In plain English, liquidated damages are a pre-agreed amount of money one party pays if they break a contract. Think of it as a late fee for a big project. It’s a number you both decide on from the start to cover potential losses if things don't go as planned, saving everyone from a messy and expensive court battle down the road.

What Are Liquidated Damages and Why Do They Matter?

At its heart, a liquidated damages clause is all about managing risk and creating certainty for everyone involved.

Let’s say a construction company is hired to build a new retail store. The owner needs it open before the massive holiday shopping rush. A delay of just one week could mean hundreds of thousands in lost sales. But how could you ever prove the exact amount of that loss after the fact? It would be a nightmare.

Instead, the owner and the builder can agree on a fixed amount upfront—say, $10,000 for each day the project runs late. This figure is their best, honest guess at the financial damage a delay would cause.

This pre-agreed sum is exactly what liquidated damages are for. It’s not a random penalty meant to punish the builder. It serves a few very practical purposes:

- Creates Predictability: Both sides know the financial stakes of a breach from day one. No surprises.

- Avoids Costly Fights: It stops you from having to hire lawyers and go to court to prove how much money was actually lost.

- Ensures Fair Compensation: It gives the wronged party a straightforward way to be compensated for their estimated losses.

- Motivates Performance: A clear financial consequence gives everyone a powerful reason to stick to the plan and meet their deadlines.

To give you a quick snapshot, here’s how the core ideas behind a liquidated damages clause break down.

Liquidated Damages At a Glance

| Concept | Simple Explanation | Primary Goal |

|---|---|---|

| Pre-Agreed Sum | An amount of money decided on when the contract is signed. | To avoid guessing games and disputes about damages later on. |

| Reasonable Estimate | The amount must be a genuine, fair guess of the potential loss. | To compensate the injured party, not to punish the breaching party. |

| Difficult Calculation | Used when actual damages would be hard or impossible to prove. | To provide a practical solution for complex financial losses. |

Ultimately, a well-drafted clause brings clarity and efficiency to a situation that could otherwise become a drawn-out legal battle.

The Two Rules for Enforceability

For a liquidated damages clause to actually hold up in court, it has to pass two critical tests: foreseeability and reasonableness.

First, the potential damages from a breach must have been genuinely hard to calculate when the contract was signed. If the loss is something simple and easy to add up, a court might decide this clause isn't necessary.

Second, the amount itself must be a reasonable estimate of the harm that could occur. If the number is way too high, a judge will likely see it as an unenforceable penalty clause—something designed to scare or punish, rather than to fairly compensate.

A valid liquidated damages clause is a substitute for actual damages, not a punishment for breaking a contract. The goal is to make the non-breaching party whole when calculating the exact financial injury is impractical.

Understanding this difference is key. The clause has to represent a good-faith attempt to estimate the foreseeable loss. When these conditions are met, liquidated damages become a smart and powerful tool for enforcing agreements and managing business risks without needing to step foot in a courtroom.

Why Businesses Use Liquidated Damages Clauses

At its core, a liquidated damages clause is all about managing risk. Businesses use them to bring financial predictability to situations that are otherwise messy and uncertain.

Think about it. These clauses are most valuable when figuring out the actual financial damage from a contract breach would be a nightmare.

Imagine a major retailer’s new e-commerce platform misses its launch date right before Black Friday. The true cost isn’t just the money spent on development. It’s the lost sales, the hit to customer trust, and the operational chaos that follows. Trying to put an exact dollar amount on that kind of damage after the fact is an incredibly complex, expensive, and time-consuming legal battle.

This is where a liquidated damages clause proves its worth. It answers the tough question of "how much" right from the start, letting both parties know exactly where they stand if things go wrong.

Allocating Risk and Ensuring Performance

A well-crafted liquidated damages clause is a smart way to allocate risk before a project even begins. By agreeing on a specific dollar amount for a potential breach, both sides acknowledge what’s at stake and accept their responsibilities upfront.

This isn't about punishment. It's about clarity.

For instance, a marketing agency that commits to a campaign launch date knows the precise financial outcome if they miss it. This clarity brings a few major benefits to the table:

- Financial Certainty: You can budget with more confidence, knowing your potential liability is a known, predictable number.

- Performance Motivation: The clause acts as a powerful, built-in incentive for everyone to hit their deadlines and fulfill their promises.

- Dispute Prevention: It settles arguments over damages before they ever start, avoiding drawn-out and expensive court fights.

When drafting contracts, including important provisions in a service agreement is standard practice. Liquidated damages are often a key part of that, defining expectations and the consequences of falling short. It’s a proactive approach that protects business relationships.

Key Takeaway: Liquidated damages clauses transform uncertain future losses into a defined, manageable risk. They allow businesses to operate with greater confidence by establishing a clear financial roadmap for potential contract breaches, ensuring fairness and efficiency without resorting to punitive measures.

By setting these terms from day one, companies can focus their energy on executing a successful project, not on worrying about a potential legal mess down the road. It’s a practical, forward-thinking way to manage contracts and build trust between partners.

How Courts Decide if a Clause Is Enforceable

Just dropping a liquidated damages clause into your contract doesn’t make it bulletproof. Courts look at these provisions very closely to make sure they're fair and are actually compensating for a loss, not just punishing someone. A judge will toss out any clause that looks like a penalty meant to strong-arm a party into performing.

For a clause to hold up in court, it generally has to pass a two-part test. The key here is that the evaluation is based on what was known when the contract was signed—not with the benefit of hindsight after a breach has already happened.

The Difficulty of Estimation Test

First, a court will ask: were the potential damages from a breach truly hard to figure out at the time the contract was made? This is the starting point for everything.

Think about something simple, like selling a standard pallet of bricks. If the seller doesn’t deliver, the buyer's damages are pretty easy to calculate—it’s just the difference between the contract price and whatever it costs to get replacement bricks elsewhere. In a case like this, a liquidated damages clause isn’t really necessary and probably wouldn’t be enforced.

Now, picture a much more complex scenario, like an IT firm building a custom logistics platform for a national shipping company. A delay here could trigger a whole mess of losses that are incredibly hard to put a number on, like damage to their reputation, lost customer contracts, or just pure operational chaos. Since it's nearly impossible to estimate the exact financial hit in advance, a liquidated damages clause makes perfect sense.

The Reasonable Forecast Test

Second, the amount written into the contract must be a reasonable forecast of the harm that could occur. The number can’t be pulled out of thin air or be ridiculously high. It needs to reflect a genuine, good-faith effort to predict the actual losses.

A court’s main job is to separate a legitimate pre-estimate of damages from an unenforceable penalty. If the amount seems designed to force performance rather than to cover a loss, it will likely be thrown out.

For example, a $1 million fee for a single day's delay on a small $50,000 project would clearly be an unreasonable penalty. On the other hand, a $5,000 per-day fee for a delay in finishing a new concert venue—which would cause lost ticket sales and vendor fees—could easily be seen as a reasonable forecast. Understanding what a breach of contract means in real financial terms is essential for setting a figure that will stand up to scrutiny.

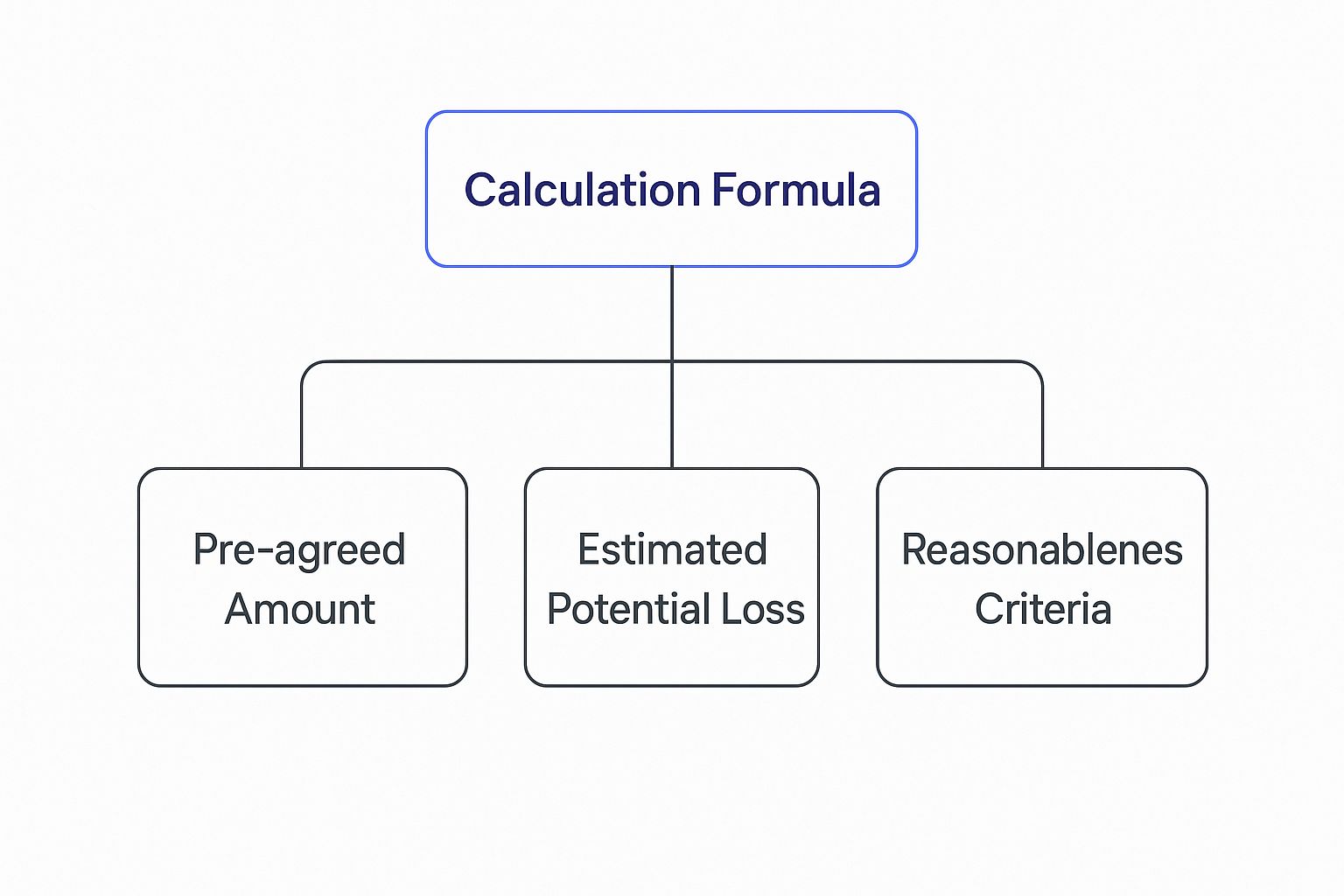

The infographic below shows how these core ideas—the pre-agreed amount, the estimated loss, and reasonableness—all come together.

As the diagram illustrates, a valid clause is like a balanced equation where the pre-agreed amount is directly linked to a reasonable estimate of the potential loss.

It's also critical to remember that legal standards can change depending on where you are. Laws vary from place to place, so it's always smart to get professional legal advice to make sure your clause is enforceable in the jurisdiction that matters most.

Calculating and Applying Liquidated Damages

Figuring out the right dollar amount for a liquidated damages clause isn’t just pulling a number out of thin air. It’s a strategic estimate, carefully grounded in the potential financial harm a breach could cause. The whole point is to come up with a genuine pre-estimate of the loss, not just slap an arbitrary penalty on the other party. Businesses use a few solid methods to land on a figure that’s both fair and legally defensible.

The most common approach you’ll see is the per-diem, or per-day, charge. This is a go-to in construction or IT projects where every single day of delay creates a clear, cascading financial mess. For instance, a commercial lease might specify a $500 fee for each day a tenant's renovation work disrupts neighboring businesses—a reasonable estimate of lost foot traffic and sales.

Another popular method is a lump-sum payment tied to hitting—or missing—specific milestones. Imagine a software company agreeing to a fixed amount if a critical feature isn’t delivered by its launch date. That sum would be calculated based on what they stand to lose in projected revenue or market advantage.

Common Calculation Formulas

To make sure the number holds up if challenged, businesses lean on concrete data and logical formulas. The goal is to leave a clear paper trail showing exactly how you reasoned your way to the final amount.

Here are a few ways it’s typically done:

- Percentage of Contract Value: The damages are set as a specific percentage (like 1%) of the total contract price for each week of delay.

- Historical Data Analysis: Companies will look back at past projects to figure out the average financial hit caused by similar breaches.

- Industry Benchmarks: Sometimes, the easiest way is to use standard rates common in a specific industry for certain types of failures.

- Project-Specific Risk Assessment: The calculation might also account for unique risks, like lost rental income, storage fees for delayed materials, or the cost of keeping staff on the project longer than planned.

The absolute key is documenting how you arrived at the number. That justification is your best defense if the clause ever gets challenged in court as an unreasonable penalty. Strong contract compliance management practices always include keeping detailed records of these calculations.

International and Industry-Specific Calculations

As you might guess, the bigger the contract, the more complex these calculations can get. A quick look at international trade agreements shows that formulaic approaches are standard practice. They often factor in the contract value, how severe the breach is, and other costs directly tied to the failure to perform.

Take the shipping industry, where a single delay can trigger a chain reaction costing billions. It's common for a contract to stipulate damages equal to 1% of the shipment’s value per week of delay. It’s a powerful way to make sure everyone stays on schedule.

No matter which method you choose, the final sum must reasonably reflect the foreseeable loss at the time the contract is signed. By rooting the calculation in tangible data, both sides can create a clause that fairly manages risk and keeps the project moving forward.

Real-World Examples of Liquidated Damages in Action

Theory is one thing, but seeing how these clauses work in the real world makes the concept click. Liquidated damages clauses aren't just abstract legal ideas; they're practical tools used every day to set clear expectations and head off expensive, time-consuming disputes before they even start.

Let's walk through a few scenarios where these clauses are absolutely essential.

Construction Project Delays

Imagine a contractor is hired to build a luxury hotel. The grand opening is set for June 1st, right before the peak tourist season kicks off. A delay would be a financial disaster—lost bookings, canceled events, and a major blow to the hotel's brand-new reputation. Trying to calculate the exact financial fallout after the fact would be a nightmare.

This is where a liquidated damages clause saves the day.

- The Clause: The builder agrees to pay $20,000 for each day the project is late past the June 1st deadline.

- Why It Works: This figure isn’t just pulled out of thin air. It’s a reasonable, pre-agreed estimate of the hotel's daily lost revenue and other costs. It gives the contractor a crystal-clear financial reason to finish on time and is a cornerstone of effective contract risk management.

Technology and Software Delivery

A software development firm is building a new e-commerce platform for a major retailer. The deadline is October 15th, giving the retailer just enough time to prep for the Black Friday sales frenzy. If that platform isn't ready, the retailer will miss its biggest sales event of the year. The potential loss is massive, but proving the exact amount with certainty would be incredibly difficult.

The clause pre-calculates the damages for a specific breach, like a late delivery, to avoid future disputes. It provides a level of certainty for both parties involved.

Instead of gearing up for a potential legal battle, they agree on liquidated damages upfront.

- The Clause: The development firm agrees to a fixed lump-sum payment of $500,000 if the platform isn't fully functional by the deadline.

- Why It Works: This amount reflects a genuine forecast of the lost profits and market share the retailer would suffer. It gives the development firm a powerful motivator to hit that critical deadline.

Real Estate Transactions

Here’s a classic example from the world of real estate: the earnest money deposit. A buyer makes an offer on a home and puts down a deposit to show they're serious. Once all contingencies are cleared, if the buyer suddenly backs out for a reason not covered in the contract, the seller is left holding the bag. They've lost time, and now they have to cover extended mortgage payments, relist the property, and start the marketing process all over again.

- The Clause: The purchase agreement states that if the buyer defaults without a valid reason, the seller is entitled to keep the deposit as liquidated damages.

- Why It Works: It fairly compensates the seller for taking the house off the market and saves them from having to sue to recover those hard-to-calculate losses. It’s a clean, simple solution to a common problem.

Frequently Asked Questions

Even after you get the hang of liquidated damages, a few specific questions always seem to come up. Let's tackle the most common ones to clear up any lingering confusion.

Are Liquidated Damages the Same as a Penalty?

No, and this is probably the most important legal line to draw. They might feel the same on the surface, but their intent and how the law treats them are worlds apart.

A liquidated damages clause is all about compensation. It's a genuine, good-faith estimate of the financial hit one party would take if the other breaches the contract. The whole point is to make the injured party whole again.

A penalty, on the other hand, is designed to punish. It’s an excessive amount that has little to do with actual losses and is really there to scare a party into performing. Courts hate penalty clauses and will almost always refuse to enforce them. The legal system is built on fairness, not giving one side a club to beat the other with.

Can I Sue for More Money if a Clause Exists?

In most cases, the answer is a firm no. If you have a valid and enforceable liquidated damages clause, it's typically considered the exclusive remedy for that specific breach.

When you agree to that number in the contract, you’re basically saying, "If this goes wrong, this is the amount that will make things right." You're trading away your right to sue for actual damages later, even if you find out the breach cost you way more than the clause specified.

The trade-off is certainty. You get a guaranteed, predetermined payout without the time, expense, and stress of a lawsuit. You give up the chance for a bigger court award in exchange for a faster, more predictable resolution.

This is a huge reason why businesses love these clauses. They lock in the financial risk and remove the guesswork of a court battle.

What Makes a Liquidated Damages Clause Strong?

A rock-solid, defensible liquidated damages clause is built on reasonableness and clear justification. If you want it to stand up in court, you have to do the legwork upfront.

Here’s what makes a clause truly enforceable:

- Difficulty in Calculation: The clause must cover a situation where figuring out the exact financial damage at the time of signing would be incredibly hard, if not impossible. Think lost profits on a delayed software launch.

- Reasonable Forecast: The dollar amount has to be a sensible, fair estimate of the potential harm. If the number is wildly out of proportion, it’s going to look like a penalty.

- Clear Documentation: This is your secret weapon. You need to document how you and the other party landed on that figure. This paper trail should show a logical process based on things like projected lost revenue, industry data, or historical costs.

Ultimately, the smartest move is to talk to a lawyer. They can help you craft a clause that fits the laws in your area, ensuring it's fair, enforceable, and actually protects your interests.

Navigating the complexities of liquidated damages clauses and other legal terms can be daunting. Legal Document Simplifier uses AI to instantly translate dense contracts into clear, easy-to-understand summaries. Upload your document today and get the clarity you need to make confident decisions. Discover how it works.