What Is A Closing Agent? Beyond The Textbook Definition

Think of a real estate transaction as an orchestra getting ready for a big performance. The buyer, seller, real estate agents, and lenders are all talented musicians, but without a conductor, their efforts might just create a mess of noise. The closing agent is that conductor—an impartial leader who makes sure everyone performs their part correctly to achieve a successful finale: the transfer of the property.

Think of a real estate transaction as an orchestra getting ready for a big performance. The buyer, seller, real estate agents, and lenders are all talented musicians, but without a conductor, their efforts might just create a mess of noise. The closing agent is that conductor—an impartial leader who makes sure everyone performs their part correctly to achieve a successful finale: the transfer of the property.

A closing agent is much more than a paper-pusher; they are a neutral third party who facilitates the entire process. Their main responsibility is to carry out the instructions laid out in the purchase agreement, making sure the deal concludes fairly and legally for everyone. They don't take sides with the buyer or the seller; instead, they represent the integrity of the transaction itself.

The Hub of the Transaction

A closing agent, who might also be called a settlement or escrow agent, is the central point for every critical part of the real estate deal. They manage a wide range of tasks that connect the initial offer to the moment you get the keys. These duties often include:

- Coordinating all parties: Making sure communication flows smoothly between the buyer, seller, lender, and other professionals.

- Preparing and managing documents: Handling key paperwork like the deed, settlement statements, and mortgage agreements.

- Overseeing financial transfers: Collecting the down payment, loan funds, and closing costs into a secure escrow account.

A transaction isn't considered complete just because the seller has been paid. The closing agent orchestrates the final steps, and the deal is only officially closed after all documents are signed and all funds have been collected in their account. This structured process protects both the buyer and seller from financial risk.

The sheer amount of paperwork can be overwhelming, and it's often filled with confusing terminology. A closing agent guides you through this complexity, turning a daunting process into a clear and organized event. This gives you the confidence to finalize one of the most important purchases of your life.

How Closing Agents Protect Your Money During The Transaction

When you're involved in one of the biggest financial deals of your life, knowing your money is safe is a top priority. A closing agent acts as the financial guardian of the real estate transaction, a neutral third party trusted to handle huge sums of money with security and precision. Their most important tool for keeping everything safe is the escrow account—a special, regulated bank account where all the funds for the deal are held until it's officially closed.

When you're involved in one of the biggest financial deals of your life, knowing your money is safe is a top priority. A closing agent acts as the financial guardian of the real estate transaction, a neutral third party trusted to handle huge sums of money with security and precision. Their most important tool for keeping everything safe is the escrow account—a special, regulated bank account where all the funds for the deal are held until it's officially closed.

The Escrow Process Explained

The escrow process creates a secure holding area for the funds, acting as a buffer between the buyer and seller. This prevents money from changing hands too early. Here is how a closing agent typically orchestrates the flow of funds:

- Holding Earnest Money: Once the purchase agreement is signed, your earnest money deposit is placed in the secure escrow account, not given directly to the seller.

- Receiving Loan Funds: The buyer's lender wires the loan amount directly to the closing agent, who adds it to the escrow account.

- Collecting Closing Costs: Both the buyer and seller contribute their share of the closing costs to the same escrow account.

After all the money is gathered and every document has been signed, the closing agent distributes the funds exactly as outlined on the closing statement. This includes paying off the seller's outstanding mortgage, covering real estate agent commissions, settling property taxes, and finally, transferring the remaining proceeds to the seller.

Ensuring Financial Accuracy

A huge part of the closing agent's job is to calculate and double-check every number on the final settlement statement. With over 5.5 million home sales in the U.S. residential market in 2022, closing agents are responsible for managing transactions worth trillions of dollars each year. They make sure all costs—which often fall between 2% to 5% of the home's purchase price—are assigned correctly to the right party.

This meticulous oversight prevents costly errors and ensures every single dollar is accounted for, giving everyone involved peace of mind. By managing the complex financial web of a real estate deal and carefully reviewing all the paperwork, the closing agent plays an indispensable role. For more guidance on navigating these types of agreements, you may find our guide on understanding legal documents helpful.

Closing Agent Vs Other Professionals: Who Handles What

A real estate transaction can feel like trying to follow a team sport without knowing the players' positions. You have a closing agent, a title company, and sometimes a real estate attorney all working on your deal. While their roles can overlap, each professional has a distinct job to ensure the property changes hands smoothly.

A real estate transaction can feel like trying to follow a team sport without knowing the players' positions. You have a closing agent, a title company, and sometimes a real estate attorney all working on your deal. While their roles can overlap, each professional has a distinct job to ensure the property changes hands smoothly.

Think of the closing agent as the project manager for the final stage, the title company as the historical researcher, and the attorney as the legal advisor. Understanding who does what is key to a successful closing day.

Closing Agent vs. Title Company

It’s common for a closing agent to work for a title company, which often causes confusion. The title company has one primary focus: to make sure the property’s title is clean and legitimate. They perform a detailed title search to uncover any potential issues like liens, ownership disputes, or other claims against the property. Once the title is verified, they issue title insurance to protect the new owner and the lender from future title-related problems.

The closing agent’s duties are much broader. While they depend on the title company’s research, they are responsible for managing the entire closing event. This involves preparing the settlement statement, coordinating with all parties, handling the escrow account, and overseeing the final signing of documents. In short, the title company verifies the property's history, and the closing agent executes the transaction based on that clear history.

When Does a Real Estate Attorney Get Involved?

A real estate attorney offers legal advice and representation. In some states, often called "attorney states," having an attorney involved in the closing is mandatory because the transaction is considered a legal practice. In these situations, the attorney frequently takes on the duties of the closing agent.

Even in states where an attorney isn't required, hiring one is a good idea for complex transactions. This could include deals with unusual contract terms, commercial properties, or situations where a legal dispute might come up. While a closing agent ensures the contract's instructions are followed precisely, an attorney can draft, negotiate, and interpret those instructions to best protect your specific legal interests.

To make these distinctions clearer, here’s a breakdown of how each professional contributes to a real estate deal.

Closing Agent vs. Other Real Estate Professionals

A detailed comparison of roles, responsibilities, and when each professional is involved in real estate transactions

| Professional | Primary Role | Key Responsibilities | When Needed |

|---|---|---|---|

| Closing Agent | Transaction Coordinator | - Prepares settlement statements - Manages escrow accounts - Oversees document signing - Disburses funds after closing |

In almost all real estate transactions to manage the final steps. |

| Title Company | Title Verification | - Conducts title searches - Identifies and helps clear title defects - Issues title insurance policies - Provides title abstract |

Always involved to ensure the property's title is clear and insurable. |

| Real Estate Attorney | Legal Advisor | - Drafts and reviews contracts - Negotiates terms - Provides legal counsel - Represents clients in disputes |

Mandatory in "attorney states"; recommended for complex or contentious deals. |

This table shows that while a closing agent, title company, and attorney work toward the same goal, their roles are specialized. The closing agent is the central figure managing the process, the title company secures the property's legal history, and an attorney provides an essential layer of legal protection when needed.

Your Closing Journey: What Actually Happens Step-By-Step

The time between signing a purchase contract and finally getting the keys can feel like a mysterious waiting game. What is the closing agent really doing during those weeks? They’re acting as the director of a complex play, making sure every actor and prop is in place for a smooth finale on closing day. This process breaks down into a few key phases.

Behind the Curtain: The Preparation Phase

As soon as the ink is dry on your purchase agreement, your closing agent starts working. This first stage is all about gathering the necessary pieces and getting everyone on the same page. Here’s what they do:

- Open the file and order a title search: The agent officially kicks off the process and hires a title company. This company dives into the property's history to check for any hidden issues like liens or ownership claims that could derail the sale.

- Communicate with the lender: They act as a bridge to your mortgage lender, coordinating to get all the necessary loan documents, funding information, and specific instructions needed for the closing.

- Prepare the settlement statement: The agent begins drafting the initial Closing Disclosure (CD), which is a detailed breakdown of every single cost associated with the transaction.

Think of this phase as setting the foundation for a house. If any problems with the property's title are found here, they must be fixed before anything else can happen.

The Final Approach: Document Review and Signing

As closing day gets closer, the pace picks up. You should receive your final Closing Disclosure about three business days before your scheduled signing. This document is extremely important, so review it with a fine-tooth comb to ensure all the numbers are correct.

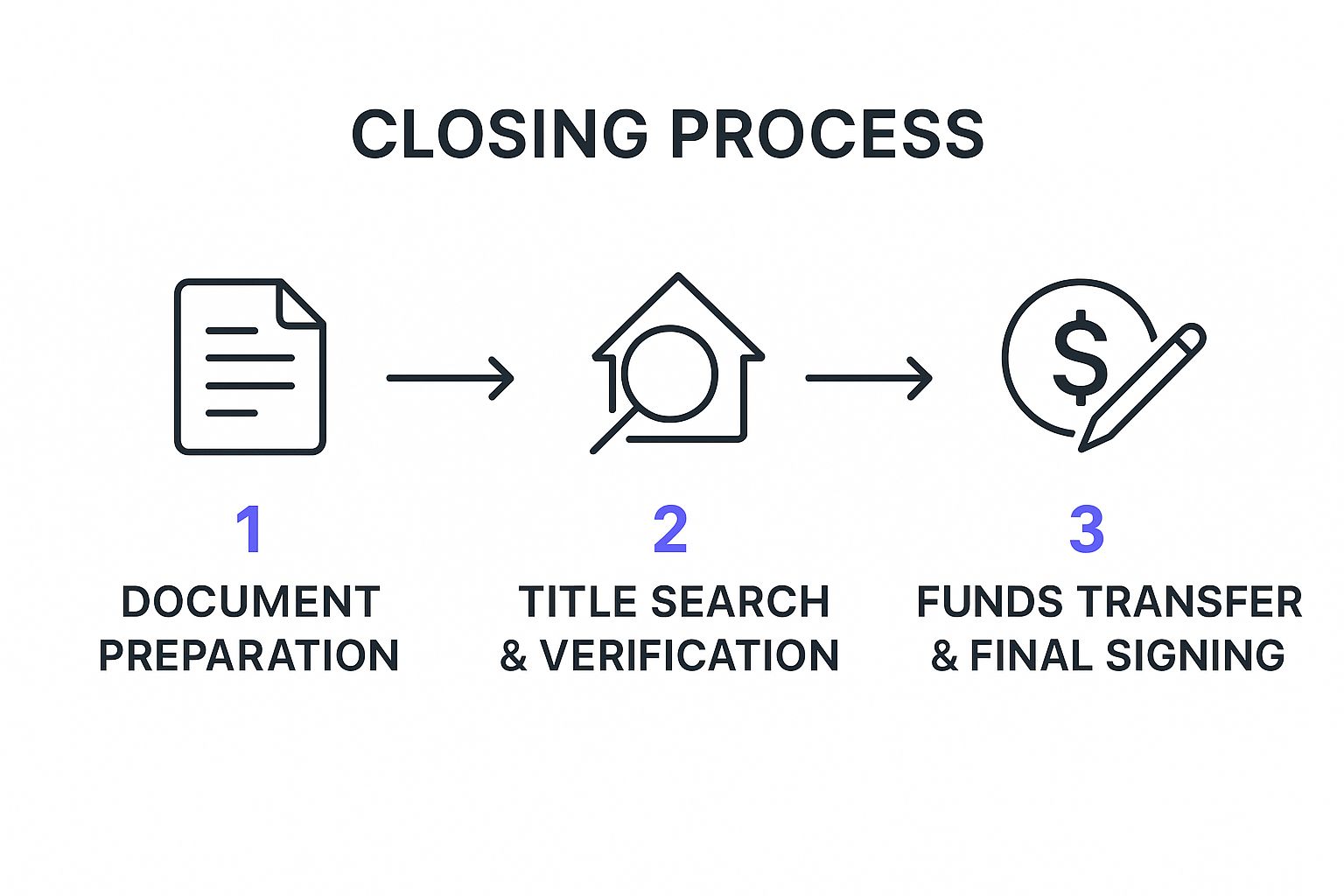

The infographic below shows the essential workflow your closing agent manages to get you to the finish line.

This visual highlights how document preparation, title checks, and fund management are all connected steps that have to happen in the right order. During the actual closing meeting, the agent will walk you through signing a tall stack of papers, including the deed, the mortgage note, and the final settlement statement. They make sure every signature is in the right spot and every document is correctly filled out. Once everything is signed and the money has been transferred, ownership officially changes hands, and you get your keys.

Why You Actually Need A Closing Agent (Beyond Requirements)

While many states require a closing agent for a real estate deal, their real value goes far beyond just checking a legal box. Think of them as the transaction's air traffic controller—a professional whose job is to spot and prevent problems before they turn into costly disasters. Their role is to ensure the process lands smoothly, not just to meet minimum legal standards. This proactive oversight is a layer of protection many buyers and sellers don't realize they have.A Neutral Guardian in a High-Stakes Deal

In any real estate transaction, everyone has their own motivation. The seller wants the highest price, the buyer wants the lowest, and real estate agents want their commission. The closing agent, however, is the only party whose sole interest is the integrity of the deal itself. This neutrality is essential. It prevents conflicts of interest and ensures all terms of the purchase agreement are met exactly as written, without favoring either side.

Their impartial position allows them to effectively:

- Prevent Fraud: By verifying identities and managing all funds through a secure escrow account, they serve as a critical defense against wire fraud schemes.

- Resolve Disputes: When last-minute disagreements pop up over repairs or final walkthrough issues, a closing agent can mediate based on the contract’s terms to find a fair solution for everyone.

- Catch Title Issues: An experienced agent works with the title company to make sure potential problems, like an old, undiscovered lien, are cleared long before you get to the closing table.

Ultimately, a good closing agent offers immense peace of mind. Knowing a dedicated professional is managing the complex financial and legal details significantly reduces stress. They are your safeguard, ensuring your major investment is protected. This level of diligence can be especially helpful when you encounter dense paperwork; for more clarity, you can check out our guide on common legal terms explained.

Finding The Right Closing Agent: Your Selection Strategy

Selecting a closing agent isn't just another box to check on your home-buying list; it's a strategic decision that can make or break your entire transaction. Think of them as the project manager for one of the biggest financial milestones of your life. While your real estate agent or lender might suggest someone, the final choice is yours. A great closing agent keeps everything organized and communicates clearly, while a poor one can cause expensive delays and a mountain of stress.

Key Evaluation Questions

Before you hire a closing agent, it's wise to interview a few candidates. This helps you gauge their expertise and professionalism. Their answers to a few specific questions will reveal a lot about their ability to manage your closing effectively.

- Experience: How many residential closings do you typically handle each month? You're looking for an agent with steady, current experience, especially with your type of property (e.g., single-family home, condo, or new construction).

- Communication: How will you keep me updated on the progress of my closing? A professional who values transparency will have a clear plan for communication, whether it's through email, a secure portal, or regular phone calls.

- Fees: Can you give me an itemized breakdown of your settlement fees? A trustworthy agent should be able to explain their charges without hesitation. Vague answers or an unwillingness to provide a detailed list is a major red flag.

- Technology: What secure platforms do you use for sharing documents and communicating sensitive information? In an age of digital transactions, strong security practices are non-negotiable to protect your personal and financial data.

To help you compare your options, we've put together a table outlining the key criteria for selecting a great closing agent.

| Criteria | What to Look For | Questions to Ask | Red Flags |

|---|---|---|---|

| Experience & Reputation | Consistent closing volume, positive online reviews, and local market knowledge. | "How long have you been a closing agent?" "Do you have experience with [Your Property Type]?" | Vague answers, few recent closings, or consistently negative online feedback. |

| Communication | A clear communication plan and proactive updates. | "What is your primary method for client updates?" "What's your average response time?" | Slow or no response to initial inquiries, disorganized communication. |

| Fee Transparency | An itemized list of all settlement fees provided upfront. | "Can you provide a detailed list of your fees?" "Are there any other potential charges?" | Hesitation to provide a fee sheet or unclear explanations of costs. |

| Technology & Security | Use of secure online portals for document signing and sharing. | "What tools do you use for secure document exchange?" | Reliance on non-secure methods like standard email for sensitive documents. |

This table serves as a guide to ensure you're asking the right questions and looking for the right qualities. Making an informed choice now can save you significant trouble later.

Spotting Potential Red Flags

Beyond the answers to your questions, pay close attention to other signals. A messy, disorganized office can be a warning sign of a disorganized process. Slow response times to your initial calls or emails often predict how they'll communicate once the closing is underway.

Similarly, a pattern of poor online reviews from past clients should not be ignored. Choosing the right closing agent means finding a partner who is not only experienced and transparent but also dedicated to ensuring your transaction proceeds without a hitch.

Your Closing Success Action Plan: What To Do Next

Now that you have a solid grasp of what a closing agent does, it's time to put that knowledge into action. Think of yourself not as a bystander, but as a prepared partner in the closing process. A smooth transaction is all about teamwork between you and your closing agent, and that starts with clear communication and good organization on your part.

Before Your Closing Appointment

The weeks before closing day are crucial. Your main job is to collect all the required documents and maintain regular contact with your agent.

- Review your preliminary Closing Disclosure: This document will arrive at least three business days before closing. Go over it with a fine-tooth comb and ask your agent to explain any fees or charges that seem unclear.

- Prepare your funds: Your agent will give you the final amount you need to bring to the closing table. Make sure to get a cashier’s check or set up a wire transfer ahead of time to avoid last-minute stress.

- Gather identification: Have a valid, government-issued photo ID ready to go for the appointment.

During and After Closing

On the big day, your closing agent is there to walk you through the final stack of paperwork. Don't be shy about asking questions—this is your final opportunity to make sure everything is accurate before the deal becomes official. Once all the documents are signed, your job isn't quite done.

Store your final closing package in a secure place. It contains critical documents like the deed and the final settlement statement, which you will need for tax season and as a future record of the transaction. A little bit of organization at this stage can save you from big headaches down the road.

Feeling swamped by all the legal language in your contracts and disclosures? The Legal Document Simplifier can instantly translate complex legalese into simple, easy-to-read summaries. Upload your documents today and walk into your closing with total confidence.