So, what is exculpation, really?

At its core, exculpation is a legal way of saying, "You can't blame me for this." It’s an agreement made ahead of time that frees one party from being held liable if something goes wrong. Think of it as a pre-agreed "hall pass" for specific situations, designed to manage risks before they ever become a real problem.

What Exculpation Looks Like in the Real World

If you've ever signed a waiver at a gym, ski resort, or trampoline park, you’ve already seen an exculpatory clause in action. That piece of paper you quickly initial is a contract where you agree not to sue the business for injuries that might happen due to ordinary negligence—like tripping over your own feet while jumping.

This legal shield isn't just for fun and games, though. It's a fundamental tool used across all sorts of business and legal contexts to decide who shoulders the risk. The idea comes from the Latin word exculpare, which literally means "to clear from blame."

Essentially, an exculpatory clause is just a provision tucked into a contract. One party agrees not to hold the other responsible for certain kinds of harm or damages.

Key Takeaway: The point of exculpation isn't to give someone a free pass for reckless behavior. It’s about protecting parties from liability for honest accidents or unforeseen issues that can happen even when everyone is being reasonably careful.

This concept is widely accepted. For example, 46 states in the U.S. generally enforce well-written exculpatory agreements that shield service providers from lawsuits over ordinary negligence. Of course, the agreement has to be clear, and the signature voluntary. You can dive into a state-by-state comparison of these legal standards to see how the rules change depending on where you are.

But this "hall pass" has its limits. Courts scrutinize these clauses to make sure they're fair and don't go against public policy. A clause trying to excuse a party for gross negligence or intentional harm? That will almost always be thrown out. Getting a feel for this distinction is the first step in knowing when exculpation is a reasonable shield and when it's trying to get away with too much.

How Exculpatory Clauses Work in Contracts

You’ve probably seen an exculpatory clause before, even if you didn’t know it. They’re often tucked away in the fine print of a contract you sign before, say, renting a jet ski or joining a gym. These sections, known as exculpatory clauses, are a business's go-to tool for managing risk before you ever use their product or service.

Think of them as the operating manual for what happens if things don’t go as planned.

Businesses that offer services with some level of built-in risk—like recreational facilities, rental companies, or even professional consultants—rely heavily on these clauses. They aren't meant to be corporate traps. Instead, their job is to draw a clear line in the sand, spelling out which party accepts responsibility for specific potential mishaps.

This is especially important for activities where accidents can happen even when everyone is being reasonably careful. Without this legal shield, many of these businesses would be buried in constant, expensive litigation. That could make their services too costly for anyone to afford, or force them to shut down completely.

The Critical Line Between Types of Negligence

Now, an exculpatory clause isn't a get-out-of-jail-free card. Its power isn’t absolute. Courts are very particular about what these clauses can and can't cover, and it all comes down to the type of negligence involved.

There are two key concepts here:

- Ordinary Negligence: This is your run-of-the-mill mistake. It’s a failure to exercise the kind of care a reasonably sensible person would. Think of a gym employee forgetting to wipe up a small water spill right away. It's an oversight, not a malicious act.

- Gross Negligence: This is a whole different level of failure. It’s not just a simple mistake; it’s a conscious and voluntary disregard for safety. It’s acting so recklessly that you know someone could get hurt. An example? A rock-climbing gym that knows its ropes are frayed and unsafe but uses them anyway.

Most legally sound exculpatory clauses are designed to protect a business from liability for ordinary negligence only. Courts almost never enforce clauses that try to let a party off the hook for gross negligence, intentional harm, or illegal acts. This distinction is crucial. It allows businesses to protect themselves from everyday accidents while ensuring they can't escape accountability for reckless behavior that endangers people.

Exculpation as a Tool for Mutual Understanding

At its core, an exculpatory clause is about creating a clear agreement. It tells you, the consumer, exactly what risks you're accepting in exchange for getting to use a service or participate in an activity. It's a trade-off: you get to do the fun thing, and the provider is protected from liability for certain kinds of accidental harm.

This function is a lot like other tools in a contract that set the ground rules for how a business relationship will work. For instance, many agreements have specific sections outlining how disagreements will be resolved long before any conflict arises. To see how businesses pre-plan for potential disputes, you can explore our guide on what is an arbitration clause.

By clearly allocating risk, an exculpatory clause helps both parties understand their responsibilities and potential liabilities from the outset, preventing future misunderstandings and disputes.

Real-World Scenarios of Exculpation

Understanding the theory behind exculpation is one thing, but seeing it in action is what makes the concept really click. These clauses pop up in all sorts of agreements, usually to shield a party from liability tied to their specific role. Let's walk through a few real-world situations to see how this legal tool works in practice.

Each example will show how the idea of what is exculpation moves from a legal term to a practical way of managing risk.

The Software Developer's Safety Net

The Situation: A small business hires a freelance developer to build a custom inventory management app. The developer is good, but they know that even the best software can have unexpected bugs. To protect themselves, they add a specific clause to their service agreement.

How Exculpation Applies: The clause states that the developer isn’t liable for financial losses or data corruption from non-critical software bugs that pop up after the final version is delivered and accepted. This is a common-sense protection in software development—it keeps the developer from getting sued over every minor glitch that might interrupt the client’s business.

This shield isn't absolute, though. The clause wouldn’t cover gross negligence. For example, if the developer knowingly built the software with a major security hole or ignored repeated warnings about a critical bug, that clause wouldn't help them one bit.

The Landlord's Liability Shield

The Situation: You’re excited to sign a one-year lease for a new apartment. Tucked away in that stack of paperwork is a section outlining the landlord's responsibilities and—just as importantly—their limitations.

How Exculpation Applies: This section almost certainly has an exculpatory clause. It might say the landlord isn't responsible for damage to your personal property from a minor issue, like a slow leak under the sink that you haven't reported yet. The logic here is that the tenant has a duty to promptly report maintenance issues.

This clause draws a line in the sand, protecting the landlord from things they couldn't possibly know about. It doesn't, however, let them off the hook for maintaining a safe and habitable home.

If the landlord ignored five of your emails about a faulty electrical outlet that later caused a fire, that’s negligence. The exculpatory clause would offer zero protection in that case.

The Business Consultant's Boundaries

The Situation: A startup brings in a marketing consultant to create a new go-to-market strategy. The consultant's agreement needs to manage the client’s expectations and clearly define the limits of their professional accountability.

How Exculpation Applies: The contract includes a clause clarifying that while the consultant will provide expert, professional advice, they can't be held financially responsible if the strategy doesn't hit specific sales targets. This type of exculpation is crucial for any professional whose work is influenced by outside factors they can't control, like market shifts or a competitor's surprise move.

It lets them give honest, bold advice without carrying the financial risk for the company’s ultimate performance. It's about separating professional guidance from guaranteed business outcomes.

Where Else You Might Find Exculpation

While you'll bump into exculpation clauses in everyday contracts, their reach extends into much more specialized and high-stakes corners of the law. The core idea—providing a shield against liability to encourage necessary action—pops up in settings far removed from a gym membership or software agreement. Seeing how it's used in these other areas really shows how fundamental the concept is.

One of the most significant fields is bankruptcy law. When a company goes under, a trustee or management team gets the unenviable job of making tough calls under immense pressure. They have to sell off assets, wrangle with creditors, and map out a restructuring plan, all while trying to navigate a financial hurricane.

To empower these individuals to act decisively without constantly looking over their shoulder, bankruptcy plans often include very strong exculpation clauses.

These provisions protect trustees, debtors, and their professional advisors from being held liable for actions they took in good faith during the bankruptcy proceedings. Without this legal armor, the fear of endless lawsuits could paralyze the very people trying to salvage some value for everyone involved.

Exculpation in Corporate and Tort Law

The principle also makes a prominent appearance in corporate governance. Take Delaware, for example. In 2022, the state amended its laws to let corporations include charter provisions that shield senior officers from personal liability for certain breaches of their duty of care. This move, which mirrors a long-standing protection for corporate directors, is designed to help companies attract and keep top executive talent by lowering their personal risk for honest business mistakes.

Since that change, over 300 public companies, including many in the Fortune 1000, have put officer exculpation to a shareholder vote.

Of course, exculpation is also a cornerstone of tort law, which covers civil wrongs that cause someone else to suffer harm. This brings us right back to the liability waivers we talked about earlier. When you sign a waiver, you're essentially engaging with a tort law concept: you're agreeing not to sue for ordinary negligence.

The legal system gets that in many situations, it's fair for people to voluntarily take on known risks. These clauses are just the formal way of documenting that assumption of risk.

A Unifying Legal Principle

Across all these different fields, the goal of exculpation is remarkably consistent: to strike a balance between risk and responsibility. In bankruptcy, these clauses have become a powerful tool for protecting fiduciaries who are managing incredibly complex reorganizations. You'll find this protective language in bankruptcy plans across major markets like the United States, Canada, and the United Kingdom, which just goes to show its vital role in global insolvency law. For a closer look, you can explore a deeper dive into the use of exculpation in bankruptcy and tort law.

From corporate boardrooms to bankruptcy courts, exculpation acts as a critical legal instrument. It allows fiduciaries, officers, and service providers to do their jobs effectively, encouraging action and decision-making right where it's needed most.

When an Exculpatory Clause Can Be Challenged

Just because you signed a contract doesn't mean every single clause inside it is ironclad. Exculpatory clauses, in particular, have to walk a very fine line to be considered legally enforceable. Courts look at these provisions with a magnifying glass to make sure they aren’t an unfair attempt to dodge responsibility.

So, what makes a court say "no" to one of these clauses?

Ambiguity and Unfairness

One of the biggest red flags for any court is ambiguity. If the language is fuzzy, confusing, or buried deep in the fine print, a judge is likely to decide you couldn't have possibly understood what you were agreeing to. For an exculpation to stand, it needs to be out in the open and written in plain, direct language.

Ultimately, courts are looking for fairness. Was the agreement negotiated freely, or was it a take-it-or-leave-it situation? If one party has all the bargaining power and the other has no real choice but to sign, the clause might get tossed out. One-sided agreements rarely hold up.

Violations of Public Interest

Another major reason a clause gets invalidated is when it goes against public policy or the public interest. This legal standard is there to stop providers of essential services from simply washing their hands of their basic duties.

For instance, a court would almost certainly reject a clause that tries to let:

- A hospital avoid liability for a surgeon's blatant medical malpractice.

- An electric company escape responsibility for a power surge that fries everyone's appliances.

- A landlord waive their legal duty to provide a safe and habitable apartment.

In these cases, society has a vested interest in holding these parties to a higher standard. Allowing them to hide behind an exculpatory clause would put public safety and welfare at risk.

The line between an enforceable and unenforceable clause can be tricky. Generally, it comes down to whether the clause is specific and fair versus overly broad and one-sided. This table breaks down the key differences.

Enforceable vs. Unenforceable Exculpatory Clauses

| Characteristic | Enforceable Clause Example | Unenforceable Clause Example |

|---|---|---|

| Clarity | Clearly states that a gym is not liable for injuries from using equipment. | Vaguely states the company is not liable for "any harm whatsoever." |

| Specificity | Releases a ski resort from liability for risks inherent to skiing, like falls on the slope. | Attempts to release a business from liability for intentional harm or gross negligence. |

| Fairness | A clause in a recreational activity waiver where participation is voluntary. | A clause in a residential lease that a landlord cannot be sued for failing to maintain the property. |

| Public Policy | Limits liability for a software company for data loss due to bugs. | Allows a public utility to escape all liability for service outages. |

As you can see, the more a clause tries to cover, the more likely it is to be struck down.

Strong vs. Weak Clauses

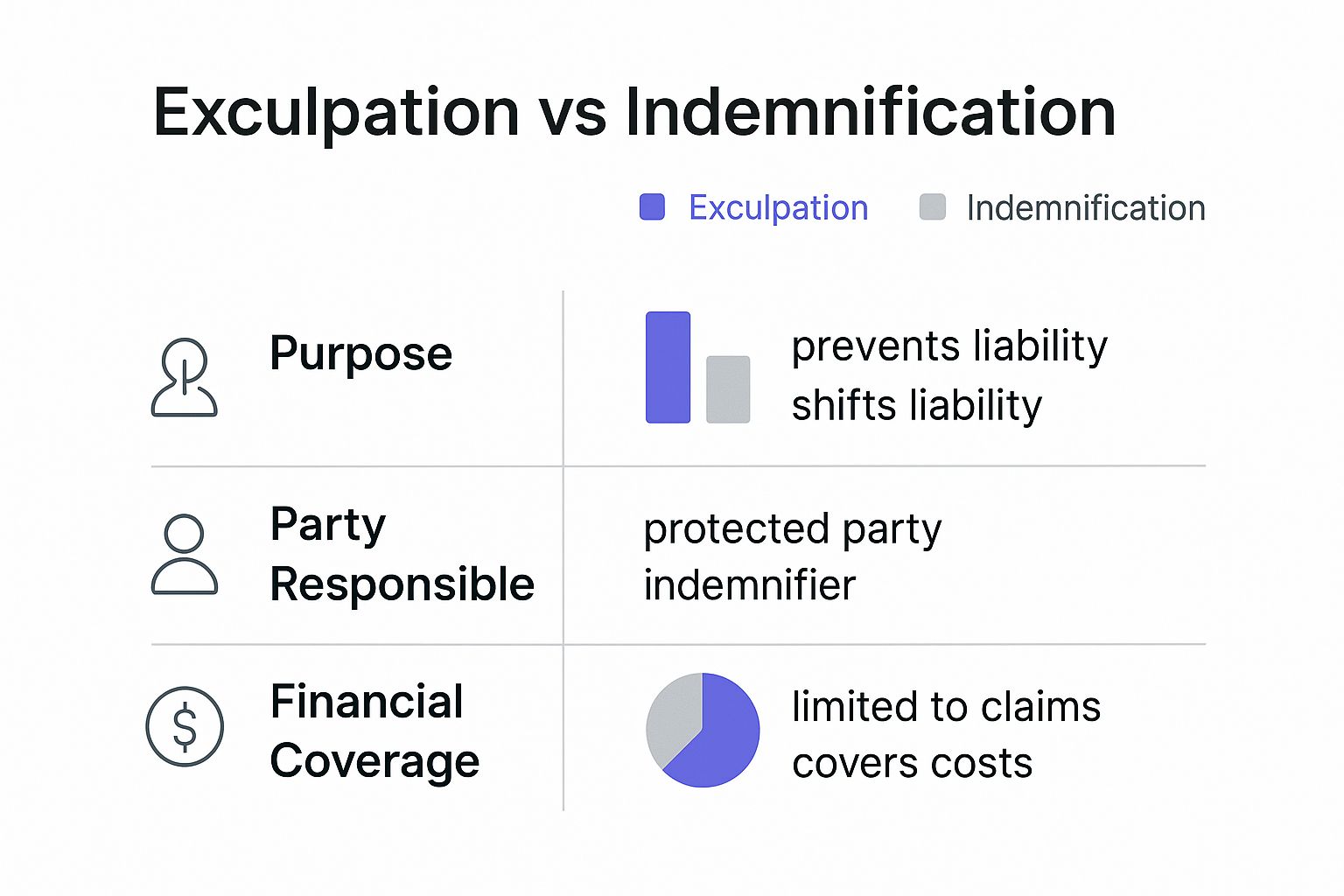

At the end of the day, a strong, enforceable clause is always clear, specific, and fair. A weak one is often vague, overly broad, or hidden away in the contract. This infographic shows how different legal tools, like exculpation and indemnification, are meant for specific situations.

As the chart shows, exculpation is about preventing a claim, while indemnification is about shifting the financial responsibility for a claim to someone else. Getting these details wrong matters. An overly aggressive exculpatory clause might even be considered a what does breach of contract mean if it violates legal standards. The law will almost always step in to protect people from agreements that are fundamentally unfair or try to excuse reckless or intentional harm.

How to Handle Documents with Exculpation Clauses

It’s one thing to understand what an exculpation clause is in theory, but it's another thing entirely to stare one down in a real contract. Seeing that dense block of legalese can be intimidating, but it doesn’t have to be. A good, systematic approach can cut through the jargon and make it a clear, manageable part of the agreement.

The trick is to shift from theory to practice. With a simple three-step process, you can confidently identify, understand, and question these clauses before you sign on the dotted line.

Step 1: Spot the Trigger Words

First things first, you need to know what to look for. Exculpatory language relies on specific "trigger words" that signal a shift in who holds the risk. Think of this as your first line of defense—scanning for these terms can stop you from accidentally taking on a huge amount of liability.

Keep an eye out for phrases like these:

- "Waive and release": This is a classic combo. It’s a direct sign that you are giving up your right to sue if something goes wrong.

- "Hold harmless": This means you’re agreeing not to blame the other party for any damages that might occur.

- "Assume all risk": It doesn’t get much more direct than this. The clause is explicitly placing the responsibility for any negative outcomes squarely on your shoulders.

Step 2: Grasp the True Meaning

Once you've spotted the trigger words, the real work begins. You need to figure out what they actually mean in the context of your agreement. What specific situations or actions does the clause cover? Is it just protecting the other party from ordinary negligence, or is it trying to go too far by covering reckless behavior?

The goal isn't just to find the clause but to understand its reach. A well-written, fair clause will be specific. A problematic one will be vague and overly broad, trying to absolve the party of any and all responsibility.

This is where tools like the Legal Document Simplifier come in handy. It can automatically flag these critical sections and translate the dense legalese into plain English you can actually understand.

This screenshot shows exactly how the tool highlights and simplifies an exculpation clause, making its impact immediately obvious. Getting a clear picture of the risks you’re accepting is a cornerstone of effective contract risk management.

Step 3: Ask the Right Questions

Finally, armed with this knowledge, you can start asking pointed questions. Never be afraid to push for clarification or even negotiate the terms. It's your right.

Here are a few essential questions to get you started:

- What specific risks am I accepting if I agree to this?

- Is this clause negotiable? Can we make the language more specific or narrow its scope?

- Does this clause only cover ordinary negligence, or does it extend to other situations?

By following these three steps, you switch from being a passive signer to an active, informed participant in the agreement. You’re not just signing a document; you’re making sure you fully understand and agree to every part of it.

Frequently Asked Questions About Exculpation

Once you get a handle on the basics of exculpation, a few common questions almost always pop up. Let's tackle some of the most frequent ones to clear up any lingering confusion.

Is an Exculpatory Clause the Same as a Waiver?

For all practical purposes, yes. Think of a liability waiver as a specific type of document whose main job is to act as an exculpatory agreement. When you sign that waiver before going ziplining, you’re agreeing to an exculpatory clause that says you won’t sue them for ordinary negligence if something goes wrong.

The terms get tossed around interchangeably in conversation, but "exculpatory clause" is the more formal, umbrella term. It refers to the specific provision that can show up in all sorts of contracts, not just in standalone waiver forms.

Can I Refuse to Sign an Agreement with an Exculpatory Clause?

You absolutely can. You always have the right to walk away from a contract you're not comfortable signing. The flip side, of course, is that the business also has the right to refuse service if you don't agree to their terms.

In many consumer situations, like recreational activities, these clauses are pretty much take-it-or-leave-it. But in other contexts, say a business-to-business deal, you might have more leverage to negotiate or even strike the clause.

Remember: A contract is a two-way street. It never hurts to ask if a clause can be tweaked or removed, especially if it feels overly broad. Just be ready for the answer to be no.

What Is the Difference Between Exculpation and Indemnification?

This is a fantastic question, and the distinction is crucial. While both deal with who's on the hook for legal trouble, they work in opposite ways.

- Exculpation is like a shield. Its goal is to stop one party from suing the other in the first place. You agree not to file a claim.

- Indemnification is more like a safety net. It kicks in after a lawsuit is filed, usually by a third party. It forces one party to pay for the other's legal costs and damages.

So, exculpation blocks a direct claim between the two parties in the contract. Indemnification shifts the financial fallout from a third-party claim onto someone else.

Feeling buried in dense legal documents? Legal Document Simplifier can dig you out. Our AI-powered tool instantly scans contracts, flags risky clauses like exculpation, and translates baffling legalese into plain English. Now you can sign with confidence. See how it works at https://legaldocumentsimplifier.com.