Whether you're a small business owner, freelancer, or individual, understanding these concepts is crucial for long-term success and financial stability. Remember, a well-negotiated lease can contribute significantly to your peace of mind and allow you to focus on what matters most: your business or personal endeavors.

Taking the Next Step: Simplify Your Lease Review

Analyzing complex legal documents can be overwhelming. Gain clarity and confidence in your lease negotiations with Legal Document Simplifier. This tool simplifies legal jargon, highlights key provisions, and helps you understand the implications of your lease agreement. Visit Legal Document Simplifier to learn more and streamline your lease review process.