Breaking Down The Contract Review Bottleneck

Let's be honest: the contract review process is often where momentum grinds to a halt. Deals that were moving at lightning speed suddenly get stuck in a seemingly endless cycle of legal back-and-forth. It’s a common frustration across departments, but what's really causing this slowdown? The reasons often go deeper than just a long document.

From our conversations with legal teams, a few culprits emerge time and again. Perfectionism is a big one. The desire to craft a flawless document can lead to agonizing over every comma, while unclear accountability creates a "pass the buck" scenario where no one feels empowered to give the final sign-off. This creates a significant drag on resources. Studies show the average human-led contract review process takes about 92 minutes per contract. While that might not sound like much, it adds up quickly, becoming a major operational bottleneck for businesses handling any significant volume. You can discover more insights about these contract management realities from Juro.

The Real Cost of Inefficiency

The cost of a slow review process isn't just about billable hours. It’s about lost opportunities, strained partner relationships, and internal friction. Every day a contract sits in review is a day your company isn't reaping the benefits of that agreement. Successful organizations have learned to pinpoint their specific bottlenecks by asking tough questions: Is the delay in the initial legal pass? Is it in getting approvals from finance or operations? Or is it the back-and-forth negotiation with the counterparty?

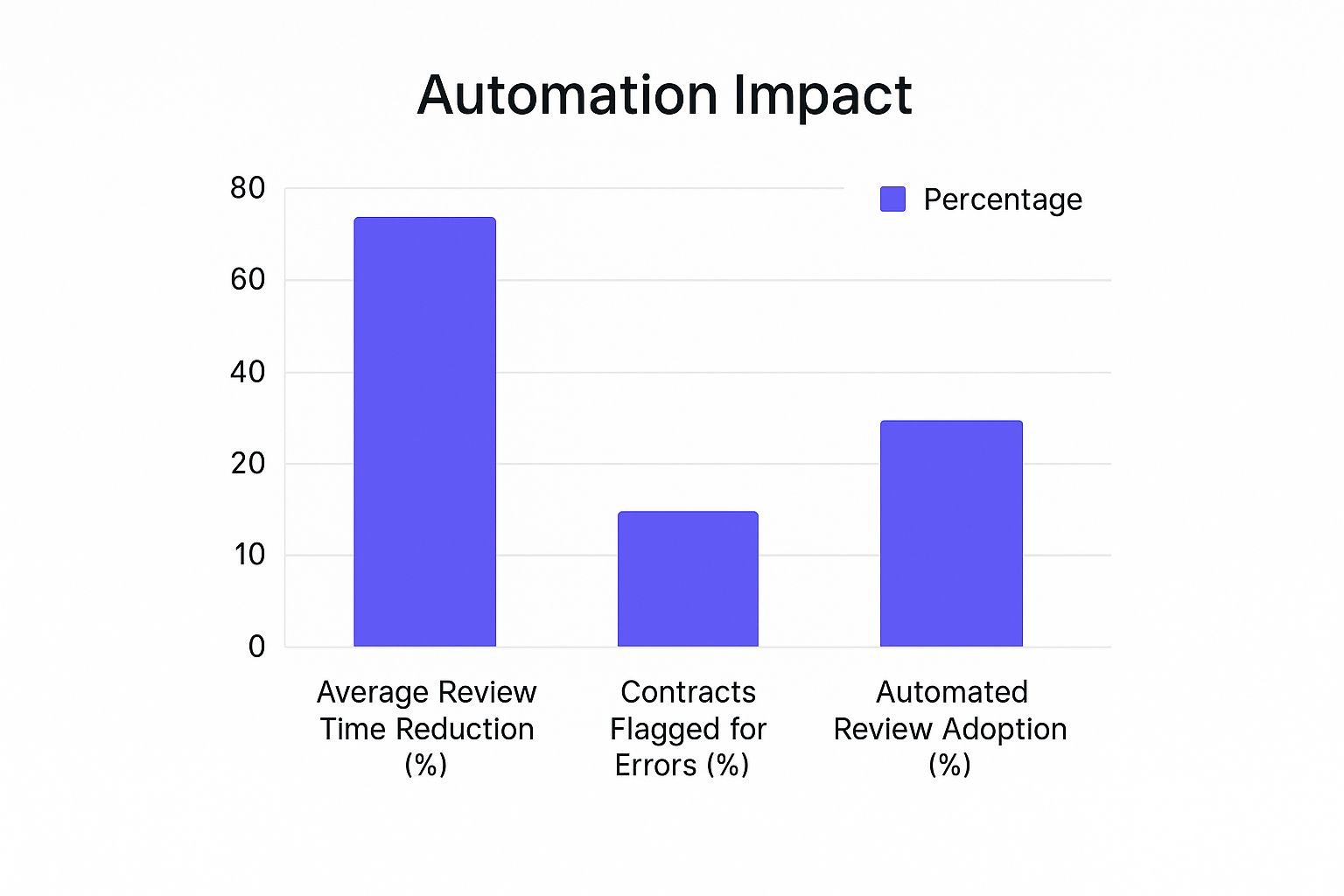

The following infographic illustrates how organizations are tackling these issues, comparing review time reductions, error detection rates, and the adoption of automated tools.

This data clearly shows a strong correlation between adopting automated review processes and achieving significant gains in both speed and accuracy.

Measuring What Matters

To fix a bottleneck, you first have to measure it. Without data, you're just guessing. Start by tracking the time it takes for a contract to move through each stage of your current process. This simple act of measurement often reveals surprising insights.

For example, you might find that low-risk, standard agreements like NDAs are taking nearly as long to approve as complex, high-value sales contracts. This is a clear warning sign that your process lacks the flexibility to assess risk and allocate resources appropriately.

The table below breaks down how review times can differ based on contract type, highlighting where delays commonly occur. This helps illustrate how complexity and specific clauses directly impact the review timeline.

Contract Review Time Breakdown by Contract Type

Comparison of average review times across different contract types and complexity levels

| Contract Type | Complexity Level | Average Review Time | Key Bottlenecks |

|---|---|---|---|

| Non-Disclosure Agreement (NDA) | Low | 1-3 Business Days | Stakeholder availability for signature |

| Master Services Agreement (MSA) | Medium | 5-10 Business Days | Negotiation of liability & indemnity clauses |

| Enterprise SaaS Agreement | High | 10-20+ Business Days | Data privacy, security, and IP negotiations |

| Vendor/Supplier Contract | Low to Medium | 2-7 Business Days | Aligning payment terms with finance |

As you can see, higher complexity directly translates to longer review cycles. An Enterprise SaaS agreement can take weeks due to intricate clauses, whereas a simple NDA is often held up by something as basic as getting the right person to sign. Pinpointing these specific bottlenecks is the first step toward streamlining your entire process.

Setting Up Your Pre-Review Foundation For Success

Jumping straight into the legalese of a contract without any prep work is like trying to build a house without a blueprint. You might get a structure up, but it will likely be unstable and full of problems you’ll only discover later. A solid contract review process begins long before you read the first clause. It's about laying a foundation that turns a reactive, chaotic scramble into a proactive, efficient system.

The most successful legal teams I've worked with don’t just review contracts; they build a machine to process them. This starts with gathering the right information upfront. Before you even look at the document, you need a clear summary of the business deal, the key objectives, and any non-negotiables from your stakeholders. This prevents the frustrating scenario where you spend hours negotiating a point, only to find out it wasn't a priority for the business team in the first place.

Establish Clear Roles and Checklists

A common point of failure is when no one is sure who is responsible for what. When roles are ambiguous, documents get lost in endless email chains, and critical feedback from departments like finance or IT never makes it into the final version. This is where deals stall and risks creep in.

To stop this from happening, define your review team for different contract types and clarify each person's responsibility:

- Business/Sales Lead: This person’s job is to confirm that the commercial terms—like pricing, scope, and deliverables—perfectly match the deal they negotiated.

- Legal Reviewer: This is where you focus on risk mitigation. You'll scrutinize liability, compliance, ambiguous language, and crucial clauses covering termination, indemnity, and warranties.

- Finance/Operations: This team member validates payment terms, billing cycles, and any operational commitments that might affect company resources or workflows.

With roles clearly defined, the next move is creating a dynamic checklist, not a static document that gathers dust. A generic checklist is mostly useless. Instead, it should be tailored to specific contract types. For instance, a checklist for a SaaS agreement will need sections on data security and privacy that are irrelevant for a simple vendor contract.

This focused approach ensures that every critical element is checked without anyone wasting time on irrelevant points. By setting up this foundation, you transform your contract review from a dreaded bottleneck into a strategic advantage, ensuring every agreement is not just signed, but truly set up for success.

Decoding Contract Complexity: Why Timing Matters Most

Not all contracts are created equal, and treating them that way is a recipe for wasting time and overlooking major risks. A simple non-disclosure agreement (NDA) just doesn’t need the same level of scrutiny as a multi-year, international partnership agreement. Learning how to judge a contract’s complexity before you dive in is a key part of an efficient contract review process. It helps you dedicate the right amount of attention and set realistic timelines for everyone involved.

Not all contracts are created equal, and treating them that way is a recipe for wasting time and overlooking major risks. A simple non-disclosure agreement (NDA) just doesn’t need the same level of scrutiny as a multi-year, international partnership agreement. Learning how to judge a contract’s complexity before you dive in is a key part of an efficient contract review process. It helps you dedicate the right amount of attention and set realistic timelines for everyone involved.

Think of it this way: reviewing a standard, one-page lease is like proofreading an email. On the other hand, tackling a complex enterprise software agreement is like editing a novel. Both require an eye for detail, but the scope, depth, and potential consequences are worlds apart. The trick is to build an instinct for telling which document is which right from the get-go. This initial assessment will shape your entire approach, from who you need to involve to how many rounds of edits to expect.

Key Indicators of Contract Complexity

So, what makes one contract a quick read and another a week-long project? It usually boils down to a few common factors. If you can spot these red flags early, you can adjust your review strategy and keep everyone’s expectations in check. The more of these elements a contract has, the more time and expertise it will demand.

Here are the main indicators to watch for:

- Jurisdiction and Governing Law: An agreement that crosses state or country lines brings in extra layers of legal and regulatory rules that can seriously extend review times.

- Custom vs. Template Language: Contracts based on standard boilerplate language are generally easier to get through. Agreements filled with custom-drafted clauses require a much closer read to uncover hidden risks.

- Number of Parties Involved: More parties means more competing interests. This almost always leads to longer and more complicated negotiations.

- Financial and Technical Specifics: High-value deals or those with detailed technical requirements need specialized review from your finance, engineering, or IT teams.

Sector and Scope Impact on Timelines

A contract’s complexity isn’t just about what’s written inside; its context is just as important. For instance, public sector contracts are known for moving at a snail’s pace compared to their private sector counterparts. Research shows that even a simple public sector agreement takes an average of 8 weeks to finalize—double the 4 weeks it takes in private enterprise.

This gap gets wider with more complex deals. A high-complexity international contract can take an average of 29.6 weeks to complete, while a simple domestic one might only take 4.4 weeks. This difference is often due to strict procurement rules, multiple layers of bureaucracy, and political factors. You can dive deeper into these contract management trends and statistics from Fynk. Keeping these external factors in mind is crucial for planning accurate timelines and avoiding frustration down the road.

Building Your Strategic Review Framework

A good contract review process is more than just a defensive spell-check; it’s a strategic asset for your business. When you move past just catching typos, you start building a repeatable framework that protects your interests while keeping business flowing. This isn’t about creating rigid, bureaucratic rules. It’s about developing a smart, systematic approach to identify what truly matters in each agreement. A solid framework acts as your guide, ensuring you evaluate risks and opportunities with the same rigor every time.

This structured approach is critical because contracts have a massive operational footprint, governing roughly 70% to 80% of all business activities. When managed poorly, the financial drain is huge; a business with around 1,000 employees can waste between $2.5 million to $3.5 million annually just trying to find or recreate misplaced documents. You can see more details on these financial impacts of contract management on Procurement Tactics. This really drives home why a reliable framework isn't just a "nice-to-have"—it's a core business necessity.

Prioritizing Key Risk Areas

The first pillar of your framework is figuring out what to worry about most. Not all risks are created equal, and your review should reflect that. Instead of treating every clause with the same level of suspicion, it's smarter to develop a risk matrix that helps you categorize potential issues based on their likelihood and potential impact. This lets you focus your energy where it counts.

Here are a few key risk areas to build into your framework:

- Financial Obligations: Dig into the payment terms, pricing structures, and any chance of hidden costs or penalties. Do the numbers line up with your financial forecasts?

- Liability and Indemnification: This is often the most heavily negotiated part of a contract. Your framework needs to clearly define your organization's risk tolerance and establish standard positions on things like liability caps.

- Termination and Exit Rights: What’s the plan if the relationship goes south? A strong framework ensures you always have a clear, fair, and actionable exit path.

- Data Security and Privacy: Clauses related to data handling are non-negotiable today. Your review has to confirm compliance with regulations like GDPR or CCPA.

Creating a Scalable Review Workflow

Your framework should also map out a clear workflow. This means deciding who reviews what and when. For low-risk, everyday contracts, a simple workflow with just one or two reviewers might be all you need. But for complex, high-stakes agreements, you’ll want a multi-stage process that pulls in specialists from legal, finance, and operations. To learn more about the specifics of this stage, you might be interested in our guide on the legal review of documents.

By setting up these tiered workflows, you create a system that can adapt to your needs. This ensures every contract gets the right level of attention—thoroughness without sacrificing speed.

Integrating Technology Without Losing The Human Touch

The idea of handing over your contract review to a machine can be a bit unsettling. The goal isn't to replace your team's expertise but to give it a major boost. The most effective strategy is a hybrid one, where automation takes on the tedious, repetitive tasks, freeing up your human reviewers to focus on strategy, negotiation, and subtle risk assessment.

It's about letting software do what it does best—scan, flag, and compare—so your team can do what they do best: think critically.

For example, think about tackling a 50-page Master Services Agreement. Instead of your legal team manually hunting for every mention of liability or payment terms, an AI tool can pull and summarize those clauses instantly. This isn't just about saving time; it's about making sure nothing gets missed due to human fatigue. In fact, automated contract review can cut down turnaround time by as much as 80%, a massive improvement that helps you close deals faster.

Finding the Right Balance: Human vs. Machine

So, where do you draw the line? The trick is to delegate tasks where they fit best. Automation is perfect for high-volume, low-complexity work where you need unwavering consistency. On the other hand, human expertise is absolutely essential for high-stakes decisions that demand context, judgment, and a deep understanding of the business relationship.

Here's a practical way to think about dividing the labor in your contract review process:

| Task Category | Best Suited for Automation (AI) | Best Suited for Human Expertise |

|---|---|---|

| Initial Screening | Flagging non-standard clauses, identifying missing terms, and checking against your playbook. | Understanding the business context of the deal and assessing the relationship with the counterparty. |

| Risk Analysis | Identifying specific risk keywords like "unlimited liability" or "auto-renewal." | Evaluating the acceptability of those risks and balancing business needs against legal exposure. |

| Version Control | Running redline comparisons to instantly spot every change between drafts. | Interpreting the intent behind an edit and preparing to negotiate on tricky changes. |

| Obligation Tracking | Extracting key dates, deadlines, and renewal notices to populate a calendar or tracking system. | Managing the ongoing relationship and ensuring operational teams can actually meet the commitments. |

Adopting Technology Without a Revolt

Trying to roll out new software can be met with resistance, especially if your team feels it's being forced on them. The secret is to frame it as a tool that gets rid of their most mind-numbing work.

Start with a pilot program focused on a specific, nagging pain point—like the initial review of all your standard NDAs. When the team sees firsthand how much time they get back in their day, they'll be far more open to adopting it more broadly. This approach builds trust and proves the tool's value, making technology a welcome partner instead of an unwelcome replacement.

Avoiding The Pitfalls That Derail Contract Reviews

Even the sharpest business minds can stumble into common traps during a contract review process, turning what should be a straightforward agreement into a drawn-out mess. These aren't just minor bumps in the road; they're the kinds of issues that can sink deals, damage relationships, and leave your business exposed to serious risk. One of the biggest mistakes is failing to separate the "nice-to-haves" from the "deal-breakers," which leads to endless haggling over small details while major red flags go unnoticed.

Another frequent error is skimming over the "boilerplate" or standard language. It’s tempting to assume these clauses are harmless, but that’s where you’ll often find nasty surprises like automatic renewals or unfavorable legal jurisdiction terms. I once saw a marketing agency sign a vendor contract without giving the termination clause a second thought. They ended up locked into another year of expensive services because of an auto-renewal provision they had completely missed. That single oversight cost them a significant amount of money and taught a hard lesson about the danger of assumptions.

Recognizing and Preventing Costly Oversights

To avoid these problems, you need to build a safety net into your review workflow. This starts with getting all your key players on the same page before the review even begins. It's common for sales, legal, and finance teams to have conflicting priorities that cause delays. For example, the sales team is pushing to close fast, but the finance department flags the payment terms as a no-go. A quick pre-review meeting to align on objectives can stop these internal tugs-of-war from stalling negotiations.

The statistics on contract management show just how widespread these issues are.

This reliance on manual methods is a major source of preventable mistakes and explains why so many businesses fall into the same traps. A structured approach is key to breaking this cycle. One of the best ways to do this is to perform a detailed contract risk assessment for every agreement, no matter how routine it seems. This forces you to methodically check for common problems, such as:

- Vague or Ambiguous Language: Clauses that could be interpreted in multiple ways, leading to future disputes.

- Unilateral Amendment Rights: Terms that let one party change the contract on their own, without your consent.

- Disproportionate Liability: Clauses that unfairly shift most of the risk onto your business.

To get a clearer picture of what to watch for, here’s a breakdown of common pitfalls and how to steer clear of them.

Top Contract Review Pitfalls and Prevention Strategies

Analysis of the most common contract review mistakes and actionable prevention methods

| Common Pitfall | Frequency | Average Cost Impact | Prevention Strategy |

|---|---|---|---|

| Overlooking Boilerplate (e.g., auto-renewal) | 45% of SMB contracts | $15,000 annually | Create a standardized checklist for all boilerplate clauses (termination, jurisdiction, etc.). |

| Vague Scope of Work | 35% of service agreements | 20% project cost overrun | Define deliverables, milestones, and acceptance criteria with extreme precision. Use examples. |

| Unfavorable Liability Caps | 30% of tech & software contracts | $50,000+ per incident | Negotiate liability caps that are mutual and proportionate to the contract value. |

| Ignoring Data Privacy Clauses | 25% of all B2B contracts | $25,000 in fines (avg) | Involve IT or a data privacy expert to review compliance with GDPR, CCPA, etc. |

The data in the table makes it clear: these are not minor oversights. They carry significant financial and operational consequences that can be avoided with a bit of foresight.

By proactively searching for these red flags, you move from a reactive, fire-fighting posture to a strategic one that protects your interests from the start. This simple shift in mindset can make all the difference.

Your Action Plan for Contract Review Excellence

Turning your contract review from a bottleneck into a business advantage takes more than wishful thinking. It needs a clear, practical roadmap. The aim isn't to create another set of rules nobody follows, but to build a system that produces real, measurable improvements. A solid plan begins with a candid look at your current process, pinpointing the biggest issues before you start making changes.

Build Stakeholder Buy-In Early

The first move isn't drafting a new template or buying software—it's getting everyone on board. Without buy-in from key people, even the most brilliant plans are dead on arrival.

Set up a meeting with the main players from your legal, sales, and finance teams. Instead of walking in with a pre-baked solution, open a discussion about their biggest frustrations with the way things are now. This approach fosters a sense of shared ownership and turns team members into champions for the new process, not roadblocks. Once you all agree on what the problems are, you can work together to design solutions that genuinely work for everyone.

Establish Meaningful Metrics for Success

To show that your changes are making a difference, you have to measure what matters. Vague goals like "improving efficiency" won't cut it. Instead, zero in on specific, numbers-based metrics that show a direct business impact.

Here are a few metrics to track:

- Average Review Turnaround Time: Don't just track the overall average. Break it down by contract type, like NDAs versus Master Service Agreements (MSAs). This will show you exactly where the most significant delays are happening.

- Number of Review Cycles: How many times does a typical contract bounce back and forth before it gets signed? Driving this number down is a clear sign of progress.

- Clause Deviation Rate: Keep a tally of how often non-standard clauses make it into final agreements. This helps you standardize your contracts and better manage risk.

These metrics paint a clear picture of your progress and help you prove the value of the new system. This data-driven approach is a cornerstone of effective contract compliance management. By tracking and reporting these figures, you build a sustainable system that can adapt as your company grows.

Ready to simplify your contracts and make smarter decisions faster? Discover how the Legal Document Simplifier can transform your review process with AI-powered insights.