A deed is the official, written legal document that transfers ownership of real estate from one person to another. Think of it as the official bill of sale for a property—it’s the concrete, paper proof of who holds the title and the key that unlocks all your property rights.

The Foundation of Property Ownership

So, what exactly is a deed in practical terms? Let's use an analogy. When you buy a car, the title—often called the "pink slip"—is the paper that proves you own it. A deed does the exact same job for real property, whether it’s a house or a raw plot of land. It’s far more than just a receipt; it’s the legal instrument that makes the ownership transfer official and legally binding.

This crucial document contains all the necessary information to identify everyone involved in the deal. The person selling the property is known as the grantor, while the buyer is the grantee. To be valid, a deed must also include a very specific legal description of the property, leaving no room for doubt about what, exactly, is being transferred.

Why Deeds Are Non-Negotiable

The whole practice of formally recording property transfers isn't new; it has deep historical roots. Back in 1795, a congressional mandate required U.S. counties to set up public offices for recording deeds and mortgages. The goal was to create a clear, publicly accessible record of ownership—a system designed to prevent fraud and settle disputes before they start. You can discover more about the history of land records and see why they are so vital for secure ownership.

Without a properly executed and recorded deed, proving you own a property becomes a nightmare. It opens the door to legal challenges and devastating financial loss. The deed is the definitive statement that officially shifts all rights, interests, and title from the grantor to the grantee.

A deed is not just a receipt for a real estate purchase; it is the legal embodiment of ownership itself. It provides the clarity and public notice necessary to secure your most valuable asset.

This guide will walk you through everything you need to know, from the essential elements that make a deed valid to the different types you'll encounter and what they mean for you.

To get started, let's break down the core components you'll find in any deed. This table lays out the fundamental concepts in simple terms.

Key Deed Concepts at a Glance

| Concept | What It Means | Why It Matters |

|---|---|---|

| Grantor | The person or entity selling or transferring the property. | The grantor must have the legal right to transfer the property. |

| Grantee | The person or entity receiving the property. | The grantee becomes the new legal owner upon transfer. |

| Conveyance | The legal language in the deed that states the property is being transferred. | This clause makes the transfer official and legally binding. |

| Legal Description | A precise, detailed description of the property's boundaries. | It ensures there is no confusion about the exact property being sold. |

Understanding these four pillars—the who, what, and how of the transfer—is the first step to mastering property deeds. They form the backbone of any legitimate real estate transaction.

The Essential Elements of a Valid Deed

For a deed to hold up in court, it needs certain key ingredients. Think of it like a recipe—leave something out, and the whole thing could fall apart. If even one essential component is missing, the entire document could be invalidated, putting the ownership transfer at risk.

Each element plays a specific legal role, ensuring the document is clear, intentional, and enforceable. From naming the right people to describing the property with pinpoint accuracy, every detail matters. Let’s walk through exactly what makes a deed legally binding.

Identifying the Parties and Property

First things first, every deed must clearly name the grantor (the person selling or giving the property) and the grantee (the person buying or receiving it). You’ll want to use full legal names here to avoid any confusion down the road. If multiple people are receiving the property, the deed also needs to spell out how they will share the title. For more on this, you can explore the details of the right of survivorship for co-owners.

Just as critical is the legal property description. This goes way beyond a simple street address. It’s a formal, highly detailed description that might include things like metes and bounds, lot numbers, or references to a government survey. This ensures the exact boundaries of the property are crystal clear. A mailing address alone is almost never enough for a legal transfer.

"A deed must be a written instrument. While oral contracts can be binding in some scenarios, the transfer of real estate ownership universally requires a written document to comply with the Statute of Frauds, a legal principle demanding certain agreements be in writing."

Stating the Intent and Exchange

Next up, the deed must contain what’s called words of conveyance. This is just a clear, straightforward statement showing the grantor’s intent to transfer their property rights to the grantee. Simple phrases like "I hereby grant and convey" do the trick, leaving no room for doubt about the document's purpose.

The deed also has to mention the consideration, which is simply the value exchanged for the property. This is usually the purchase price, but in some cases, like a transfer between family members, it might be a nominal amount, such as “$10 and other good and valuable consideration.” This formality shows that something of value was given in return for the property.

Finally, a few signatures and official steps are needed to make it all official:

- Grantor's Signature: The person transferring the property has to sign the deed. It’s their official sign-off.

- Notarization: An impartial notary public must witness the signature. This verifies the grantor's identity and confirms they signed willingly.

- Delivery and Acceptance: The transfer isn't complete until the grantor delivers the deed to the grantee, and the grantee accepts it.

Each of these steps acts as a crucial checkpoint, ensuring the property transfer is legitimate, intentional, and officially recognized by law.

Exploring the Different Types of Deeds

Not all deeds are created equal. Just as different keys unlock different doors, various types of deeds provide different levels of protection and guarantees to the buyer. Getting this right is critical, as the type of deed you receive directly shapes your rights and potential risks as a new property owner.

Think of it like buying a product with different warranty levels. Some come with a lifetime guarantee, others cover a specific period, and a few are sold completely "as-is" with no promises. Property deeds work on a similar principle, spelling out just how far the seller is willing to go to stand behind the property's title history.

The Gold Standard: General Warranty Deed

A general warranty deed offers the highest level of protection you can get as a buyer. When a seller gives you one of these, they are making a series of legally binding promises, known as covenants, that cover the entire history of the property—not just the time they owned it.

These guarantees are comprehensive and typically include:

- Covenant of Seisin: A promise that the seller legally owns the property and has the full right to sell it.

- Covenant Against Encumbrances: A guarantee that the property is free from any hidden liens or debts, except for those specifically noted in the deed.

- Covenant of Quiet Enjoyment: An assurance that your ownership won't be challenged by a third party with a superior legal claim to the title.

- Covenant of Further Assurance: A pledge from the seller to provide any additional documents needed to make the title good.

Because it provides such robust protection, the general warranty deed is the go-to for traditional home sales. It gives the buyer maximum confidence in their new investment.

The Limited Protection: Special Warranty Deed

A special warranty deed is a significant step down in terms of protection. With this deed, the seller only guarantees that they didn't cause any title defects during their period of ownership. They make absolutely no promises about what might have happened before they came into the picture.

This type of deed is often used in commercial real estate deals or by executors of an estate who have limited knowledge of the property's full history. It essentially says, "I promise the title is clean for the time I owned it, but I can't vouch for anything before that."

The "As-Is" Transfer: Quitclaim Deed

Finally, we have the quitclaim deed. This deed offers the least protection of all. It simply transfers whatever interest the seller has in the property—if they have any at all—over to the buyer. It makes zero guarantees about the state of the title.

A quitclaim deed contains no warranties. The seller is essentially saying, "I'm giving you my interest in this property, but I'm not promising that I actually have any interest to give."

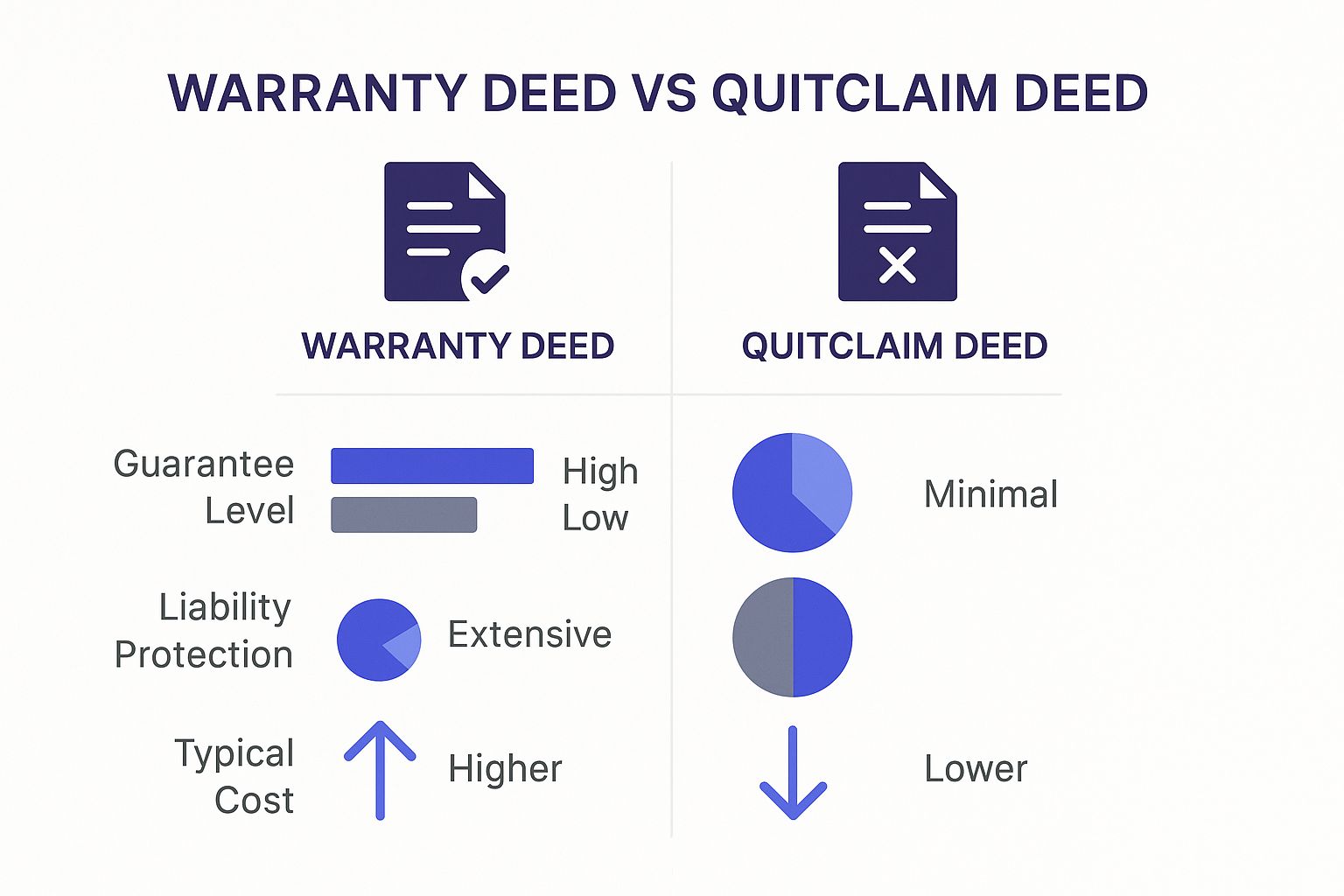

This infographic neatly compares the two most distinct types of deeds—warranty and quitclaim—to highlight their key differences in protection and cost.

As the visual shows, a warranty deed provides extensive protection but usually comes at a higher cost. A quitclaim deed offers minimal guarantees and is generally cheaper to prepare. These differences are critical when deciding which deed fits your situation. For instance, quitclaim deeds are perfect for simple transfers like moving property between family members, adding or removing a spouse from a title, or clearing up a "cloud" on the title.

To make these distinctions even clearer, here’s a quick breakdown of the most common deed types.

Comparison of Common Deed Types

| Deed Type | Protection Level for Buyer | Guarantees from Seller | Common Use Case |

|---|---|---|---|

| General Warranty Deed | Highest | Warrants against all title defects, even from previous owners. | Standard residential home sales where maximum protection is desired. |

| Special Warranty Deed | Medium | Warrants only against defects that arose during the seller's ownership. | Commercial real estate transactions, estate sales, or foreclosures. |

| Quitclaim Deed | None | Offers no warranties. Transfers only the seller's current interest, if any. | Adding a spouse to a title, transferring property between family, clearing title defects. |

Choosing the right deed is a fundamental step in any property transaction. The level of assurance it provides can make all the difference in protecting your ownership down the road.

While these deeds are fundamental in many countries, global property registration still faces major hurdles. A World Bank estimate suggests only about 30% of the world's population has a legally registered title to their land. This shows a massive gap in formal ownership security and highlights just how important it is to understand and use the correct legal instruments like deeds to secure your property rights.

How a Deed Is Signed, Executed, and Recorded

Just signing a deed doesn't quite seal the deal. For a property transfer to be legally sound and secure, the document has to go through a formal process of execution and recording. Think of it as a two-step verification that makes the whole thing official and enforceable, protecting the new owner’s rights from the get-go.

The first step is execution. This is the formal signing of the document. The grantor (the seller) must sign the deed in front of a notary public. A notary is a state-appointed official who serves as an impartial witness, confirming the signer's identity and making sure they're signing willingly, not under duress. This simple act is a powerful defense against fraud and gives the document its legal muscle.

Making It Official: The Recording Process

Once the deed is signed and notarized, it’s ready for the most critical step: recording. This is how you officially announce the change of ownership to the world. The executed deed is taken to the county recorder's office (or a similar government agency) in the county where the property sits.

There, it’s filed and becomes a part of the public record. This creates a permanent, searchable history of who has owned the property, which anyone can look up. Recording the deed provides what’s called "constructive notice," a legal concept meaning the public is officially informed that the title has changed hands. This is what solidifies your claim and protects you against anyone else trying to claim ownership later. The whole process is often managed by a professional, which you can learn more about in our guide on what is a closing agent.

Recording a deed is like calling "dibs" on a public scale. It stakes your official claim and establishes a clear, chronological chain of title that protects your investment from future disputes.

This system of public registration is the bedrock of modern property law. Land registration and deed recording systems are essential across the globe for guaranteeing property ownership. Countries from South Africa to the Philippines rely on rigorous deeds registry systems to ensure property titles are legally sound. It's why such a structured, formal approach is so vital for preventing messy disputes down the road.

Beyond the common deed types, other related instruments are key to different real estate strategies. For anyone looking at real estate as an investment, understanding concepts like trust deed investing can offer more insight into how deeds are used to secure financial transactions.

Common Misconceptions About Deeds

The world of real estate is swimming in jargon, and it's easy to get tangled up. When it comes to deeds, a few common myths can create some serious confusion—and lead to expensive mistakes. Let’s set the record straight on these crucial legal documents.

One of the biggest mix-ups is the difference between a deed and a title. People use these terms interchangeably, but they aren't the same thing at all.

Think of it like this: a title is the concept of your ownership rights to a property. It's your legal standing as the owner. The deed, however, is the physical, paper document that actually transfers those ownership rights from one person to another.

You can’t hold a title in your hand, but you can definitely hold a deed. The deed is the tangible proof that the title was legally handed over to you.

This leads us to another stubborn myth: that just having the physical deed makes you the owner. Not so fast. Real ownership is only locked in when the deed is properly signed, executed, and—this is the critical part—recorded in the public land records.

An unrecorded deed is a disaster waiting to happen. It fails to give the world official notice that you're the owner, leaving your claim weak and vulnerable.

Deed vs. Deed of Trust

Here's another one that trips people up: the difference between a deed and a deed of trust. They sound almost identical and both pop up in real estate deals, but they do completely different jobs.

- A Deed: As we've covered, its one and only job is to transfer property ownership from a seller (the grantor) to a buyer (the grantee). Simple as that.

- A Deed of Trust: This document is often used in place of a traditional mortgage. It doesn't transfer ownership to you. Instead, it secures a loan by putting a lien on the property. It involves three parties: the borrower, the lender, and a neutral third party (the trustee) who holds the title until the loan is paid off.

So, while a deed marks a change in who owns the property, a deed of trust is all about securing debt. Confusing the two can have serious legal and financial blowback.

Getting these details right is just as important as knowing what it means to quash a legal document. By busting these myths, you can walk into your next real estate transaction with a lot more confidence and a lot less risk.

Frequently Asked Questions About Property Deeds

Even with a solid grasp of the basics, a document as critical as a property deed can bring up some practical questions. Getting these answers straight can save you a world of stress and potential legal headaches down the road. Let's dig into some of the most common questions homeowners and buyers have.

What Happens If I Lose My Deed?

First off, don't panic. While that original deed you received at closing feels incredibly important, it’s not the ultimate proof of your ownership. The version that truly matters is the one that was recorded with your county recorder's office. This public record is the official, legally recognized evidence of your title.

If your original deed gets lost, stolen, or destroyed, you can simply request a certified copy from the county office where the property is located. This copy carries the same legal weight as the original and works for any official purpose, like selling your home or refinancing. Think of it this way: the public record is what truly secures your ownership, not the piece of paper in your file cabinet.

The physical deed in your possession is a personal record, but the publicly recorded deed is your official proof of ownership to the world. Your rights are protected by the public record, not the paper in your file cabinet.

Can I Create a Deed Myself?

Technically, yes, you can find templates online and draft your own deed. But this is a path loaded with risk. Real estate laws are notoriously complex and vary wildly between states and even counties.

A mistake that seems minor—like an incorrect legal description, improper wording, or a botched notarization—can invalidate the entire deed. The fallout from a flawed deed can be disastrous, leading to:

- A "Clouded" Title: This makes selling or refinancing the property a nightmare, if not impossible.

- Future Legal Battles: An invalid transfer could be challenged years later by heirs or other claimants.

- Complete Loss of Ownership: In the worst-case scenario, an improper deed could mean the transfer never legally happened in the first place.

Given what’s at stake, hiring a qualified real estate attorney or title company isn’t just a good idea; it’s a wise investment to protect your most valuable asset.

How Is a Deed Different From a Mortgage?

This is a common point of confusion, but the difference is actually quite simple. A deed and a mortgage have two entirely separate jobs in a real estate transaction.

A deed is the legal document that transfers ownership from the seller to the buyer. Once it’s recorded, you are the legal owner.

A mortgage, on the other hand, is a loan agreement. It's the contract you sign with a lender that uses your property as collateral for the money you borrowed. It doesn't give you ownership; it creates a lien on your property, giving the lender the right to foreclose if you don't pay back the loan.

Basically, the deed says you own it, and the mortgage says you owe on it.

Navigating the specifics of deeds and other legal documents can be daunting. Legal Document Simplifier uses powerful AI to translate dense contracts and agreements into clear, understandable summaries. Upload your document and instantly see key terms, obligations, and risks, so you can make informed decisions with confidence. Learn more at https://legaldocumentsimplifier.com.