Think of legal advice as just a shield against lawsuits? That’s one of the most common—and costly—mistakes an entrepreneur can make. Smart legal strategy isn't just about playing defense; it's a powerful tool for growth, helping you secure your assets, build rock-solid partnerships, and create a company that’s ready for anything.

Why a Legal Game Plan Is Your Best Business Advantage

Too many business owners see legal services as a necessary evil—an expensive line item for when things go wrong. But waiting for a disaster to strike is a reactive mindset, and it leaves you vulnerable. Shifting your perspective to see legal counsel as a strategic asset is one of the most impactful decisions you can make. It’s the difference between just surviving and actively thriving.

Running a business without a legal game plan is like playing chess without knowing the rules. You might make a few good moves by sheer luck, but you have no real strategy. A competitor who understands the board can see your mistakes coming, corner you, and call checkmate before you even sense the danger.

From Defense to Offense

A proactive legal approach flips the script, moving you from a defensive crouch to an offensive stance. Instead of just reacting to problems as they pop up, you build a framework that prevents them from happening in the first place and even creates new opportunities.

This mindset touches every part of your business. For example:

- Contracts: A well-written contract does more than protect you from a lawsuit. It builds a foundation for a great relationship with a client or partner by setting crystal-clear expectations for everyone.

- Intellectual Property (IP): Securing your trademarks and copyrights isn’t just about stopping copycats. It turns your brand and brilliant ideas into tangible assets that add real, measurable value to your company’s balance sheet.

- Compliance: Meeting regulations isn't just about dodging fines. It’s about building trust with your customers and cementing your reputation as a legitimate, professional operation.

When you handle these areas proactively, you're not just putting out fires—you're fireproofing your entire business. This is a big reason why the global legal services market was valued at around USD 789.5 billion and continues to grow. As more businesses launch, the need for smart legal navigation becomes undeniable. You can explore more about these market dynamics and see how they impact companies of all sizes.

Thinking strategically about legal from day one saves an unbelievable amount of time, money, and stress down the road. It’s an investment in resilience that creates a company ready to face challenges and jump on opportunities with confidence.

Ultimately, weaving legal planning into your business strategy is all about control. It gives you the power to shape your company’s future, protect what you’ve worked so hard to build, and create a lasting enterprise on a foundation of strength. That’s the best small business legal advice anyone can give.

Build Your Business on a Rock-Solid Legal Foundation

Every great business starts with a smart legal setup. Getting these early steps right isn't just about ticking boxes; it's about building a stable platform that can handle growth and protect you when things go wrong. If you rush this part, you're essentially building your dream on quicksand.

Think of it like laying the foundation for a house. The legal structure you pick is that foundation. A flimsy choice, like sticking with a sole proprietorship when you really need liability protection, can jeopardize everything you build on top. A tiny crack at the start can become a massive, business-ending problem later. This is truly the most critical legal advice any small business owner can get.

Your decision here directly affects two huge things: your personal liability and how much you pay in taxes. The wrong call can leave your personal assets—your home, car, and savings—exposed to business debts or stick you with a bigger tax bill than necessary.

Choosing Your Business Structure

Picking the right legal entity is your first line of defense. Each option strikes a different balance between personal protection, paperwork, and tax rules. Let's break down the common choices in plain English to see how they actually work.

- Sole Proprietorship: This is the default for any one-person show. It's incredibly simple to start, but it comes with a massive catch: there is no legal separation between you and the business. If the company gets sued or racks up debt, your personal assets are fair game.

- Limited Liability Company (LLC): An LLC acts like a legal shield, creating a barrier between your personal life and your business finances. It separates your assets from the company's, giving you serious protection while keeping your tax situation flexible. It’s the go-to for most small businesses looking for that sweet spot of safety and simplicity.

- S Corporation (S-Corp): An S-Corp isn't a business structure itself but a special tax status. It lets business profits (and losses) pass straight to the owners' personal income, avoiding corporate tax rates. This can save you a lot on taxes, but it also comes with more rigid rules and paperwork.

Choosing the right structure is all about matching your legal setup to your business goals and how much risk you're willing to take. It's the best proactive step you can take to head off future fights over ownership, liability, and money.

Navigating Registrations and Permits

Once you've poured the concrete by choosing a structure, it’s time to frame the house by getting the right permits and registrations. This is a multi-step dance involving federal, state, and local governments. Skipping a step here is like forgetting to get an electrical permit—it can bring your entire project to a screeching halt.

A typical roadmap looks something like this:

- Federal Registration: For most businesses, the first stop is getting an Employer Identification Number (EIN) from the IRS. Think of it as a Social Security Number for your company. You'll need it to open a business bank account, hire people, and file your business taxes.

- State Registration: Next, you have to register your business name and structure with your state’s Secretary of State office. This is what officially makes your LLC or corporation a real, legal entity.

- Local Licenses and Permits: Finally, you need to check with your city and county for any local operating licenses. These can be anything from a general business license to specific permits for health, zoning, or even the sign you hang out front.

These initial decisions, from picking your entity to getting all the right paperwork filed, are your foundation. They make your company legit and shield you from personal risk. As your business grows, these early choices will shape how you handle every agreement and obligation that comes your way. To get a jump on what's next, check out our guide on small business contract management to see how a solid foundation supports everything else you build.

Master Your Contracts Without Drowning in Fine Print

Contracts are the lifeblood of your business. They turn handshakes into official agreements, whether you're bringing on your first vendor or landing a major new client. While the dense legal language can feel overwhelming, understanding these documents is a skill every business owner must develop.

Think of a contract not as a legal minefield, but as a clear road map for a successful partnership. It sets expectations, defines who does what, and creates a predictable path forward. Without one, you’re just hoping for the best, which is a fast track to misunderstandings and financial headaches.

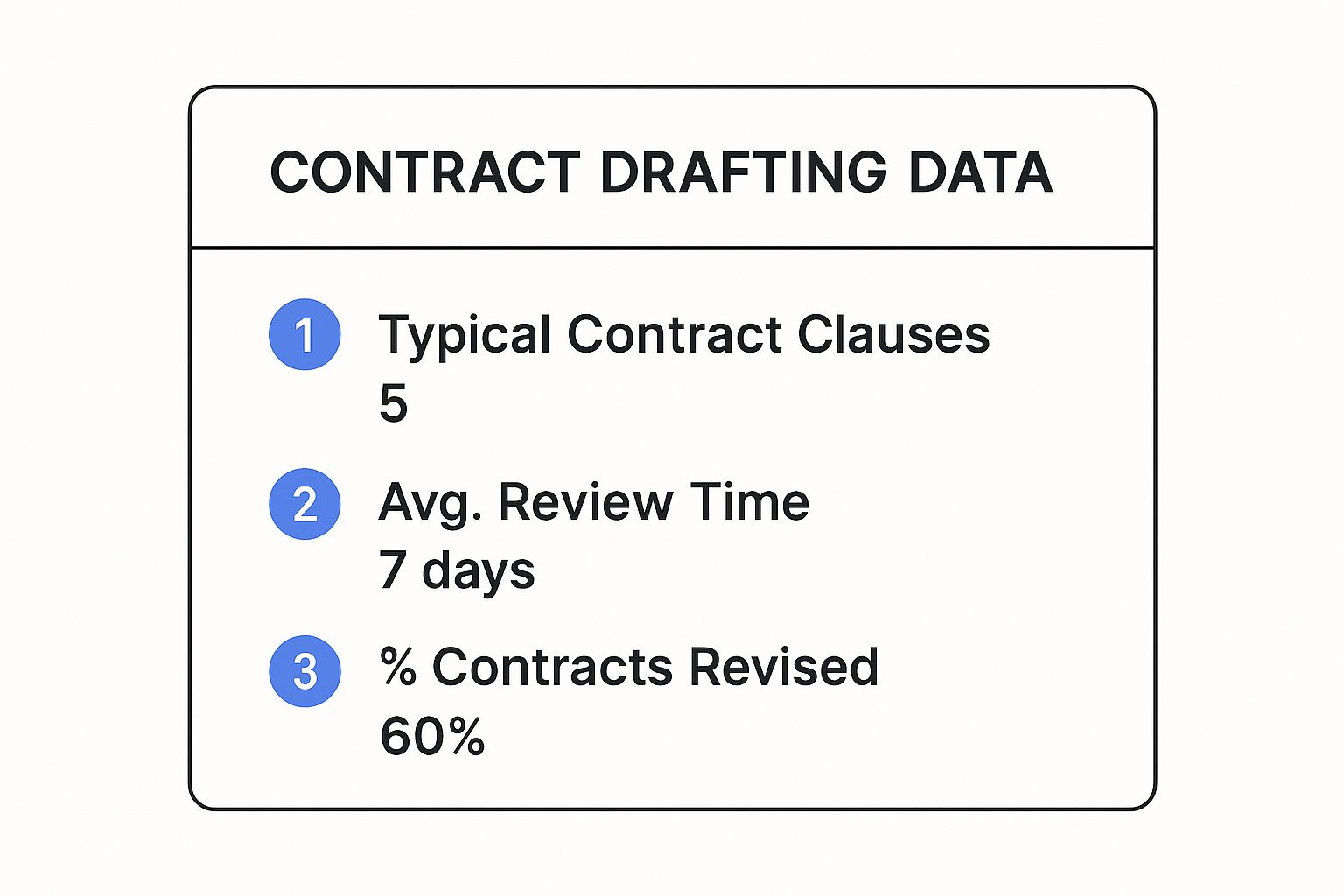

This infographic shows just how common it is for contracts to go through changes before they’re finalized.

The takeaway is clear: a whopping 60% of contracts get revised before anyone signs. This stat alone proves why you need to pay close attention to the details.

What’s Really Inside a Contract?

Every binding contract, whether it's one page or fifty, is built on the same foundation. Once you know the core ingredients, you can instantly tell if something important is missing.

Here are the essential components:

- Offer and Acceptance: This is the heart of the deal. One person makes a clear offer, and the other agrees to it exactly as-is. If they suggest a change, that’s a counter-offer, and the process starts over.

- Consideration: This is the legal term for the exchange of value—what each side gives and gets. It could be money for services or products for payment. A contract isn't real if only one person is on the hook.

- Legality: The whole point of the agreement has to be legal. You can't have a valid contract for something illegal.

- Capacity: Everyone signing must be legally able to enter into an agreement, meaning they are of sound mind and legal age.

Knowing these building blocks helps you cut through the noise and focus on what matters.

Don't Fall for These Common Contract Traps

The most dangerous contracts aren't the longest ones—they're the ones with vague or missing terms. Ambiguity is where disputes are born, creating expensive problems that were completely avoidable.

A vague term in a contract is like a pothole on a dark road—you won't see it until it's too late and the damage is done. Clarity is your greatest form of protection.

When you're reviewing an agreement, keep an eye out for these three common traps:

- Undefined Scope of Work: A contract for "marketing support" is a red flag. A strong contract specifies exactly what that means: "deliver five 1,000-word blog posts per month and manage three social media platforms with two daily posts."

- Weak or Missing Exit Clauses: How do you get out if things go south? A good contract has a clear termination clause explaining how either party can end the agreement, including notice periods and any fees.

- Unclear Payment Terms: The contract must spell out exactly when and how you'll be paid. "Net 30" is fine, but "payment due within 30 days of invoice receipt via ACH transfer" is even better. It leaves zero room for debate.

Key Clauses in Common Small Business Contracts

Contracts are not one-size-fits-all. The clauses you need to watch out for depend on the type of agreement you're signing. A client contract will have different pressure points than a commercial lease or an employee agreement.

Here’s a quick breakdown of common contract types and the critical clauses you absolutely must scrutinize to protect your business.

| Contract Type | Critical Clauses to Review | Potential Risk If Ignored |

|---|---|---|

| Client/Service Agreement | Scope of Work, Payment Terms, Termination | Scope creep, late payments, being stuck in a bad deal |

| Vendor/Supplier Agreement | Delivery Terms, Quality Standards, Liability | Late shipments, poor quality products, being held responsible for their mistakes |

| Commercial Lease | Rent Escalation, Maintenance, Subletting Rights | Unexpected rent hikes, surprise repair bills, inability to leave or downsize |

| Employment Agreement | Non-Compete, Confidentiality, Job Duties | Losing employees to competitors, leaked trade secrets, role confusion |

| Independent Contractor | Work-for-Hire (IP), Indemnification, Payment | Losing ownership of your IP, being liable for their actions, payment disputes |

This table is a starting point. Always read the entire document, but give these specific clauses an extra-close look. Getting these right can save you a world of trouble down the line.

Your Go-To Contract Review Checklist

Before you sign anything, run through a consistent review process. Making this a habit is a game-changer for managing risk and saving time. If you really want to sharpen your skills, you should also learn how to negotiate contracts to secure the best possible terms.

Use this checklist as your guide:

- Are all parties clearly identified with their correct legal names?

- Is the scope of work or deliverables spelled out in detail?

- Are payment amounts, deadlines, and methods crystal clear?

- Are all important dates and deadlines specified?

- Is there a clear termination clause?

- Does the contract define how disputes will be handled?

Pro-tip: Create standardized templates for your own routine agreements, like for new clients or contractors. It saves a ton of time and ensures you always start negotiations from a position of strength.

Protect Your Most Valuable Asset: Your Intellectual Property

What's the most valuable thing your company owns? It’s probably not your office furniture or your inventory. More often than not, it's your ideas, your brand name, and your unique creative work. We call these intangible assets intellectual property (IP), and they are frequently worth more than everything else combined.

Getting the right small business legal advice to protect your IP isn't just a defensive tactic. It's a fundamental part of building long-term, sustainable value.

Think of your intellectual property like a piece of prime real estate. You wouldn't leave a valuable plot of land unfenced and open to anyone, would you? Of course not. In the same way, you need to put up legal fences around your ideas and branding. Neglecting this is like leaving your front door wide open—it's an invitation for trouble.

The need for solid IP protection is growing. As more startups and e-commerce stores enter the scene, the global market for B2B legal services is projected to jump from around $100 billion to over $144 billion by 2034. A huge part of that growth is driven by IP support. You can learn more about this trend in B2B legal services and see how it impacts businesses like yours.

The Different Types of Intellectual Property

"Intellectual property" isn't just one thing; it's a catch-all term for several distinct types of assets. Knowing the difference is the first step to making sure you have the right protection in place.

Here are the main types of IP, broken down with simple analogies:

- Trademark: This is your brand’s unique signature in the market. It protects things like your business name, logos, and slogans so competitors can't use them. Think of the Nike "swoosh"—that's a world-famous trademark.

- Copyright: Think of this as an invisible shield around your creative work. It automatically protects original creations like blog posts, website code, photos, and music from being copied or used without your permission.

- Patent: A patent is a government-granted monopoly on an invention. It protects a new process, machine, or design, giving you the exclusive right to make, use, and sell it for a set period.

- Trade Secret: This is any confidential business information that gives you a competitive advantage. The recipe for Coca-Cola is a classic example. It’s protected not by formal registration, but by keeping it a secret.

The first step is simply recognizing what IP you already have. Got a catchy business name? That's a potential trademark. A beautifully designed website? The code and content are protected by copyright.

Intellectual property is one of the few assets you can create out of thin air that can become immensely valuable. Protecting it is not an expense—it’s an investment in your company’s future equity.

How to Secure Your Intellectual Property

Identifying your IP is half the battle. The other half is making it official. While copyright protection is automatic the moment you create something, other types, like trademarks, need a formal registration process to give them real legal teeth.

For Trademarks: You should register your business name and logo with the U.S. Patent and Trademark Office (USPTO). This move puts the public on notice that you own the mark and gives you the legal high ground to stop anyone else from using something confusingly similar.

For Copyrights: Your work is copyrighted as soon as it's created, but it’s still a smart move to formally register it with the U.S. Copyright Office. Registration is a prerequisite if you ever need to file a lawsuit for infringement, and it allows you to claim statutory damages.

Avoid These Common IP Mistakes

Many small business owners stumble into preventable IP mistakes that can have devastating results. Knowing these common pitfalls is the best way to avoid them.

One of the biggest blunders is assuming you automatically own the work you paid a freelancer or contractor to create. Unless you have a written agreement with a specific "work for hire" clause, the creator often legally retains the copyright. That means the graphic designer you hired could technically still own your company logo.

Another frequent error is accidentally using someone else's IP. Grabbing a photo from a Google search for your blog or using a hit song in a promotional video can lead to an expensive infringement lawsuit. Always use royalty-free stock assets or get explicit, written permission. Providing sound legal advice on these issues is a key function of any good small business advisor.

Navigate Hiring and Compliance With Confidence

Bringing your first team member on board is a huge milestone. It’s a sign of real growth, and frankly, it’s exciting! But this step also swings open the door to a whole new world of legal rules and responsibilities. Employment law can feel like a tangled mess, but getting it right from the start is non-negotiable for building a strong, fair workplace and steering clear of expensive disputes.

The first, and most critical, decision you'll make is how to classify your new hire. Are they an employee or an independent contractor? This isn't just a matter of preference; it's a legal distinction with massive financial implications. Get this wrong, and you could be facing serious penalties from the IRS and the Department of Labor, including back taxes, steep fines, and benefit payments you never planned for.

The Employee vs. Contractor Divide

Let’s break it down with an analogy. An employee is like renting a car that comes with a dedicated driver. You get to direct when, where, and how they drive. An independent contractor, on the other hand, is like calling a taxi. You just tell them the destination, not the route they have to take or what kind of car to use. You’re paying for the outcome, not controlling the process.

The IRS generally looks at three key factors to figure out a worker's status:

- Behavioral Control: Do you control how the work gets done? This includes the specific instructions you give, the tools you provide, and the training you offer.

- Financial Control: Do you control the business side of their job? This covers how they’re paid, whether you reimburse expenses, and who’s on the hook for providing tools and supplies.

- Relationship of the Parties: How do you both see the relationship? This is where written contracts describing the arrangement come in, as well as whether you provide employee-style benefits like insurance or paid time off.

Misclassifying an employee as a contractor is a surprisingly common—and costly—mistake. It's truly worth getting some small business legal advice on this before you make your first hire.

Core Compliance Areas You Cannot Ignore

Once you officially have an employee, a whole set of rules kicks in. These laws aren’t optional; they're designed to create a safe and fair environment for everyone. Ignoring them won’t just tarnish your reputation—it can land you in serious legal trouble.

Here are the key compliance areas to focus on:

- Wage and Hour Laws: You absolutely must follow the Fair Labor Standards Act (FLSA), which sets the rules for minimum wage, overtime pay, and recordkeeping. Don't forget to check your state and local wage laws, as they can be even more stringent.

- Workplace Safety: The Occupational Safety and Health Administration (OSHA) mandates that employers provide a safe workplace free from known dangers. What this means for you specifically will depend on your industry.

- Anti-Discrimination Laws: You cannot make hiring, firing, or promotion decisions based on a person’s race, color, religion, sex, national origin, age, or disability. These protections are the bedrock of fair employment practices.

Creating a simple, clear employee handbook is your first line of defense. It lays out your policies, sets expectations, and shows you’re committed to running a fair and compliant business. It becomes the go-to guide for both you and your team when questions come up.

Building Your Team Legally

Don't worry, an employee handbook doesn’t need to be a hundred-page legal tome. At its heart, it just needs to clearly state your company's policies on the most important issues. A great starting point is to include sections covering your code of conduct, non-discrimination policy, and the steps for reporting any problems.

This simple document does more than just shield you from potential disputes. It helps you build a positive workplace culture from day one—the kind that attracts and keeps great people. When your team feels safe, respected, and clear on the rules, they're freed up to do their best work.

Find Affordable Legal Support That Fits Your Budget

Let's bust one of the biggest—and most damaging—myths for entrepreneurs: the idea that quality legal advice has to carry a shocking price tag. Too many small business owners put off getting help because they picture a lawyer’s meter running endlessly, draining their precious startup capital.

Thankfully, that old-fashioned view is completely out of date. The legal world has changed, and a new wave of flexible, modern, and surprisingly affordable options has popped up, built specifically for the budgets of businesses like yours. You no longer have to choose between getting expert guidance and protecting your bottom line.

Beyond the Billable Hour Model

The traditional model of paying a lawyer by the hour still exists, of course, but it’s no longer the only game in town. Smart business owners are now embracing more predictable and cost-effective approaches that get rid of the fear of a surprise invoice.

Here are a few of the most popular alternatives:

- Flat-Fee Projects: Need a single contract looked over or a trademark filed? Many modern law firms now offer a fixed price for specific, clearly defined tasks. You know the exact cost upfront, which makes budgeting simple and stress-free.

- Legal Subscription Services: Think of this as having a lawyer on retainer, but for a manageable monthly fee. For a set price, you get ongoing access to legal advice, document reviews, and general counsel. It’s a fantastic option if you need continuous support.

- Legal Tech Platforms: Online services now offer everything from creating customized legal documents to connecting you with vetted attorneys for specific projects. These platforms lean on technology to slash their overhead, and they pass those savings on to you.

Your budget should never be a barrier to getting the legal protection your business needs to thrive. By exploring these modern solutions, you can find expert advice that aligns perfectly with your financial reality, allowing you to invest in protection without breaking the bank.

How Technology Is Making Legal Advice More Accessible

One of the biggest reasons for this shift is technology. The legal profession, especially the part that serves small businesses, is adopting advanced tools to work more efficiently. That efficiency directly translates into lower costs for clients like you.

This isn't just a niche trend; it's becoming standard practice. Research shows that artificial intelligence is quickly becoming a go-to tool for the very firms that entrepreneurs rely on most.

This screenshot from a recent report on legal trends shows just how widespread AI adoption has become.

In fact, an impressive 72% of solo lawyers and 67% of attorneys in small firms are now using AI in their day-to-day work. This is fantastic news for small business owners. It's the key to making legal services more accessible and affordable than ever before. You can learn more about the 2025 legal trends for small firms to see how technology is reshaping the industry for the better.

This tech-driven shift puts you, the business owner, in a much stronger position. When you seek legal help today, you're not just paying for an attorney’s time—you're benefiting from their efficiency. This reframes professional guidance as a smart, manageable investment rather than an intimidating expense.

Answering Your Top Small Business Legal Questions

Let's be honest: navigating the legal side of your business can feel like trying to find your way through a maze, blindfolded. But knowing the major pressure points makes a world of difference. Here, we're going to tackle the most common questions we hear from small business owners, with practical advice to help you move forward.

When Do I Absolutely Need a Lawyer?

You can definitely handle some legal tasks on your own, but a few moments are just too high-stakes for a DIY approach. Think of these as the "call for backup" situations where getting professional legal advice isn't just a good idea—it's essential.

You should always have a lawyer in your corner for:

- Business Formation: Deciding between an LLC, an S-Corp, or another entity isn't just paperwork. It has huge tax and liability consequences down the road, and a lawyer can map out the best path for your specific goals.

- Major Contract Negotiations: Are you signing a high-value client deal, a commercial lease, or a complex partnership agreement? An attorney is your best bet to make sure your interests are actually protected.

- Intellectual Property Disputes: If you need to send a cease-and-desist letter or, even worse, someone accuses you of infringement, you need an expert in your corner immediately. Don't go it alone.

- Facing a Lawsuit: The second you're threatened with or receive notice of a lawsuit, your very first call should be to an attorney. Time is critical.

Can I Use Online Legal Templates?

Online templates look like a fantastic, budget-friendly shortcut. And for super simple agreements, they can be a decent place to start. The problem is, they come with some serious risks. A template is like a one-size-fits-all suit from a department store—it might technically cover you, but it's not going to fit you well.

A legal template has no context. It doesn’t know your state’s specific laws, the unwritten rules of your industry, or the unique risks your business faces. Relying on one blindly can leave you dangerously exposed.

The biggest issue? Most templates aren't state-specific and are missing the custom clauses that give you real protection. The smart way to use them is as a rough first draft, but always have it reviewed and customized by a legal professional before you use it for anything important.

How Can I Minimize My Risk of Getting Sued?

The best defense has always been a good offense. Being proactive about managing your legal risk is far cheaper and a whole lot less stressful than reacting to a lawsuit after the fact. The good news is that the steps are pretty straightforward and boil down to solid business fundamentals.

Focus on these proactive measures:

- Use Solid Contracts: Always, always get agreements in writing. Clear contracts that spell out the scope of work, payment terms, and responsibilities are your best tool for preventing the misunderstandings that turn into disputes.

- Maintain Clear Communication: Keep a detailed paper trail of important conversations with clients, vendors, and employees. An email can save you a massive headache later.

- Get the Right Insurance: General liability, professional liability (often called errors and omissions), and other relevant insurance policies are your financial safety net if things go wrong.

- Stay Compliant: Meticulously follow all the rules and regulations for your industry and location. If you need a refresher, it's always a good idea to review the essential small business legal requirements that apply to your operations.