So you've found a house you love, and you're ready to make an offer. This is where you'll first encounter the term earnest money. Think of it as your financial handshake—a good-faith deposit you make to show the seller you're serious about buying their home. It proves you have the intention and the means to see the purchase through.

While it's a crucial first step, it's important to remember this deposit is not your full down payment. It's simply the initial cash you put on the line to get the ball rolling and secure your dream home.

What Exactly Is an Earnest Money Deposit?

When a seller accepts your offer, they're taking a big leap of faith. They pull their property off the market, stop showing it to other potential buyers, and trust that you'll complete the purchase as promised. The earnest money deposit is what gives them financial assurance during this period. It reduces their risk and weeds out anyone who isn't truly committed.

Typically, this deposit is between 1% to 3% of the home's sale price. These funds aren't handed directly to the seller, though. Instead, they're held in a neutral third-party account—usually an escrow or title company—until closing day. If everything goes smoothly, that money is then applied toward your down payment or closing costs.

An earnest money deposit is essentially a signal to the seller that says, "I'm serious about buying your house, and I'm willing to put money down to prove it."

The professional managing this neutral account is known as a closing agent. They play a key role in safeguarding the funds until the deal is done. To see how this deposit fits into the bigger picture, it helps to understand the full UK house buying process.

Earnest Money At a Glance

For a quick summary, here are the core components of an earnest money deposit.

| Aspect | Brief Explanation |

|---|---|

| Purpose | To show the seller you are a serious and committed buyer. |

| Typical Amount | Generally 1% to 3% of the home's final purchase price. |

| Who Holds It | A neutral third party like an escrow company or title agency. |

Ultimately, this deposit does more than just show you're serious—it strengthens your offer and officially sets the transaction in motion.

How Much Earnest Money Should You Actually Offer

Figuring out the right amount of earnest money is less of a science and more of a strategy. While you’ll often hear the standard advice of 1% to 3% of the home's purchase price, think of that as just a starting point. The real answer is all about the local market you're playing in.

In a hot seller's market, where homes get multiple offers the day they’re listed, a bigger deposit can make you stand out. Offering 3% or even more sends a powerful signal to the seller: you’re serious, you're financially solid, and you’re not going to get cold feet. It can give you a real edge, sometimes even over offers with a slightly higher purchase price.

On the flip side, if you're in a buyer's market where houses tend to sit for a while, the power shifts to you. A deposit closer to 1% might be perfectly fine, as sellers are usually more flexible and just happy to have a committed buyer at the table.

Navigating Different Market Conditions

What’s considered normal for an earnest money deposit can change dramatically from one city to the next, so understanding the local customs is key. In some high-demand areas, it's not unheard of for sellers to expect deposits as high as 5% to 10%.

Take Silicon Valley, for example. Sellers there often expect an earnest money deposit of around 3%. On a median-priced home, that could mean putting down something in the ballpark of $63,000. These kinds of regional trends are tracked by groups like the National Association of Realtors and show just how much location matters.

Your real estate agent is your best friend here. They're on the ground every day and know exactly what local sellers expect. They’ll help you craft an offer that’s competitive without having you tie up more cash than necessary.

Remember, the earnest money deposit is just one piece of the financial puzzle. It’s a good idea to also calculate your down payment on a house to get a full picture of your upfront costs. At the end of the day, you want to offer an amount that makes a strong impression on the seller but still feels comfortable for your own finances.

The Journey of Your Earnest Money Deposit

So, your offer was accepted—congratulations! Now you're probably wondering where that sizable earnest money check actually goes. It doesn't land directly in the seller's bank account. Instead, it starts a carefully managed journey designed to protect everyone involved until the keys are in your hand.

Think of it as putting your stake in a secure holding area, managed by a neutral third party. This "referee" is usually an escrow company, a title company, or sometimes a real estate attorney who holds the funds in a special trust account. Their one job is to hang onto that money impartially until the deal either closes successfully or is terminated for a reason covered in the contract. This keeps the seller from spending your deposit and makes sure it's ready for a refund if things go south.

From Deposit to Closing Day

The path your money takes is pretty straightforward. It moves from your account into safekeeping, and you won't see it again until it's applied at the very end of the homebuying process.

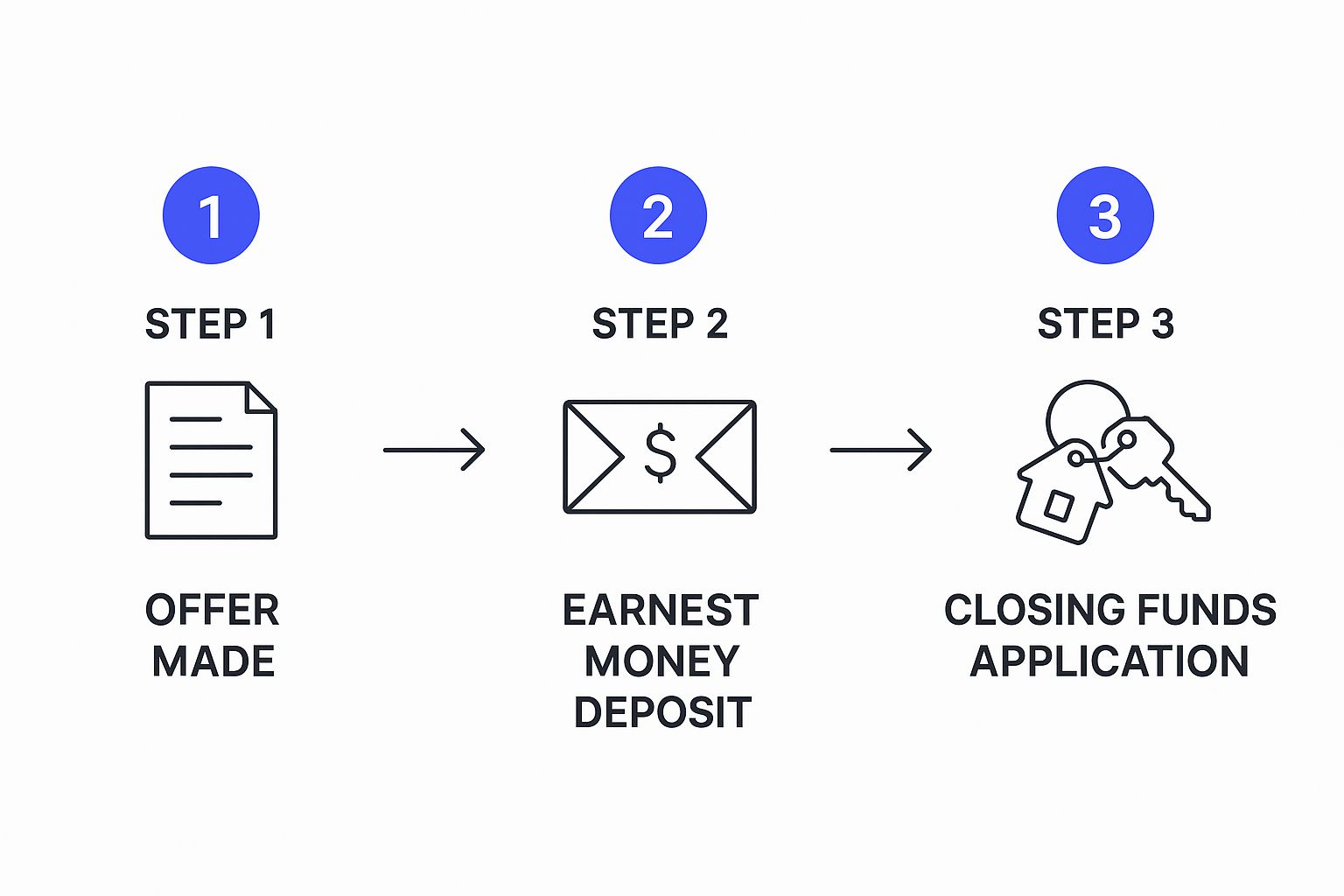

This simple visual breaks down the three main stages of your deposit's journey.

As you can see, the process is built to keep your funds separate and secure until the final moments of the transaction.

When closing day arrives, the escrow or title company works its magic and finalizes all the numbers. Your earnest money is released from the holding account and credited directly back to you on the settlement statement. This usually happens in one of two ways:

- It's applied to your down payment. This is the most common scenario. The deposit simply reduces the amount of cash you need to bring to the closing table.

- It's put toward your closing costs. Alternatively, the funds can be used to cover various fees associated with the sale, like appraisal fees, loan origination charges, or title insurance.

Ultimately, the journey of your earnest money is a critical part of what makes the whole system work. It’s not just a deposit; it’s a protected investment that follows a clear, secure path from your initial offer to your final purchase, giving you valuable peace of mind.

How Contingencies Safeguard Your Deposit

Handing over thousands of dollars for an earnest money deposit can feel like a leap of faith, but it doesn't mean your money is gone for good. Your purchase agreement should include crucial clauses called contingencies, which are essentially your financial safety net.

Handing over thousands of dollars for an earnest money deposit can feel like a leap of faith, but it doesn't mean your money is gone for good. Your purchase agreement should include crucial clauses called contingencies, which are essentially your financial safety net.

Think of them as legally binding "if-then" conditions. If a specific condition isn’t met, then you can legally walk away from the deal and, most importantly, get your deposit back. They turn a firm commitment into a protected one.

These clauses are a standard part of the process—in fact, nearly 76% of recent buyers had them in their contracts. While you can negotiate various types, three are absolutely essential for protecting your deposit.

The Three Key Contingencies

Each of these contingencies gives you a clear exit strategy if a specific part of the home-buying process goes sideways.

The Inspection Contingency: This gives you a window of time to bring in a professional home inspector. If they find something serious—think a cracked foundation or a roof on its last legs—you have options. You can ask the seller to make repairs, renegotiate the price, or back out completely and get your earnest money back.

The Appraisal Contingency: Before your lender gives you a mortgage, they’ll order an appraisal to make sure the house is actually worth what you've offered. If the appraisal comes in low, this contingency lets you renegotiate with the seller or cancel the contract without losing your deposit.

The Financing Contingency: Sometimes called a mortgage contingency, this protects you if your loan falls through. Even with a pre-approval, things can go wrong during underwriting. This clause ensures that if you can't secure the financing, you won’t be forced to forfeit your deposit.

Contingencies are your contractual escape hatches. They turn a potentially risky deposit into a calculated, protected step, allowing you to move forward with confidence while minimizing your financial exposure.

Understanding how to use these clauses is just as important as negotiating the sale price. The same principle of using contractual terms for protection applies in many other areas; for example, you can learn more about how to negotiate a lease to see how this works elsewhere. By making sure these protections are built into your offer, you stay in control of your earnest money.

Understanding How You Could Lose Your Earnest money

While contingencies are your best defense, they only work if you follow the rules spelled out in the purchase agreement. Losing your earnest money almost always comes down to one thing: breaching the contract. This is just a formal way of saying you failed to hold up your end of the deal for a reason that wasn't legally protected.

The most common way this happens is by trying to back out of the sale for a reason not covered by a contingency. For instance, if you simply get "cold feet" or find another house you like better after everyone has signed, the seller is generally entitled to keep your deposit. It’s their compensation for taking their home off the market for you.

Another risky move is waiving all your contingencies to make your offer more attractive in a bidding war. It’s a bold strategy that can help you win the house, but it leaves you with absolutely no escape route. If you discover a massive issue with the foundation or your financing falls through at the last minute, you could be forced to forfeit your entire deposit.

Critical Deadlines and Contract Terms

Time really is of the essence in real estate deals. Your purchase agreement is filled with specific deadlines for things like completing the home inspection, securing your loan approval, and formally removing your contingencies.

Missing these dates can put your deposit in serious jeopardy.

If you let a deadline pass without taking the required action or getting an extension in writing, you could be considered in default of the contract. This gives the seller the right to cancel the whole deal and keep your earnest money. This is why understanding every clause is so vital, and why a solid contract risk management process can help you spot these traps before they become expensive problems.

Your earnest money is a promise backed by cash. As long as you follow the contract's terms and timelines, it's safe. The moment you step outside those agreed-upon rules, you risk losing it.

To make this crystal clear, let's look at some real-world situations to see when your deposit is typically returned versus when it’s likely forfeited.

Earnest Money Returned vs Forfeited

This table compares common scenarios to illustrate when a buyer typically gets their earnest money back versus when they might lose it to the seller.

| Scenario | Typical Outcome for Earnest Money |

|---|---|

| Loan financing falls through (with a financing contingency in place) | Returned to the buyer |

| Home appraisal comes in lower than the sale price (with an appraisal contingency) | Returned to the buyer |

| Major issues are found during the home inspection (with an inspection contingency) | Returned to the buyer |

| Buyer gets "cold feet" and backs out for a personal reason | Forfeited to the seller |

| Buyer misses a critical contract deadline without an extension | Forfeited to the seller |

| Buyer waives all contingencies, then cancels the deal | Forfeited to the seller |

As you can see, contingencies are the key. They provide the contractual "outs" you need to protect your deposit if something unexpected goes wrong. Without them, your earnest money is very much at risk.

The Most Common Earnest Money Questions, Answered

Once you get the basics down, a few specific questions always seem to pop up for homebuyers. Getting these details straight is the key to feeling confident as you move forward with one of the biggest purchases of your life. Let's clear up any lingering confusion about how your good-faith deposit actually works in the real world.

Think of this as the final piece of the puzzle—the practical, need-to-know info that takes you from understanding the concept to knowing exactly what to expect.

Is Earnest Money the Same Thing as a Down Payment?

Not exactly, but they are closely related. Your earnest money is the initial deposit you make when you sign the purchase agreement. It’s your way of showing the seller, "Hey, I'm serious about this." The down payment is the much larger chunk of cash you'll pay at closing, which becomes your initial equity in the home.

Here's the good news: your earnest money almost always gets credited toward your down payment or closing costs. This means it reduces the final amount of cash you need to bring to the closing table.

Think of it like this: The earnest money is like putting a deposit down to hold a car, while the down payment is the first big installment you pay when you actually buy it. Your initial deposit gets subtracted from the final price.

Who Actually Holds Onto the Earnest Money?

This is a great question. Your deposit is never paid directly to the seller—that would be way too risky for you. To protect everyone involved, the funds are held by a neutral third party in a secure escrow account until the deal is either done or officially called off.

This third party is usually one of the following:

- An Escrow Company: This is their specialty. They are a licensed and regulated firm that exists to manage funds for real estate deals.

- A Title Company: The same company handling the title search and insurance often holds the deposit as part of their services.

- A Real Estate Brokerage: In some states, the broker's firm is legally allowed to hold the funds in a special trust account.

Can I Get My Earnest Money Back if I Just Change My Mind?

Generally, no. If you decide to back out for a reason that isn't covered by a specific contingency in your contract—like finding another house you like better or just getting cold feet—you will almost certainly lose your deposit.

The whole point of earnest money is to compensate the seller for the time and opportunity they lost by taking their home off the market for you. This is exactly why having clear, well-written contingencies in your offer is so incredibly important.

Navigating purchase agreements and understanding every clause is critical to protecting your investment. Legal Document Simplifier can instantly analyze complex contracts, highlighting key terms, deadlines, and potential risks so you can make informed decisions with confidence. Learn more at https://legaldocumentsimplifier.com.