Understanding What Right Of Survivorship Really Means

When you hear about property ownership, the term right of survivorship often pops up. But what does this legal feature actually mean for you and your property? In simple terms, it means that if one joint owner passes away, their portion of the property automatically goes to the surviving joint owner or owners.

This process happens directly, without needing to go through a will. Crucially, it also sidesteps the probate process, which can often be a long and expensive ordeal. This makes it a significant factor in how jointly owned assets, particularly real estate, are managed after an owner’s death. Many property owners choose this setup for its directness and the comfort it can provide to loved ones.

The Core Principle: Automatic Asset Transfer

The most important aspect of the right of survivorship is that the transfer is automatic. Let’s say two siblings, Sarah and Tom, buy a house together as joint tenants with right of survivorship. If Sarah were to pass away, Tom would immediately become the sole owner of the house.

Sarah’s stake in the property wouldn't become part of her estate, meaning it won't be divided according to her will or intestacy laws. Instead, her interest passes straight to Tom. This direct transfer is a major reason this ownership type is popular.

It can save surviving owners a lot of time, stress, and potentially thousands of dollars in legal and court fees typically linked to probate. While probate can drag on for months or even years, a transfer through right of survivorship is often much faster, usually just needing a death certificate and some simple paperwork.

The Four Unities: Foundation Of Survivorship Rights

For a joint tenancy with right of survivorship to be valid, the law traditionally requires what are known as the "four unities" to be in place when the ownership is first established. These are critical conditions that must all be met:

- Unity of Time: All joint owners must get their share of the property at the very same moment.

- Unity of Title: All joint owners must get their share through the same legal document, like a deed or a will.

- Unity of Interest: All joint owners must hold an identical type and proportion of interest in the property (for example, equal shares and the same kind of ownership).

- Unity of Possession: All joint owners must have an equal right to occupy and use the entire property.

If these unities aren't correctly set up from the beginning, the right of survivorship might not hold up legally. This could lead to arguments and issues later on. Making sure these details are accurate is essential. Overlooking necessary legal elements can result in misleading outcomes, similar to issues in other fields of analysis.

For instance, the idea of survivorship bias can seriously affect how investment returns are viewed over time. Looking back, if you only consider companies currently in an index, you ignore the major effect of those that went out of business or were removed. This can distort your understanding of actual market performance. You can find more details about survivorship bias in market data and what traders should be aware of. This highlights why a full and correct setup in legal agreements is so important to achieve the desired results.

Getting these elements right not only ensures the automatic transfer but also strengthens the legal basis of the ownership arrangement. It's vital to understand every part of legal documents, including any additions. For more on how small clauses can be very important in legal paperwork, check out our guide on The Meaning of Addendums in Legal Documents.

Joint Ownership Types That Include Survivorship Rights

Deciding how to share ownership of a property with others is a significant choice. The specific form of joint ownership selected has a direct bearing on how assets are passed on when an owner dies, which is a central element in understanding what is right of survivorship. Getting these details right can help avoid legal troubles for your family down the road.

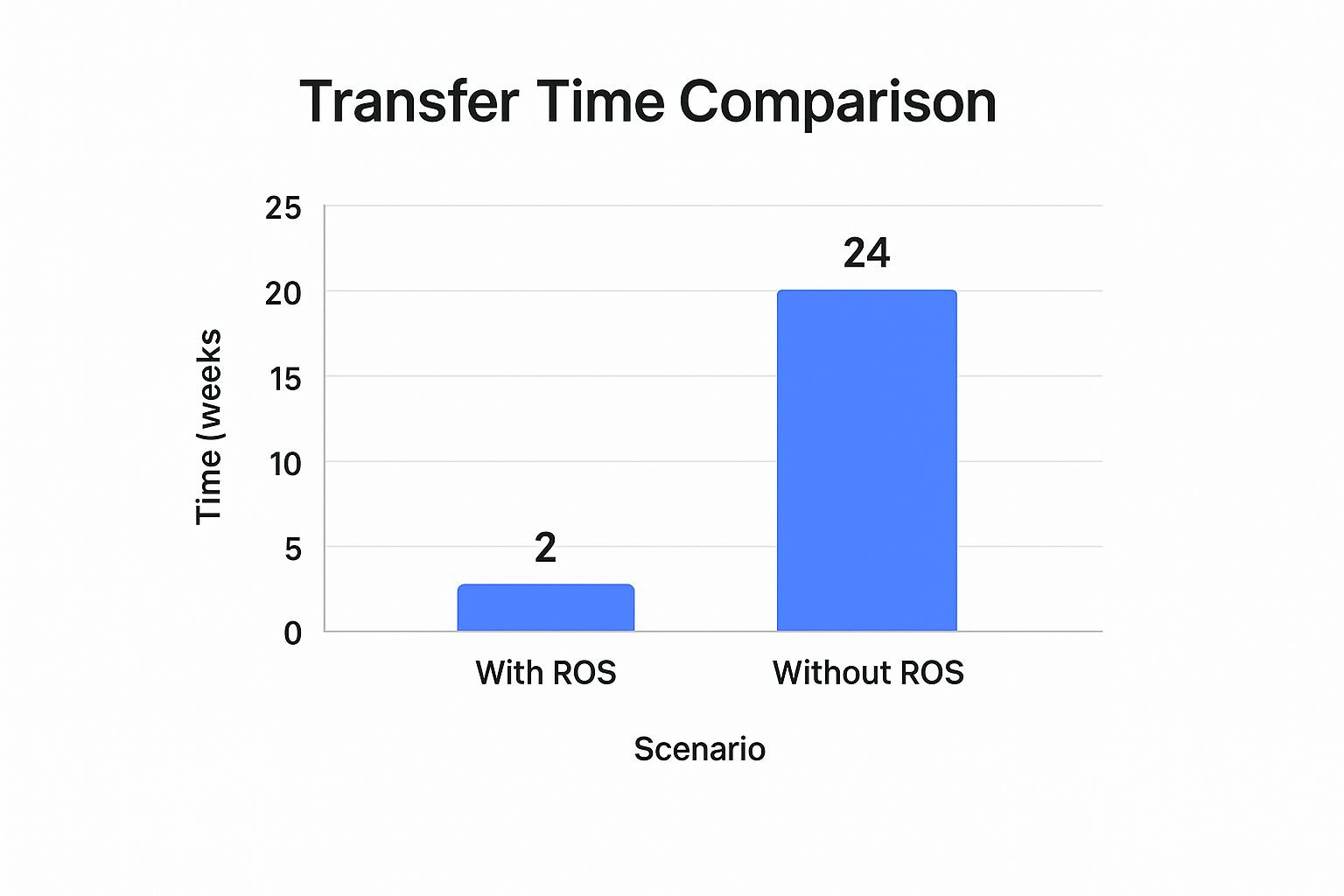

The 'Transfer Time Comparison' chart below illustrates the usual timelines for transferring assets, comparing situations with and without survivorship rights.

It’s evident that properties with the right of survivorship (ROS) change hands much quicker, usually within 2 weeks. This is a stark contrast to the 24 weeks often needed for properties without ROS, which typically involve the probate process. This considerable difference in time underscores a major advantage of using survivorship agreements.

It’s evident that properties with the right of survivorship (ROS) change hands much quicker, usually within 2 weeks. This is a stark contrast to the 24 weeks often needed for properties without ROS, which typically involve the probate process. This considerable difference in time underscores a major advantage of using survivorship agreements.

Joint Tenancy with Right of Survivorship (JTWROS)

Joint Tenancy with Right of Survivorship (JTWROS) is a popular method for two or more people to hold equal shares in a property. Its standout characteristic is automatic inheritance: upon the death of one owner, their stake in the property seamlessly passes to the surviving joint owner(s). This process sidesteps the often drawn-out and expensive probate system.

Setting up a JTWROS generally necessitates the presence of the "four unities": time, title, interest, and possession. It’s important to note that a joint tenancy can be broken, sometimes unintentionally, if one owner sells or moves their share, which can change the ownership arrangement for that portion. Consequently, the precise legal language used in the property deed is crucial from the very beginning.

Tenancy by the Entirety (TBE)

Available only to married couples in many jurisdictions, Tenancy by the Entirety (TBE) provides the same automatic rights of survivorship found in JTWROS. A key additional benefit of TBE is substantial creditor protection. Typically, property owned under TBE is protected from the separate debts incurred by one spouse. For instance, if one partner accumulates significant personal debt, creditors generally cannot compel the sale of the TBE-held property to settle these obligations. Information from the Consumer Financial Protection Bureau indicates that surviving spouses frequently encounter collection efforts for a deceased spouse's debts, making TBE's safeguards especially useful.

This ownership type demands the four unities along with the unity of marriage, reinforcing the couple's shared interest. A TBE arrangement usually ends if one spouse dies (with full ownership going to the survivor), in the event of a divorce (often changing the ownership to Tenancy in Common), or through a mutual decision by both spouses.

To clarify these distinctions, the 'Comparison of Joint Ownership Types' table below provides a detailed look at the key differences between joint tenancy, tenancy by entirety, and the contrasting tenancy in common.

| Ownership Type | Survivorship Rights | Creditor Protection | Requirements | Termination Method |

|---|---|---|---|---|

| Joint Tenancy (JTWROS) | Yes, deceased's interest automatically passes to survivor(s) | Varies by state; generally less protection than TBE | Four Unities (Time, Title, Interest, Possession); specific language in deed | Sale/transfer by one owner (severs their share), partition suit, death, mutual agreement |

| Tenancy by the Entirety (TBE) | Yes, deceased's interest automatically passes to surviving spouse | Strong protection from individual debts of one spouse (rules vary by state) | Four Unities + Unity of Marriage; only for legally married couples; specific deed language | Death of a spouse, divorce (often converts to TIC), mutual agreement, joint sale/conveyance |

| Tenancy in Common (TIC) | No, deceased's share passes through their estate (probate) | No special protection; individual shares are subject to creditors of individual owners | Only Unity of Possession is essential; shares can be unequal, acquired at different times | Sale of an individual share, partition suit, death (share goes to estate), mutual agreement |

This comparison underscores that while JTWROS and TBE ensure assets pass directly to survivors, TBE offers enhanced creditor shielding. Tenancy in Common, however, directs an owner's share to their estate, highlighting its fundamental difference.

Tenancy in Common (TIC): Understanding the Alternative

It is important to differentiate the previously mentioned ownership types from Tenancy in Common (TIC), which was briefly introduced in the table above. This ownership model does not feature the right of survivorship. In a TIC arrangement, co-owners may possess unequal shares, and their respective interests are treated as separate. Consequently, when a tenant in common passes away, their portion of the property does not automatically transfer to the other co-owners.

Rather, the deceased owner’s share is incorporated into their estate. It is then distributed based on the terms of their will or, if no will exists, according to state intestacy laws, inevitably involving the probate process. Grasping this distinction is key when considering what is right of survivorship and the advantages it offers for straightforward asset transfer. This difference is particularly important for effective estate planning.

Making sure your chosen ownership structure is legally robust demands meticulous attention to all paperwork. The exact phrasing used in property deeds is absolutely essential for correctly establishing these rights and realizing your desired outcome for asset distribution.

Real Estate Survivorship Transfers: The Step-By-Step Process

When a property co-owner dies, figuring out the transfer through the right of survivorship is really important. While it's meant to be simpler than going through probate, there are still specific actions surviving owners need to take, often during a tough time. Being prepared can make the ownership change go more smoothly.

The process of moving real estate using survivorship rights usually starts with acknowledging the co-owner's death and getting property records updated. This is where the legal idea of what is right of survivorship turns into real-world steps.

The Initial Steps After an Owner's Passing

The first thing you'll absolutely need is an official death certificate. This document is key because it’s the legal proof of death required for every step that follows in the transfer. You can't start formally moving the property title without it.

After getting the death certificate, the surviving owners need to let certain parties know. These usually include:

- The title company involved in the original property purchase, if you know who they are.

- The mortgage lender, if the property still has an outstanding loan.

- The property insurance provider, so the policy can be updated.

Contacting these parties early on helps avoid confusion and makes sure all the administrative details are handled quickly.

Navigating the Paperwork: Affidavits and Deeds

To make the transfer of the deceased owner's share official, certain legal forms need to be filled out and submitted. A frequently used document is an Affidavit of Death of Joint Tenant (though the exact name can differ from state to state). This formal statement, together with the death certificate, gets filed with the county recorder's office.

The title company can be very helpful at this stage, assisting with the paperwork and checking that the title is free from other claims before a new deed is created. The last step is typically recording a new deed, like a grant deed or quitclaim deed, which formally lists the surviving co-owner(s) as the only owner(s). Although this is usually quicker than probate, it might still take a few weeks to be all done, based on how fast local government offices process things.

Practical Considerations During the Transition

While the property is being transferred, there are day-to-day issues to handle. Surviving owners need to keep up with mortgage obligations. Lenders typically have procedures for ownership changes after a death, which could mean the survivor takes over the existing mortgage or refinances it.

It's also important to keep property taxes and insurance policies up to date to prevent coverage gaps or fines. The surviving owner(s) also take on responsibility for the property's ongoing upkeep. Knowing these duties is key.

Just looking at how survivorship transfers can be quick without thinking about these practical tasks can be a bit deceptive, much like survivorship bias in other areas. For example, a 2020 academic study showed that survivorship bias accounted for about one-third of the historical equity risk premium in the U.S. market. You can read more about this study on the Wharton School's website.

By understanding this step-by-step transfer process, surviving owners can better manage the practical and legal hurdles. This awareness helps ensure all state recording requirements are met and avoids costly delays that could complicate property management. This clear path is a significant advantage when considering what is right of survivorship for estate planning purposes.

Financial Accounts With Survivorship Benefits Explained

Your financial assets, such as bank and investment accounts, can also be set up with survivorship benefits. However, the way these work is quite different from how survivorship applies to real estate. Grasping these differences is crucial when deciding what is right of survivorship for your complete financial strategy, ensuring your assets go where you intend without unnecessary hurdles.

Joint Accounts vs. Beneficiary Designations

A popular way to establish survivorship for financial accounts is through joint ownership, often with a Right of Survivorship (JTWROS). For example, with a joint bank account, the surviving owner generally gets immediate access to the funds when the other owner dies, avoiding the probate process. This quick access can provide much-needed financial resources promptly.

Alternatively, many financial accounts offer Payable-on-Death (POD) designations for bank accounts, and Transfer-on-Death (TOD) registrations for brokerage or investment accounts. These options allow you to name a beneficiary who will inherit the account assets directly upon your death, also bypassing probate. A key distinction from joint ownership is that with POD/TOD, the original account owner maintains full control over the account during their lifetime, a feature many find attractive.

How Financial Institutions Handle Survivorship Transfers

When a co-owner or named beneficiary needs to claim assets, financial institutions follow specific procedures. Typically, they will ask for official documents, most importantly a certified death certificate and valid identification from the survivor or beneficiary. For joint accounts, the surviving owner often continues to have uninterrupted access.

For POD and TOD accounts, the designated beneficiaries will need to fill out claim forms provided by the institution. While the aim is a straightforward transfer, there can sometimes be temporary holds or restrictions, particularly if the documents submitted are incomplete or if any disputes arise concerning the claim. This highlights why clear designations are so important.

Avoiding Pitfalls and Ensuring Smooth Transitions

Keeping your beneficiary designations up-to-date on all financial accounts, including retirement plans like 401(k)s and IRAs, is essential. Outdated or incorrect information is a frequent problem that can cause assets to be frozen or distributed in a way you didn't intend. For instance, retirement accounts often have specific federal or spousal consent rules that must be adhered to for beneficiary designations to be valid.

Not updating these details can lead to unintended outcomes, similar to how incomplete information can distort views in other contexts. Consider survivorship bias in investments; it’s a known issue where the apparent success of current market indexes can be deceptive because they don’t include companies that have failed and been removed. Research shows that, over a 10-year period, as many as three-quarters of the original companies in U.S. indices might change. Explore this topic further to see how such biases can affect understanding.

Likewise, neglecting your account beneficiaries is like overlooking potential "failures" in your estate plan, which can create significant difficulties for your loved ones. Organizing your accounts effectively involves regularly reviewing and updating these details. This proactive step helps ensure appropriate access and control, making sure your financial legacy is managed according to your wishes.

Tax Consequences You Need To Know About

The automatic transfer that comes with right of survivorship certainly makes things easier, but it’s important to get a handle on the tax side of things. These tax effects can really impact your family’s finances, sometimes appearing out of the blue after an owner dies. Not thinking about these taxes beforehand can mean dealing with bills you didn't see coming.

Stepped-Up Basis: A Potential Tax Saver

A major tax point to consider with inherited property is the stepped-up basis. When property passes to a surviving owner via right of survivorship, its cost basis for tax calculations usually gets adjusted, or "stepped up," to its fair market value on the date the co-owner passed away. This is good news because if the survivor decides to sell the property later, capital gains tax will only apply to the increase in value from that date of death, not from when it was first bought.

Let's look at an example. Say a property was originally purchased for $100,000. If it’s valued at $500,000 when one owner passes, the survivor's new cost basis is $500,000. If they then sell it for $520,000, capital gains tax is calculated only on the $20,000 profit. This could mean significant tax savings compared to paying taxes on the entire $420,000 gain from the original purchase. Keep in mind, though, that these rules can differ, particularly if the co-owner who died was a spouse.

Gift Tax Considerations When Adding Owners

Bringing a new joint owner onto an existing property title can lead to gift tax implications, especially if this person isn't your spouse. If you add someone to the title and they don’t contribute what’s considered fair market value for their portion, the IRS might view this as a taxable gift. There is an annual exclusion amount – for instance, $18,000 per person in 2024 – but gifts larger than this could mean you need to file a gift tax return. These amounts can also reduce your lifetime gift and estate tax exemption.

This is where knowing the ins and outs of right of survivorship becomes very important for tax planning. It’s vital to keep proper records of these transfers and to speak with a tax advisor to fully grasp any potential tax obligations.

Estate Taxes and Survivorship Property

Generally, property owned with right of survivorship becomes part of the deceased owner's estate when calculating estate taxes. If married couples own property as joint tenants with right of survivorship or as tenants by the entirety, usually 50% of the property's value goes into the estate of the first spouse to pass away. For joint owners who aren't married, the full value of the property might be included in the deceased's estate, unless the surviving owner can show they contributed to buying the property.

The federal estate tax exemption is quite generous – over $13 million for an individual in 2024. However, it's important to remember that some states have their own estate taxes with much lower exemption amounts. So, even if you don’t owe federal estate tax, state estate taxes might still apply.

Understanding how different types of jointly owned assets are treated for tax purposes can be complex. The following table, titled Tax Implications of Right of Survivorship, provides an overview of tax consequences for different types of jointly owned assets upon transfer to surviving owners.

| Asset Type | Income Tax Impact for Survivor | Estate Tax Treatment for Deceased | Basis Adjustment for Survivor | Reporting Requirements |

|---|---|---|---|---|

| Real Estate | Potential capital gains on sale (stepped-up basis may apply) | Included in deceased's gross estate | Typically stepped-up to fair market value | IRS Form 706 (Estate Tax Return) if applicable |

| Joint Bank Acct | Interest income taxable to survivor from date of death | Portion attributable to deceased included | Usually no step-up for cash | Varies; possibly Form 706 |

| Investment Acct | Capital gains on sale of securities (stepped-up basis applies) | Portion attributable to deceased included | Securities stepped-up to fair market value | Form 1099-B for sales; Form 706 |

As the table illustrates, the tax treatment varies significantly depending on the asset type. Notably, the stepped-up basis can offer considerable income tax advantages for assets like real estate and investments, while cash in bank accounts typically doesn't receive this benefit.

Coordinating Survivorship with Your Overall Estate Plan

It's important to realize that survivorship arrangements might not always fit neatly with your wider estate planning objectives if they aren't thoughtfully combined. For example, assets that transfer through right of survivorship do so directly, outside the control of a will or trust. This could mean that beneficiaries you've named in your will or trust might be unintentionally bypassed, leading to outcomes like accidental disinheritance or uneven sharing of assets among your heirs.

Good coordination means making sure that your use of right of survivorship works in concert with your total financial and estate plan. This involves detailed record-keeping for tax purposes, like keeping track of who contributed what to jointly owned property. Having a solid grasp of these tax details can help reduce potential tax burdens and ensure your assets are protected. When dealing with intricate agreements, careful review is always a smart move. For more on this, you might find this resource helpful: Our Contract Risk Assessment Checklist for a smoother process.

Hidden Risks And Costly Mistakes To Avoid

The right of survivorship offers a straightforward way to transfer assets, which can make estate matters simpler. However, this approach isn't foolproof and comes with its own set of potential problems. If you're not aware of these hidden risks, what seems like a good plan can quickly become a source of trouble. It's really important to grasp these downsides when deciding if the right of survivorship is the right choice for your property.

The Specter Of Family Conflict And Disinheritance

A frequent problem pops up when right of survivorship clashes with your overall estate plans. Assets under this arrangement go straight to the surviving owner, sidestepping what you've written in a will or trust. This can accidentally lead to unintended disinheritance. Imagine a parent adding just one of their three kids to the house deed; that child gets the whole house, even if the parent’s will said to split assets equally among all children. Situations like these can unfortunately spark family arguments and create a lot of heartache.

It's not just about disinheritance; the automatic transfer can also cause trouble if the deceased person's wishes weren't crystal clear. Disputes can also arise if other family members believe the joint ownership was set up under pressure or without everyone fully grasping the implications. These scenarios really highlight why open family talks are essential before choosing this type of ownership structure.

Losing Control: The Irrevocable Nature Of Joint Tenancy

Putting someone else on your property title as a joint owner with right of survivorship is usually an irrevocable decision that you can't undo without their okay. Once they're on the deed, you generally can't take them off, sell the property, or even refinance it unless they agree. Giving up this sole control can become a real headache if your relationship with the co-owner sours or if your own life situation changes drastically.

Consider an elderly person who adds their adult child to their home's deed to help with estate planning. If that parent later needs to sell the house to pay for long-term care, they could be stuck if the child doesn't want to sell or won't cooperate. This inflexibility can put the original owner in a tough spot, unable to use their home's value when they most require it.

When Your Co-Owner's Debts Become Your Problem

One major drawback of the right of survivorship is that your property could be at risk due to the debts of any co-owner. If your co-owner gets into serious debt, files for bankruptcy, or is sued, their creditors might be able to put a lien on the property. They could even force a sale to cover the debt. This means your own asset could be threatened by someone else's financial troubles, something completely beyond your control.

This kind of risk can completely defeat the purpose of setting up joint ownership with survivorship for security. That’s why it’s so important to think carefully about the financial health and potential debts of anyone you're thinking of adding as a joint owner.

Navigating Long-Term Care And Medicaid Complexities

Setting up joint ownership can also create big problems for Medicaid eligibility and planning for long-term care. When you transfer an asset into joint ownership, Medicaid might see it as a "gift" or an uncompensated transfer. This can result in a penalty period, making you wait longer to qualify for Medicaid benefits for things like nursing home care. For many people, this means having to pay for care themselves, which can quickly eat through their savings.

Medicaid rules are quite complex, and the way joint property is viewed can differ. It's critical to get a handle on these details before you change how your property is owned, particularly if you think you might need Medicaid down the road. If you want to learn more about common legal terms that pop up in these scenarios, check out Our Explanation of Common Legal Terms. Knowing more can help you avoid making choices that end up being very expensive later on.

Key Takeaways For Smart Property Owners

Getting a handle on what is right of survivorship is more than just knowing the definition; it's about smart planning and careful action. Property owners who are on the ball turn this knowledge into a solid plan, making sure this estate planning method works smoothly to protect their assets for their loved ones.

Your Action Plan For Effective Survivorship

To put survivorship rights to work effectively and make sound choices, here’s a straightforward guide:

- Talk to a Legal Expert: Finding an attorney who specializes in estate planning is a key first step. They can shed light on state-specific requirements for survivorship and ensure your property deed is worded precisely. This is vital because laws can differ quite a bit from one place to another.

- Connect with Title Companies Early On: It's wise to discuss their processes for documenting and recording survivorship setups. Knowing this information upfront can help you avoid hold-ups or issues when a property transfer needs to happen.

- Keep Detailed Records: Maintain thorough records of all ownership agreements. This includes initial contributions and any changes made later on. Proper documentation is essential for heading off disagreements down the road.

- Fit it Into Your Overall Estate Plan: It's important to see how adding a right of survivorship to a property works with your will, trusts, and other financial arrangements. For example, assets passed via survivorship usually take precedence over what’s in a will for that specific asset, which could cause unexpected problems if not planned correctly.

Also, stay alert for potential warning signs. These might include feeling pressured to add someone as a co-owner, or if a potential co-owner has significant personal debts. Chat with your legal advisors about how survivorship could affect Medicaid eligibility, the typical costs of setting it up, and whether your grasp of what is right of survivorship truly matches your long-term objectives. Sometimes, other options, like setting up a trust, might be a better fit for your family's unique situation, especially with complex family dynamics or if you want more say in how assets are distributed.

Understanding complex legal agreements is a big part of estate planning. To help ensure your documents reflect your wishes and to identify potential pitfalls early, consider using a tool designed for clarity. Discover how Legal Document Simplifier can help you today!