Launching a Business? Know Your Legal Ground

Starting a small business? Understanding small business legal requirements is crucial for success. This list covers 7 essential legal areas to address, saving you time, money, and potential legal headaches. From registering your business structure and obtaining an EIN to navigating employment laws and protecting your intellectual property, we simplify these key concepts. Learn what you need to know to operate legally and confidently.

1. Business Structure Registration

Choosing and registering the right business structure is a crucial first step for any small business. This legal framework determines how your business operates, how you're taxed, and your personal liability. Ignoring this essential small business legal requirement can lead to significant problems down the line, from hefty penalties to personal financial risks. Common business structures include sole proprietorship, partnership, Limited Liability Company (LLC), and corporation (S-corp or C-corp). Each option has different legal and tax implications that significantly influence your business's trajectory. When setting up your business structure, one of the first steps is often securing your online presence. This involves choosing and registering a domain name that reflects your brand. You can explore available domain options and secure your preferred choice by using a reliable resource to check domain availability.

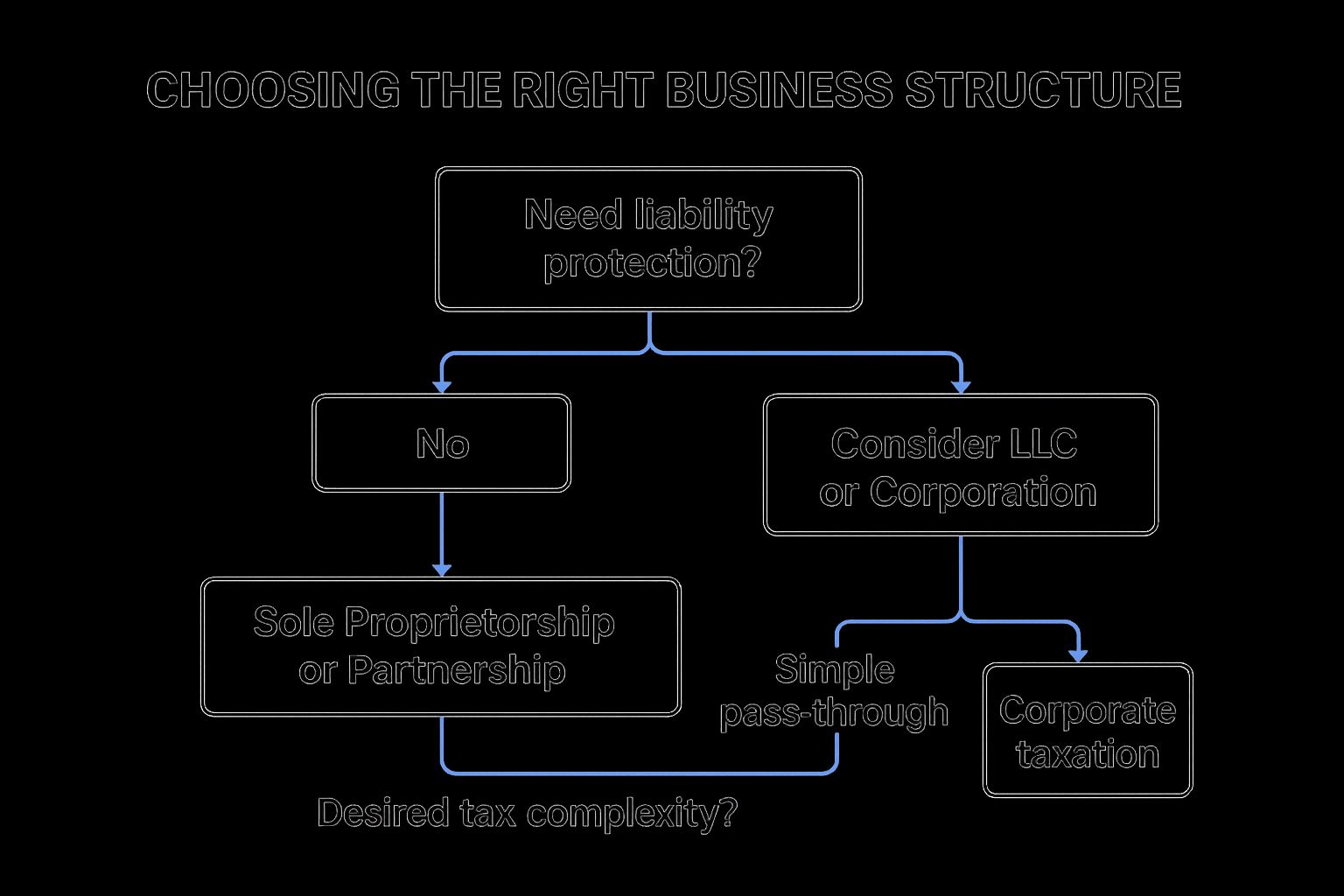

The infographic above provides a decision tree to help you navigate the complexities of choosing a business structure. It starts by asking if you are operating alone or with partners. This fundamental question branches out to further inquiries about liability protection, fundraising needs, and tax implications, eventually leading you to the most appropriate structure for your specific situation. As the visualization demonstrates, navigating these decision points thoughtfully can lead you to the optimal structure for your business.

This decision tree simplifies the process of determining the right business structure by breaking down the key considerations. You can use this flowchart to understand the implications of each choice and follow the path that best aligns with your business needs and goals. For example, if you prioritize simplicity and minimal paperwork and are operating solo, a sole proprietorship might be suitable. However, if you are concerned about personal liability, forming an LLC or corporation would be a wiser choice.

Features and Benefits of Registering Your Business Structure:

- Establishes legal identity: Formal registration gives your business a separate legal existence, essential for contracts, banking, and other business activities.

- Determines tax treatment: Your business structure dictates how your business income is taxed and what deductions you can claim.

- Defines owner liability protection: LLCs and corporations offer personal liability protection, shielding your assets from business debts and lawsuits.

- Affects ability to raise capital: Certain structures, like C-corporations, are more attractive to investors.

- Influences operational complexity: Sole proprietorships are the simplest to operate, while corporations have more stringent compliance requirements.

Pros:

- Liability Protection: LLCs and corporations provide a layer of protection between your personal assets and business liabilities.

- Tax Advantages: Certain structures may offer tax benefits depending on your income and location.

- Credibility: A formally registered business structure enhances credibility with customers and partners.

- Prevents Penalties: Proper registration ensures you avoid penalties for non-compliance.

Cons:

- Cost: More complex structures like LLCs and corporations involve higher setup and maintenance costs.

- Double Taxation: C-corporations can face double taxation on profits (at the corporate level and again when distributed to shareholders).

- Varying State Requirements: Registration requirements and regulations vary by state.

- Ongoing Compliance: Some structures require ongoing compliance obligations, such as annual reports and meetings.

Examples:

- Zoom, initially focused on attracting venture capital, strategically chose to incorporate as a Delaware C-Corporation.

- Many consultants start as sole proprietorships for simplicity and then convert to LLCs as their businesses grow and require greater liability protection.

Tips for Small Business Owners:

- Consult with a business attorney or legal professional to determine the best structure for your specific circumstances. Learn more about Business Structure Registration

- Consider your long-term growth plans when selecting a structure to avoid costly conversions later.

- Register your business with your Secretary of State's office or equivalent agency.

- Periodically review your business structure as your business evolves to ensure it still meets your needs.

Popularized By:

- LegalZoom and Rocket Lawyer have popularized DIY online platforms for business registration.

- Delaware is known for its business-friendly corporate laws, attracting many corporations to incorporate there.

By carefully considering these factors and seeking professional guidance, you can ensure your business is structured for success from the outset, fulfilling a key aspect of small business legal requirements.

2. Employer Identification Number (EIN)

Obtaining an Employer Identification Number (EIN) is a crucial step in meeting small business legal requirements. This unique nine-digit number, assigned by the IRS, is essentially a Social Security number for your business. It's a fundamental component of establishing your business as a separate legal entity and is essential for various financial and operational activities. Understanding its function and importance is vital for any small business owner navigating the complexities of legal compliance.

An EIN identifies your business to the IRS for tax purposes. It's used to track your business's financial activities and ensure proper tax reporting. Without an EIN, you'll face significant limitations in how you can operate and grow your business. This requirement helps the government monitor business activities and collect the appropriate taxes, contributing to the overall economic stability.

When and Why You Need an EIN:

Several scenarios necessitate obtaining an EIN. These include:

- Hiring Employees: If you plan to hire employees, an EIN is mandatory for payroll tax reporting and compliance with labor laws.

- Forming a Business Entity: Certain business structures, such as corporations, partnerships, and LLCs, require an EIN, even if they don't have employees. This separates your personal finances from your business finances, providing liability protection and simplifying tax filing.

- Opening a Business Bank Account: Most banks require an EIN to open a business bank account. This helps them differentiate your business transactions from your personal ones and comply with regulatory requirements.

- Filing Business Tax Returns: An EIN is necessary for filing various business tax returns, including income tax, employment tax, and excise tax returns.

- Establishing Business Credit: Just like your personal credit score, building business credit is crucial for securing loans and favorable terms with suppliers. An EIN allows lenders and vendors to track your business's credit history.

Features and Benefits of an EIN:

- Federal Tax ID: Serves as your business's official identification number for federal tax purposes.

- Employee Management: Enables payroll processing and tax withholding.

- Business Banking: Facilitates opening business bank accounts and managing finances.

- Tax Compliance: Simplifies tax filing procedures and ensures accuracy.

- Credit Building: Allows you to establish and build business credit.

Pros:

- Free to Obtain: Applying for an EIN through the IRS website is free.

- SSN Protection: Using an EIN protects your personal Social Security Number from potential fraud or misuse in business transactions.

- Business Legitimacy: An EIN adds a layer of legitimacy and professionalism to your business.

- Simplified Taxes: Streamlines tax processes and ensures proper reporting.

Cons:

- Application Time: While online applications are generally processed quickly, other methods (mail, fax) can take longer.

- International Applicants: International applicants may face additional requirements and processing times.

- Changes in Business Structure: Changing your business structure may require obtaining a new EIN, which can be cumbersome.

Examples of EIN Implementation:

- A new restaurant obtains an EIN to hire staff and open supplier accounts, demonstrating responsible financial management and enabling legal compliance.

- A freelancer forming an LLC gets an EIN to separate personal and business finances, safeguarding their personal assets and simplifying tax reporting.

Actionable Tips for Obtaining and Using an EIN:

- Apply Online: The fastest way to obtain an EIN is to apply online at the IRS website (www.irs.gov). You will receive your EIN immediately upon successful application.

- Secure Documentation: Keep your EIN confirmation letter in a safe place, as you'll need it for various business activities.

- Use with Vendors: Always use your EIN when working with vendors and suppliers to build your business credit and ensure accurate record-keeping.

- Alternative Application Methods: You can apply by mail or fax, but the online application is significantly faster.

- Sole Proprietors: Sole proprietors without employees can sometimes use their SSN instead of an EIN, but obtaining an EIN is generally recommended for liability protection and business legitimacy.

The EIN is a cornerstone of meeting small business legal requirements. It's essential for tax compliance, financial management, and establishing your business as a legitimate entity. By understanding its function and following the tips provided, you can navigate the process efficiently and focus on growing your business.

3. Business Licenses and Permits

Navigating the legal landscape as a small business owner can be daunting. One crucial aspect of legal compliance is securing the necessary business licenses and permits. This requirement, relevant to almost all businesses, ensures you're operating legally and can avoid hefty penalties. These legal authorizations vary widely depending on your business location, industry, and specific activities. Overlooking this critical step can lead to significant fines, business closure, and damage to your reputation. Therefore, understanding and obtaining the correct licenses and permits is a fundamental element of small business legal requirements.

Licenses and permits can range from general business licenses issued at the city or county level to highly specialized permits required for specific industries at the state or even federal level. For example, a restaurant might require a general business license, a food service permit from the health department, and a liquor license if they plan to serve alcohol. A construction company, on the other hand, may need specific permits for building, demolition, or environmental compliance. Understanding these nuanced requirements is essential for legal operation.

Features of Business Licenses and Permits:

- Location-Specific Requirements: Regulations can differ significantly across federal, state, county, and city jurisdictions. You must research and comply with all applicable levels.

- Industry-Specific Regulations: Certain industries, such as healthcare, finance, and construction, are subject to stricter licensing and permitting requirements due to the nature of their work.

- Periodic Renewal Requirements: Most licenses and permits need to be renewed regularly, often annually or biennially. Missing renewal deadlines can result in penalties or business interruption.

- Application Fees: Obtaining licenses and permits typically involves application fees, which can vary significantly based on the type of license and the jurisdiction.

- Inspections and Certifications: Some licenses and permits require inspections of your business premises or certifications demonstrating compliance with specific standards.

Pros of Obtaining Necessary Licenses and Permits:

- Legal Compliance: Avoid costly penalties, legal issues, and potential business closure.

- Customer Trust and Legitimacy: Demonstrates professionalism and builds trust with customers.

- Safety Regulations: Many licenses and permits incorporate important safety regulations, protecting both your employees and the public.

- Reduced Competition: In some cases, specific licenses create barriers to entry, reducing competition in your market.

Cons of Obtaining Necessary Licenses and Permits:

- Cost and Time: The application process can be time-consuming and expensive, requiring significant upfront investment.

- Complex Requirements: Navigating the patchwork of regulations across different jurisdictions can be complex and confusing.

- Administrative Burden: Tracking renewal deadlines and maintaining compliance creates an ongoing administrative burden.

- Changing Regulations: Requirements can change, requiring constant vigilance to stay up-to-date and compliant.

Actionable Tips for Obtaining Business Licenses and Permits:

- Comprehensive Research: Check requirements at all governmental levels: federal, state, county, and municipal. Resources like the Small Business Administration (SBA) website and industry associations can be invaluable.

- Renewal Calendar: Create a calendar specifically for license and permit renewal deadlines to avoid missing critical dates.

- Budgeting: Factor application and renewal fees into your budget.

- Local Resources: Utilize your city's business development office or chamber of commerce as a resource. They can often provide guidance on local regulations.

- Permit Expeditors: For complex industries, consider using permit expeditors. They specialize in navigating the licensing process, saving you time and potential frustration.

By prioritizing and proactively addressing business license and permit requirements, you lay a solid foundation for legal compliance, build credibility with customers, and ensure the long-term success of your business. This essential component of small business legal requirements deserves meticulous attention and should be a priority from the outset of your venture.

4. Employment Laws and Regulations

Navigating the landscape of employment laws and regulations is a critical aspect of running a small business. This area of small business legal requirements becomes relevant the moment you hire your first employee and grows in complexity as your team expands. Failing to comply can lead to hefty fines, lawsuits, and damage to your business's reputation. This section will outline the key aspects of employment law that small business owners need to understand.

What it is and How it Works:

Employment law encompasses a broad range of federal, state, and even local regulations designed to protect the rights of both employers and employees. These laws govern virtually every aspect of the employer-employee relationship, from hiring and firing to wages, hours, working conditions, and benefits. Compliance requires staying informed about current regulations and implementing systems to ensure adherence.

Key Features of Employment Law Compliance:

- Minimum Wage and Overtime Requirements: Adhering to federal and state minimum wage laws and correctly calculating overtime pay is fundamental. Some states have higher minimum wage requirements than the federal level.

- Workplace Safety Standards (OSHA): The Occupational Safety and Health Administration (OSHA) sets standards to prevent workplace hazards and ensure a safe environment for employees. This includes providing appropriate safety equipment, training, and maintaining records of workplace incidents.

- Anti-Discrimination Laws: Federal laws like Title VII of the Civil Rights Act of 1964, the Americans with Disabilities Act (ADA), and the Age Discrimination in Employment Act (ADEA) prohibit discrimination based on protected characteristics like race, religion, gender, age, and disability. These laws influence hiring practices, promotions, and workplace conduct.

- Employee Classification (W-2 vs. 1099): Correctly classifying workers as either employees (W-2) or independent contractors (1099) is crucial for tax purposes and legal liability. Misclassification can result in significant penalties.

- Required Labor Law Posters: Federal and state laws mandate the display of specific posters in the workplace informing employees of their rights, such as minimum wage, worker's compensation, and anti-discrimination laws.

- Workers' Compensation Insurance: Most states require businesses to carry workers' compensation insurance to cover medical expenses and lost wages for employees injured on the job.

Examples of Successful Implementation:

- A small restaurant diligently tracks employee hours using a payroll system that automatically calculates overtime pay, ensuring compliance with the Fair Labor Standards Act (FLSA).

- A manufacturing company conducts regular safety training and provides appropriate safety equipment, adhering to OSHA guidelines and minimizing workplace accidents.

- A tech startup develops a diverse hiring process that includes blind resume reviews to mitigate unconscious bias and promote equal opportunities, complying with anti-discrimination laws.

Actionable Tips for Small Businesses:

- Invest in a robust payroll system: A good payroll system handles tax withholding, overtime calculations, and generates necessary reports, simplifying compliance with wage and hour laws.

- Create an employee handbook: A comprehensive employee handbook outlines company policies, expectations, and employee rights, fostering transparency and reducing potential misunderstandings.

- Consult with an employment attorney: Seek professional legal advice before implementing major HR policies or making significant employment decisions, especially regarding complex issues like employee classification or accommodating disabilities.

- Stay updated on changing regulations: Subscribe to newsletters from industry associations, the Department of Labor (DOL), and the Equal Employment Opportunity Commission (EEOC) to stay informed about regulatory updates.

- Consider Professional Employer Organizations (PEOs): PEOs can handle various HR functions, including payroll, benefits administration, and compliance, allowing small business owners to focus on their core business operations.

Pros and Cons:

Pros:

- Protects both employer and employee rights

- Reduces the risk of costly lawsuits

- Creates a fair and safe working environment

- Improves employee retention and satisfaction

Cons:

- Complex compliance requirements

- Requirements vary by location and company size

- Regulations change frequently

- Can be expensive to implement proper systems

Why Employment Law Deserves Its Place on the List:

Compliance with employment laws is non-negotiable for any business with employees. It's a fundamental aspect of operating ethically and legally. Failing to comply can have severe consequences, including financial penalties, legal battles, and reputational damage. By prioritizing employment law compliance, small businesses can build a strong, positive work environment and protect themselves from potential legal pitfalls. This area of small business legal requirements is crucial for long-term sustainability and success.

5. Tax Compliance

Tax compliance is a crucial aspect of meeting small business legal requirements. It encompasses understanding and adhering to a complex web of tax obligations at the federal, state, and local levels. These obligations, which are a fundamental part of operating a legitimate business, include income tax, self-employment tax, employment tax, sales tax, and potentially industry-specific taxes. Neglecting these requirements can lead to significant penalties, interest charges, and damage to your business's reputation. Therefore, proper tax planning, accurate recordkeeping, and timely filing are not just recommended—they are essential for survival and success.

This area deserves its place on the list of small business legal requirements because it's a non-negotiable aspect of operating within the law. Ignoring tax responsibilities can quickly derail a business, regardless of how profitable it might otherwise be.

Features of Small Business Tax Compliance:

- Income Tax Filing Requirements (Federal, State, Local): Depending on your business structure (sole proprietorship, LLC, corporation, etc.) and location, you'll face different income tax filing requirements.

- Quarterly Estimated Tax Payments: If your business expects to owe a certain amount in taxes, you may be required to make estimated tax payments throughout the year.

- Sales and Use Tax Collection and Remittance: If you sell tangible goods or certain services, you'll likely need to collect and remit sales tax. The rules governing this, particularly for online businesses selling across state lines, have become increasingly complex after the South Dakota v. Wayfair decision. Learn more about Tax Compliance for a broader overview of compliance.

- Payroll Tax Withholding and Reporting: If you have employees, you are responsible for withholding payroll taxes (income tax, Social Security, and Medicare) and reporting them to the appropriate authorities.

- Property Tax Obligations: If your business owns property, you will likely be subject to property taxes.

- Industry-Specific Taxes: Certain industries, such as alcohol, tobacco, and cannabis, often face additional excise taxes.

Pros of Maintaining Tax Compliance:

- Avoids Penalties and Interest: Staying compliant prevents costly penalties and interest charges that can quickly erode profits.

- Tax Planning Can Identify Legitimate Deductions: Proper tax planning can help you take advantage of all applicable deductions and minimize your tax liability legally.

- Good Recordkeeping Helps in Case of Audit: Maintaining meticulous records simplifies the audit process and can protect you in case of discrepancies.

- Compliance Builds Business Credibility: Demonstrating tax compliance builds trust with customers, vendors, and financial institutions.

Cons of Managing Tax Compliance:

- Complex and Time-Consuming Obligations: Understanding and meeting all tax obligations can be complex and time-consuming, especially for small business owners with limited resources.

- Requirements Vary by Location and Business Type: Tax laws and regulations differ significantly based on location and business structure, adding to the complexity.

- Multiple Filing Deadlines Throughout the Year: Keeping track of various filing deadlines for different tax types can be challenging.

- Constant Regulatory Changes Require Vigilance: Tax laws are subject to change, requiring business owners to stay informed and adapt.

Examples of Tax Compliance Challenges:

- E-commerce businesses navigating the complexities of multi-state sales tax collection and remittance after the South Dakota v. Wayfair Supreme Court decision.

- Restaurants dealing with different tax rates for dine-in versus takeout orders in some jurisdictions.

Actionable Tips for Small Business Tax Compliance:

- Use Accounting Software: Invest in accounting software specifically designed for small businesses to help track income, expenses, and tax liabilities. QuickBooks and other similar platforms can simplify many aspects of tax compliance.

- Hire a Tax Professional: Consider hiring a qualified tax professional familiar with your industry to navigate the complexities of tax law and ensure compliance.

- Separate Business and Personal Finances: Maintaining separate bank accounts and credit cards for your business and personal finances simplifies recordkeeping and helps avoid commingling funds.

- Set Aside Tax Funds: Regularly set aside a portion of your business income to cover anticipated tax liabilities. This prevents a financial strain when tax payments are due.

- Detailed Recordkeeping: Keep thorough records of all business income and expenses. This includes invoices, receipts, bank statements, and any other relevant documentation.

- Stay Informed: Stay up-to-date on tax law changes that may affect your business. Subscribe to IRS publications, attend webinars, and consult with your tax advisor.

By understanding and proactively addressing tax compliance, small business owners can build a solid foundation for financial stability and long-term success. They can also avoid the pitfalls and penalties that come with neglecting these crucial small business legal requirements.

6. Insurance Requirements

Navigating the legal landscape as a small business owner can feel overwhelming. One crucial aspect of meeting your small business legal requirements is securing adequate insurance coverage. Insurance acts as a safety net, protecting your business from financial ruin due to unforeseen circumstances. While it represents an ongoing expense, the protection it affords is invaluable and often legally required. Failing to address insurance needs can expose your business to significant risks, jeopardizing its long-term viability. This is why understanding and fulfilling insurance requirements deserves a prominent place on your list of legal to-dos.

Insurance essentially transfers risk from your business to an insurance provider. You pay regular premiums, and in return, the insurer agrees to cover specific losses as outlined in your policy. This can include everything from property damage and lawsuits to employee injuries and data breaches.

Types of Insurance to Consider:

Several types of insurance cater to the unique needs of small businesses. While specific requirements vary based on industry, location, and business structure, some common types include:

- General Liability Insurance: This foundational coverage protects your business from claims of bodily injury, property damage, and personal injury (like libel or slander) caused by your business operations.

- Professional Liability/Errors and Omissions (E&O) Insurance: Essential for service-based businesses, this insurance covers claims of negligence or mistakes in providing professional services. For example, a consultant might need E&O insurance to protect against claims of faulty advice.

- Property Insurance: This covers physical assets like your building, equipment, and inventory against damage from events like fire, theft, or natural disasters.

- Workers' Compensation Insurance: Legally required in most states once you hire employees, this insurance covers medical expenses and lost wages for employees injured on the job.

- Cyber Liability Insurance: With the increasing threat of data breaches and cyberattacks, this insurance helps cover the costs associated with data recovery, legal fees, and notification requirements.

- Business Interruption Insurance: This coverage helps replace lost income if your business is forced to temporarily close due to a covered event, like a fire or natural disaster.

- Commercial Auto Insurance: If your business uses vehicles, this insurance is crucial for covering accidents and related liabilities.

Pros and Cons of Business Insurance:

Pros:

- Protection from Catastrophic Losses: Insurance can prevent financial ruin in the event of a major lawsuit or disaster.

- Coverage of Legal Defense Costs: Many policies cover legal fees, even if the claim against your business is ultimately unsuccessful.

- Essential for Contracts and Business Relationships: Many clients and landlords require businesses to carry certain levels of insurance before entering into agreements.

- Facilitates Recovery from Unexpected Events: Insurance provides the financial resources needed to rebuild and resume operations after unforeseen setbacks.

Cons:

- Ongoing Premium Expenses: Insurance premiums represent a recurring cost for your business.

- Potential Coverage Gaps: Policies may have exclusions and limitations, leaving your business vulnerable in certain situations. It's crucial to understand what is and isn't covered.

- Complex Terms and Conditions: Insurance policies can be complex and difficult to decipher. Working with an insurance broker can help you navigate these complexities.

- Evolving Coverage Needs: As your business grows and changes, so will your insurance needs. Regular policy reviews are essential.

Actionable Tips:

- Consult an Insurance Broker: Work with a broker specializing in small business insurance. They can help you identify your specific needs and find the best coverage at a competitive price.

- Annual Policy Review: Review your policies annually to ensure they still adequately address your business risks.

- Consider a Business Owner's Policy (BOP): A BOP bundles general liability, property insurance, and often business interruption insurance into a single package, often at a lower cost than purchasing separate policies.

- Document Business Assets: Maintain detailed records and photographs of your business assets to facilitate claims processing in the event of a loss.

- Understand Policy Exclusions: Pay close attention to what is not covered by your policy to avoid unpleasant surprises.

- Implement Risk Management Procedures: Taking proactive steps to mitigate risks, such as implementing safety protocols and cybersecurity measures, can help lower your insurance premiums.

By diligently addressing your insurance needs, you are not only fulfilling small business legal requirements but also safeguarding your investment and ensuring the long-term success of your enterprise. Providers like The Hartford, Nationwide, and Hiscox, as well as newer entrants like Next Insurance, offer products specifically tailored to small businesses. Consulting resources from your state insurance commissioner can also provide valuable information specific to your location.

7. Intellectual Property Protection

Intellectual property (IP) protection is a crucial aspect of small business legal requirements. It allows you to safeguard your creative assets, brand identity, and innovations, effectively building a protective barrier around your unique offerings. This encompasses various legal instruments, including trademarks for business names and logos, copyrights for creative works like website content and marketing materials, patents for inventions and unique processes, and trade secrets for confidential business information such as recipes or client lists. Proper IP protection prevents competitors from unfairly capitalizing on your hard work and investments, building brand value and fostering a stronger market position. Ignoring IP protection can leave your business vulnerable to copycats and significantly diminish your long-term value.

For example, a small craft brewery carefully registering trademarks for their distinctive beer names and logos ensures that no other brewery can use similar branding, protecting their market share and brand recognition. Similarly, a software startup filing provisional patents before seeking investors secures their invention and makes them a more attractive investment opportunity. These examples highlight the importance of proactive IP protection in diverse business contexts. Features of a robust IP strategy include trademark protection for business names, logos, and slogans; copyright protection for creative works; patent protection for inventions and processes; trade secret protection for confidential information; and domain name registration to solidify your online presence.

This multifaceted approach offers significant advantages. It creates valuable business assets that can be licensed or sold, generating additional revenue streams. It provides legal recourse against infringement, allowing you to take action against those who copy your work. Furthermore, robust IP protection enhances business valuation, making your business more attractive to investors and potential buyers. Finally, and perhaps most importantly, it prevents competitors from copying your unique offerings, allowing you to maintain a competitive edge.

However, obtaining and enforcing IP protection can be expensive and time-consuming. Application processes can be complex, and international protection requires additional filings, adding to the cost and complexity. Ongoing monitoring and enforcement are also necessary to ensure your IP rights are respected, which further adds to the financial burden. Therefore, strategically prioritizing IP protection based on business value and risk is crucial for small business owners.

To navigate the complexities of IP law, consider these actionable tips: conduct thorough searches before adopting business names or product names to avoid infringing on existing trademarks; use proper markings (™, ®, ©) to indicate claimed rights; include confidentiality provisions in employee and contractor agreements to protect trade secrets; consider international protection if expanding globally; and budget for both initial registration and enforcement costs. You might find a Learn more about Intellectual Property Protection helpful for further insights. By understanding the nuances of intellectual property protection and implementing a proactive strategy, you can secure your business’s future and maximize its potential for growth and success. This makes IP protection a critical component of any small business's legal requirements.

7 Key Legal Requirements Overview

| Legal Requirement | Implementation Complexity 🔄 | Resource Requirements 💡 | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Business Structure Registration | Medium to High (varies by structure) |

Moderate (legal advice, filing fees) |

Legal identity, tax treatment, liability defined | New businesses planning growth or raising capital | Liability protection, tax advantages, credibility |

| Employer Identification Number (EIN) | Low (simple IRS process) |

Low (application time, documentation) |

Federal tax ID, hiring, banking enabled | Businesses hiring employees or seeking credit | Free, protects SSN, simplifies tax filing |

| Business Licenses and Permits | High (varies by location and industry) |

Moderate to High (fees, applications) |

Legal compliance, industry authorization | Businesses with regulated activities or locations | Avoids penalties, builds legitimacy, safety ensured |

| Employment Laws and Regulations | High (complex, multiple laws) |

High (systems, legal counsel, training) |

Legal compliance, safe, fair workplace | Businesses with employees | Reduces lawsuits, protects rights, improves retention |

| Tax Compliance | High (multiple filings and rules) |

High (accounting, software, professionals) |

Avoid penalties, good recordkeeping, tax planning | All active businesses | Avoids penalties, identifies deductions, credibility |

| Insurance Requirements | Medium (varies by business risk) |

Moderate to High (premiums, broker time) |

Risk protection, legal compliance | Businesses with assets, employees, contractual obligations | Protects assets, covers legal costs, risk mitigation |

| Intellectual Property Protection | Medium to High (filings and monitoring) |

Moderate to High (legal, filing, enforcement) |

Protects brand and innovations | Businesses with unique products, branding, inventions | Legal recourse, asset creation, prevents copying |

Ready to Simplify Your Legal To-Dos?

Navigating the complexities of small business legal requirements can feel overwhelming. From understanding the nuances of business structure registration and obtaining your Employer Identification Number (EIN), to staying compliant with employment laws and regulations, tax obligations, necessary insurance, and protecting your intellectual property, there's a lot to manage. This article has highlighted the key areas requiring your attention, emphasizing the importance of each step in building a strong and legally sound foundation for your business. Mastering these aspects of small business legal requirements isn't just about checking boxes; it's about safeguarding your business, minimizing risks, and empowering you to focus on growth and innovation. By proactively addressing these requirements, you can create a more stable and successful future for your venture. Whether you're a freelancer, a startup founder, or managing a growing team, understanding and complying with these legal aspects is crucial for long-term success.

Staying on top of these requirements, however, can be a significant time investment. Legal Document Simplifier can help alleviate this burden by providing clear, concise summaries of complex legal documents, tracking important deadlines related to your small business legal requirements, and identifying potential risks. Streamline your legal processes and gain valuable peace of mind. Visit Legal Document Simplifier today for a free trial and discover how we can help you simplify your legal to-dos and focus on what you do best – growing your business.