A contingency contract is really just a fancy term for an "if-then" deal. It’s a promise that only kicks in once a specific condition has been met. Think of it this way: if a particular thing happens, then an agreed-upon action or payment follows.

Decoding the If-Then Agreement

At its heart, a contingency contract weaves a safety net directly into a legal agreement. It links an outcome to an uncertain future event, which means no one is stuck with an obligation unless the right circumstances fall into place. It’s a smart way to manage and shift risk.

Let's use a classic example: buying a house. A homebuyer almost always signs a purchase agreement that's contingent on a clean home inspection. If the inspector finds a cracked foundation, the buyer can walk away from the deal, no strings attached. The "if" is the satisfactory inspection, and the "then" is the sale going through. If that condition isn't met, the deal is off.

How Contingencies Align Goals

This 'if-then' structure is brilliant for getting everyone on the same page. It creates a shared goal that both parties have to work towards to make the contract a reality. This performance-based model shows up everywhere:

- Legal Services: A personal injury lawyer often works on a "no win, no fee" basis. They only get paid if they win the case or secure a settlement.

- Real Estate: A real estate agent's commission is almost always contingent on the successful sale of the property. No sale, no commission.

- Freelance Projects: A content creator might agree to a bonus payment that's contingent on their video hitting a certain number of views within the first month.

A contingency contract isn't just a legal document; it's a strategic tool. It motivates action and protects parties from unfavorable outcomes by making obligations conditional on success.

The use of these agreements is exploding, especially with the rise of flexible work. By 2025, freelancers are expected to make up a staggering 46.6% of the global workforce. The gig economy, which runs on these types of contracts, is projected to soar past $2.1 trillion by 2033. You can explore more insights on the contingent workforce to grasp the sheer scale of this shift. This trend makes it more important than ever to understand what a contingency contract is and how it works.

To break it down even further, every contingency contract is built on a few core components. This table gives you a quick snapshot of what to look for.

Key Elements of a Contingency Contract at a Glance

| Component | Description | Example |

|---|---|---|

| The Condition (The "If") | The specific, measurable event that must occur. It needs to be clear and unambiguous. | "If the house passes a professional home inspection with no major structural defects." |

| The Obligation (The "Then") | The action or payment that is triggered once the condition is met. | "Then the buyer will proceed with the purchase of the property for the agreed-upon price." |

| The Timeframe | A defined period during which the condition must be met. | "The home inspection must be completed within 14 days of signing this agreement." |

| Termination Clause | A statement explaining what happens if the condition is not met. | "If the inspection reveals major defects, the buyer may terminate this contract without penalty." |

Understanding these pieces is the first step to confidently creating or signing a contingency agreement.

The Anatomy of a Contingency Contract

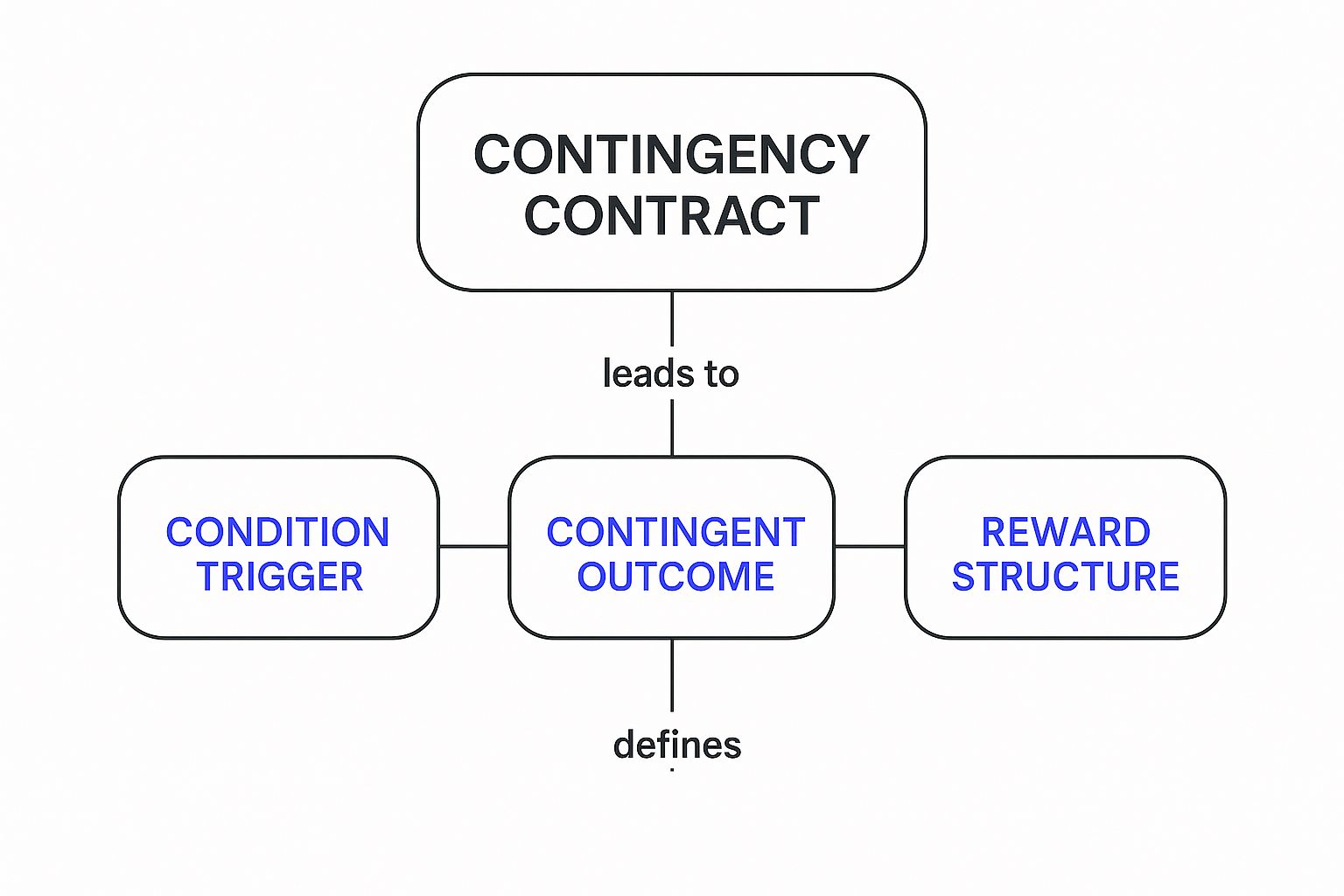

When you strip it down, every contingency contract, no matter the industry, has a simple but incredibly solid backbone. I like to think of it as a three-legged stool. If any one of those legs is wobbly or missing, the whole agreement falls apart. These three crucial pillars are the condition, the action, and the consequence.

Getting how these pieces fit together is the key to moving beyond a textbook definition. It turns an abstract legal idea into a practical tool you can use to manage risk and set clear expectations from the start.

This visual breaks down how those three elements link up to create a solid contingency clause.

As you can see, a specific event—the condition—has to happen. That event triggers a required outcome, which then dictates how, when, or if payment is made. This direct line connecting performance to payment is what makes these contracts so effective.

The Condition: The Foundational “If”

The condition is the very heart of the agreement. It's the specific milestone or event that must occur for the rest of the contract to kick in. This is the "if" in your "if-then" statement, and it needs to be crystal clear. Vague conditions are just asking for a dispute down the road.

For instance, a condition like "if the project is satisfactory" is a nightmare waiting to happen. Satisfactory to whom? A far better condition would be, "if the software passes all 15 specified user acceptance tests by October 31st." See the difference?

A well-crafted condition should always be:

- Specific: It leaves no room for interpretation about what needs to happen.

- Measurable: You can objectively prove whether it was met or not.

- Time-Bound: It sets a clear deadline or timeframe for completion.

The Action: The Obligatory “Then”

Once the condition is met, the action is triggered. This is the "then" part of the deal—the obligation one party must now fulfill. It could be making a payment, signing over a property title, or kicking off the next phase of a project.

Let's look back at our examples:

- Real Estate: If the buyer secures a mortgage for at least $400,000, then the sale moves to closing.

- Legal: If the lawyer secures a $100,000 settlement, then they are paid their 33% contingency fee.

- Freelance: If the new marketing campaign generates 500 qualified leads in Q3, then the freelancer gets their bonus.

This cause-and-effect structure ensures that rewards are tied directly to results, which is a powerful way to get everyone's interests pointing in the same direction.

The Consequence: Handling What Happens If Not

Just as critical as the "if" and "then" is what happens if the condition isn't met. This is the consequence, often built into a termination clause. Think of it as a clean exit strategy, allowing parties to walk away without penalty if a crucial prerequisite falls through.

A strong contingency clause defines failure just as clearly as it defines success. It outlines the 'what if not' scenario, providing a clear path forward and preventing a minor setback from becoming a major legal battle.

Without this "out," you could find yourself trapped in a deal that no longer makes sense. For example, if a home inspection reveals a cracked foundation, the consequence clause lets the buyer back out and get their deposit back. Nailing the wording on these provisions is critical. You can get a better feel for how they're structured by looking at some of the top contract clause examples.

Contingency Contracts in the Real World

The theory behind contingency contracts is interesting, but where they really come to life is in the real world. These "if-then" agreements aren't just for law books; they’re practical tools people and businesses use every single day to manage risk and make sure everyone is working toward the same goal.

Let’s walk through a few common situations to see exactly how they work.

Scenario 1: The Homebuyer's Financing Clause

Imagine Sarah, who is ready to buy her first home. She’s found the perfect place, but like most people, she needs a mortgage to make it happen. To protect herself, she includes a contingency clause in her purchase offer.

- Parties Involved: Sarah (the buyer) and the property seller.

- The Contingency: The deal is only final if Sarah can secure a home loan for at least $350,000 at an interest rate under 6.5% within 30 days.

- The "If-Then" Logic: If Sarah gets approved for the specified loan, then the sale moves forward to closing.

So, what could happen?

- Best Case: The bank approves her loan on good terms. The condition is met, the contingency is lifted, and Sarah is on her way to becoming a homeowner.

- Worst Case: She tries her best, but the banks will only approve a loan for $300,000. Because the condition wasn't met, the contingency kicks in. Sarah can legally and cleanly walk away from the sale and get her deposit back.

This is a classic safety net in real estate. It keeps buyers from being trapped in a deal they can no longer afford. To understand more about the role of deposits, you can check out our guide on what does earnest money mean.

Scenario 2: The Personal Injury Case

Now, let's look at David. He was in a car accident that wasn't his fault and needs to sue the other driver's insurance company. The problem? He can't afford a lawyer's high hourly rates. His attorney agrees to take the case on a contingency fee basis.

- Parties Involved: David (the client) and his personal injury lawyer.

- The Contingency: The lawyer only gets paid if they win the case or negotiate a settlement for David.

- The "If-Then" Logic: If the lawyer secures a financial award, then they collect a pre-agreed portion—usually 30-40%—as their fee.

This setup is brilliant because it perfectly aligns the lawyer's goals with the client's. The attorney is now fully invested in getting the best possible result, because their own paycheck depends on it.

This model opens the doors to the justice system for people who would otherwise be locked out due to cost, giving them a fair shot without any upfront financial burden.

Scenario 3: The Modern Business Agreement

Finally, think about a startup hiring a marketing agency. The startup needs to see a real return on its investment, not just a report on "efforts." So, they build a contingency into the contract.

- Parties Involved: The startup and the marketing agency.

- The Contingency: The final 25% of the agency's payment is tied to generating 1,000 new, qualified leads within the first three months.

This kind of performance-based deal is becoming more and more common, especially with the explosion of the contingent workforce. It’s a massive market—in 2024, the Americas' contingent workforce was valued at a staggering $4.6 trillion. A huge chunk of that, $3.3 trillion, was for Statement of Work (SOW) contracts that, just like this one, tie payment directly to performance. You can read more about the growth of the contingent workforce market.

Weighing the Benefits and Risks

Think of a contingency contract as a calculated bet, where the payoff is directly tied to the outcome. It's a powerful tool, for sure. On one hand, it’s a brilliant way to slash your upfront financial risk and make sure everyone involved is laser-focused on hitting the same target. But on the other hand, that same performance-based structure can introduce a whole new layer of complexity and potential headaches.

Getting a handle on this trade-off is absolutely essential before you jump in. You need to weigh not just what you stand to gain, but what you could potentially lose if things don't go as planned.

The Upside of Performance-Based Agreements

Let's start with the big one: you risk less money upfront. If you're the client hiring someone on a contingency basis, you often pay very little—or nothing at all—until they deliver the goods. For a startup or an individual without deep pockets, this can be a total game-changer.

Beyond the cash flow benefits, this model naturally aligns everyone's interests. When a consultant's or lawyer's paycheck depends entirely on getting you a win, their goals become your goals. This shared mission often translates into a deeper level of commitment and a more creative, determined effort to get the job done right.

A contingency contract essentially makes your partner a stakeholder in your success. Their reward is directly proportional to the value they create, which can be a powerful motivator for high-quality work.

The Downside and Potential Pitfalls

Now for the flip side. That "no win, no fee" arrangement often means a much bigger payout in the end. A lawyer on contingency, for instance, might take a 30-40% slice of the final settlement. That percentage isn't just for their work; it's to compensate them for the huge risk they shouldered—the very real possibility of getting paid zero after months of effort.

When you do the math, that percentage can end up being significantly more than you would have paid at a standard hourly rate.

Another major pitfall is the potential for conflict over what "success" actually looks like. If the conditions for payment aren't crystal clear, you're setting yourself up for a nasty dispute. Ambiguous terms like "satisfactory results" are a recipe for disaster, as each party might have a different idea of what that means. This can easily spiral into a legal battle that negates any initial savings.

Understanding how to spot and manage these issues is a core part of good contract risk management. Let's break it down further with a direct comparison.

Benefits vs. Risks of Using a Contingency Contract

Deciding whether a contingency contract is the right move means taking a clear-eyed look at both sides of the coin. Here’s a table that lays out the potential upsides and downsides to help you make an informed decision.

| Aspect | Potential Benefits (Pros) | Potential Risks (Cons) |

|---|---|---|

| Financial Risk | Minimized upfront cost for the client, preserving cash flow. | Higher overall cost if the contingency is met, as the fee includes a risk premium. |

| Motivation | Strong incentive for performance, as payment is tied directly to successful outcomes. | The provider might cut corners or rush to meet the contingency, potentially sacrificing quality. |

| Goal Alignment | Both parties share a common, clearly defined goal, fostering a collaborative partnership. | Disputes can arise if the contingency conditions are vague or open to interpretation. |

| Accessibility | Opens access to services (like legal representation) for those who can't afford upfront fees. | Providers may be selective and reject cases or projects they deem too risky. |

Ultimately, a contingency agreement can be an incredibly effective arrangement when the goals are clear and the risks are well understood by everyone involved. It’s all about finding the right balance for your specific situation.

How to Draft an Ironclad Contingency Clause

A poorly written contingency clause is a ticking time bomb. When you leave terms vague and undefined, you're essentially creating cracks in your contract's foundation—cracks that can easily lead to costly disputes down the road. Drafting an ironclad clause isn’t about stuffing it with complex legal jargon; it's about achieving total clarity.

The goal is to write a condition so clear that any neutral third party could look at the facts and immediately agree on whether it was met. It’s like creating a simple, objective test. Instead of a fuzzy phrase like "a satisfactory outcome," your clause should spell out "a final settlement of no less than $50,000."

This precision is what protects everyone involved. It turns a potential point of conflict into a straightforward checklist item, allowing the contract to do its job as a clear roadmap for what happens next.

Key Ingredients for a Strong Clause

To make sure your contingency is both fair and enforceable, it needs a few non-negotiable pillars. Think of these as the building blocks that remove ambiguity and set clear, measurable expectations right from the start.

Here’s a practical checklist to follow:

- Be Incredibly Specific: Define every single key term. If the contingency hinges on a "qualified lead," spell out the exact criteria that lead must meet. No assumptions allowed.

- Set Concrete Deadlines: Every contingency needs an expiration date. A clause that goes on forever is just not practical. Specify the exact timeframe, like "within 30 calendar days from the signing of this agreement."

- Outline the "What If Not" Scenario: This is crucial. Clearly state the consequences if the condition isn't met. Detail exactly how to terminate the agreement and what happens to any deposits or initial payments.

The strength of a contingency contract lies in its clarity. An effective clause anticipates potential disagreements and resolves them in advance with precise, measurable, and time-bound language.

Watching for Red Flags

When you're on the other side of the table reviewing a contract someone else has drafted, knowing what to look for is half the battle. Certain phrases or, just as importantly, omissions can signal future trouble.

Keep your eyes peeled for these common red flags:

- Vague or Subjective Language: Terms like "best efforts," "reasonable satisfaction," or "in a timely manner" are massive red flags. They're subjective and wide open to interpretation—and disagreement.

- Unrealistic Conditions: Be wary of contingencies with goals that are nearly impossible to achieve. Sometimes, this can be a tactic to lock you into an agreement while giving the other party an easy exit.

- Missing Details: If a clause doesn't have a firm deadline or fails to specify what happens if the condition isn't met, it's incomplete. And an incomplete clause is a risky one.

This kind of careful risk management is vital in every industry. Take the global event industry, which is projected to grow to $1.4 billion by 2030. Event contingency contracts are the backbone of that market, using specific triggers—like an unexpected cancellation—to activate insurance payouts. It’s a perfect example of how critical clear conditions are. You can read more about the event contingency insurance market to see this in action.

By making sure every detail is crystal clear, you can sidestep common pitfalls and build an agreement that genuinely protects your interests.

Common Questions About Contingency Contracts

Even after you've wrapped your head around the basics, some practical questions about contingency contracts almost always come up. It's totally normal. These agreements pop up in so many different corners of business and law that a few lingering "what-ifs" are to be expected.

Let's clear up some of the most common questions. Think of this as the quick-hit guide for when you're moving from theory to the real world.

Are Contingency Contracts Legally Binding?

Yes, absolutely. A contingency contract is 100% legally binding as long as it checks all the boxes of a standard, valid contract—things like a clear offer, acceptance, and an exchange of value (what lawyers call "consideration").

The contingency clause itself doesn't make the agreement any less official. It just sets up a specific trigger. The key is how that trigger is described. For a court to enforce it, the condition has to be crystal clear, measurable, and totally unambiguous. Any gray area can lead to a dispute down the road about whether the condition was actually met.

What Is the Difference Between a Contingency and a Condition Precedent?

This is a fantastic question because the legal jargon can be confusing. But the truth is, there's not much of a practical difference at all.

"Condition precedent" is the formal, legal term for an event that has to happen before a party is required to perform their side of the bargain or before the entire contract kicks in.

"Contingency" is just the more common, everyday business term for the exact same idea.

You can think of "contingency" as the practical, plain-language label you'd use in a meeting, while "condition precedent" is the technical term your lawyer will write into the formal document. They both describe that core "if-then" mechanic.

At the end of the day, one is business-speak, and the other is legalese. They both mean that a specific duty or obligation is waiting for something else to happen first.

Can You Negotiate a Contingency Contract?

Not only can you, but you absolutely should. Treat every part of a contingency clause as something that's on the table for discussion. From the nitty-gritty details of the condition to the final payment, it’s all negotiable.

Here are a few key areas to focus on:

- The Specific Conditions: Never settle for vague language like "satisfactory results." Push for objective, measurable goals that leave no room for interpretation.

- Payout Amounts or Percentages: Especially in fee-based agreements, that percentage is rarely set in stone. A little research on industry standards can give you a lot of leverage here.

- Deadlines and Timeframes: How long someone has to meet the condition is a critical point. A realistic timeframe protects everyone involved.

A good negotiation makes sure the final agreement is fair and that everyone walks away with a clear, shared understanding of the risks and rewards.

What Happens if Parties Disagree on a Contingency?

This is exactly why clarity is king. When a dispute pops up over whether a condition was fulfilled, the very first step is to go back to the contract and read the exact wording.

If the language is objective (e.g., "secure a loan for at least $300,000"), proving it is straightforward. But if it’s subjective ("achieve a satisfactory design"), you're walking into a potential minefield of disagreement.

When the parties just can't see eye-to-eye, they'll usually turn to the dispute resolution methods laid out in the contract itself, like mediation or arbitration. If that doesn't work, the issue may land in court, where a judge will have the final say on interpreting the contract's language.

Navigating the dense world of legal documents can feel overwhelming, even for experienced pros. At Legal Document Simplifier, we specialize in turning complex legal agreements into summaries you can actually understand and use. Our AI-powered platform helps you quickly pinpoint crucial terms, monitor deadlines, and flag potential risks, giving you the clarity to make smart decisions. Stop second-guessing what your contracts say. Learn more about how Legal Document Simplifier can help you.