Liquidated damages are a pre-agreed sum of money one party owes the other if they break a specific promise in a contract. Think of it as a financial consequence decided upfront for failing to meet a key obligation, like hitting a project deadline. This amount is locked in when the contract is signed, giving both sides a clear picture of the stakes.

Decoding Liquidated Damages

At its heart, a liquidated damages clause is a risk management tool. It’s designed to answer a critical question before anything goes wrong: "If this specific part of the deal fails, what's the likely financial damage?"

By setting a figure in advance, both parties skip the potential for messy, expensive legal fights trying to calculate actual damages after the fact.

Imagine a construction company is hired to build a new retail store with a grand opening set in stone. A delay of just one day could cost the owner thousands in lost sales, wasted marketing, and staff wages. Instead of duking it out over these complicated losses later, they can agree to a liquidated damages clause from the start.

Key Takeaway: The whole point of liquidated damages is compensation, not punishment. The goal is to make the wronged party whole for their estimated losses, not to hit the other party with an excessive fine.

Distinguishing Fair Compensation From a Penalty

That line between compensation and punishment is the single most important factor for a court. If a clause seems designed to threaten or scare a party into performing, it's likely to be tossed out as an unenforceable penalty.

To sidestep common contract writing traps, it's good to get a handle on the terminology. Our guide on legal jargon explained can shed more light on this.

The key to an enforceable clause is whether the amount is a reasonable, good-faith estimate of the potential losses figured out at the time of signing.

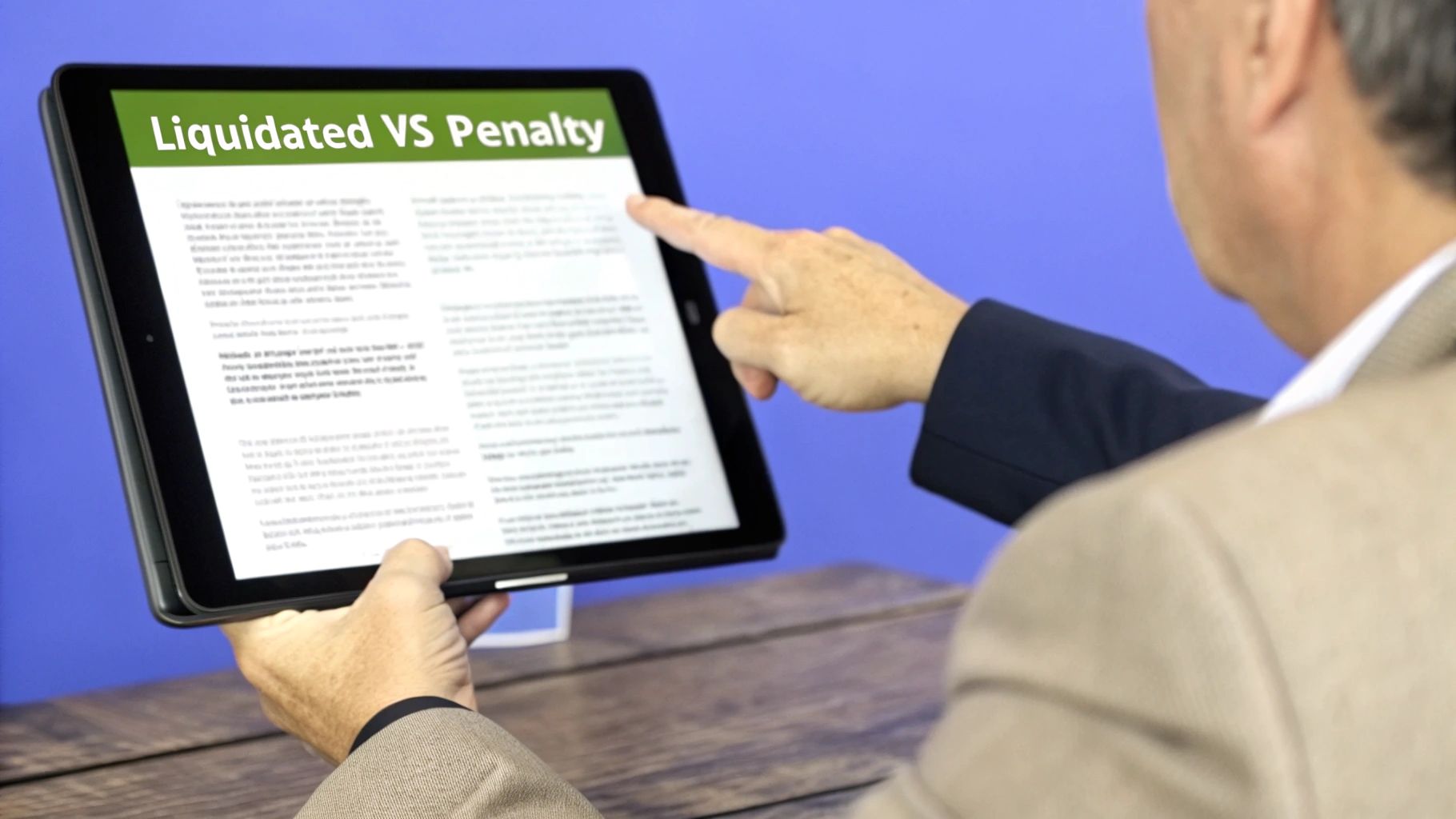

Liquidated Damages vs Penalty A Quick Comparison

It's crucial to know the difference between a valid liquidated damages clause and an unenforceable penalty. This table breaks it down.

| Characteristic | Liquidated Damages (Enforceable) | Penalty Clause (Unenforceable) |

|---|---|---|

| Purpose | To fairly compensate for a predicted loss | To punish or deter a breach of contract |

| Calculation | Based on a reasonable forecast of potential harm | An arbitrary amount unrelated to actual damages |

| Enforceability | Generally upheld by courts | Generally rejected by courts |

In short, if the amount is a genuine pre-estimate of loss, it will likely stand. If it's just a number plucked from thin air to scare someone, courts will probably see it as a penalty and refuse to enforce it.

Why Businesses Use Liquidated Damages Clauses

At first glance, a clause that spells out a financial penalty might seem a bit one-sided. But the real reason businesses use liquidated damages is to create predictability and certainty for everyone involved, turning abstract risks into concrete, manageable figures.

Think about launching a new software product. A three-month delay in development could be catastrophic, but how do you measure the damage? Missed market opportunities, a tarnished brand, lost customer trust—it's nearly impossible to put an exact dollar amount on that kind of harm.

This is where liquidated damages become an incredibly useful business tool. Instead of waiting for a disaster and then fighting a costly, drawn-out legal battle to prove actual financial losses, both sides agree on a reasonable estimate upfront.

Managing Risk and Avoiding Costly Disputes

By setting a clear financial consequence for a specific breach, both parties know exactly what’s on the line. This clarity is a game-changer for protecting your interests and keeping projects on track.

The main benefits are pretty straightforward:

- Risk Management: It puts a number on the financial risk of a potential breach, which helps with better project planning and resource allocation.

- Cost Avoidance: It helps you sidestep the massive legal fees and court costs that come with trying to prove actual damages after the fact.

- Encouraging Performance: When there's a pre-agreed financial penalty for failure, it creates a powerful and clear incentive to meet deadlines and obligations.

- Preserving Relationships: If a breach happens, the path to a solution is already mapped out. This can stop a minor issue from snowballing into a legal war that torches a valuable business relationship.

This approach is especially powerful in industries where timelines are everything. The global construction industry, for example, relies heavily on these clauses to manage the huge risks tied to project delays. You can learn more about how liquidated damages provide certainty about potential losses in that context. A pre-agreed sum for things like extra labor or loss of use keeps everyone out of lengthy court battles over damages that are tough to prove.

Creating a Clear Path to Resolution

In more complex agreements, liquidated damages clauses often work hand-in-hand with other performance goals. For instance, they can be directly linked to the uptime guarantees or delivery timelines laid out in a service level agreement. If you want to dive deeper into this, check out our guide on what is a service level agreement.

Ultimately, these clauses aren't about punishing the party that falls short. They're about taking a pragmatic, strategic approach to managing contracts.

A well-drafted liquidated damages clause is a sign of foresight. It shows that both parties have thoughtfully considered potential problems and have collaboratively established a fair and efficient way to resolve them without resorting to a courtroom showdown.

By turning an unknown future loss into a known, quantifiable number, businesses can operate with far more confidence. This pre-agreed financial outcome protects investments and helps manage project timelines effectively, transforming a legal concept into an essential tool for smart business operations.

When a Liquidated Damages Clause Is Enforceable

Just because a liquidated damages clause is written into a contract doesn't mean it's automatically valid. Its real power depends on whether a court will actually enforce it. Think of the court as a referee, applying a strict set of tests to tell the difference between a fair, pre-agreed damage estimate and an illegal penalty designed to punish someone.

The whole analysis really boils down to one core question: was the clause meant to genuinely compensate for a potential loss, or was it just there to scare a party into performing their duties? To figure this out, courts typically focus on two key conditions that get to the heart of the clause's intent and fairness.

The Two Pillars of Enforceability

For a liquidated damages clause to hold up in court, it generally has to pass a two-part test. Crucially, both conditions are judged from the perspective of when the contract was signed—not after a breach has already happened.

- Difficulty in Forecasting Damages: At the time the contract was created, was it genuinely hard or even impossible to calculate the exact financial damage a breach would cause?

- Reasonableness of the Estimate: Was the amount set for liquidated damages a reasonable, good-faith forecast of the actual harm that might result from the breach?

If the answer to both questions is a clear "yes," the clause is very likely to be enforced. But if the answer to either one is "no," it will probably be thrown out as an unenforceable penalty.

A clause with an outrageously high figure that has no real connection to potential losses is a major red flag. Its purpose shifts from compensation to coercion, and that's something courts simply won't support.

Putting the Tests into Practice

Let's say a photographer is hired for a wedding but fails to show up. It’s incredibly difficult to calculate the actual damages here. How do you put a price tag on lost memories? Because the damages are so uncertain, a reasonable liquidated damages amount—maybe a full refund plus an additional 50%—would likely be enforceable.

Now, consider a simple delivery contract where a supplier is one day late delivering $500 worth of office paper. If the liquidated damages clause demands $10,000 for that single day of delay, a court would almost certainly see it as a penalty. The actual harm is easy to calculate (the cost of getting paper from somewhere else for a day), and the $10,000 fee is completely out of proportion.

Liquidated damages also show up in U.S. labor law, particularly under the Fair Labor Standards Act (FLSA) for unpaid wages. Historically, this meant an employee could receive an amount equal to their unpaid wages as compensation for the delay. However, policies evolve. As of June 27, 2025, the Department of Labor's Wage and Hour Division has stopped seeking these damages in pre-litigation settlements to help get payments to workers faster. You can find more details on this U.S. Department of Labor policy shift on littler.com.

How to Calculate a Fair Liquidated Damages Amount

Figuring out the right number for liquidated damages is where the rubber meets the road. It absolutely must be a genuine pre-estimate of your potential losses, not just some random number pulled out of thin air to punish the other party. The whole process requires a thoughtful, documented approach that clearly connects the final figure to the financial hit you'd take from a specific breach.

The most common way to do this, especially for project delays, is a per-diem (or per-day) calculation. This involves adding up all the foreseeable daily costs the non-breaching party would have to shoulder if the project runs late. The goal is to land on a daily rate that’s defensible because it reflects actual, quantifiable losses.

Building a Defensible Calculation

To get to a fair number, both sides should ideally work together to identify and estimate all the potential daily expenses. It's critical to document this process meticulously. That paper trail is your proof that the figure was a reasonable forecast and not a penalty in disguise.

Here’s how you can break it down:

- Identify Potential Losses: Brainstorm every specific financial harm that would pop up from the breach (like a project delay). Think lost rent, extra staff time, you name it.

- Estimate Daily Costs: Put a realistic daily dollar value on each loss you identified.

- Sum the Daily Costs: Add up all the individual daily expenses to get your total per-diem liquidated damages amount.

- Document Everything: Keep detailed records of your calculations, any assumptions you made, and all the data you used to justify the final figure.

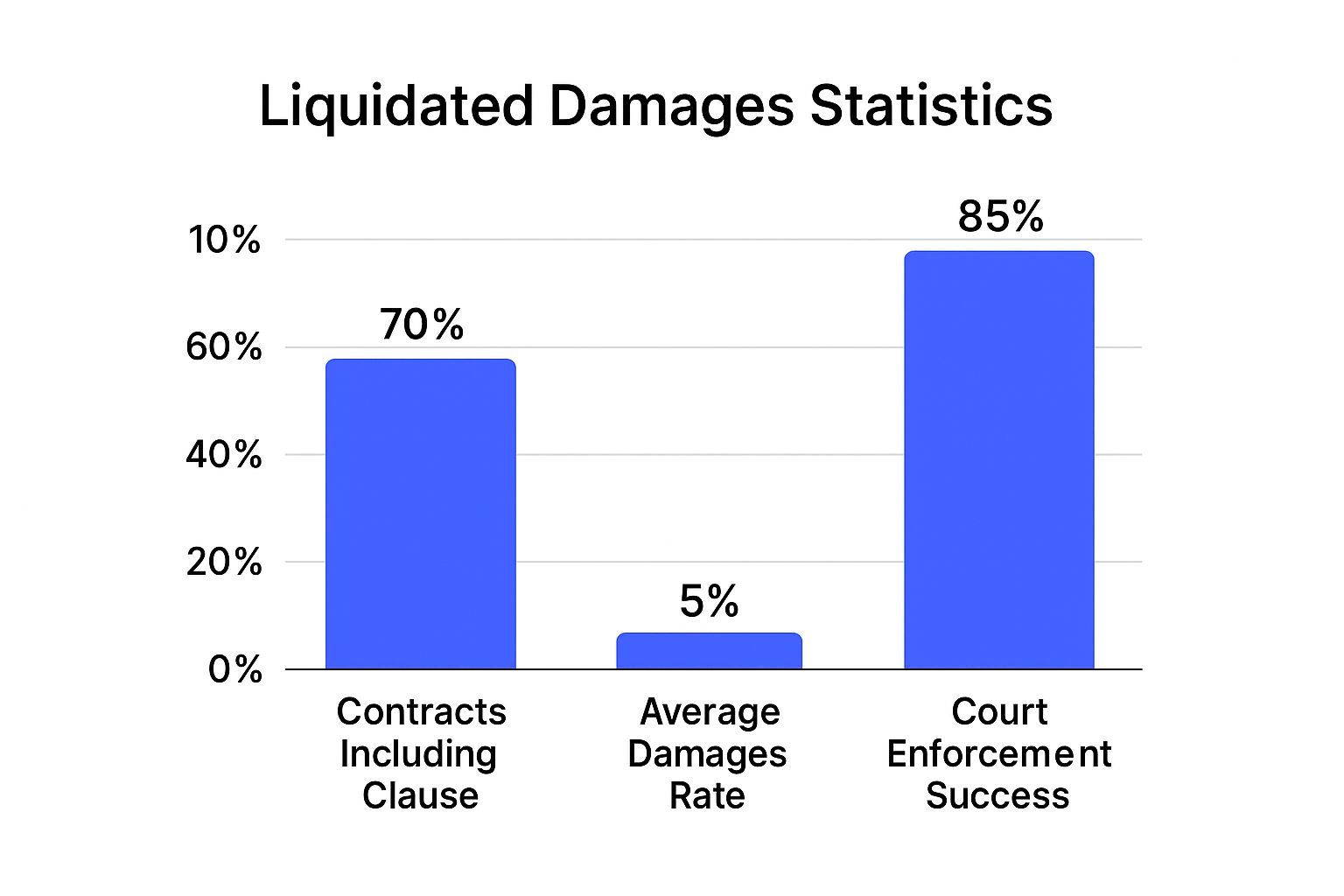

As you can see, these clauses are pretty common, but their success really hinges on whether a court will enforce them. And that almost always comes back to whether the calculation was fair from the start.

A Practical Construction Example

Let's make this real. Imagine a contractor is building a new retail space that the owner plans to lease out for $1,000 a day. If the project is late, the property owner is bleeding money from multiple sources.

Here's a sample calculation showing how the owner could tally up the daily damages to arrive at a fair liquidated damages figure.

Sample Per-Diem Liquidated Damages Calculation

| Cost Category | Estimated Daily Cost | Justification |

|---|---|---|

| Lost Rental Income | $1,000 | Direct loss based on the signed lease agreement with the incoming tenant. |

| Extended Supervision | $400 | Cost to keep the project manager on-site for each additional day of delay. |

| Equipment Rental Overages | $350 | Daily rental fees for machinery (e.g., cranes, lifts) needed until project completion. |

| Additional Financing Costs | $250 | Daily interest payments on the construction loan that continue during the delay. |

Adding these figures together ($1,000 + $400 + $350 + $250) gives us a total daily loss of $2,000.

This amount would be a reasonable and highly defensible per-diem liquidated damages figure for each day the project is late. It’s not a penalty; it’s a straightforward calculation of the actual financial damage the owner suffers.

Liquidated Damages in Different Industries

When you hear "liquidated damages," you might picture a massive construction site where every day of delay costs a fortune. While that's a classic case, these clauses are far more common and versatile than most people think. They show up in all sorts of industries, tailored to fit the unique risks of different business deals.

Seeing how they work in various fields helps you appreciate their real value. They’re a strategic tool for managing risk and making sure everyone's on the same page, no matter what you do for a living.

Software and Technology Contracts

In the tech world, timing is everything. Missing a software launch isn't just a minor setback—it can mean handing a golden opportunity to a competitor, losing your market window, or letting down customers who were counting on you. But how do you put a number on that? Calculating the exact financial damage from a delay, which includes things like lost sales and a tarnished reputation, is next to impossible.

This is where liquidated damages shine. A software development contract might have a simple per-day clause, where the development firm agrees to pay a set amount for every day the project is late. It gives the client a clear path to compensation and puts serious pressure on the developers to hit their deadlines.

Real Estate Agreements

Liquidated damages are a cornerstone of real estate deals, especially purchase agreements. In this context, they're usually there to protect the seller if the buyer suddenly gets cold feet and backs out of the deal without a good reason. The buyer's initial deposit, often called earnest money, typically doubles as the pre-agreed liquidated damages.

If the sale collapses because the buyer breaches the contract, the seller can keep the earnest money to cover their losses. Think about it: they lost time with the property off the market, wasted marketing dollars, and might have to relist the property for a lower price. This clause provides a clean, predictable solution that avoids a drawn-out court fight.

Employment and International Agreements

While you won't see them as often, these clauses can pop up in employment contracts. They're sometimes used to address breaches of non-compete or non-disclosure agreements, where proving the exact financial harm is notoriously tricky. However, their reach extends well beyond domestic contracts and onto the global stage.

International arbitration, for example, shows how different legal systems handle these clauses. In common law countries like the U.S., the agreed-upon amount is usually set in stone. But in many civil law systems across Europe and Asia, arbitrators have the power to adjust the amount if it seems unfair or wildly disproportionate to the actual harm. You can find a deep dive into this in a 2025 review of international arbitration cases. This flexible approach shows how fairness can balance contractual freedom when the numbers don't add up.

Ultimately, the purpose of a liquidated damages clause remains consistent across industries: to provide a clear, pre-agreed financial remedy for a specific breach, bringing certainty to situations where actual damages are difficult to calculate.

Drafting and Reviewing a Liquidated Damages Clause

Understanding what liquidated damages are is only half the battle. Knowing how to draft and review these clauses is where you can truly protect your interests.

Whether you're the one creating a contract or the one signing it, a poorly written clause can be a ticking time bomb. It might either be completely unenforceable when you need it most or expose you to unfair financial risk.

The goal is to craft a clause that is crystal clear, reasonable, and legally defensible. Vague language is the enemy here. A solid clause must precisely define the exact breach that triggers the damages, leaving zero room for interpretation. That level of precision is what makes it hold up.

Best Practices for Drafting a Clause

When you're the one writing the contract, your main objective is to make sure the clause can stand up in court if challenged. This means focusing on fairness and clear documentation, not on trying to sneak in a penalty.

- Use Unambiguous Language: State exactly which actions (or failures to act) trigger the clause. Instead of a fuzzy term like "project delay," get specific: "for each calendar day the final deliverable is submitted past the agreed-upon June 30th deadline."

- State the Intent: Explicitly write that the amount is intended as a reasonable pre-estimate of damages and not as a penalty. This simple statement can carry a surprising amount of weight with a judge.

- Document Your Math: Keep detailed records of how you arrived at the figure. This documentation is your single best defense if the amount is ever challenged as being excessive or punitive.

By focusing on clarity and justification, you transform the clause from a potential legal headache into an effective risk management tool. It becomes a pre-agreed solution instead of a source of future conflict.

How to Spot Red Flags When Reviewing

If you're on the receiving end of a contract, it’s time to put on your critic hat. You need to look for signs that the clause is less about fair compensation and more about giving the other party an unfair upper hand.

To see how these clauses fit into the bigger picture of an agreement, our overview of different contract clause examples offers some great context. https://legaldocumentsimplifier.com/blog/contract-clause-examples

Here are a few common red flags to watch for:

- Vague Triggers: The clause doesn’t clearly define what actually constitutes a breach. This ambiguity is a recipe for a dispute.

- Disproportionate Amounts: The specified damages seem wildly excessive and have no clear connection to any potential actual loss. If it feels like a cash grab, it probably is.

- Punitive Language: The clause uses loaded words like "penalty," "fine," or "forfeit." This signals an intent to punish rather than compensate, which is a major red flag for courts.

Common Questions About Liquidated Damages

Even after you’ve got a handle on the basics, a few specific questions always seem to pop up. Let’s tackle some of the most common ones to clear up any lingering confusion.

What Is the Difference Between Liquidated and Actual Damages?

The easiest way to think about this is timing and certainty.

Liquidated damages are an educated guess, agreed upon before anything goes wrong. It's a proactive way to set the financial consequences of a breach right in the contract itself.

Actual damages, on the other hand, are calculated after a breach has already happened. They represent the real, provable financial hit a party takes, and figuring them out often means digging through invoices, financial statements, and maybe even hiring experts—a process that can easily spiral into a lengthy and expensive legal fight.

Key Distinction: Liquidated damages are an estimate agreed upon in advance, while actual damages are the proven losses calculated after the fact.

Can I Sue for More If Actual Damages Are Higher?

In most cases, the answer is no. If a liquidated damages clause is considered valid and enforceable, it’s almost always treated as the exclusive remedy for that specific type of breach.

By agreeing to the clause, the non-breaching party is essentially saying they'll accept that predetermined amount as fair compensation. The upside is you get certainty and a much faster path to recovery. The trade-off is you can't go back and ask for more, even if your real losses end up being significantly higher.

What if the Agreed Amount Is Much Lower Than Real Damages?

This is the other side of the same coin. If the liquidated damages amount was a reasonable, good-faith estimate when the contract was signed, courts will typically enforce it—even if the actual harm turns out to be minimal or zero.

That said, if there were no actual damages at all, a court might take a closer look. They could decide that forcing payment would cross the line from compensation into an illegal penalty. But the focus almost always comes back to one key question: was the estimate reasonable at the time the contract was created?

Navigating contract clauses can be a challenge. Legal Document Simplifier uses AI to instantly transform complex legal language into clear, actionable summaries, helping you identify risks and obligations without the high cost of legal consultations. Simplify your legal documents today at legaldocumentsimplifier.com.